Your entry to private markets

The easy way to invest and trade in private equity, hedge funds and unicorns.

Why private markets?

Diversify like the pros

Institutional investors typically allocate 20% of their portfolio to private markets.*

Tap into higher returns

Private equity has consistently outperformed public markets year after year.*

Build a solid foundation

Private asset classes have proved to be more resilient in times of volatility.*

Diversify like the pros

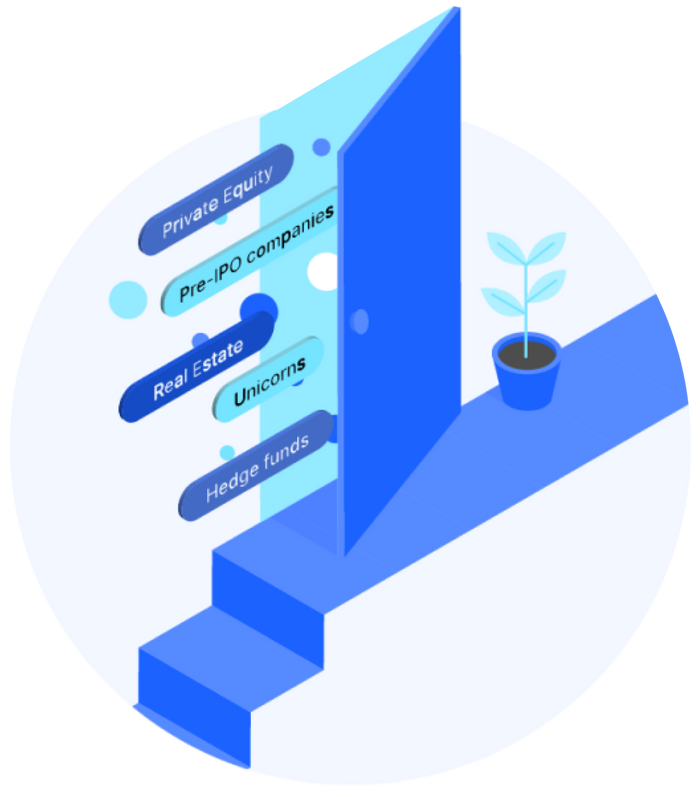

Open the door to unique asset classes

Join the institutional investors who typically allocate 20% of their portfolio to private markets.*

With ADDX, you’ll have a greater choice of unique opportunities to invest in, from venture and growth equity and infrastructure, to natural resources and real estate, across multiple industries and geographical regions.

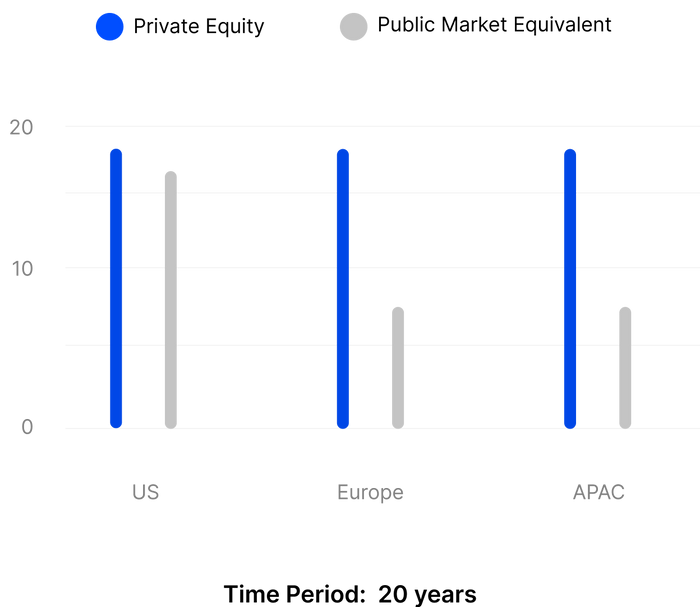

Tap into higher returns

Invest in a market that outperforms

Take your pick of strong performing investment options like hedge funds, unicorns, and pre-IPO companies.

Private markets have generated higher returns than public markets over the past decade, and private equity has consistently outperformed public markets over time, by almost every measure.*

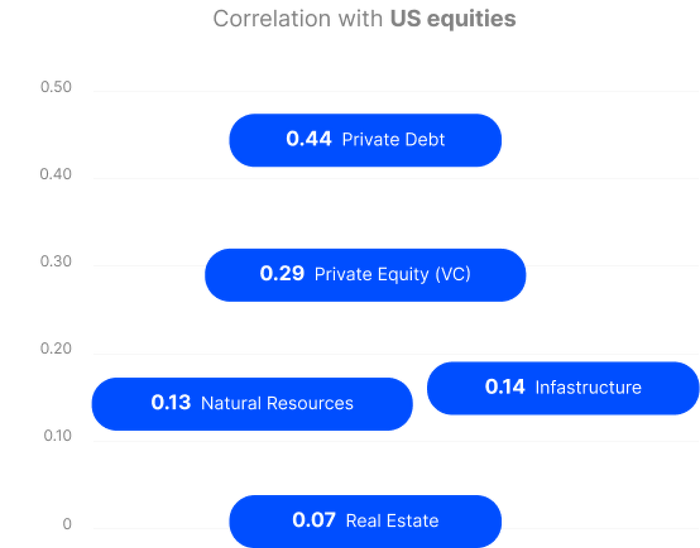

Build a solid foundation

Safeguard your portfolio with resilient assets

Build your portfolio on stable assets that are less affected by the typical ups and downs of a public market.

