Public markets have taken a beating

It’s hard not to notice the change in sentiment in the public markets over the past few months. After reaching all-time highs last year with policy support measures during the pandemic, stock markets globally have declined sharply this year. The US market as measured by the S&P 500 index declined by 13% in the first five months of this year, while the tech-heavy NASDAQ index fell by 23% over the same period.

There are multiple reasons behind the fall in the stock market. At the top of the list is surging inflation which has led to monetary tightening by central banks globally to keep prices under control. The US Federal Reserve has announced two rounds of rate hikes and will start reducing its balance sheet from next month. This tightening has come at a time of slowing economic growth, and is made worse by China pursuing lockdowns in major cities as part of its zero-covid strategy.

As public markets continue to be volatile, the private markets are only starting to feel the reverberations in capital flows. So far, the bad news has been limited to job layoffs in some private companies, as well as signs of a slowdown in fundraising activity. According to data by Crunchbase News, the global venture capital market declined modestly in the first quarter of 2022 compared to the previous quarter, even if it continued to grow compared to the previous year.

Inevitably, many investors are asking if the private markets will prove to be more resilient than the public markets like it has been so far.

All eyes on the private markets

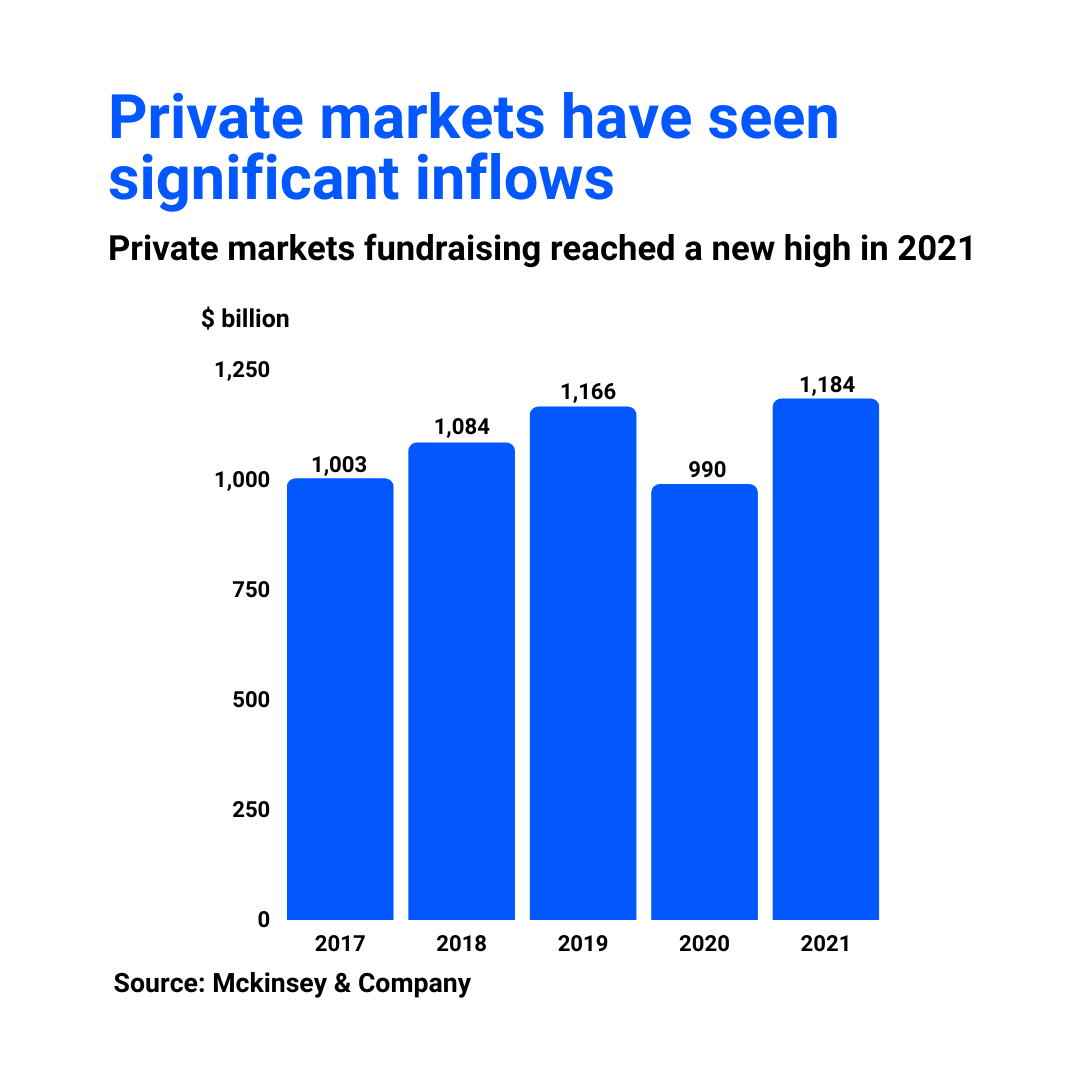

It’s undeniable that 2021 was a banner year for the private markets. According to data from McKinsey, total fundraising in the private markets reached a record of almost US$1.2 trillion, an increase of nearly 20 percent compared to the previous year.

Within private markets, private equity remained the key sub-segment driving growth as total Asset Under Management (AUM) reached an all-time high of US$ 6.3 trillion. This was driven primarily by capital appreciation, as private equity generated a pooled IRR of 27 percent in 2021. In Asia Pacific, private equity investors closed a record number of deals worth US$296 billion in 2021, an increase of 50% compared to 2020.

Are private markets more resilient than public markets?

1. Private equity outperformance increases during distressed periods

Private markets have been known to outperform public markets. Based on analysis by alternative investment advisor Cliffwater using US state pension plans over a 16-year period, private equity did better than public equities by 4.4 percentage points on average.

More importantly, research has shown that this outperformance was more significant during periods of economic slowdown. When the economy was in expansion, private equity generated an excess return over public equity by 2.9 percentage points on average. During recessions, this outperformance increased to an average of 6.6 percentage points.

