ADDX Editorial Note:

Private markets have historically outperformed the public markets, but they aren’t well understood.

Many investors traditionally see private markets as being reserved for a privileged few. They are therefore less likely to take the time to understand assets like private equity, venture capital or private credit.

As technology broadens private market access, ADDX is working with our partners to demystify the space. In this article, Hamilton Lane unpacks for investors private markets, explaining what they are and why they matter.

By Hamilton Lane

Meeting long-term return objectives is a tall order for any investor. Further confounding the problem for individual investors? A short list of opportunities.

For advisors and their high-net-worth or mass affluent clients, investment choices have been largely relegated to just two asset classes: public equities and fixed income. But these markets represent only a small — and shrinking — opportunity set.

Increasingly, much of the corporate world’s growth, innovation and returns are occurring in private markets, a target-rich environment that dwarfs the size of the public sphere. For decades, large and sophisticated institutional investors — including pensions, endowments, foundations — and ultra-wealth individuals have tapped private investments to help meet their portfolio objectives, steadily increasing allocations to this alternative asset class.

Today, innovative fund structures are removing some of the hurdles associated with private market investments, making the asset class more accessible to a broader swath of investors. In other words, individual investors may finally be able to realize the industry’s return potential in their own portfolios.

While the democratization of private markets is a welcomed change, investors would do well to educate themselves before wading in. Drawing upon Hamilton Lane’s 30-year history in the space, this guide provides an overview of the private markets to those less familiar with them. We answer some of the basic questions you might have about an asset class with enormous potential, but that represents an entirely new frontier for many individual investors.

First, what are the private markets?

While private equity is the most recognized private markets investment category, it is only one strategy of several that comprise the broader industry. Private investments also include private credit, real estate, infrastructure and real assets.

At the most basic level, private investments are assets or financial instruments that are not listed on an exchange. They are investments made directly into private companies and are utilized to increase the value of the company by making operational or strategic improvements, supporting growth initiatives, enhancing management teams, improving technology and more.

Since private investments don’t trade publicly, there is generally less readily available financial information about them. The investments are also less liquid than a stock bought and sold on a major exchange, or a corporate bond that trades over the counter. The limited liquidity and transparency in private markets are two of the biggest differences from public markets and are factors an investor should be aware of before allocating to the asset class.

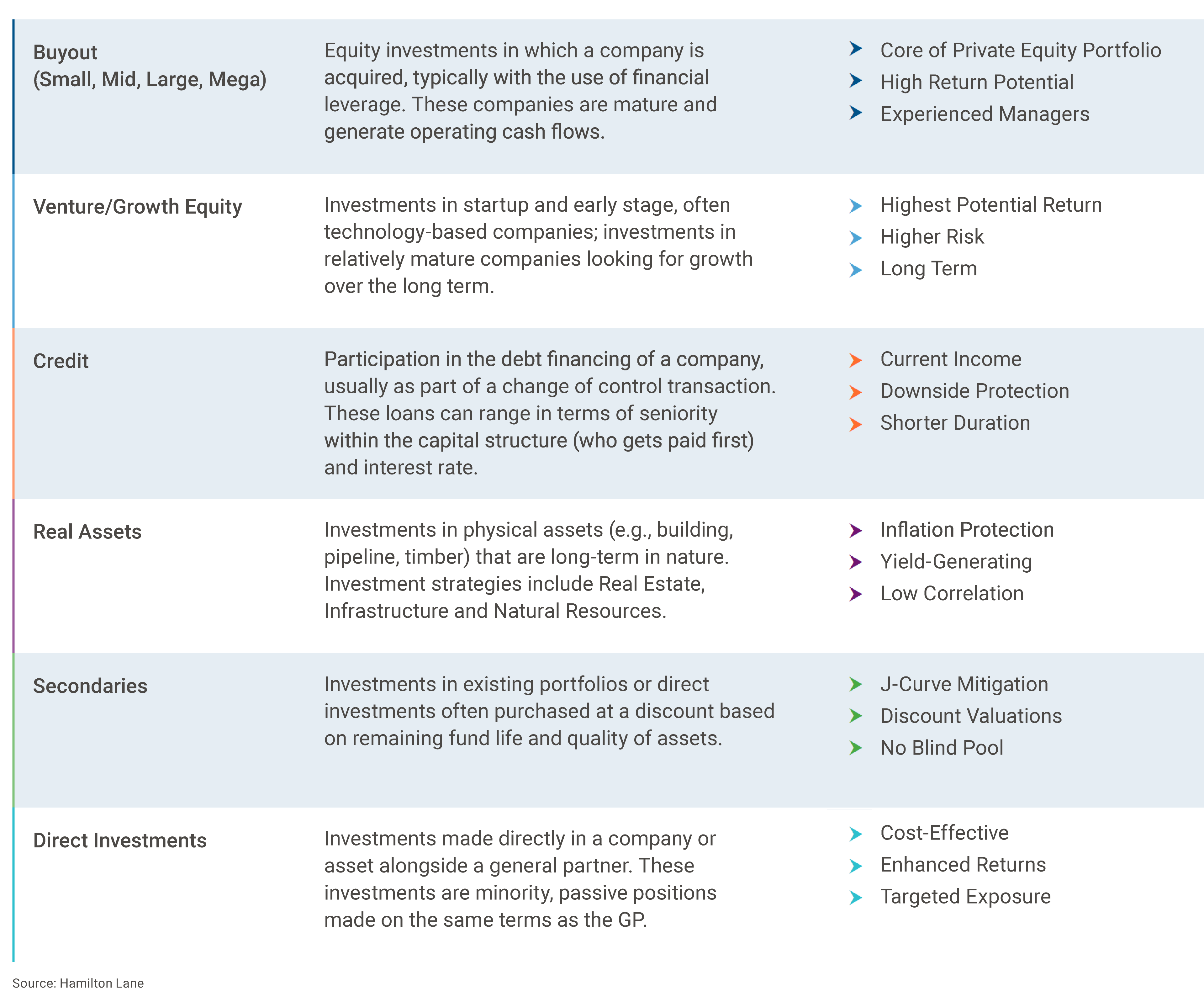

What are the different types of private market investments?

