In the current volatile economic environment, hedge funds can provide investors with unique opportunities to diversify returns outside of public markets. With flexible strategies and sophisticated investment techniques, hedge funds have the potential to enhance returns while managing risk across market cycles.

What are hedge funds?

Hedge funds are alternative investment funds. Unlike traditional mutual funds and ETFs, hedge funds can employ complex investment techniques such as derivatives, short selling, and leverage to enhance returns while mitigating risks in both rising and falling markets.

What are the different types of hedge funds?

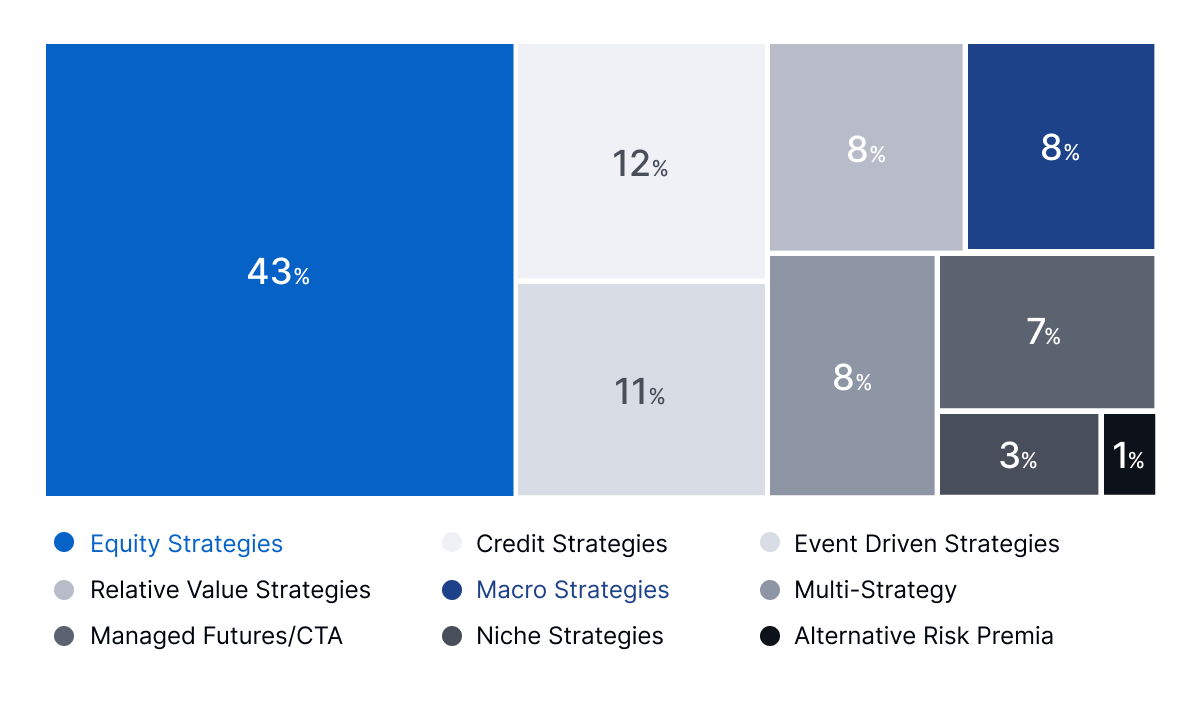

Hedge funds can be generally categorised by a single strategy or multi-strategy across the following types: equity, relative value, event driven, macro, credit, niche, and alternative risk premia.1

Equity strategies, strategies that take long positions in stocks perceived as undervalued and short positions in stocks considered overvalued, make up the largest proportion of the hedge fund universe.1

Source: Preqin

What makes hedge funds unique?

Hedge funds vary widely in strategy but generally adopt a flexible investment approach across both liquid and illiquid asset classes (i.e. stocks, bonds, commodities, currencies, real assets, etc.) and employ complex investment techniques (i.e. derivatives, leverage, and short selling). This versatility, not typically found in traditional public market funds, allows hedge funds to potentially increase portfolio diversification and generate attractive risk-adjusted returns that are hard to find elsewhere.

For example, global macro strategies carry long and/or short positions across stocks, bonds and currencies, and employ derivatives such as options and futures to capitalise on broad macro-driven themes like inflation, interest rates, monetary policy, etc.

Why consider investing in hedge funds now?

