NEW!Earn from 1,068 ADX$ with ADDX Rewards today

Invest beyond stocks and bonds

Diversify and strengthen your investment portfolio with private market and alternative opportunities

your wealth, your way

Short-term yield

Optimise your liquidity with enhanced cash solutions.

Commercial papers

3-12 months, up to 10% p.a.

Daily access funds

No lockups, up to 8% p.a.

Term notes

Varied returns

Income

Generate steady income in various market conditions.

Private credit

Monthly/quarterly payout, up to 11% p.a.

Fixed coupon notes

Monthly payout, varied returns

Growth

Pursue higher returns and diversification with institutional-grade strategies.

Private equity

Up to 17% p.a.

Hedge funds

Up to 20% p.a.

Tracker certificates

Varied returns

Exclusive, customisable opportunities

Access market-linked products that others can't. Only available on ADDX.

Structured products

Varied returns

We have solutions for all your needs

Yield seeking retiree

High net worth professionals

Corporate treasury manager

Financially sophisticated

Wealth manager

Business owner

- The content is intended solely for informational purposes.

- Any individuals mentioned are fictional and used for illustrative purposes only.

- The publication should not be relied upon as financial advice.

- ADDX is not licensed under the Financial Advisers Act and does not provide financial advisory services.

A new, trusted standard

SGD 2B+

total transactions

200+

opportunities to date

50+

investor nationalities

ADDX is 2026 Singapore’s Top Fintech Companies

Wealth Technology

Lower minimums

Start investing from just USD 1,000

Funds are safe

Your funds are securely held in a segregated DBS account, Asia's safest bank

SGD opportunities

No FX exposure with our wide range of SGD denominated opportunities

One time subscription fee

No annual management fee

Please note other fees may apply, such as management fees and performance fees.

