Global ESG Innovators Fund

Invest in impact and returns with a top Korean asset manager.

Please note that this is a past offering.

Investment highlights

The Hanwha Global ESG Innovators Fund: A Private Fund From A South Korean Pioneer In ESG Investing

- An actively managed, long-only fund investing in equity securities of public companies with ESG-centric business models

- The fund seeks out companies with transformative business models, innovative products, and/or sustainable supply chains

- Proprietary ESG evaluation process

From Hanwha Asset Management, A Leading Korean Asset Manager

- With USD 84 billion in assets under management (AUM)¹, Hanwha Asset Management is one of the top three asset managers in South Korea and is a Korean pioneer in ESG-related practices

- Part of Hanwha Group, a Fortune Global 500 company leading internationally in a broad range of businesses

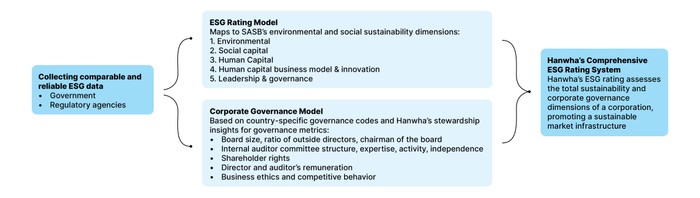

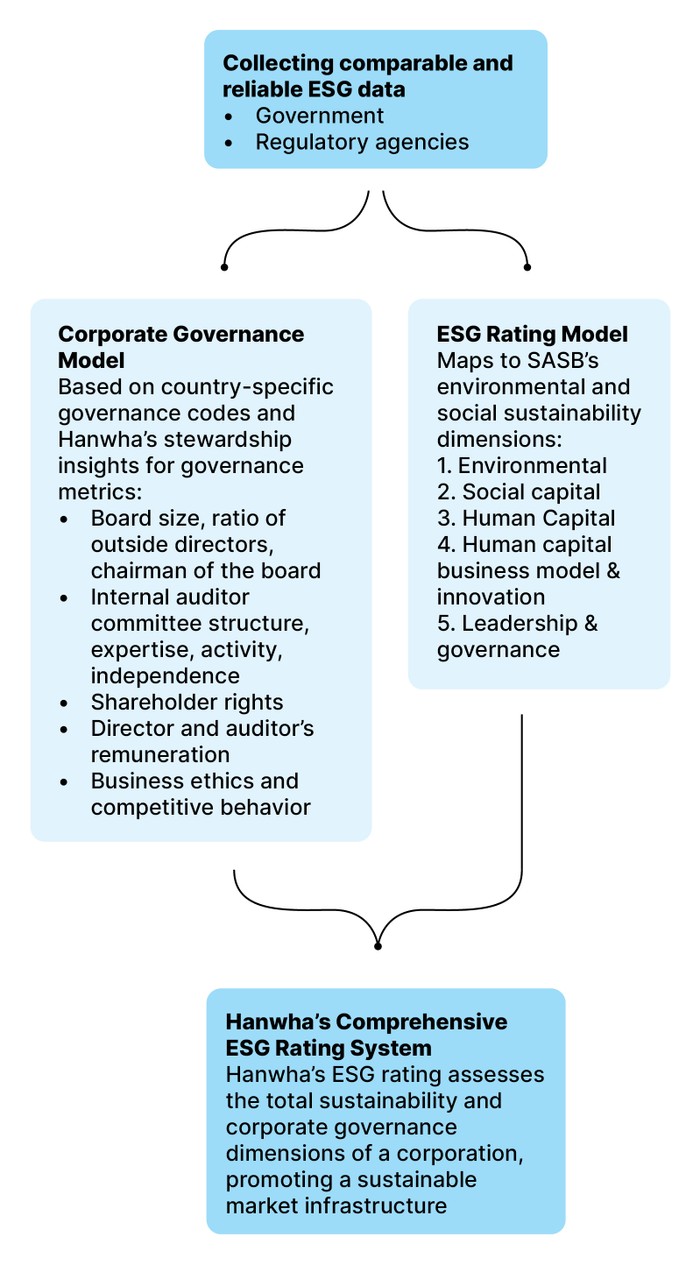

Hanwha’s Proprietary ESG Rating System

Hanwha’s dedicated ESG team uses a proprietary, in-house rating system to conduct research and analysis, from which the investment teams select the top 30-to-40 companies they believe will outperform.

Comprehensive: Fund includes approximately 1,000 securities in South Korea and 1,000 global securities.

Focused On Impact: ESG ratings are calculated using an exposure-weighted average with the most material ESG issues given the most weight. This ensures that businesses that address the most crucial ESG issues through their business models will achieve a higher rating.

Forward Looking: Fund uses forward-looking metrics to identify companies’ exposure to ESG-related risks that could impact their long-term value.

Based On Reliable Data: Ratings based on publicly disclosed information from reliable sources in order to enhance overall coverage and remove biases inherent in existing rating methodologies.

Diversified Across Geography & Industries

- Bottom-up research from the global universe of ESG top-rated companies with genuine business models

- Portfolio is rebalanced periodically in accordance with ESG rating revisions

¹Based on AUM, Source: Korea Financial Investment Association (as of January 29, 2021)

About The Issuer

Hanwha Asset Management Pte. Ltd. is based in Singapore and manages equity and alternative investments in the pan-Asian market. It is a subsidiary of Hanwha Asset Management Co., Ltd., one of the top three asset management companies in South Korea, and part of Hanwha Group. Founded in 1952, Hanwha Group is today a Fortune Global 500 company leading internationally in a broad range of businesses. Its investments in its primary industries (chemical, aerospace, mechatronics, solar energy, and finance) are laying the foundation for sustainable development and a brighter future for all.

Among other sustainability-related milestones, Hanwha Asset Management is the first and currently only Korean asset management firm to develop its own in-house ESG rating system and was the first Korean member of the Asia Investor Group on Climate Change, a private forum of regional investors creating awareness among Asia’s asset owners and financial institutions about the risks and opportunities associated with climate change and low carbon investing.

Registered Address

50 Raffles Place Singapore Land Tower, #34-06, Singapore 048623

Disclaimer: The information above has been provided by Hanwha Asset Management Pte. Ltd.. The contents of the above have not been verified by the Exchange and the Exchange assumes no responsibility for the contents above, including the accuracy, completeness or correctness of any of the information, statements or opinions made or reports contained in the content above. Target return is not necessarily indicative and does not guarantee actual return. This is not an advertisement making an offer or calling attention to an offer or intended offer.

Want to see more?

• View issuer's track record

• Investment strategy

• and other opportunities like this

Already have an account? Sign in

Invest safely with us.

Build your portfolio on a regulated platform with low minimums.

ADDX Fees

There are no hidden fees charged on your investments, only a one-time ADDX subscription fee that starts from as low as 0.5%.

What others are looking at

Get in on the market’s pick of the most popular and trending offerings amongst our investors.

Frequently asked questions

Can’t find an answer? Visit our FAQs for more commonly asked questions or get in touch with us.