Invest in

private equity

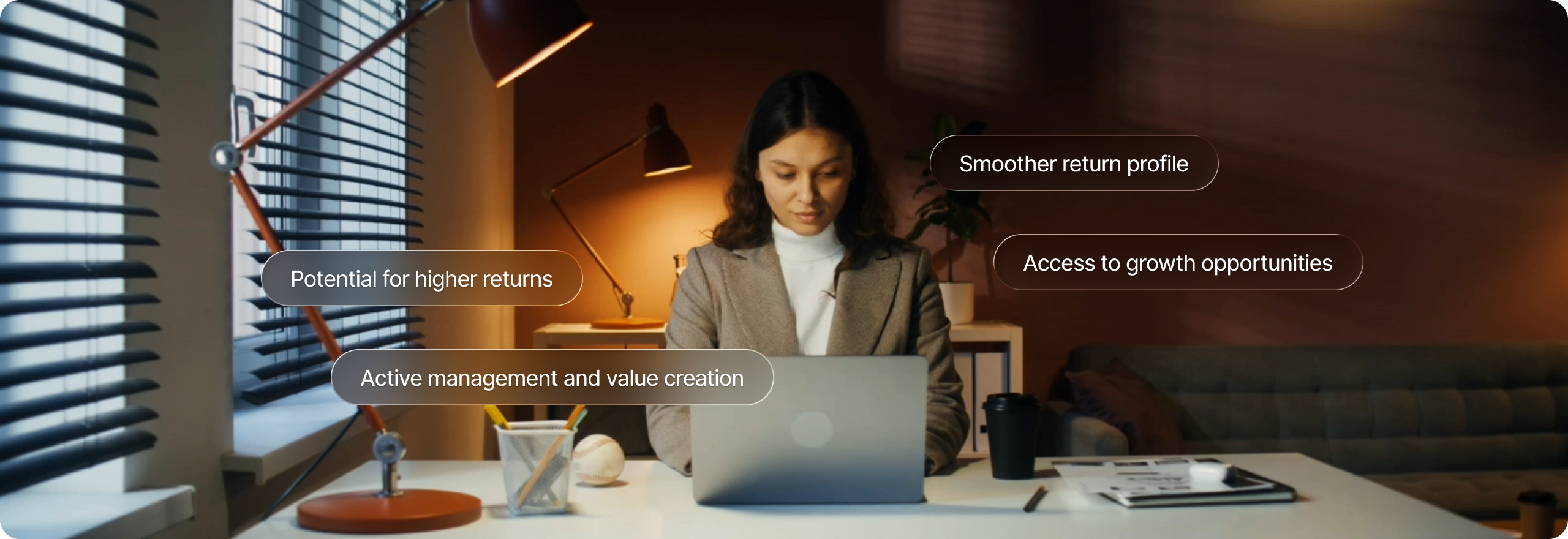

By investing directly in private companies, private equity seeks to generate value through active ownership and strategic growth. This asset class allows investors to diversify and pursue higher long-term returns beyond public markets.