Private market investing is an expansive universe that includes many investment types. This table provides a definition of several of the most common investment strategies and their corresponding characteristics.

Why should investors consider private markets in their portfolio?

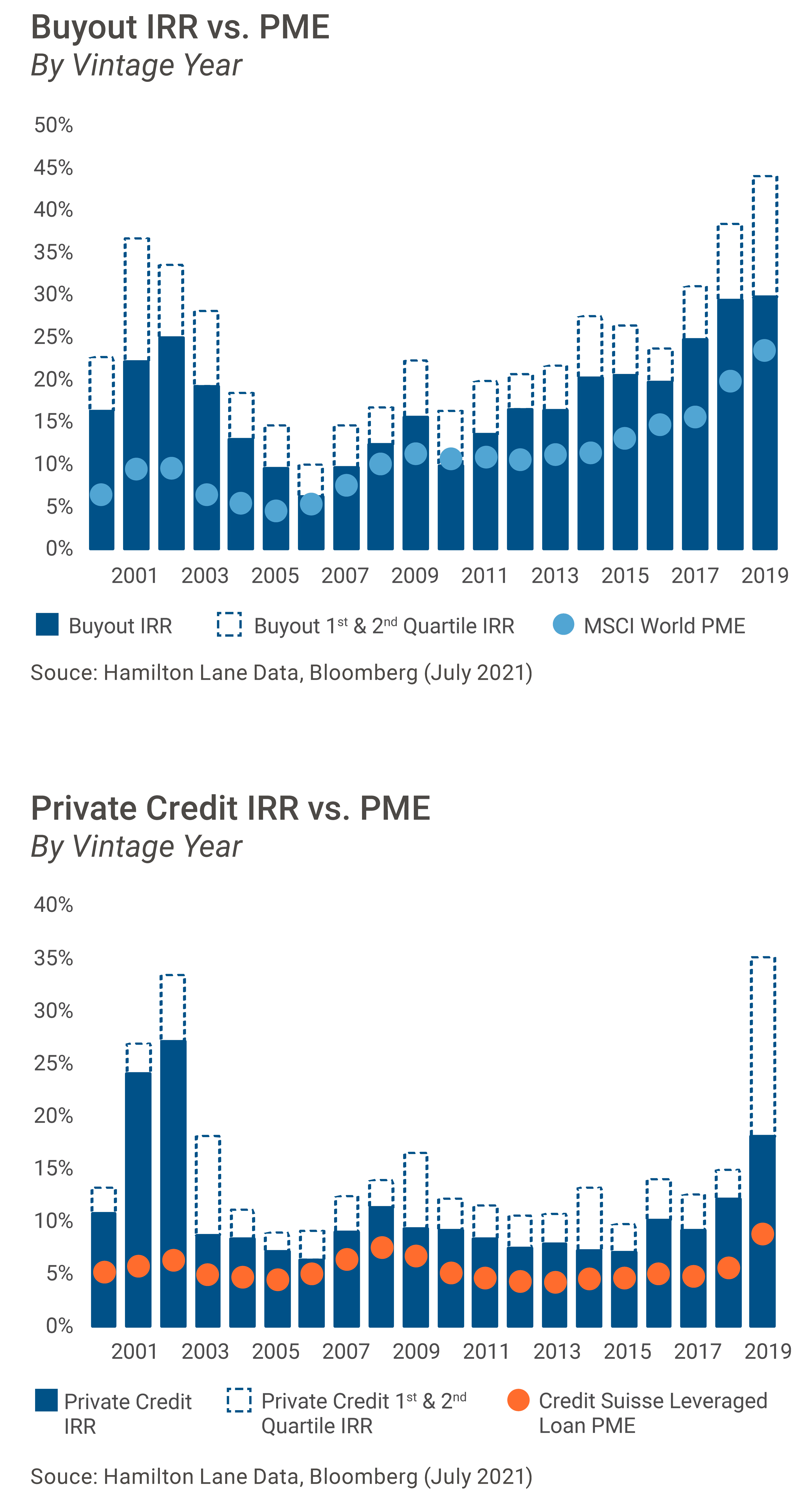

One of the biggest factors drawing investors to private markets has been performance. Case in point: Private equity and private credit have outperformed global public equity and credit markets, respectively, in 19 of the last 20 years.

A variety of factors drives the outperformance. First, there is a liquidity premium associated with private markets: Higher returns may be compensation for longer lockup periods with investors’ capital.

Another reason could be that companies are staying private longer and, in turn, have the potential to experience more of their growth and innovation before going public. For instance, in the technology sector, the average age of a new public company has gone from 4.5 years in 1999 to more than 12 years today.1 As tangible examples, two of the 10 largest-ever tech IPOs waited 10 and 12 years, respectively, before going public, long after they had disrupted the industries in which they operate.

