As the market cap of Tesla rises to close to US$1 trillion, we examine the key factors behind the sharp rise in electric vehicle sales.

Electric vehicle (EV) sales globally in the first half of 2021 increased 160% from a year earlier to reach 2.6 million units, according to independent analyst company Canalys. With growth seen across all three top auto markets of China, Europe and the US, EV sales is now estimated to be close to 7% of total new sales in the global automotive market.

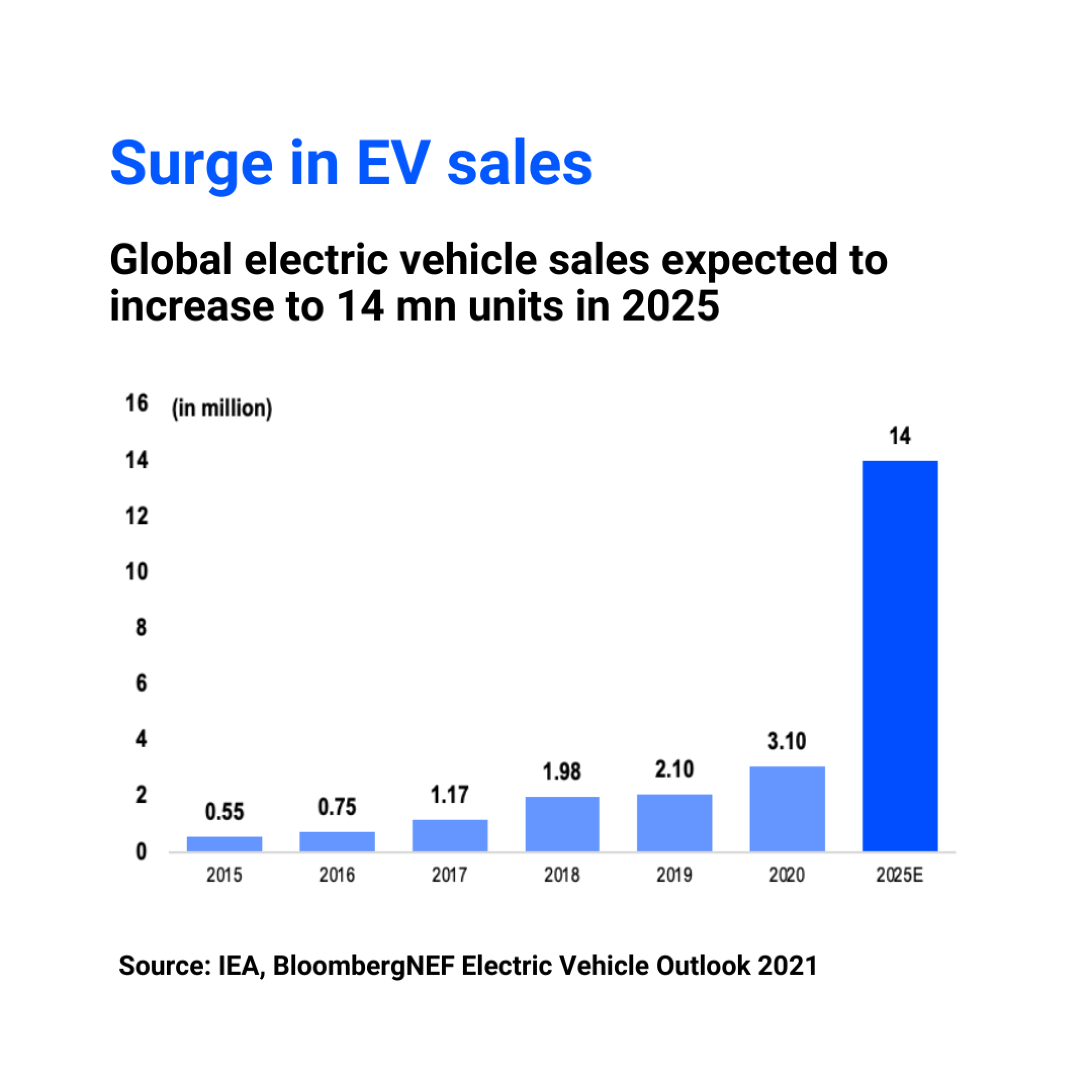

With the continued strong sales momentum, total electric vehicle sales is expected to exceed 5 million in 2021, representing a compounded annual growth rate of above 80% since 2011. This also puts EV sales on track to meeting BloombergNEF’s expectation of 14 million units to be sold in 2025.

