When we invest, most of us automatically gravitate towards stocks. That’s because they’re easily accessible.

While many of us already have significant exposure to public equities – either through the US or Singapore stock markets – we have very limited holdings in alternative investments.

What constitutes an “alternative” investment? Basically, anything that isn’t publicly listed or a bond, so private equity, private credit, hedge funds, real estate, infrastructure, venture capital, and commodities.

Historically, two of the biggest hurdles to having a larger allocation to alternative investments in our personal portfolios has been liquidity and minimum investment amounts.

However, with the proliferation of vehicles that offer better liquidity (think evergreen funds) and much lower investment minimums, those arguments may not hold anymore.

Accredited investors nowadays can consider allocating to alternatives. And here are three big reasons why they should.

1. Lower volatility

When stock markets fall, many of us tend to panic. The common adage is to continue to “stay invested” but in reality, putting that into practice is much harder.

Instead, it would be preferable if we could invest a portion of our money into assets that could deliver similar (if not better) returns but at a much lower level of volatility.

That means we’re not held completely held hostage to the inevitable gyrations of the public markets.

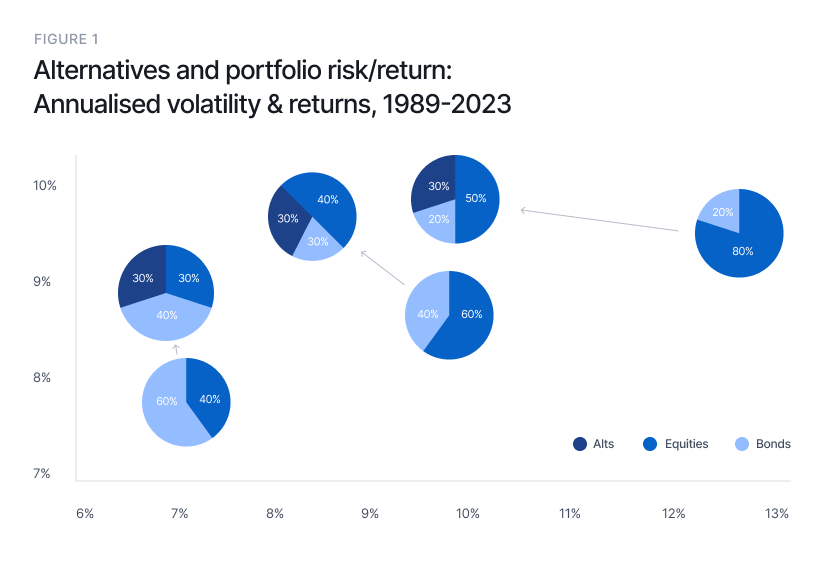

Indeed, portfolios with private market exposure have been shown to deliver superior risk-adjusted returns versus their purely stock-bond equivalents (see Fig. 1 below).

Source: Bloomberg, Burgiss, HRFI, NCREIF, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Alts include hedge funds, real estate and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Data is based on availability as of May 31, 2023

2. Reliable, regular income streams

Investors should also not forget that alternatives aren’t all about growth. In many areas, such as infrastructure, real estate and private credit, there’s an invaluable element of consistent income generation.

If we look at areas such as direct lending within private credit, the yields on offer can be attractive. Added to that are areas like real estate and infrastructure, which may deliver stable and inflation-protected cash flows.