|

Definitions |

|

|

IRR: The internal rate of

return is a metric used in financial analysis to estimate the profitability

of potential investments |

LTM: Last twelve months PME: Public market

equivalent |

Private markets may provide diversification benefits

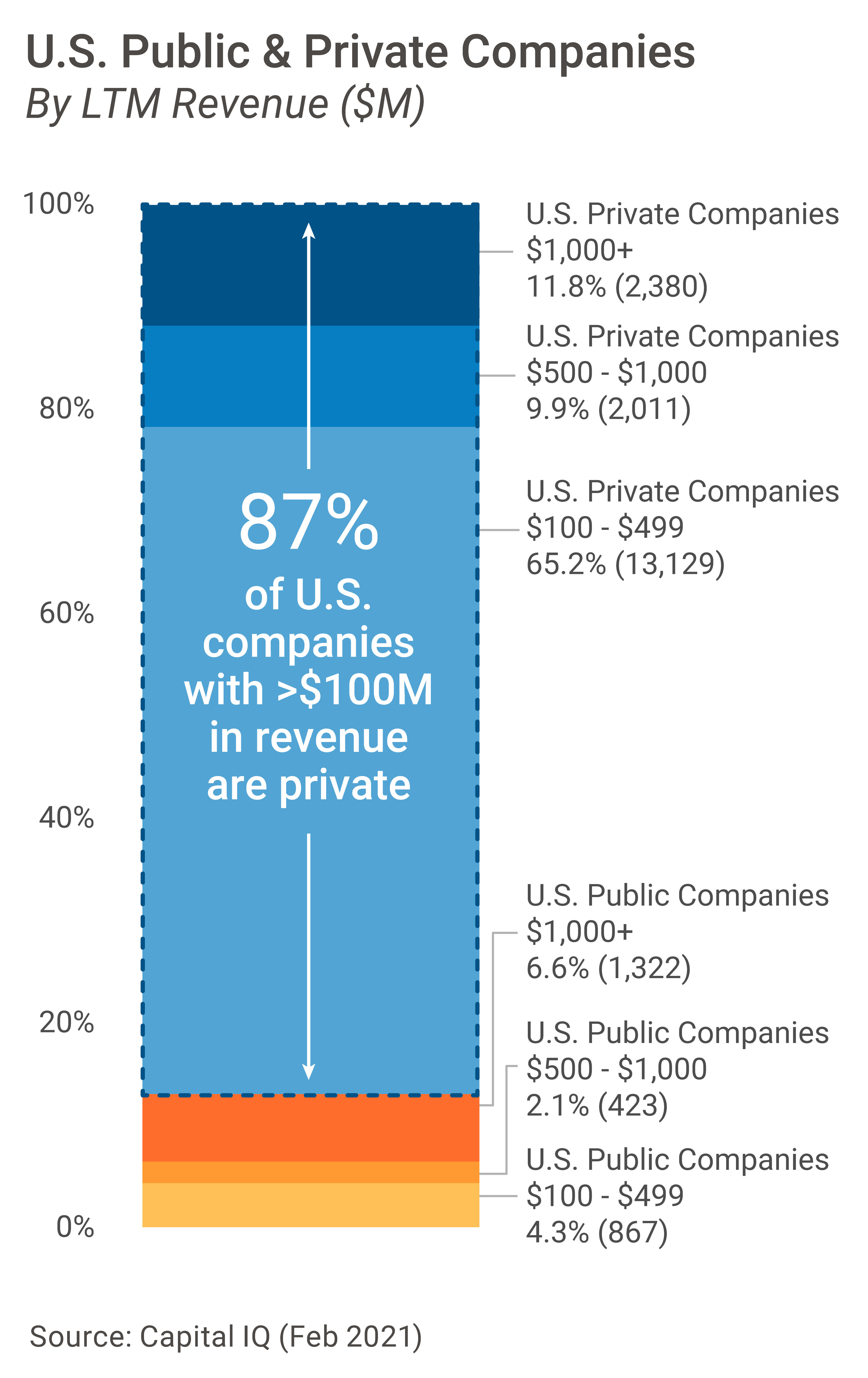

Private investments can also be a valuable diversifier. This is due to the much wider pool of companies within private markets. There are more than 17,000 U.S. private companies with annual revenues above $100 million, compared with just 2,600 public companies with those same revenue levels.

Over the last two decades, public markets have become increasingly more concentrated, dropping from more than 7,800 publicly listed companies at the beginning of 2000, to roughly 4,800 at the end of 2020.2 The dwindling number of public companies has made diversification beyond them even more important.

1: https://www.skadden.com/insights/publications/2020/01/2020-insights/private-pre-ipo-investments

2: Source: Research by Professor Jay R. Ritter, University of Florida

What is the history of private market investing?