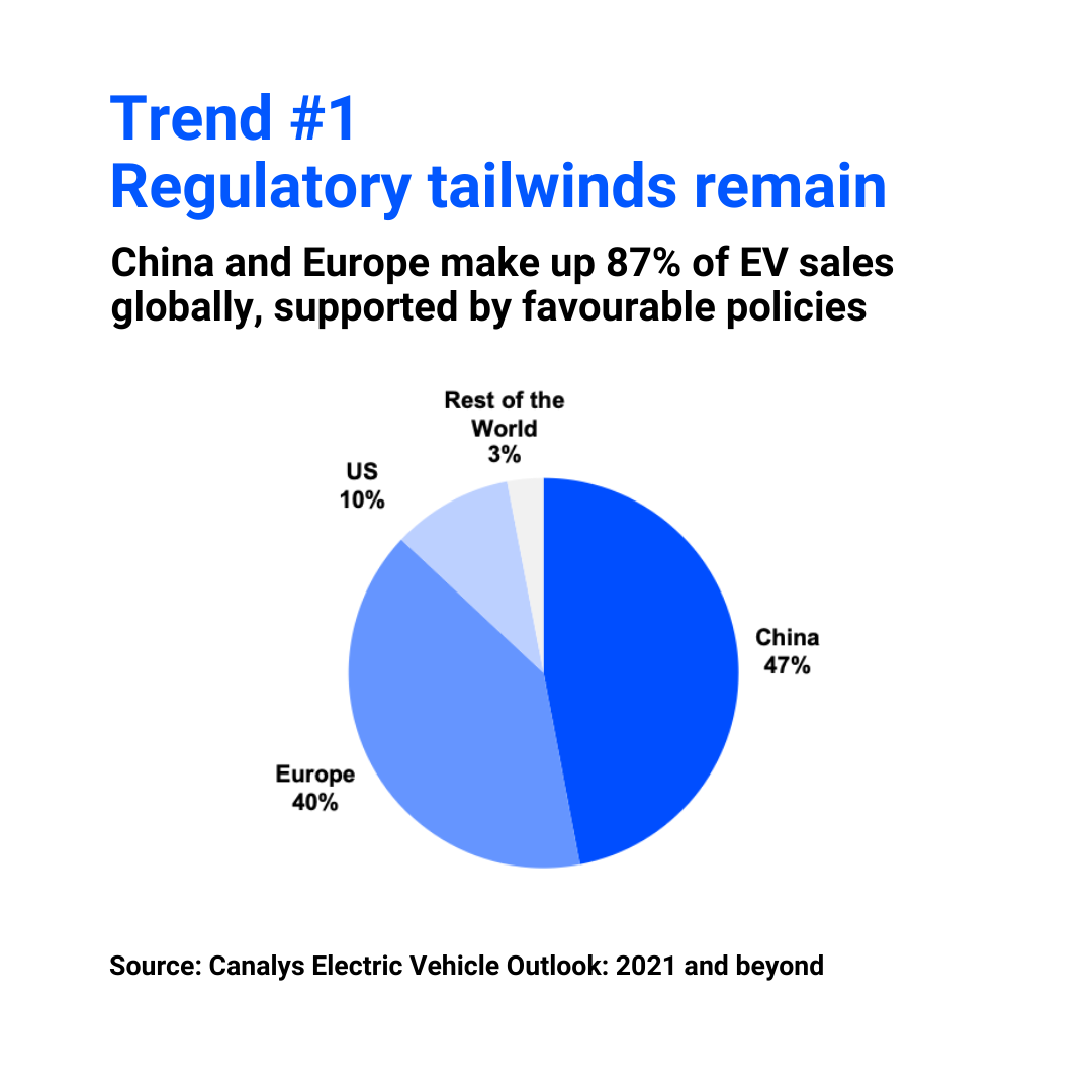

1. Regulatory tailwinds remain

The strong growth in EV adoption has been supported by many policy initiatives, particularly in China and Europe. Canalys estimates that these two markets represent close to 87% of total global EV sales in the first half of 2021.