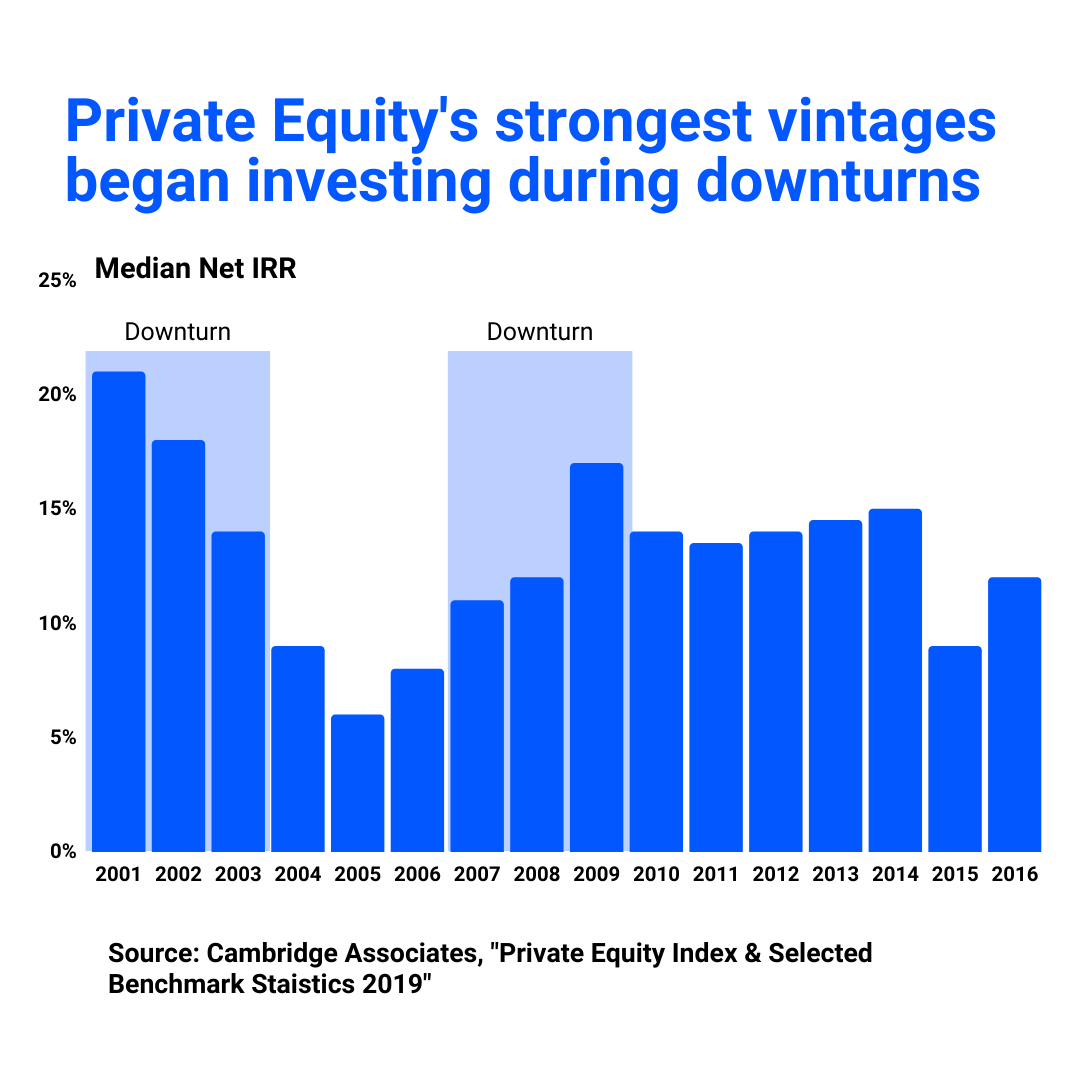

The outperformance of private equity is also reflected in data showing that the median net internal return of US buyout funds across different vintages rises during periods of economic downturns. This would include the dot-com bubble crash in 2001-2003 and the global financial crisis in 2008-09.

The data would suggest that private equity firms might offer some advantages in challenging markets. This could be due to having a longer time horizon, which allows private market investors to take a buy-and-hold strategy when valuations are low during recession periods. On the other hand, open-end mutual funds may face redemption risks during periods of selldowns, making it challenging to stick to such a buy-and-hold strategy.