Private markets are less volatile, less responsive to short-term noise, and more resilient than public markets – with low correlation.*

Why ADDX?

We offer a smoother entry to private markets

Private market opportunities are typically hard to access, hard to back out of, and much harder to understand.

Here at ADDX, our approach is straightforward:

More accessible

With more opportunities curated in one place, and lower minimums to invest, you’ll have more control on your investments.

More liquid

Private markets are typically illiquid. On ADDX exchange, you can choose to cash out as little as USD 100 anytime, with little to no lock-ups.

More transparent

We’re transparent about who’s involved, how it works, and our fees. You can also reach out to us just for a chat.

We work with industry leaders for your security

We are regulated by the Monetary Authority of Singapore (MAS) and held to some of the highest regulatory standards.

Recognised Market Operator (RMO) and Capital Markets Services (CMS) Licensee, by the Monetary Authority of Singapore (MAS).

Your funds are safely stored with Asia’s safest bank, no matter what happens to ADDX.

All customer funds are held in a segregated account with our banking partner, DBS Bank Ltd.

Your data is held by world-class security experts.

We use Amazon Web Services (AWS) Cloud Security to safely host and store data.

Unleash the full potential of ADDX

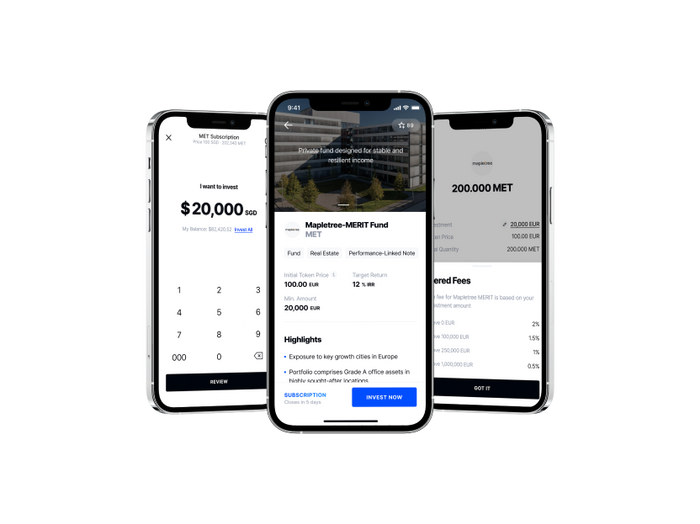

Invest

ADDX gives investors exclusive and early access to world class investment opportunities. From private equity, hedge funds and unicorns, to private debt, infrastructure, real estate and many more.

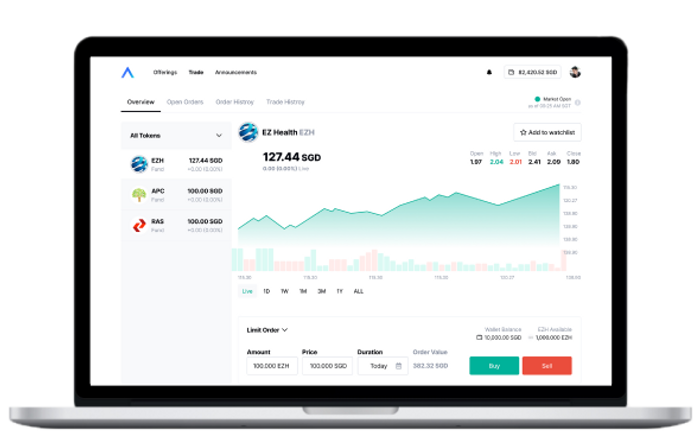

Investment feesTrade

Buy and sell tokens for as little as USD 100 with fellow ADDX Exchange investors, with little to no lock-ups, on both your desktop or mobile.

Our on-exchange trading is designed to offer all our investors an even playing field, with centralized communication of bid and offer prices, and trade information that’s available to everyone.

Keep up to date

Information is an investor’s best resource. As an ADDX investor, you’ll:

Ready to invest?

Getting started takes under 10 minutes. Here’s how to qualify:

Individual

Accredited Investor

Yearly income of at least SGD 300K

- or

Net financial assets of at least SGD 1M

- or

Net total assets of at least SGD 2M

Corporate Accredited or

Institutional Investor

Company's net assets exceeding SGD 10M in value

- or

Company's entire share capital is owned by one or more persons, all of whom are accredited investors

FAQs about ADDX

*Source: Investcorp White Paper June 2021 | McKinsey Private Markets Review 2021 | Bain Global Private Equity Report 2021

[1] Key shareholders of ICHX Tech, in turn the shareholder of ADDX Pte. Ltd.