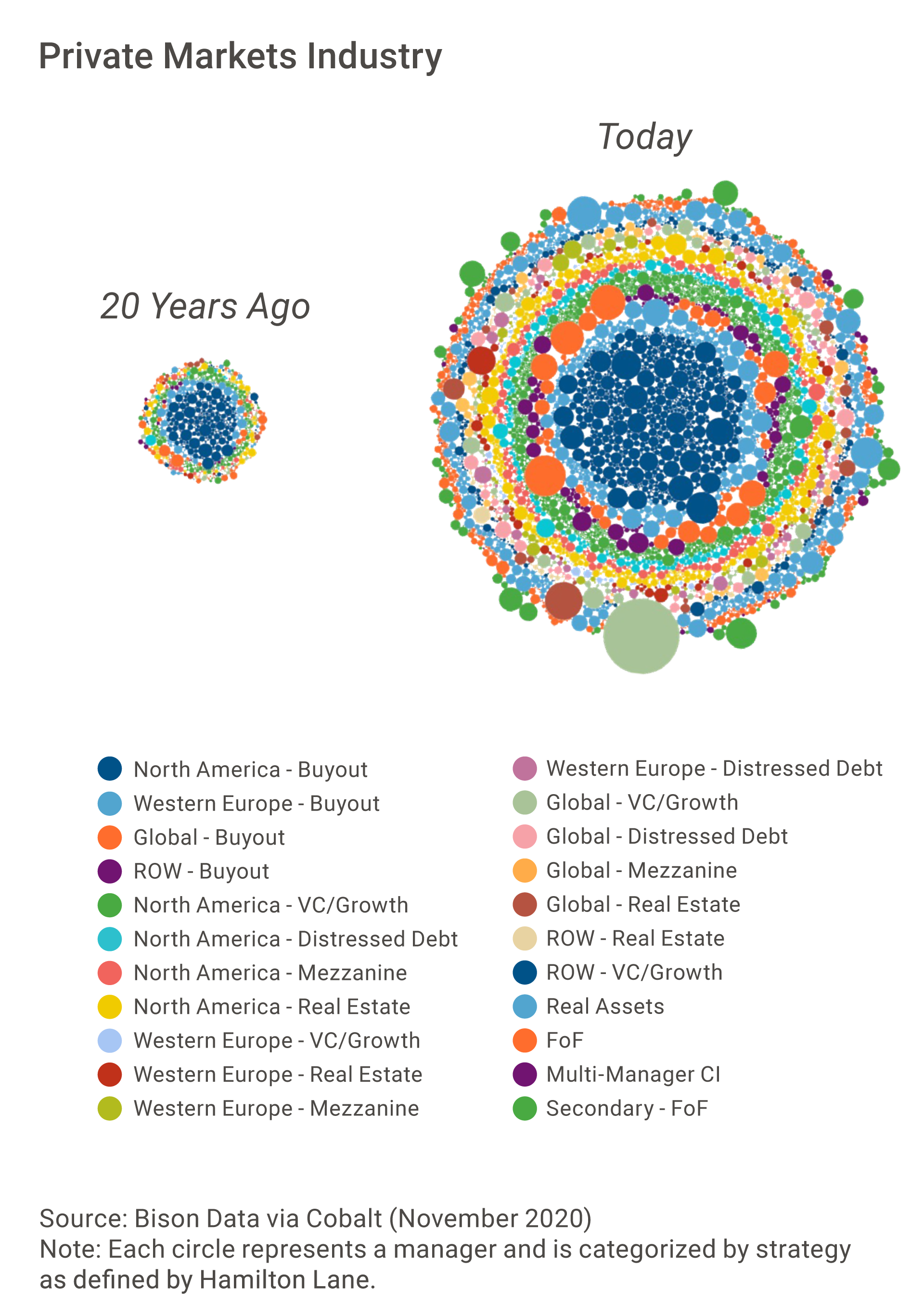

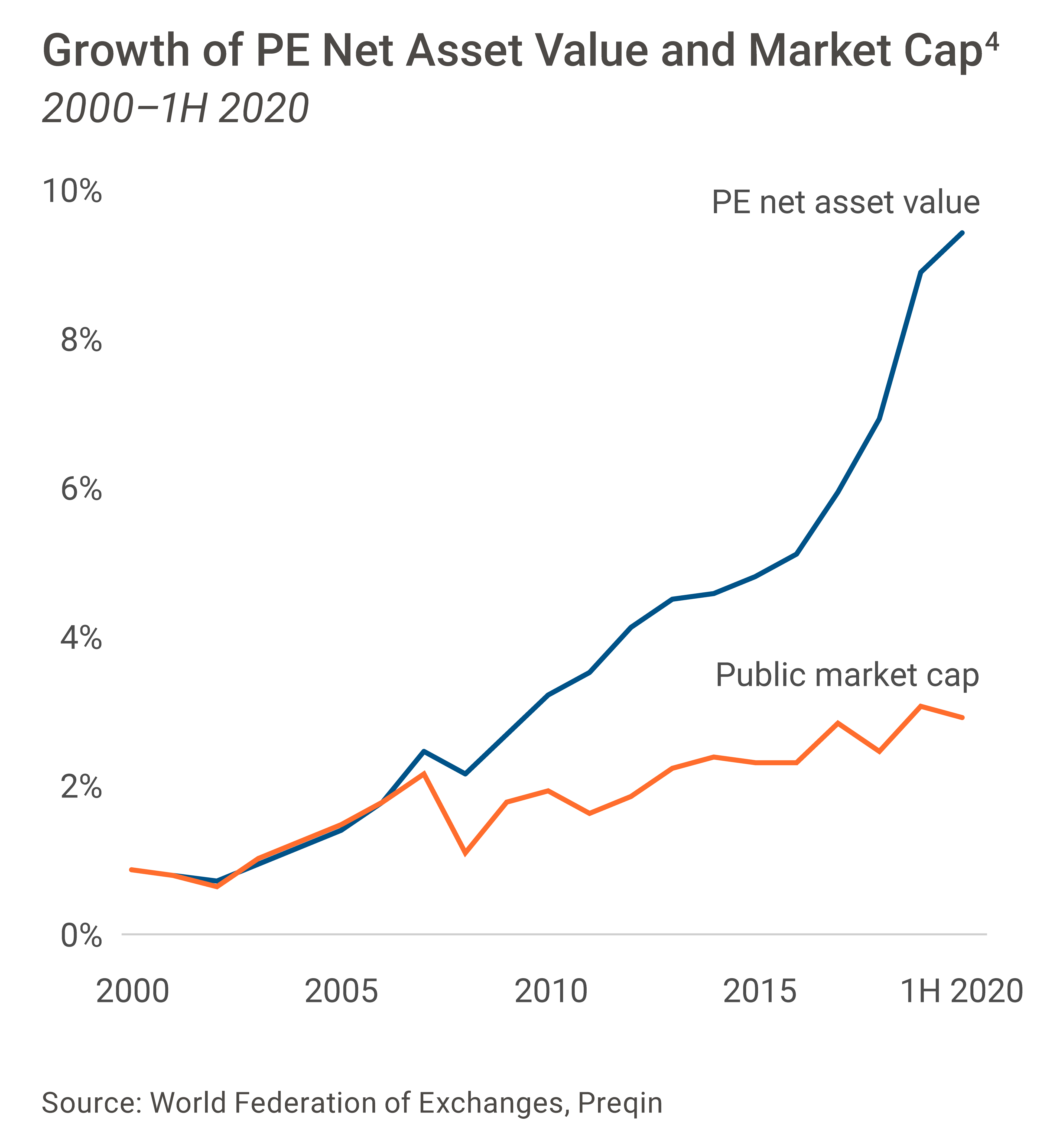

Large institutions were early entrants into the private markets and remain the predominant investors. Many have dedicated a substantial investment, with private market allocations for pensions, endowments and foundations generally ranging from 10% to 20%.3 The chart below4 shows how the asset class has grown over the past two decades as more investors have come to realize its benefits.