2. Private markets have relatively low correlation with public markets

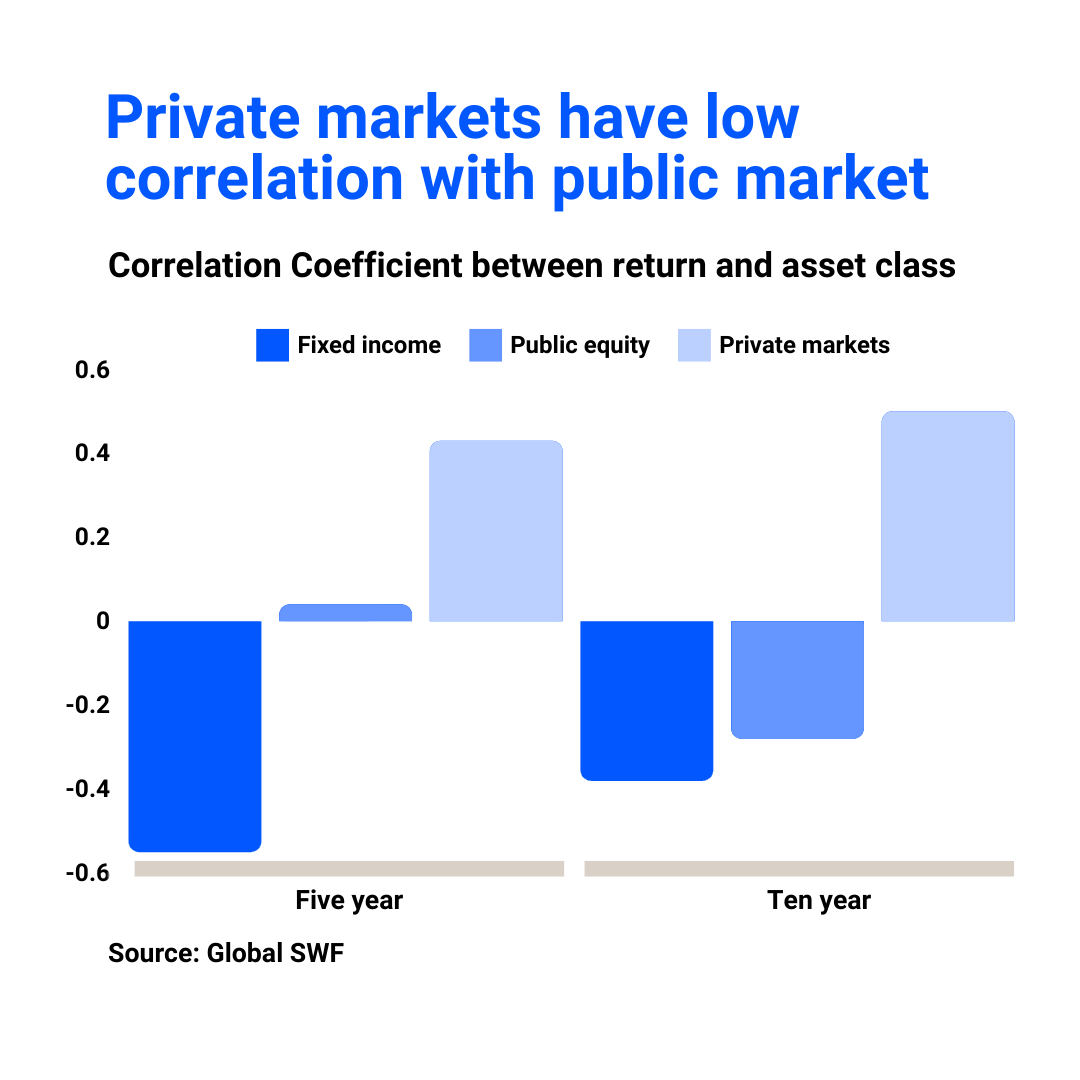

Private markets have been shown to have a low correlation to public markets. According to research by Global SWF, there is a strong positive correlation between annual returns of fixed income and public equity. However, there is a weak relationship between public equity and private market assets such as private equity, real estate and infrastructure. This means that private market assets might be an option for investors looking to diversify their portfolios away from public equity assets.

3. Private markets offer diversification

The superior performance of private markets during economic slowdown and low correlation between public equity and private markets mean that investments in private markets provide a means to diversify an investment portfolio.