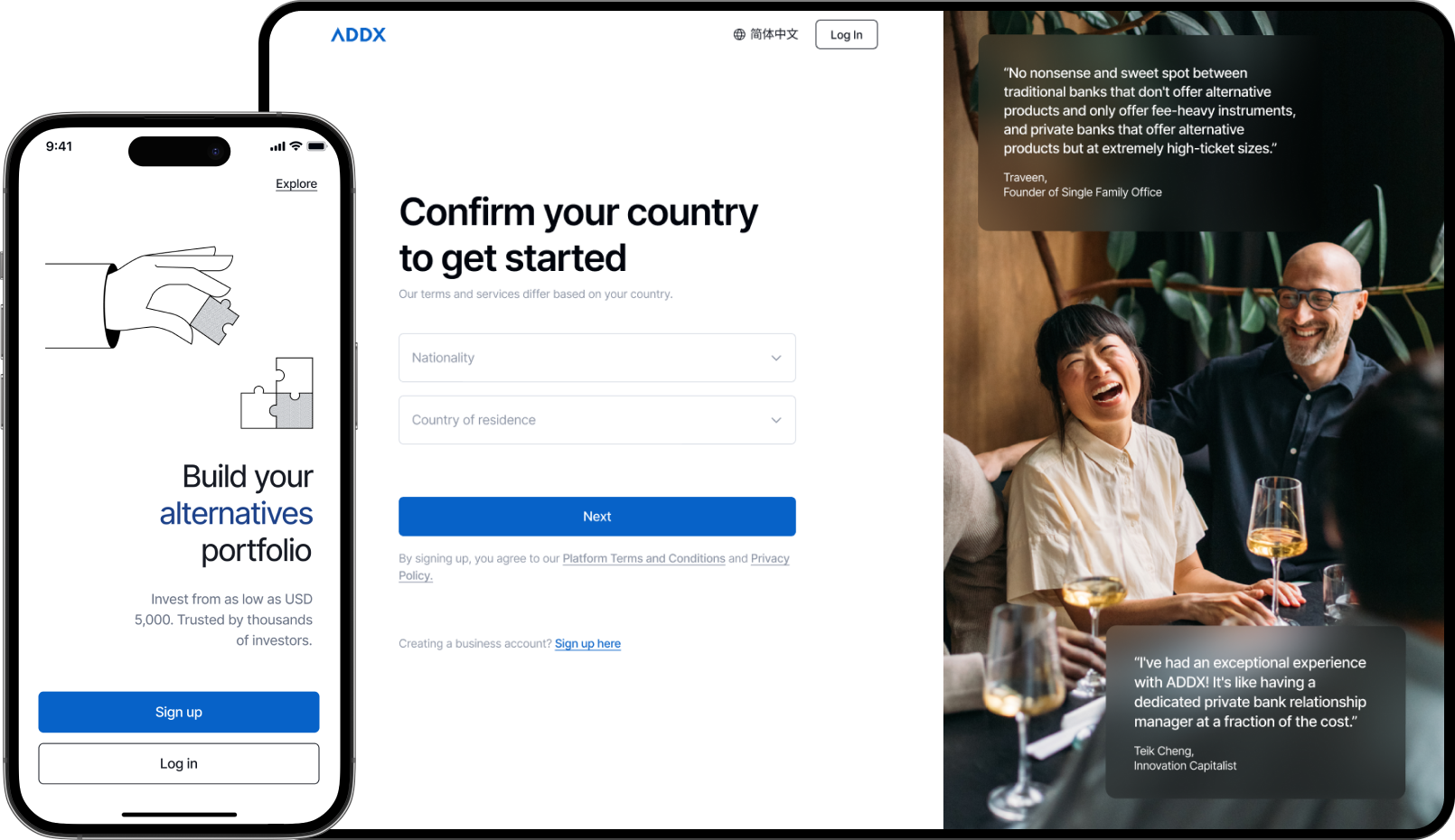

what our investors have to say

Join a platform trusted by thousands of investors

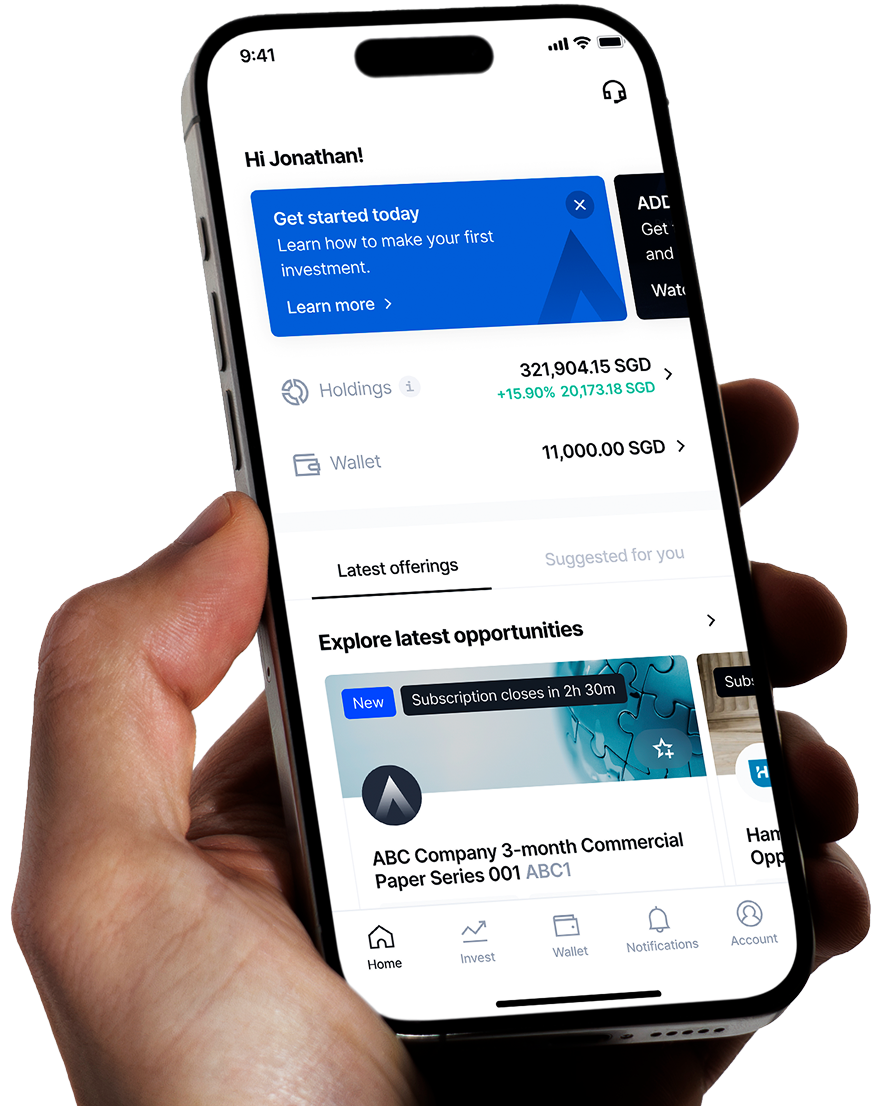

Start investing on ADDX in 3 easy steps

1Create an account

2Verify your identity and AI status

3Start investing when approved

FAQs

Let's get in touch

Manage your wealth, your way.

Gain priority access to:

- Institutional-grade opportunities in alternatives and private markets

- A seamless digital platform designed for accredited investors

- Transparent fees

- Exclusive closed-door events for accredited investors only

4.6 stars

4.6 stars Licensed by MAS

Licensed by MAS