Looking ahead, allocations could continue to grow. A recent McKinsey & Co. study on private markets found that 79% of surveyed limited partners plan to increase their private equity allocations. Twenty-three percent plan to increase them considerably.

Even though more institutions have carved out a meaningful allocation to private investments, high-net-worth and mass affluent investors have not had the same opportunity to participate. Large investment minimums and private markets’ illiquidity were two of the largest barriers for individual investment. But as the asset class has grown — and public markets have shrunk — private market managers, and in the U.S. even the SEC, have explored opportunities for private markets to become more accessible to individual investors.

As a result of those efforts, more large private market managers with institutional investor bases have developed fund structures that remove some of the traditional barriers to retail participation.

3: Source: McKinsey Global Private Markets Review 2021

4: Source: Net asset value equals assets under management less dry powder. Market cap is based on the total market cap of companies globally.

How do investors access the asset class?

Historically, institutional investors have pursued several different avenues to access the private markets. They run the gamut from direct investments into companies, commingled funds that invest in a mix of private companies, multi-manager funds that invest in a group of investment managers’ funds, and separately managed accounts.

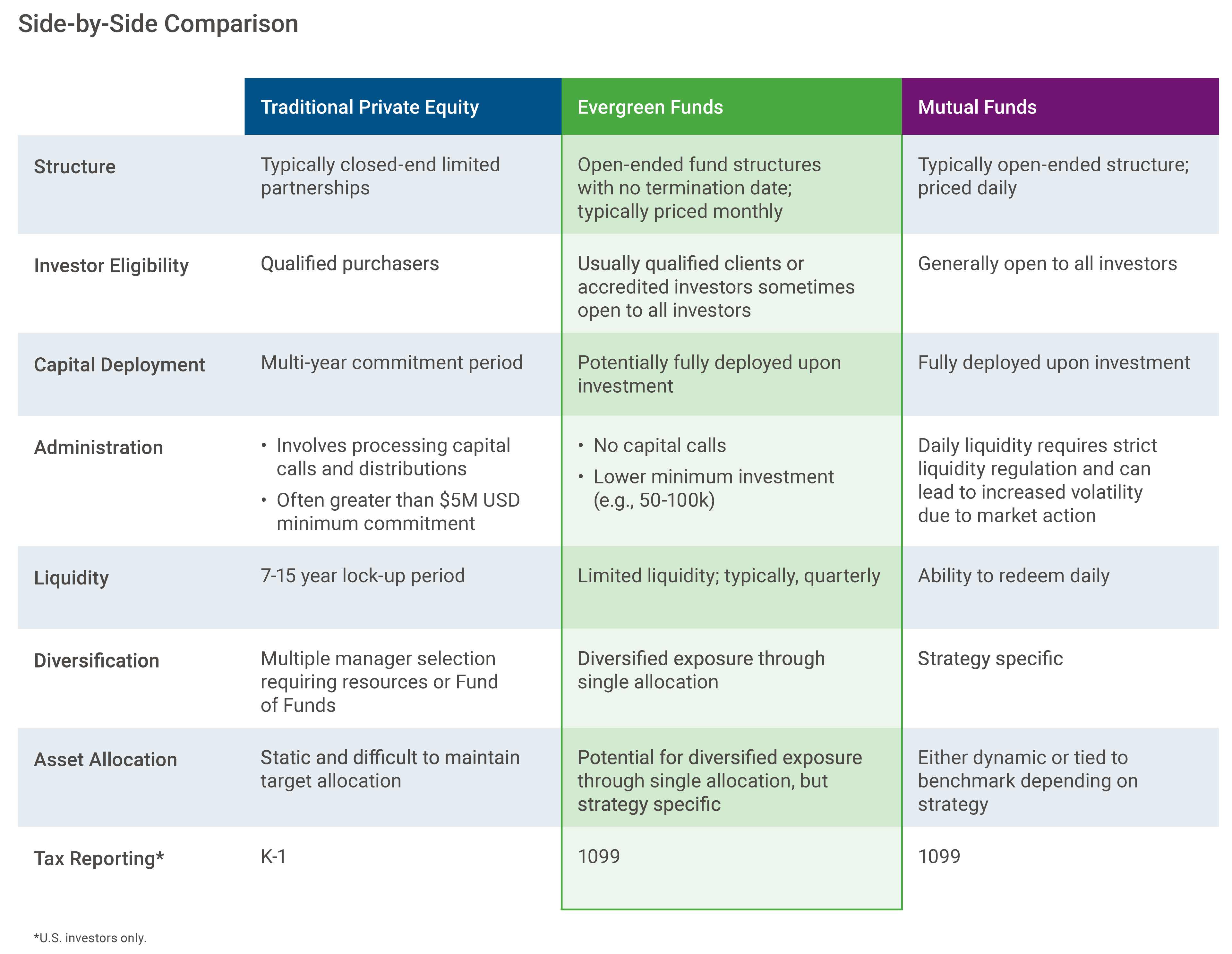

However, these vehicles often have high investment minimums (e.g., $5 million to $10 million), long lock-up periods (e.g., 7-15 years) or require clients to be qualified purchasers, such as institutions, endowments or ultra-high-net-worth. These features tend to present barriers for many advisors and their high-net-worth and mass affluent clients. In recent years, however, some of the large institutional private market managers have launched funds in structures that have made private markets more accessible to these investor groups.