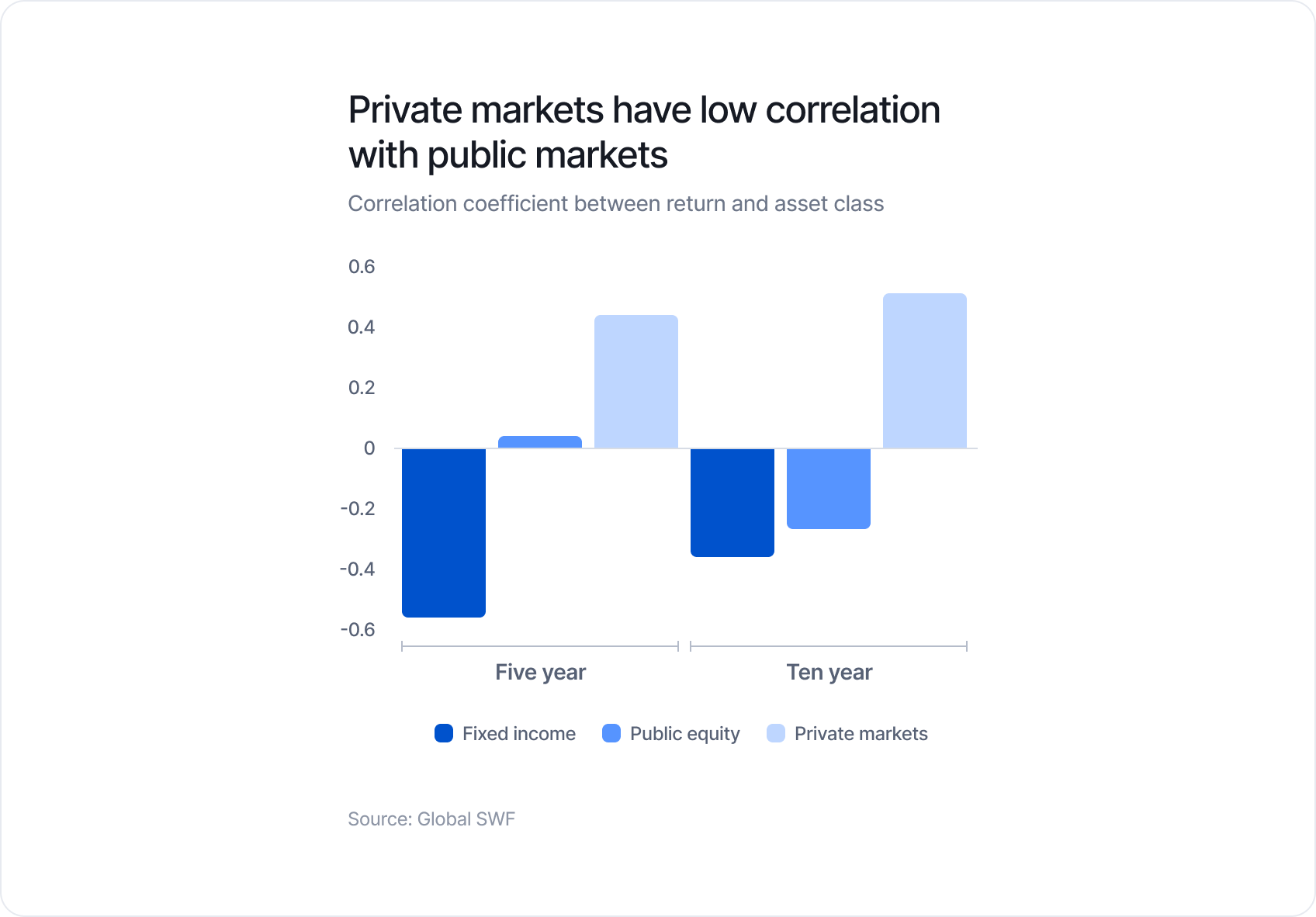

Low correlation, high diversification

Private market opportunities have grown significantly over the past two decades, driven by the trend of companies staying private longer. As a result, investor interest in this segment has surged, reflecting its growing importance in modern portfolios.

With its low correlation to public markets, private equity offers valuable diversification and the potential for enhanced long-term returns, making it a powerful addition to a resilient, well-balanced portfolio.

Private equity can potentially deliver higher returns than public markets, driven by illiquidity premiums, active management, and long-term focus.

Private equity gives investors access to companies across industries and stages, capturing growth opportunities not available in public markets.

Private equity firms actively manage portfolio companies, implementing strategies and improvements to enhance performance and drive growth.

Private equity can offer lower volatility than public markets, supporting stable, long-term returns.

Private equity

Private market

Public equity

Public market

Invests in private companies not listed on exchanges

Invests in publicly listed companies

Aims for high long-term capital growth

Varies with market conditions

Lower liquidity

Highly liquid, easily tradable

Access limited to accredited/institutional investors

Open to all retail investors

Dive deeper into private equity

FAQs

Accelerate your long-term portfolio growth with private equity.