- China - To encourage the transition to EV, China authorities initially provided consumers with subsidies. which could be as high as Rmb50k for a Rmb250k car. While these subsidies are gradually being phased out, they are being replaced by requirements for automotive manufacturers to have EV sales representing 40% of total vehicle sales by 2030.

- Europe – Europe’s ‘Fit for 55’ legislation targets to reduce greenhouse gases (GHG) emissions by 55% by 2030 (from 1990 levels). In particular, there are targets to reduce carbon emissions for new cars and vans by 100% by 2035. There are also more emission rules coming through such as the new engine standard, Euro 7. According to Volkswagen, this could pose a “tremendous challenge” for petrol-based vehicles as more expensive technology is required to ensure compliance.

- USA – While US has been slow in the take-up of EVs in the part due to a lack of regulatory and legislative changes, this could change with a new US$174m commitment to support electric vehicle uptake. This would go towards a range of initiatives from charging infrastructure to topping up the federal tax credit, with a target to reach 50% electrification by 2030.

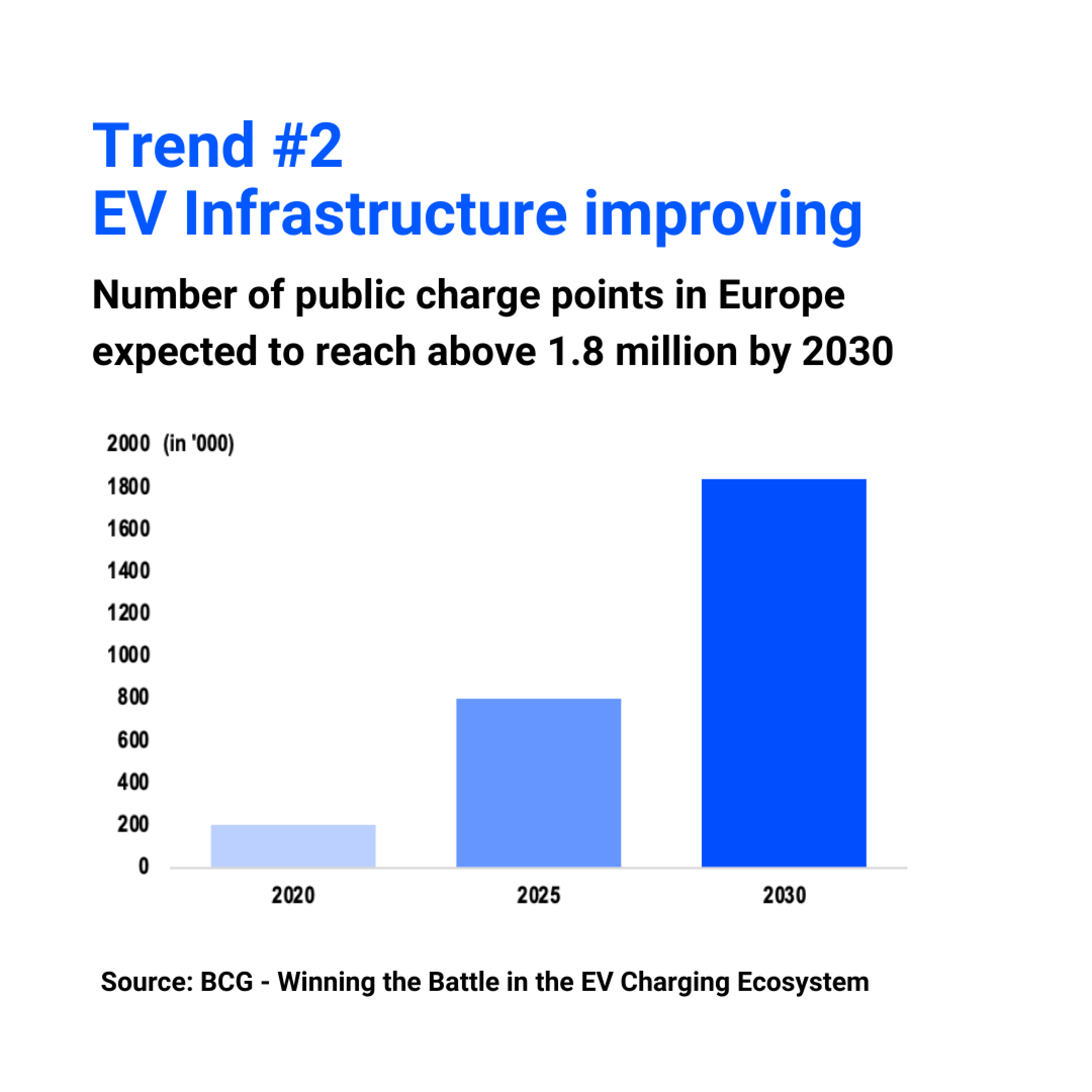

2. EV Infrastructure improving significantly