Evergreen funds: opening the door to private markets

Often referred to as evergreen funds because of their perpetual fund life, investors have the ability to enter and exit these vehicles throughout their existence. With some evergreen funds, the investor’s capital is immediately deployed into an already existent pipeline of investments. This is quite different from traditional private investment structures, where the investor commits capital for a multi-year period and the fund’s general partner calls that capital at various times to make investments once targets have been identified.

Thoughtfully constructing a diversified and fully invested portfolio is crucial to the success of these vehicles. For individual investors, certain evergreen fund structures may present potential advantages. Those that are able to deploy capital quicker can eliminate cash drag. Early deployment also allows for exposure to the private markets sooner, a critical detail for individual investors who have never had exposure, and do not have longer-term investment horizons the way a pension fund or endowment might. Below are some additional differences between evergreen funds and other investment vehicles:

- Diversification: A potential benefit of evergreen funds is that they often invest in more than one type of private market strategy. A fund may hold private credit, private equity and secondary investments, for example. This helps manage liquidity and gives the end investor broad exposure to private markets in one vehicle, instead of having to find different managers for each investment type.

- Governance: Evergreen funds in the U.S., as a ’40 Act fund, evergreen funds are subject to SEC regulations, and are governed by a fund board. These measures provide an extra level of oversight that traditional investment structures do not possess.

- Taxes (U.S): In the U.S. evergreen fund investors report the investment using a 1099. This is a simpler process than the K-1, a multipage document that is required for illiquid private partnerships.

- Investment minimums: Historically, the minimums for participating in a private equity partnership were around $5 to $10 million. Evergreen funds offer a lower entry point, typically from $50,000 to $100,000, depending on the fund and share class.

- Liquidity: Traditional private equity partnerships include a 10-12-year commitment. Evergreen funds, however, may offer monthly or quarterly redemptions. Redemptions may be limited, and, typically, the fund will allow only a set percentage of total assets to be redeemed in a quarter. (As we cover later, investors should approach the asset class with a multi-year, long-term approach.) However, a vehicle that allows greater liquidity should nevertheless provide more flexibility than traditional partnerships and remove a hurdle for some individuals.

How are investors paid?

Investors in an evergreen fund receive periodic distributions, typically on an annual basis. When an investor exits the fund, they are compensated based on the fund’s net asset value, which is calculated monthly and determined by an independent, third-party valuation firm. This is different from traditional mutual funds, where the NAV is calculated daily.

SIDE-BY-SIDE COMPARISON

How do private market portfolio managers add value?

The role of the portfolio manager in a private investment is quite different from a portfolio manager investing in public equities. In short, the private market portfolio manager is much more involved in helping a company create value.

A portfolio manager investing in public equities makes an investment based on a view that prospects or earnings for the company are poised to improve beyond what is implied in the current stock price. But the portfolio manager isn’t taking a hands-on approach in helping the company drive those future earnings. In contrast, a private fund manager is more engaged with the companies, providing guidance and input on the company’s strategy and direction, while also keeping an eye on risk. For example, the private fund manager may give input on products or capabilities the company should develop, a strategic acquisition the company should pursue, or new technologies the company should utilize.