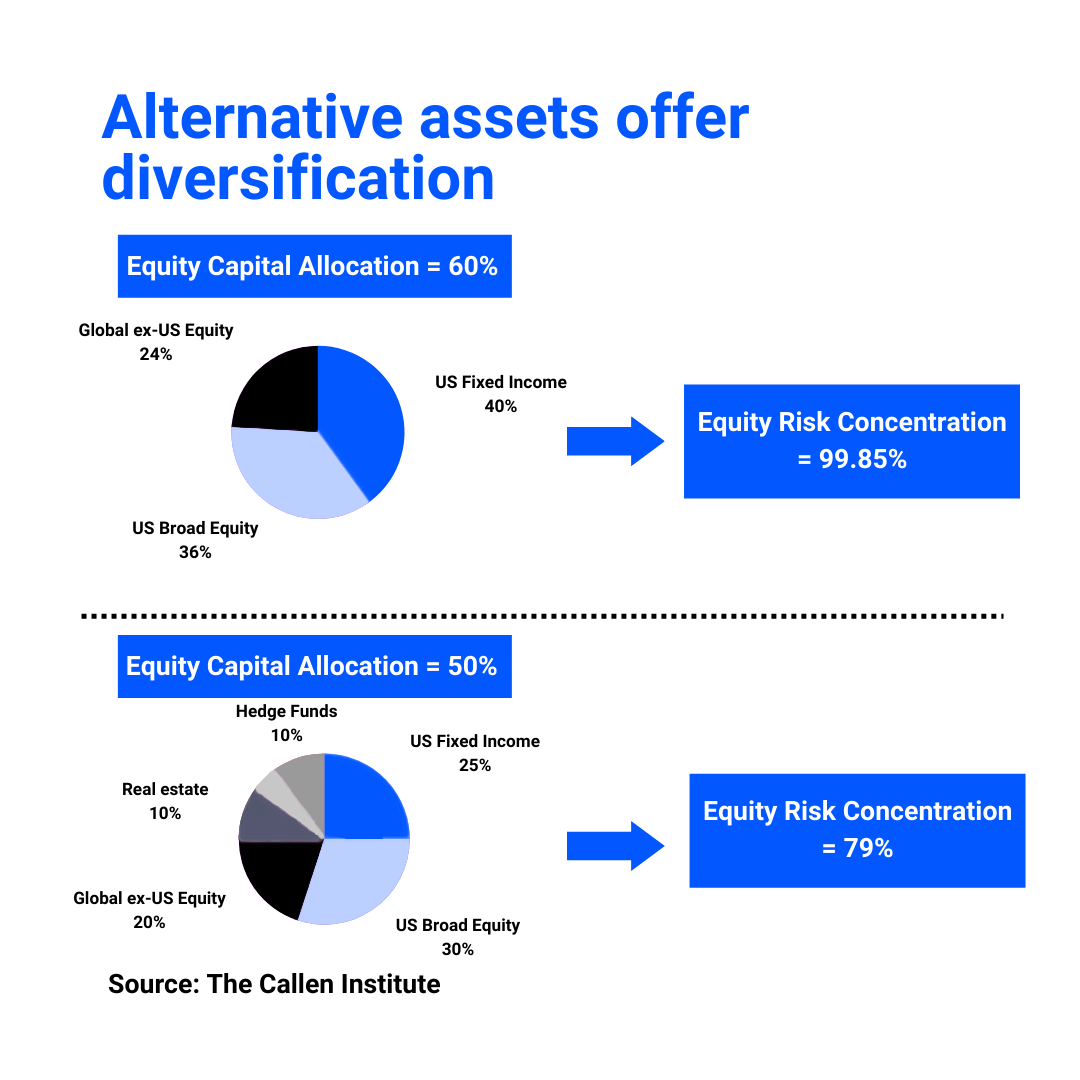

This is especially so as the traditional 60/40 strategy involving investing 60 percent of a portfolio in equities and 40 percent in bonds is increasingly seen by investors to be less effective in offering diversification. The rising correlation between equities and bonds has led investors to search for other ways to diversify their portfolios.

In a study by the Callan Institute, a 60/40 portfolio has a concentration risk of close to 99.9 percent, as measured by the fall in portfolio value when assets move in the same direction. However, when alternative assets such as hedge funds, real estate and high yield bonds are included into the portfolio, the equity risk concentration declines to about 79 percent. This would suggest that by themselves, bonds are not sufficient to offer diversification. There is a need for alternative assets, including private equity, private debt and hedge funds, to offer true diversification.

Private markets also have their vulnerabilities

Despite the benefits from diversification, private markets also have their vulnerabilities. During periods of extreme economic and market conditions, some of these vulnerabilities may be put to the test.

For example, private debt managers may face rising bad debt in a rising interest rate environment if they are not vigilant. As the cost of repayment increases, some companies may not be able to service their debt. This may lead to lower returns for private debt funds without strong management and controls. More importantly, these repayment issues may not be specific to the private debt markets, and would impact lenders in general.