A lack of electric vehicle charging infrastructure has been widely cited as a barrier to widespread EV adoption. However, as an example of the significant investments being put into EV infrastructure, Wood Mackenzie estimates that US$111 billion of cumulative investment will be put into public charging points between 2020 and 2030. This will increase the number of public charging points globally to 6 million outlets by 2030. Notable progress made across various aspects of EV infrastructure include:

- Growing number of charging points – It is estimated that the optimum EV to charging point ratio is in the range of 5 to 10 EVs per charging point. In Europe alone, the number of public charge points is expected to increase to above 1.8 million by 2030 from just 203,000 in 2020 according to BCG estimates.

- Fast charging would encourage consumer adoption – European firm ABB recently launched the world’s fastest EV charger, Terra 360. Suitable for existing fuel stations, the Terra 360 is reported to simultaneously charge up to four vehicles, fully charging an EV in 15 minutes or less. Terra 360 would be available in Europe from end 2021, and in US, Latin America and Asia Pacific regions in 2022.

- Grid investments are being made - US President Joe Biden US$2 trillion infrastructure plan includes a S$100 billion investment to upgrade and build out US’ power grid. Such investments in the power grid “cannot be underestimated” according to Daimler, as they will help to increase EV adoption together with other measures to enhance grid stability such as encouraging off-peak charging.

