Invest in

commercial paper

Commercial paper is an unsecured, short-term debt instrument used by companies to meet immediate funding needs. It offers investors a short-term, fixed-income opportunity with competitive yields.

Short-term, steady returns

Commercial papers have become an attractive option for investors seeking enhanced yield on their cash holdings, while maintaining liquidity and stability. Issued by established corporations typically to meet short-term funding needs, they offer a way to put idle cash to work.

As demand grows for efficient cash management, commercial papers provide a valuable tool for boosting returns on cash while supporting diversification and capital preservation.

Commercial paper typically has short maturities, ranging from three months to one year on the ADDX platform, aligning with investors with short-term liquidity needs.

Commercial papers can provide investors with a reliable source of income via regularly paid out coupons.

Commercial papers are issued primarily by publicly listed and/or established issuers. Financial information about the issuer is typically disclosed to provide investors insights into the financial condition of the corporation.

Commercial paper adds a different type of fixed income asset to a portfolio. It also spreads credit risk across various issuers and provides short-term investment options, enhancing portfolio diversity.

Commercial paper

Private market

Bonds/treasury bills

Public market

Issued by private/public companies

Issued by public companies/governments

Typically held to maturity, less liquid

Actively traded in secondary markets

Ultra-short maturities (up to 365 days)

Ranges from short to long-term

May be collateral-backed (eg. by inventory)

Not collateralised

Dive deeper into commercial paper

FAQs

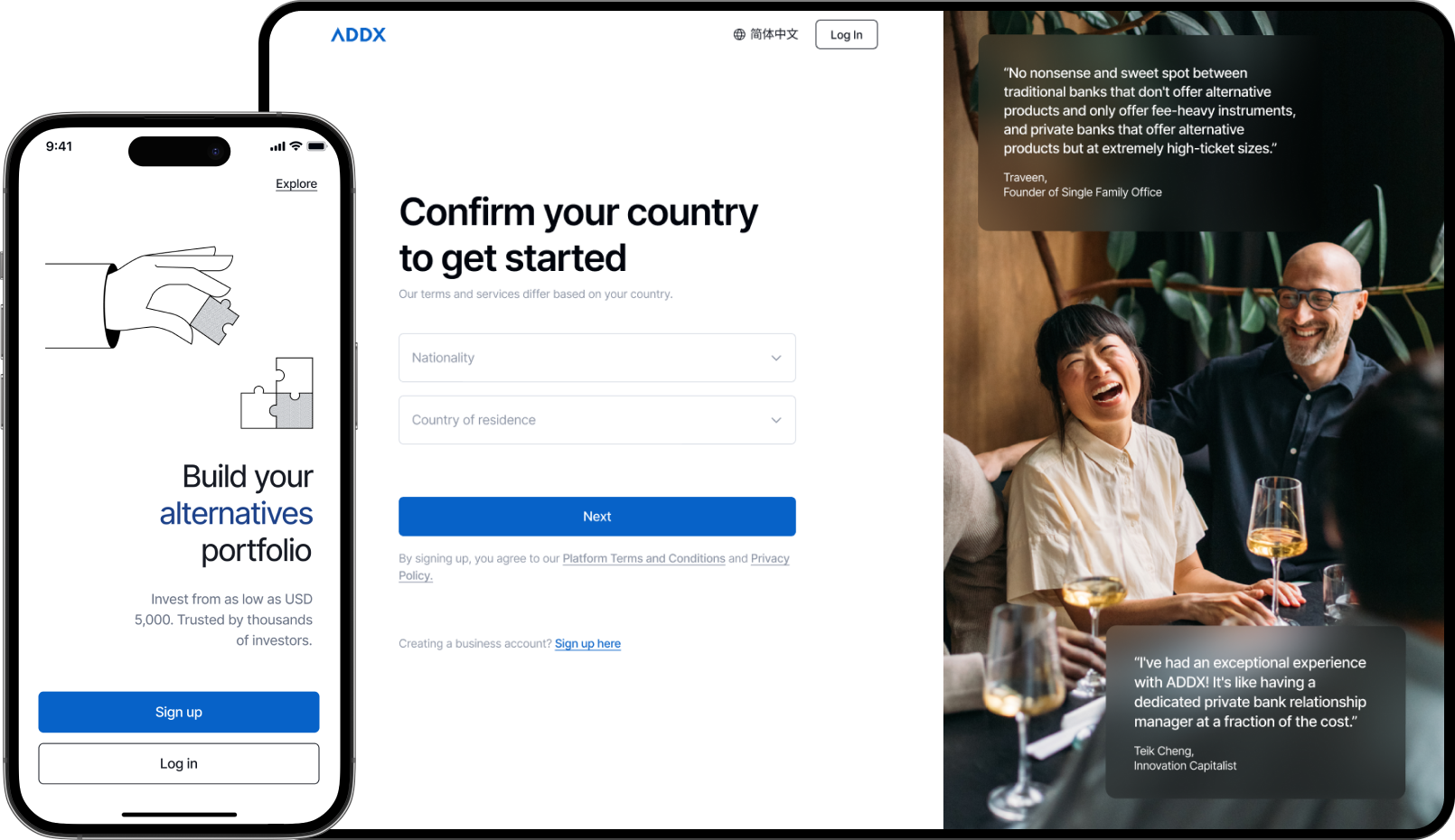

Tap into short-term yield with commercial papers.

- Access high-quality issuers with short-term debt opportunities, ideal for liquidity and diversification

- Start investing from lower minimums on a fully digital platform