Invest in

hedge funds

Hedge funds are actively managed investment pools investing across a range of asset classes and instruments. They may employ complex investment techniques such as derivatives, short selling, and leverage to deliver returns while mitigating risks.

Enhancing portfolio resilience and return potential

As markets become more complex and volatility rises across traditional asset classes, hedge funds have emerged as a powerful tool for navigating uncertainty. Their flexible, actively managed strategies (ranging from long/short equity to global macro and arbitrage) provide access to alternative sources of return, risk diversification, and downside protection.

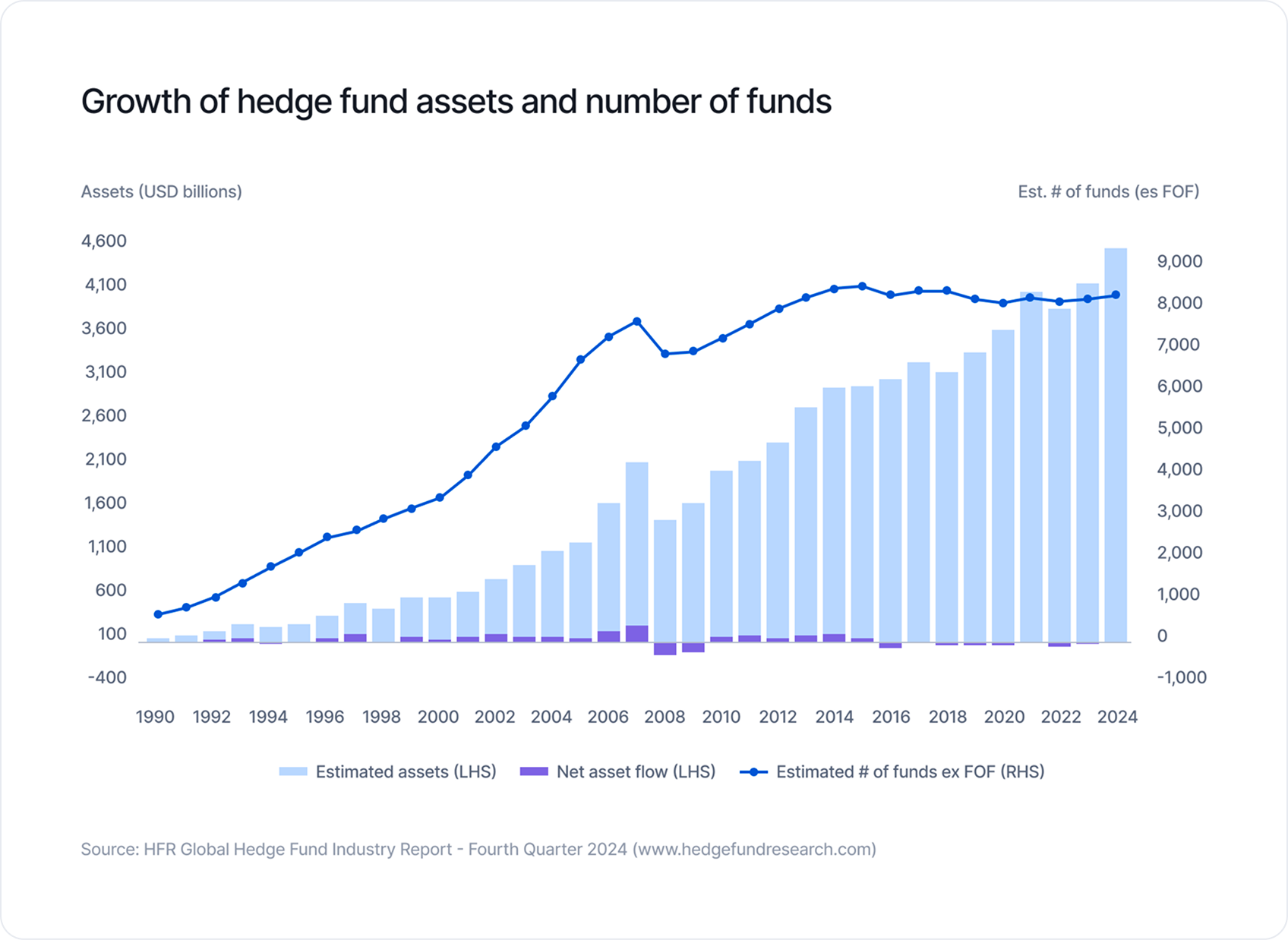

Recent shifts in market dynamics have heightened company-specific risk, which can be seen as expanding the opportunity set for skilled hedge fund managers. Reflecting this momentum, HFR reports that global hedge fund assets reached approximately $4.5 trillion by end-2024, an increase of $401.4 billion over a year.

Hedge funds invest across a wide range of asset classes and strategies, often using tools like shorting, derivatives, and leverage. This allows them to deliver alternative sources of return and unique risk exposures that traditional investments may not offer.

Hedge funds often focus on achieving positive returns in all market conditions (absolute return), as opposed to merely outperforming a benchmark (relative return). This can be potentially achieved through sophisticated techniques and strategies such as derivatives and short selling.

Hedge funds are actively managed, meaning the managers frequently make decisions to buy or sell assets based on their analysis and market conditions. This active approach can be beneficial in volatile or declining markets.

Hedge funds

Private market

Mutual funds

Public market

Uses complex strategies including leverage, derivatives, and shorting

Primarily long-only strategies within regulatory limits

Typically seeks absolute returns in all market conditions

Benchmarked relative returns

Liquidity is periodic (e.g., monthly, quarterly)

Daily liquidity

Dive deeper into hedge funds

FAQs

Add an edge to your portfolio with hedge funds.

- Diversify your portfolio with hedge funds spanning global macro, long/short, and multi-strategy.