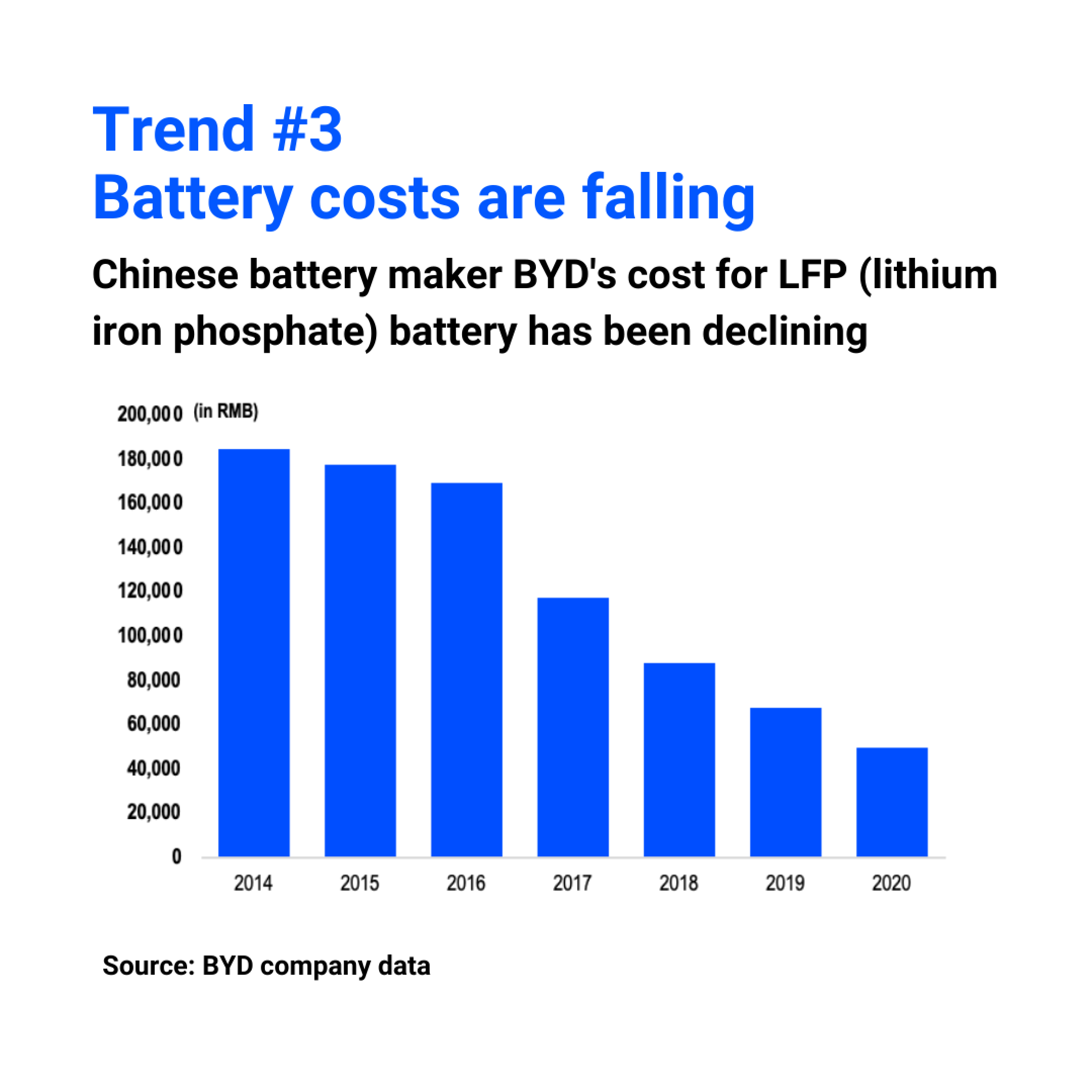

3. Battery costs continue to fall

The projected price of battery packs used in electric vehicles continues to fall. Wood Mackenzie forecasts the US$100/KWh threshold to be breached by 2024, one year earlier than earlier projections. As the biggest cost component of an EV, the cost declines play an important role in the wider adoption of EVs.

According to Chinese EV and battery maker BYD, battery costs in China have declined by over 70% since 2014. In particular, its Blade battery technology which uses lithium and iron rather than cobalt and nickel commonly used by other batter makers is reported to be capable of holding close to 50% more energy compared to other batteries. This has led to a longer range being achieved for the EVs produced.

