This research is commissioned by ADDX in collaboration with LightStream Research, an insight provider on Smart Karma.

Executive Summary

The buying and selling of securities has not fundamentally changed since the 1970s when the electronic trading revolution happened. Transactions remain expensive. In an age when email and money is moved around the world at the speed of light, the settlement of security trades still requires two working days. But blockchain looks set to overturn the status quo.

The technology that is bringing sweeping change to areas such as cryptocurrencies, trade finance, central bank monetary policy and healthcare can be applied to stocks too. Also known as distributed ledger technology, blockchain has the potential to correct many inefficiencies inherent to the journey taken when securities are passed from one owner to another. Stock exchanges from the US to Australia are now actively studying how blockchain can transform their businesses.

Driving this burgeoning interest is the potential to improve the speed, reliability and cost-efficiency associated with back-end processes when stocks are bought and sold – such as custody, settlement and regulatory compliance. The blockchain records all relevant information in a single space, with ownership records and transactions updated in real time on one ledger. This drastically reduces the need for intermediaries. Smart contracts, a key feature of blockchain technology, can also automate other asset-servicing actions such as dividend payments.

As the benefits of adopting blockchain become clearer over time, stock exchanges must decide what they should do with their legacy systems. A clear understanding of the steps needed for the transition will help them see the shift as not only beneficial but also feasible.

Reducing the Need for Intermediaries

The process of buying, selling and servicing securities involves many intermediaries – including brokers, depositories, banks, clearing firms and paying agents. These third parties continue to be needed because the trading process is modelled after that of a bygone era when securities were paper-based and much of the work enabling trades was manual. Over time, small improvements have been made and parts of the process have been digitised. But without a structural shift, each trade still triggers a set of back-end actions that are fragmented, not integrated.

Intermediaries add to transaction cost, risk and time. They represent a deadweight loss to buyers and sellers of securities, drawing down on resources without offering real value in return. Using blockchain technology, there is an opportunity to bypass a number of these intermediaries, making each transaction more efficient. For example, custody services look very different for blockchain-based securities, as assets are effectively custodised on the digital network in a way that is secure and can be verified by the relevant parties.

Not all intermediaries will be disrupted – those that remain likely perform services not easily replaceable by technology. One example is investment advice. Blockchain-powered platforms are typically not designed to provide personalised portfolio advice.

Better, Faster and Cheaper Trading

In an age when sending an email or transferring money has become instant, securities trading is still surprisingly slow, with settlements usually taking two or more working days. This is in no small part due to the many intermediaries involved and the fact that their information systems are not able to resolve in real-time the “Delivery versus Payment” problem – that is, determining whether one party has brought the right amount of securities to a transaction (delivery), while the other party has brought sufficient funds to purchase those securities (payment).

The process is complicated, with the various intermediaries having their own siloed, centralised databases, resulting in much duplication. Intermediaries have to update their digital records to reconcile changes that have occurred at each step along the journey. When an interface needs to take place between two intermediaries, the process slows down. Delayed settlements impose a price on transacting parties, as their funds or securities are held in limbo and they are prevented from taking advantage of other market opportunities.

Blockchain is uniquely positioned to overcome the problem of slow settlements. Blockchain-powered trades can be cleared on the same day – because all records of funds and securities exist on a shared ledger, and once details are confirmed by the relevant parties, who can be given real-time oversight capabilities, the swap happens almost at once.

With the elimination of cumbersome verification and reconciliation steps, the time needed to process the trade is cut from a few days to less than a day. Faster settlements imply a reduction in settlement risk – the risk of the other party in a trade defaulting during the wait. That is because when settlements are a long and drawn-out process, the market conditions could change significantly. Nasdaq, when discussing its Linq Blockchain system, has said that settlements could eventually be completed in as little as ten minutes, while reducing settlement risk by 99%.

Dividend Payment and E-Voting

Accompanying blockchain technology is a feature known as smart contracts. These are pre-programmed contracts written in the form of “if-then” statements that instruct the blockchain network to automatically execute a certain action if a specific set of circumstances comes to pass. While the blockchain ledger on its own is an efficient record of the present and the past, smart contracts give the ledger an added feature of being forward-looking.

Smart contracts bring many useful applications to securities trading and the post-trade servicing of securities. For instance, the exchange and the regulator can put in place real-time checks on whether a trade is fully compliant – say, by blocking trades that involve unfulfilled lock-in periods or by stopping “naked short selling”. Smart contracts can enforce trading halts promptly, when the price of a stock rises or falls by a certain percentage. They can also automate non-trading actions such as the payment of dividends and coupons or the tracking of investors’ leverage positions to ensure sufficient collateral.

Another potential blockchain application is in the shareholder voting process – by improving accuracy, transparency and speed. In a globalised world where shareholders of a company may be living in any country, blockchain-powered e-voting makes it more convenient for shareholders to stay engaged with the firm and participate in important decisions. Because companies can give shareholders access to the blockchain network used for voting, the vote count would also be verifiable, which enhances trust. Meiji Yasuda, a major Japanese life insurance company, has announced it intends to adopt blockchain e-voting for shareholders meetings. India’s National Stock Exchange is also conducting tests on this front.