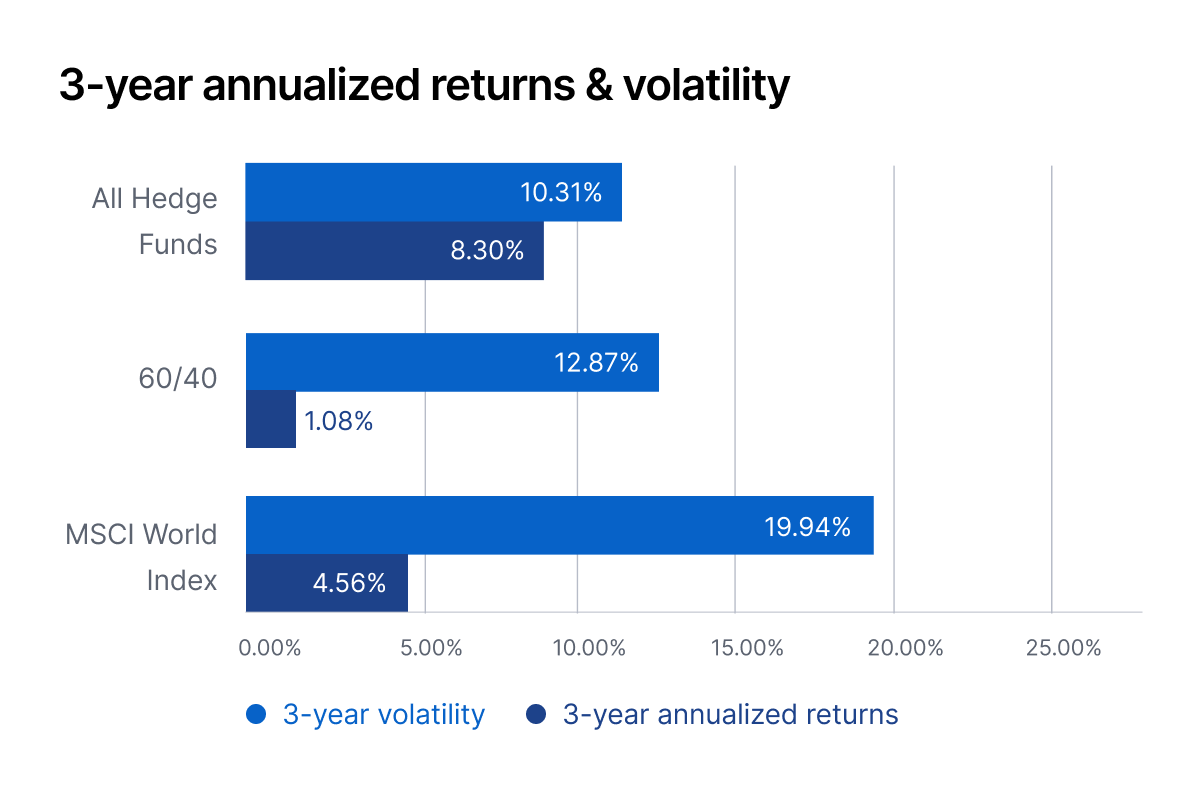

- Outperformance in public markets

Public market returns are being challenged in the current economic environment, with traditional 60% stock/40% bond portfolios and the broader equity market (represented by the MSCI World Index) returning -15.9% and –17.7% in 2022, respectively.2 In comparison, hedge funds experienced a drawdown of -4.2% (represented by the HFRI Fund Weighted Composite Index).2 This outperformance in a turbulent 2022 was led by macro hedge fund strategies – strategies based on macroeconomic events – that returned 9% with help from increasing bond yields and the strengthening dollar.3 Looking at three-year annualized returns across all strategies, hedge funds similarly outperformed a traditional 60/40 portfolio and the equity market with lower volatility.4 However, it is important to note that performance can vary widely across strategies.

Source: Preqin

Source: Morgan Stanley

- Portfolio diversification

Hedge funds can potentially provide better portfolio diversification by investing in different asset classes, markets, and strategies. In the current economic climate of continued interest rate hikes and higher market volatility, hedge funds remain relevant as a portfolio diversifier, especially with strategies such as global macro that tend to exhibit lower correlation to the global equity market.5 Some hedge funds are multi-strategy, meaning they combine different strategies within a single portfolio, offering even greater potential diversification.

- Flexible and active management approach

Hedge funds have more flexible investment strategies given their wide toolkit of investment techniques including derivatives, leverage, and short selling. This flexibility allows hedge funds to adapt to evolving market dynamics and potentially provide positive returns in different market environments. Their active management approach aims to exploit market inefficiencies, capture emerging trends, and adapt to changing market conditions, potentially leading to outperformance.

What hedge funds does ADDX offer?

Our hedge fund offerings are focused on macro strategies and multi-strategies managed by leading hedge fund managers. At ADDX, we strive to provide thoughtfully selected alternative investment opportunities with minimums now as low as USD 1,000 to help you reach your investment goals.

Sign up to explore our opportunities now

1Preqin

2Morgan Stanley

3FT.com

4Preqin

5UBS

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX have any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.