Invest in

private credit

Private credit involves lending of capital to private companies in the form of loans, bonds and other credit instruments by non-bank lenders. There are different types of private credit, including senior and junior debt, each with their own capital structure positioning.

Enhance yield, reduce volatility

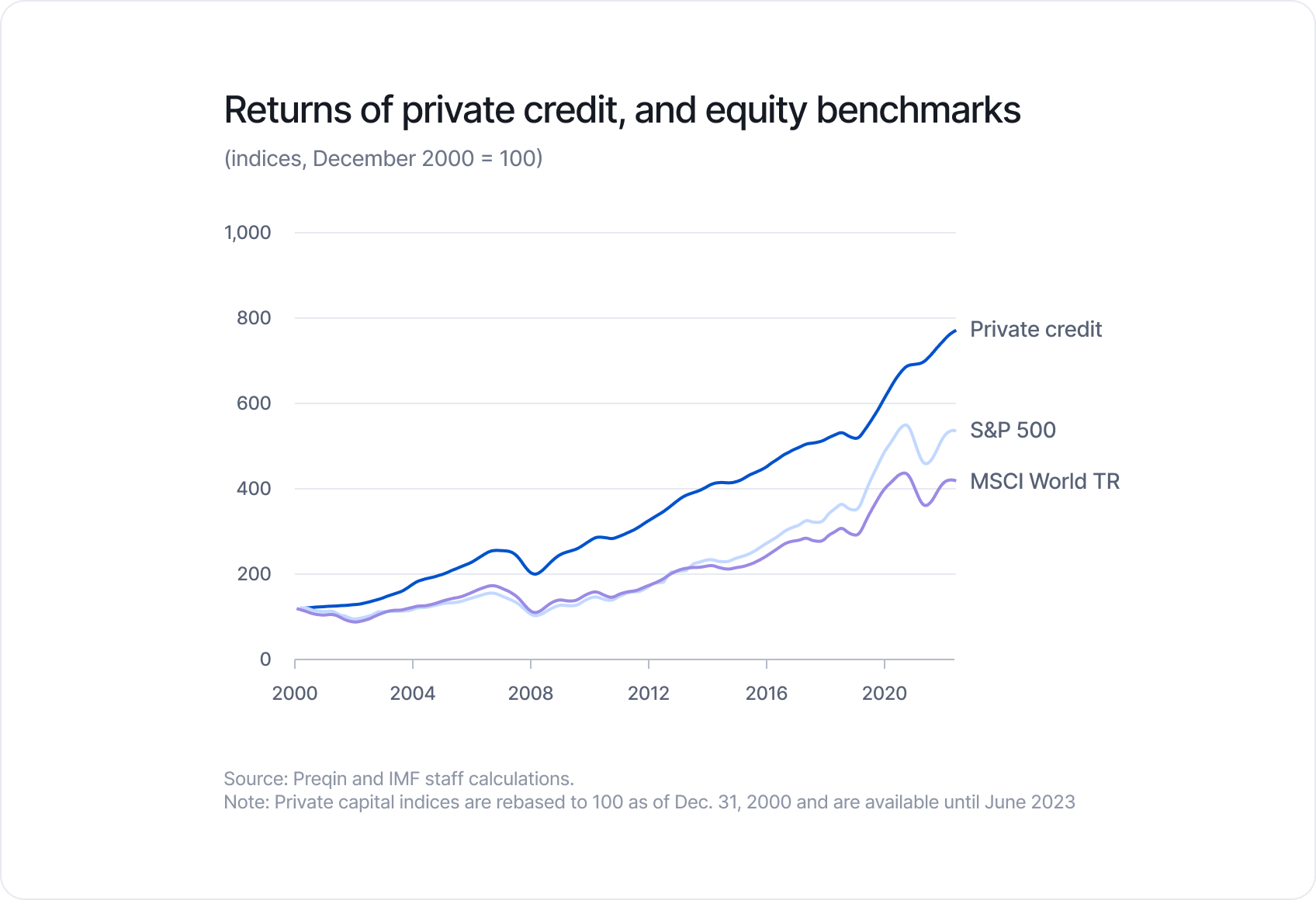

Throughout the 2010s and early 2020s, privately held companies increasingly turned to private credit to support their growth. Today, the global private credit market exceeds $1 trillion with significant potential for further expansion. It has also delivered higher returns compared to public asset classes.

This growth reflects a broader shift in capital markets, where a significant share of economic value creation is now occurring outside the public markets. For investors, this presents a compelling opportunity: private credit not only offer access to differentiated sources of return, but also help enhance diversification and resilience in portfolios built for the long term.

Private credit provides diversification with low correlation to stocks and bonds, helping reduce volatility and enhance risk-adjusted returns.

Private credit investments provide regular, predictable income through fixed or floating interest payments.

Private credit is generally senior to equity and may offer downside protection through collateral or covenants in the event of borrower default.

Private credit’s predictable cash flows and contractual structure can help smooth returns and reduce portfolio volatility.

Private credit

Private market

Corporate bonds

Public market

Loans made directly to private companies

Debt issued by public companies

Less liquid, usually held to maturity

Tradable in public bond markets

Higher yields with higher risk

Lower yields with more transparency

Dive deeper into private credit

FAQs

Discover private credit with steady income and lower volatility.

- Explore private credit opportunities offering yield, capital preservation, and downside protection.

- Join accredited investors building resilient portfolios.