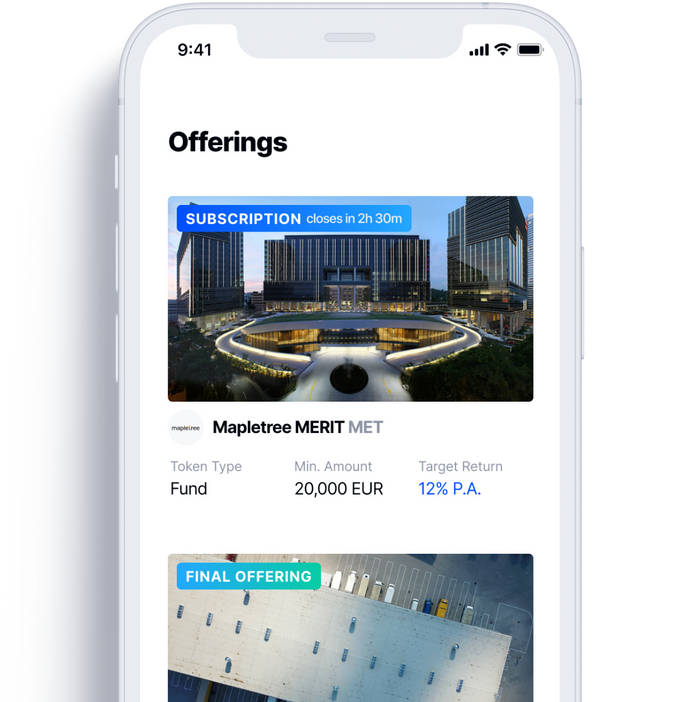

CURATED INVESTMENTS

Ride the next unicorns of private markets

Invest in expertly-curated private market offerings including unicorns in just a few clicks.

Find global names in the private markets for your clients

Private Equity |Private Debt | Private Funds

Ultimate flexibility

Hand-picked institutional investments.

Our wide product selection gives you the flexibility to craft bespoke investment strategies for your clients.

- • Institutional-quality private market opportunities

- • Diverse asset classes across the risk spectrum, from hedge funds to commercial paper

- • Minimum investments start at USD10,000

- • Early access to investments in unicorn startups

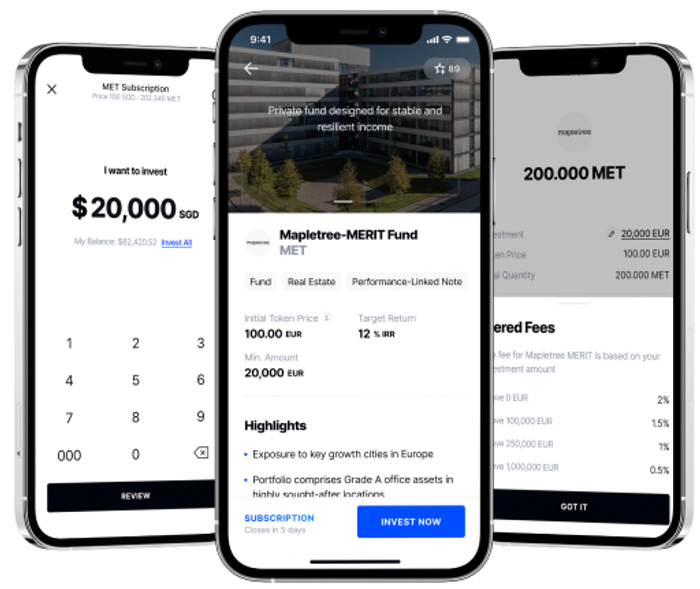

Invest with understanding

Master private market investments.

Private markets can be complex, so we distill everything you need to know into simple and clear language.

- • Comprehensive documents for each product including factsheets, fee schedules and private placement memorandums

- • Extensive educational resources on the fundamentals of private markets and digital securities

- • Latest market insights on trends and opportunities like pop culture studios, cryptocurrency and renewable energy to help you pick the next unicorn investment

Comprehensive due diligence

We enforce a rigorous selection process

You and your end-clients can rest easy knowing that our seasoned experts have decades of diverse financial experience and the industry credibility to match your every need.

See how we pick high-quality institutional investments here.

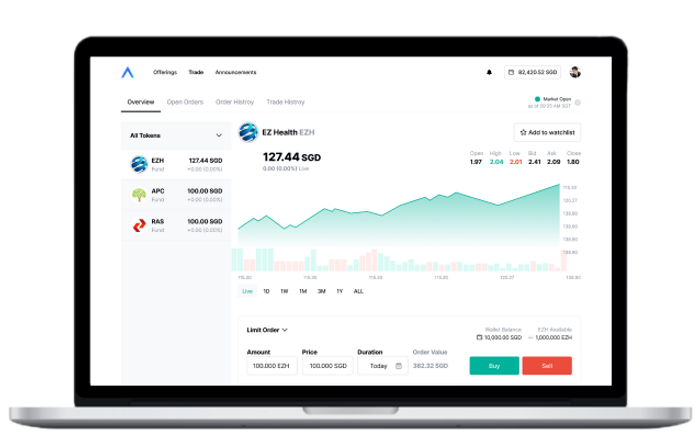

Redefine private market liquidity

Trade your digital securities on the ADDX Exchange, five days a week. All at your own convenience.

Built for institutional-level investing

Hear from our clients

Need more?

See how ADDX helps you grow your Wealth Management business:

Seamless User Experience

See why advisors, their clients, Global and Singapore investors love using ADDX.