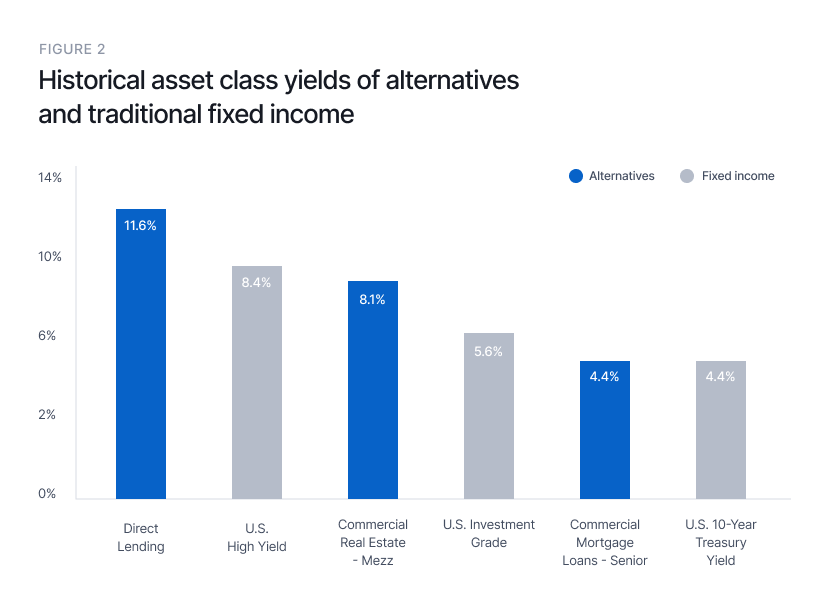

Direct lending yields have historically been higher than public credit markets, such as US high yield and US investment grade corporate bonds (see Fig. 2).

Depending on credit quality, private credit spreads can end up being substantially higher than public markets – with senior debt historically providing investors with an uplift of anywhere from 200 basis points (bps) to 600 bps.

The added benefit of private credit is that it does all this but with less volatility than publicly traded markets. The supply/demand dynamics can create mark-to-market price volatility that isn’t present in private credit market.

Source: BAML, Bloomberg Finance LP, Clarkson, Cliffwater, Drewry Maritime Consultants, Federal Reserve, FTSE, MSCI, NCREIF, FactSet, Wells Fargo J.P. Morgan Asset Management. *Fixed income yields are as of 11/30/2023. Alternative yields are as of 9/30/2023 and CRE – Mezz, which is as of 10/31/2023. CML – Senior: Gilberto-Levy Performance Aggregate Index (unlevered). Mezzanine commercial mortgage loans yield is derived from a J.P. Morgan Survey and U.S. Treasuries of a similar duration. Direct Lending: Cliffwater Direct Lending Index; U.S. High Yield: Bloomberg US Aggregate Corporate High Yield; U.S. 10-year: 10-year U.S. Treasury yield; Data is based on availability as of November 30, 2023. Past performance is not indicative of future results.

3. Diversification

While a typical 60/40 stock/bond portfolio can provide a level of diversification, in recent years it has seemed less of a certainty that diversification works.

We can just look to 2022, when both stocks and bonds fell sharply, as higher interest rates and inflation pummelled both assets.

Yet in volatile markets, particular alternative assets can still outperform. That was true of hedge funds in 2022, which outperformed (declining only 2.4%) both stocks and bonds – which finished the year down double-digit percentages.

Beyond that, areas like private credit offer wider spreads and protective loan covenants amid the current high interest rate environment we find ourselves in.

With a breadth of options to choose from; real estate and infrastructure for “enhanced”, yield-like returns, through to private credit and private equity, the options to diversify away from equities and fixed income remain numerous.

Investing in alternative assets according to risk appetite

Overall, investing in alternative assets allows us to allocate to uncorrelated asset classes that could also help lessen portfolio volatility in the process.

As is likely with most investors, a significant percentage of our overall wealth is likely tied up in stocks or bond-like investments.

By focusing on public market investments only, , we could be missing out on the huge opportunities that alternative assets offer us.

We also need to remain cognisant of our risk appetite in alternatives and allocate accordingly.

Whether we invest in income-generating assets like private credit/infrastructure or growth-oriented assets like private equity, your own portfolio goals will form a critical part of your alternatives journey.

Key risks investing in alternatives

While investing in alternatives may enhance your portfolio, it also comes with higher levels of risk due to a number of factors, including but not limited to:

Capital risk: Alternative investments are subject to economic, regulatory, market, and political risks, potentially making them worth more or less than the original investment. Investors may lose the entirety of their invested capital.

Liquidity and valuation risk: Alternative investments may have no or limited liquidity with valuations that may be based on estimates which cannot be marked to market until sale. There is no guarantee of selling these investments at fair value.

To learn more about how you can access private markets and alternative investments, open an account with us and explore the diverse opportunities we offer to enhance your portfolio.

Sources

https://am.jpmorgan.com/content/dam/jpm-am-aem/americas/us/en/insights/portfolio-insights/know-your-alternatives.pdf

https://www.jpmorgan.com/insights/investing/investment-strategy/the-case-for-alternative-investments

https://www.cambridgeassociates.com/en-as/insight/private-credit-strategies-introduction

https://www.aurum.com/hedge-fund-data/hedge-fund-industry-deep-dive/hedge-fund-industry-deep-dive-full-year-2022

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX have any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX. ADDX reserve all rights to this article.