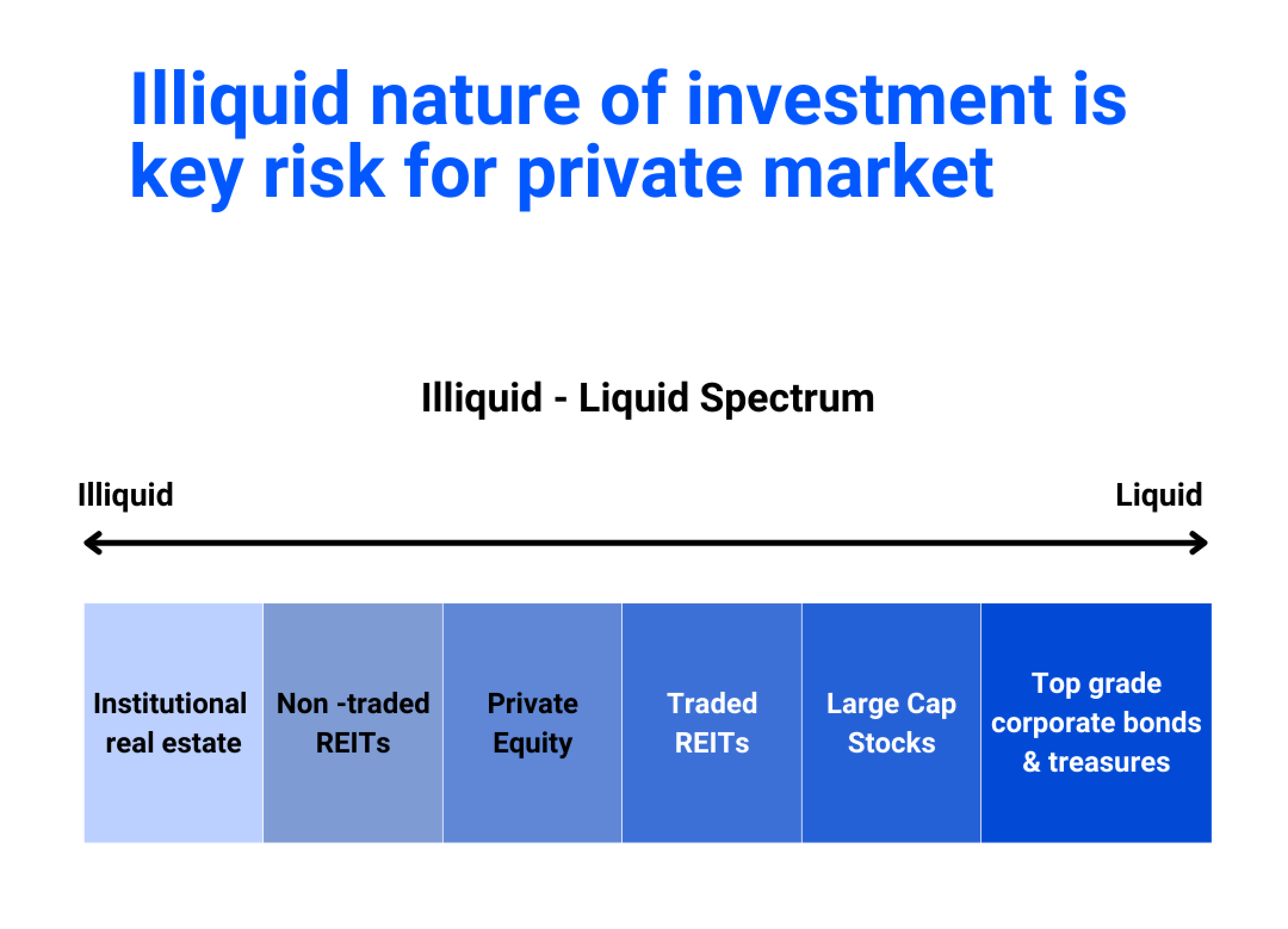

This can act as a double-edged sword. Just as the non-liquid nature of the private markets reduces the tendency for investors to sell into falling markets, the reverse is also true. For investors who truly need liquidity, they may not be able to sell their funds when they want to without potentially facing significant losses.

Making use of the downturn to create a truly resilient portfolio

As the saying goes, every crisis also presents an opportunity. In today’s environment of heightened uncertainty, there is greater impetus to build a more resilient investment portfolio that can weather different economic scenarios. In this regard, diversification is key to coping with the increase in market volatility. Private market assets have relatively low correlation with public markets, and can play a role in building a more diversified investment portfolio for the long term.

This research is commissioned by ADDX in collaboration with Canopy Research, a bespoke insights provider by Beansprout dedicated to guiding investors along their financial journey. Beansprout is a next-generation investment advisory platform licensed by the MAS.

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX have any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.