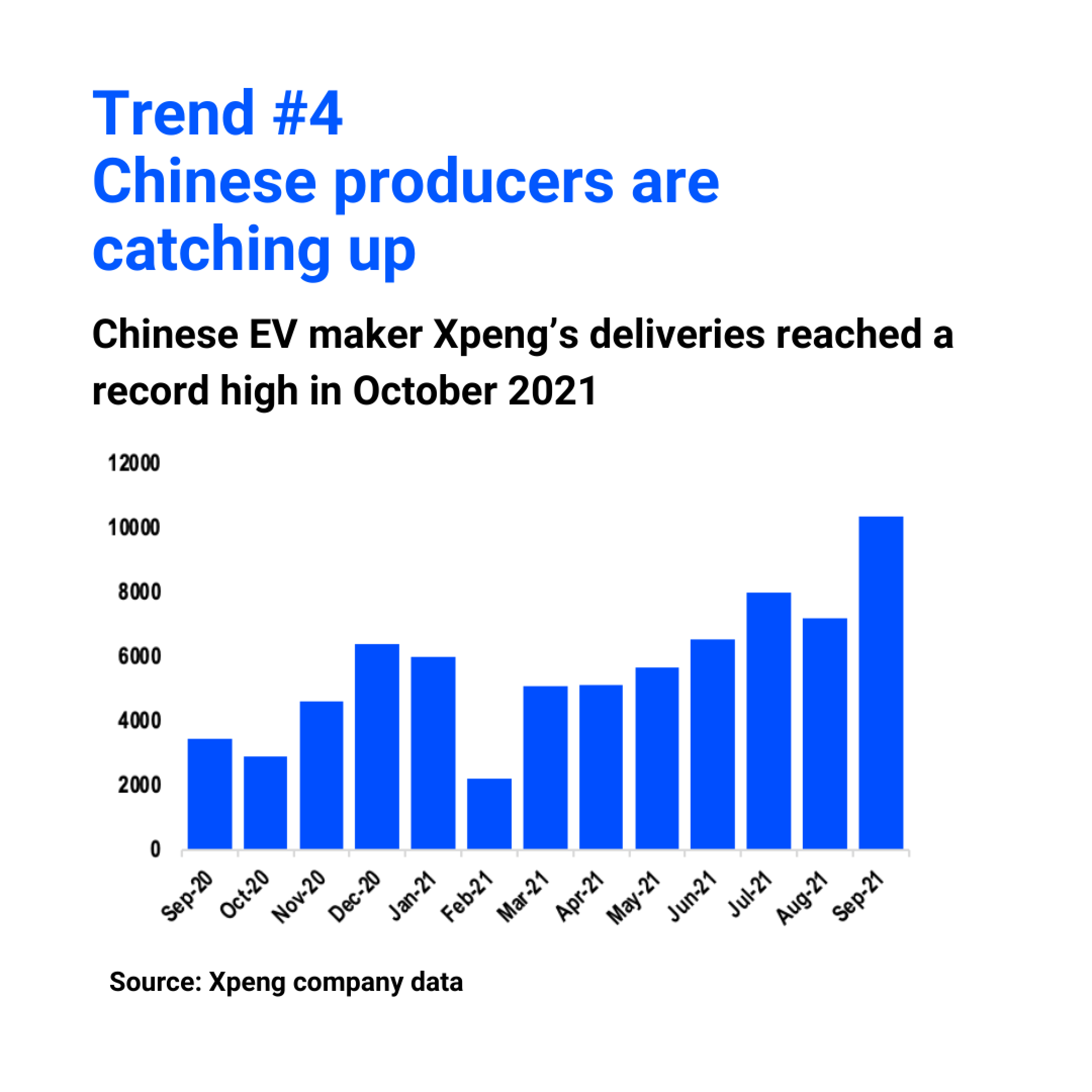

4. Chinese automakers catching up in autonomous driving software

Beyond EV pricing and driving range, software is increasingly becoming a key differentiator between EVs. Tesla’s Elon Musk has commented that some Chinese EV companies are highly competitive because of their software. Software could entail autonomous features such as self-parking, advanced-voice control and self-driving capabilities. For instance, Xpeng P5 is reportedly the world’s first production EV with LIDAR, allowing for navigation-assisted autonomous city driving.