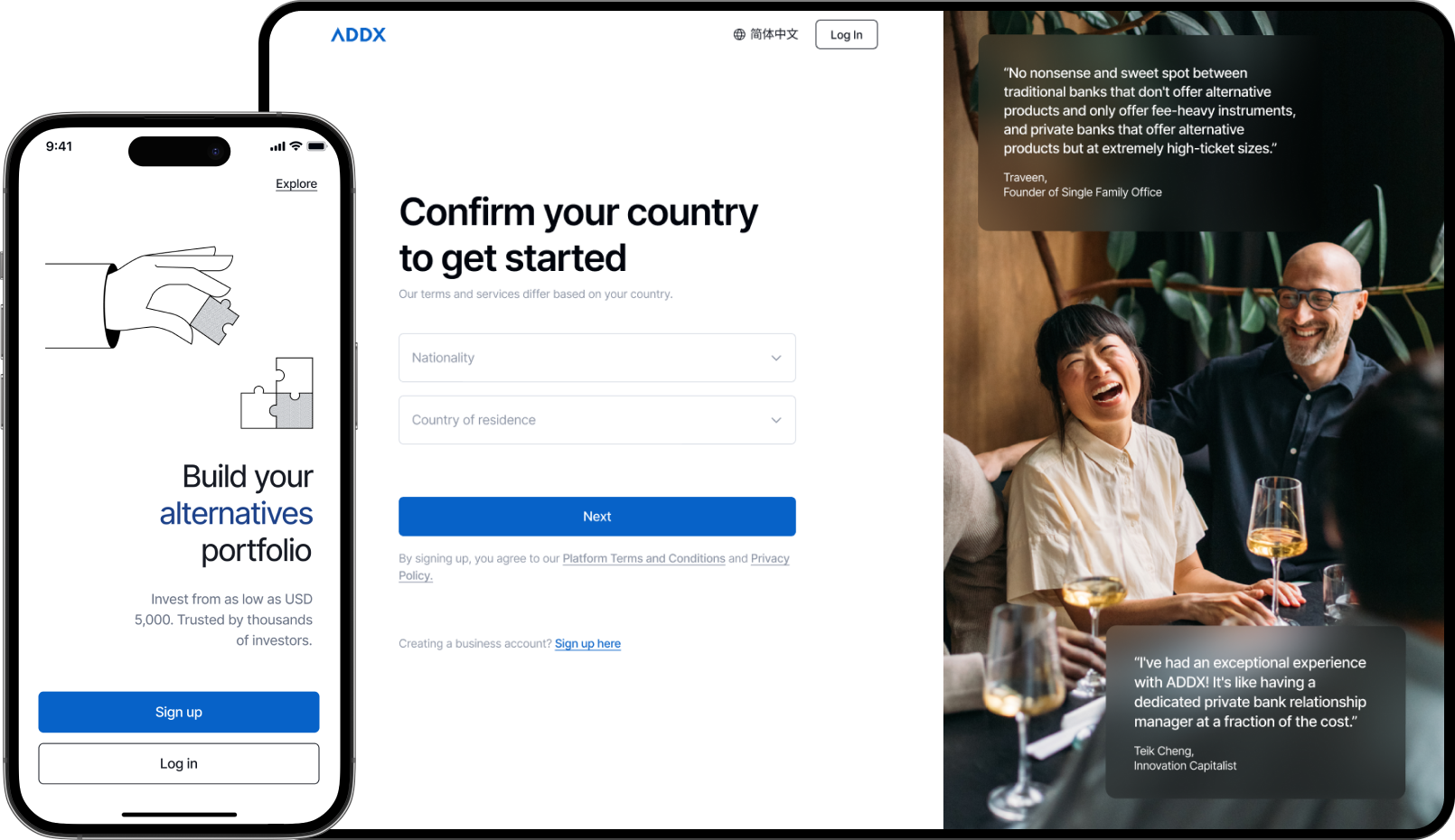

- Get exposure to private equity funds without high entry barriers.