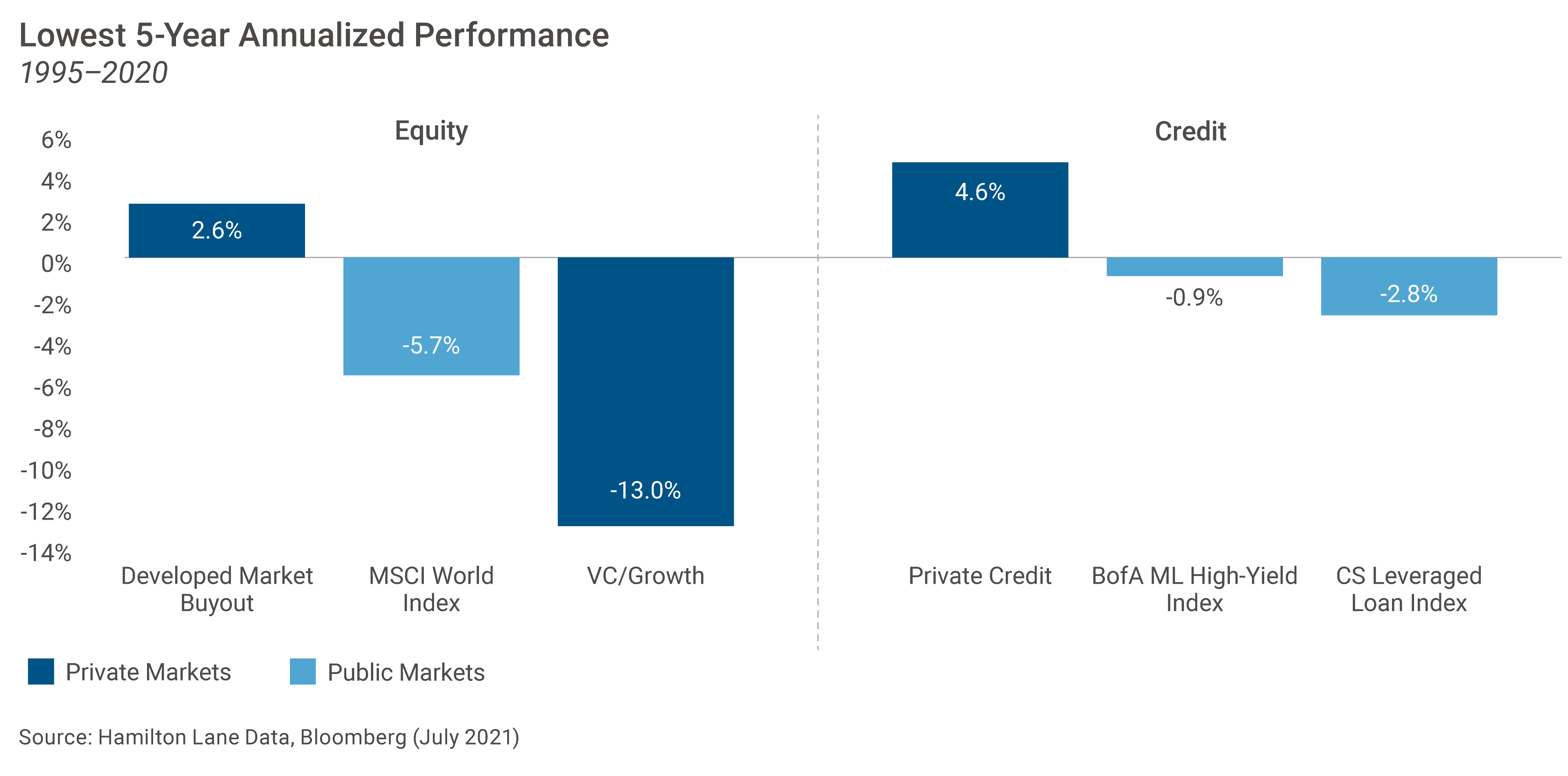

What are the risk/return tradeoffs of private markets?

As previously mentioned, private equity and private credit outperformed their respective public market counterparts over the last two decades. Data also reveals that in the lowest-returning five-year period from 1995–2020, neither private equity nor private credit experienced negative performance.

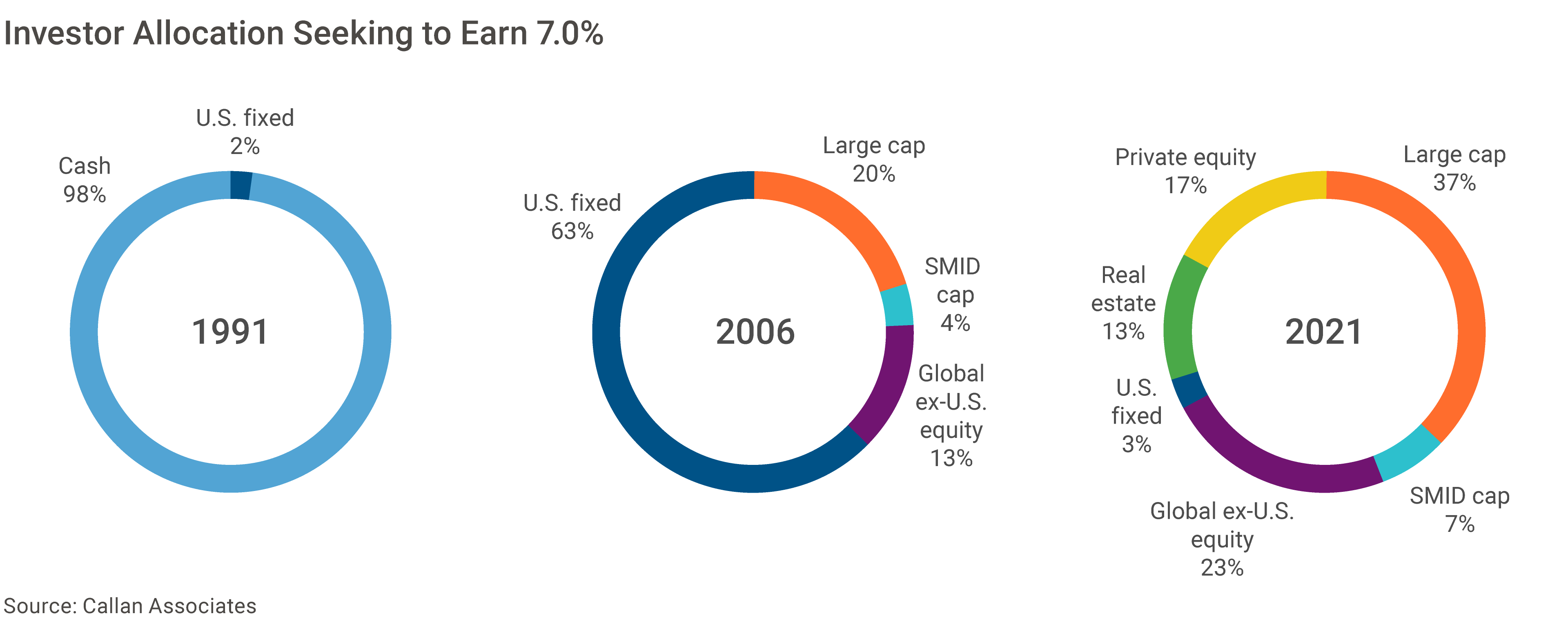

Investors have increased allocations to a more diverse lineup of investments, including alternatives, to meet return expectations.

Going forward, many experts believe private markets will have an increasingly important role to play in meeting investors’ portfolio objectives.

While the charts suggest investors may want to consider making an allocation to private markets, there are also tradeoffs. The biggest of those, as we’ve discussed, are the long-term nature and illiquidity associated with private markets. It often takes considerable time – years, not months – for private investments to realize their value. As such, investors should approach private asset classes with long time horizons.