Towards A Blockchain Future

For stock exchanges, blockchain-based trading is highly promising. But the challenge lies in what they should do with their legacy systems. Over the years, stock exchanges have made considerable investments in their current, non-blockchain technology. Replacing the system wholesale is a very complex commercial and operational decision, and stock exchanges will be willing to make the shift only after they can see clearly what steps are needed. To persuade stakeholders that the benefits outweigh the costs, they have to go over any proposal with a fine-tooth comb.

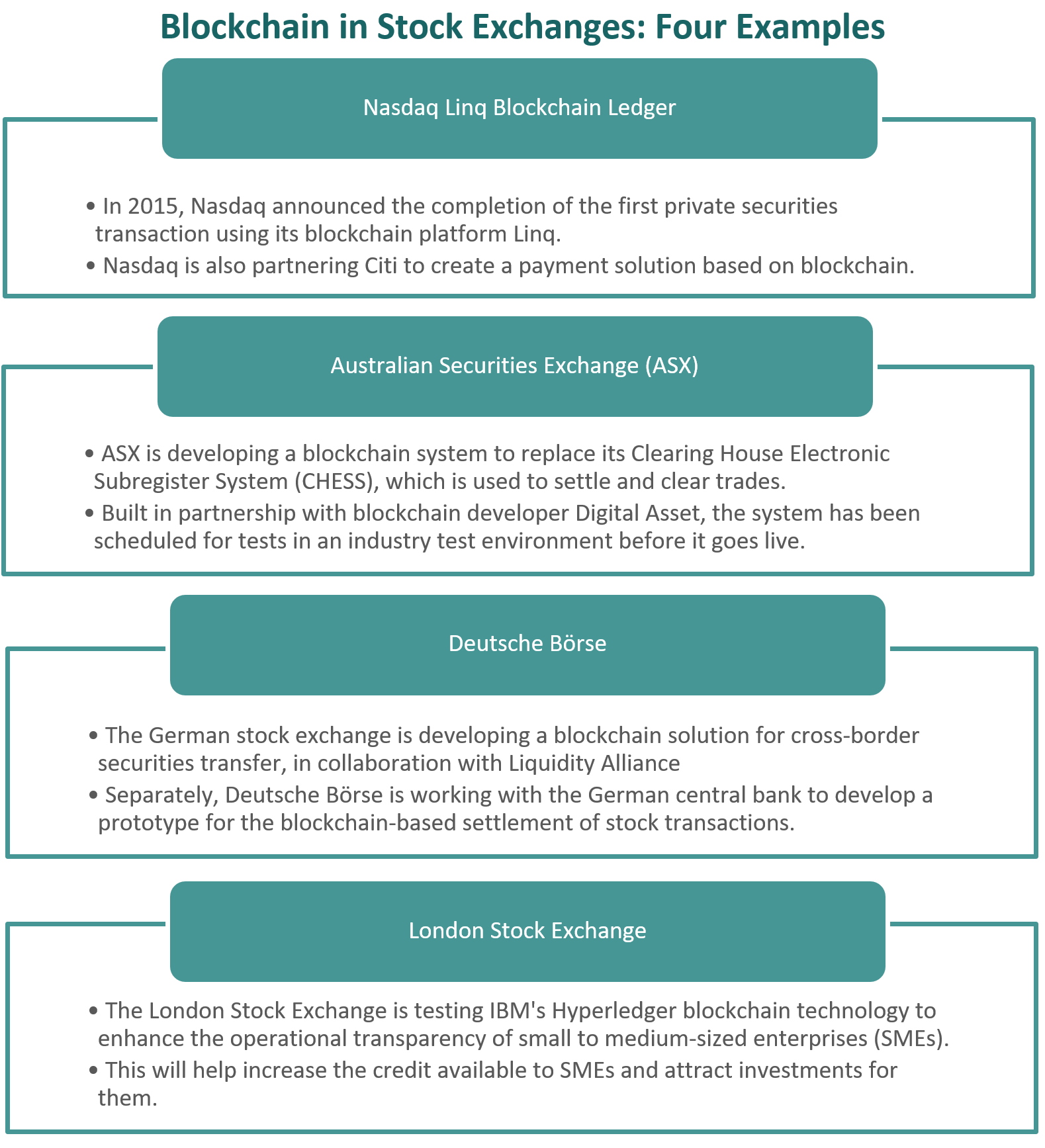

Not surprisingly, some stock exchanges are choosing instead to invest in optimising their legacy systems – for example, by reducing settlement time as much as they can without blockchain. But there are also many exchanges that have begun pilot testing on a limited scale to develop a deeper understanding of the technology. A few examples include Nasdaq, the Australian Securities Exchange, Deutsche Börse and the London Stock Exchange (see examples below). In addition, a new generation of regulated private market exchanges – including ADDX – are implementing the technology in a more comprehensive way because they have adopted blockchain technology from Day One.

As these initiatives make progress, the use of blockchain to improve securities trading is likely to be an important theme over the next few years, promising to usher in a more efficient and inclusive trading environment for the public.

ADDX is your entry to private market investing. It is a proprietary platform that lets you invest from USD 10,000 in unicorns, pre-IPO companies, hedge funds, and other opportunities that traditionally require millions or more to enter. ADDX is regulated by the Monetary Authority of Singapore (MAS) and is open to all non-US accredited and institutional investors.

![[Report] Blockchain Set To Bring Profound Change To Securities Trading](/insights/content/images/2021/07/ADDX_NewBlogPosts_1200X800-05-01.jpg)