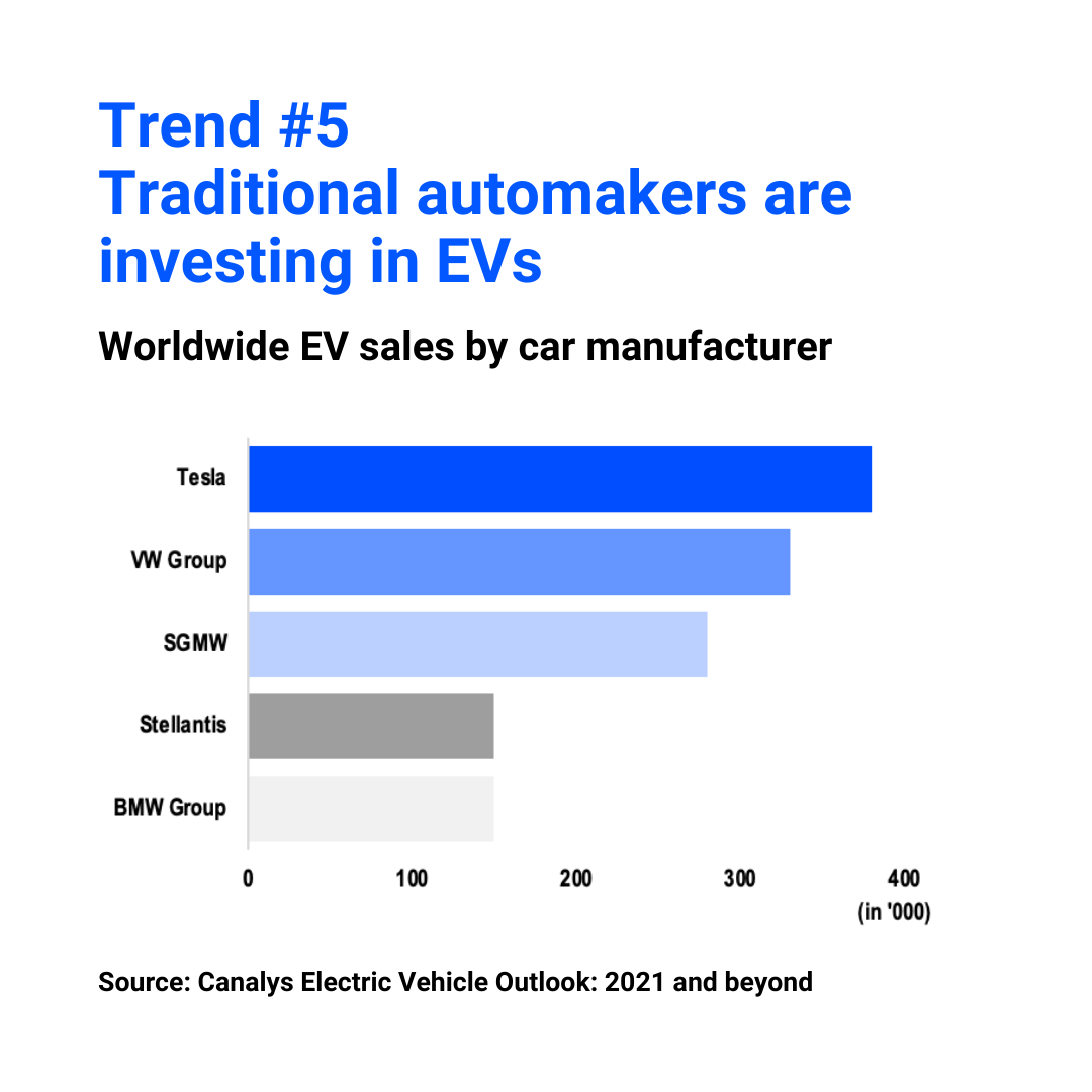

5. Traditional automakers are investing to get a share of the pie

Traditional automakers are entering the EV race by investing in cell and battery manufacturing, mines and charging infrastructure. At the same time, their vertical integration could help to keep costs low and ensure the availability of material to support growth.

According to ARK Invest, if traditional automakers overcome obstacles, global EV sales could grow roughly 20-fold to reach 40 million by 2025. The growing ambition of traditional automakers is most evident in the recent strategy presentation by General Motors (GM), which targets to have EVs representing 40% to 50% of its total automotive sales by 2030 as part of its transformation roadmap.

This research is commissioned by ADDX in collaboration with Canopy Research, a bespoke insights provider by Beansprout dedicated to guiding investors along their financial journey. Beansprout is a next-generation investment advisory platform licensed by the MAS.

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX have any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.