Individuals accessing the asset class for the first time should make sure they have enough liquidity within the rest of their portfolio to support a long-term private investment. To encourage a long-term commitment, many investors use evergreens within their retirement vehicles, intending to let the investment appreciate until retirement.

Investor Allocation Seeking to Earn 7.0%

The road ahead

Private market investments have been a staple of institutional portfolios for decades, and increasingly some of the barriers to investing are being eliminated, effectively enabling greater access to the asset class for high-net-worth and mass affluent investors. Those groups may want to consider taking advantage of the broadening market opportunity. Some of the most compelling reasons? The strong historical performance of the asset class, as well as the depth of the opportunity set relative to the shrinking number of publicly listed companies that can provide meaningful diversification for investors.

While the returns and diversification benefits have been attractive, first-time private market investors should be aware of the differences between private investments and traditional stocks and bonds. But given the opportunity, investors may benefit from making private investments a part of their broader portfolio.

This article was originally published on Hamilton Lane's website on September 14, 2021.

Hamilton Lane (NASDAQ: HLNE) is a leading investment management firm with $832.5 billion in assets under management and supervision, composed of over $108.3 billion in discretionary assets and nearly $724.2 billion in advisory assets, as of June 30, 2022. The firm currently employs more than 540+ professionals operating in 21 offices throughout North America, Europe, Asia Pacific and the Middle East.

The Hamilton Lane Global Private Assets Fund is now listed for trading on ADDX.

DISCLOSURES

This presentation has been prepared solely for informational purposes and contains confidential and proprietary information, the disclosure of which could be harmful to Hamilton Lane. Accordingly, the recipients of this presentation are requested to maintain the confidentiality of the information contained herein. This presentation may not be copied or distributed, in whole or in part, without the prior written consent of Hamilton Lane.

The information contained in this presentation may include forward-looking statements regarding returns, performance, opinions, the fund presented or its portfolio companies, or other events contained herein. Forward-looking statements include a number of risks, uncertainties and other factors beyond our control, or the control of the fund or the portfolio companies, which may result in material differences in actual results, performance or other expectations. The opinions, estimates and analyses reflect our current judgment, which may change in the future.

The information contained in this presentation may include forward-looking statements regarding returns, performance, opinions, the fund presented or its portfolio companies, or other events contained herein. Forward-looking statements include a number of risks, uncertainties and other factors beyond our control, or the control of the fund or the portfolio companies, which may result in material differences in actual results, performance or other expectations. The opinions, estimates and analyses reflect our current judgment, which may change in the future.

This presentation is not an offer to sell, or a solicitation of any offer to buy, any security or to enter into any agreement with Hamilton Lane or any of its affiliates. Any such offering will be made only at your request. We do not intend that any public offering will be made by us at any time with respect to any potential transaction discussed in this presentation. Any offering or potential transaction will be made pursuant to separate documentation negotiated between us, which will supersede entirely the information contained herein. Certain of the performance results included herein do not reflect the deduction of any applicable advisory or management fees, since it is not possible to allocate such fees accurately in a vintage year presentation or in a composite measured at different points in time. A client’s rate of return will be reduced by any applicable advisory or management fees, carried interest and any expenses incurred. Hamilton Lane’s fees are described in Part 2 of our Form ADV, a copy of which is available upon request.

The following hypothetical example illustrates the effect of fees on earned returns for both separate accounts and fund-of-funds investment vehicles. The example is solely for illustration purposes and is not intended as a guarantee or prediction of the actual returns that would be earned by similar investment vehicles having comparable features. The example is as follows: The hypothetical separate account or fund-of-funds consisted of $100 million in commitments with a fee structure of 1.0% on committed capital during the first four years of the term of the investment and then declining by 10% per year thereafter for the 12-year life of the account. The commitments were made during the first three years in relatively equal increments and the assumption of returns was based on cash flow assumptions derived from a historical database of actual private equity cash flows. Hamilton Lane modeled the impact of fees on four different return streams over a 12- year time period. In these examples, the effect of the fees reduced returns by approximately 2%. This does not include performance fees, since the performance of the account would determine the effect such fees would have on returns. Expenses also vary based on the particular investment vehicle and, therefore, were not included in this hypothetical example. Both performance fees and expenses would further decrease the return.

Hamilton Lane (Germany) GmbH is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (Germany) GmbH is authorized and regulated by the Federal Financial Supervisory Authority (BaFin). In the European Economic Area this communication is directed solely at persons who would be classified as professional investors within the meaning of Directive 2011/61/EU (AIFMD). Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients.

Hamilton Lane (UK) Limited is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (UK) Limited is authorized and regulated by the Financial Conducts Authority. In the UK this communication is directed solely at persons who would be classified as a professional client or eligible counterparty under the FCA Handbook of Rules and Guidance. Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients.

Hamilton Lane Advisors, L.L.C. is exempt from the requirement to hold an Australian financial services license under the Corporations Act 2001 in respect of the financial services by operation of ASIC Class Order 03/1100: U.S. SEC regulated financial service providers.

Hamilton Lane Advisors, L.L.C. is regulated by the SEC under U.S. laws, which differ from Australian laws.

Any tables, graphs or charts relating to past performance included in this presentation are intended only to illustrate the performance of the indices, composites, specific accounts or funds referred to for the historical periods shown. Such tables, graphs and charts are not intended to predict future performance and should not be used as the basis for an investment decision. The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein. The calculations contained in this document are made by Hamilton Lane based on information provided by the general partner (e.g., cash flows and valuations), and have not been prepared, reviewed or approved by the general partners.

As of July 1, 2021

1https://www.skadden.com/insights/publications/2020/01/2020-insights/private-pre-ipo-investments

2Source: Research by Professor Jay R. Ritter, University of Florida

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX have any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.