How long-term investors can turn market volatility into value amid rising trade tensions

Trade tensions escalate, markets waver amid renewed uncertainty

As trade tensions between the U.S. and China rise again, global markets are once more on edge. On October 10, 2025, President Donald Trump announced a new 100% tariff on all Chinese imports, effective November 1, in response to China’s recent restrictions on rare earth exports. The news triggered a sharp global sell-off: the Dow Jones Industrial Average fell nearly 2%, the Nasdaq Composite slid more than 3%, and the S&P 500 lost over 2%, while the CBOE Volatility Index (VIX) surged more than 30% in a single day.1

The broad market sell-off reflected investors’ growing worries about supply chain disruption and global growth. The U.S. dollar strengthened, commodity prices turned volatile, and safe-haven assets like Treasuries and gold saw increased buying activity. Major Asian and European stock indexes also fell sharply, while the renminbi and other emerging-market currencies weakened. Within days, risk appetite faded and investors seemed to have shifted away from riskier investments.

But scenes like this are nothing new. From the global financial crisis to the pandemic shock, every major global event has caused market turmoil and opened new opportunities. History shows that when short-term fear leads to market mispricing, patient long-term capital often steps in. In such times, private markets can serve as a haven for investors who focus on long-term value instead of short-term swings, finding potential in lower valuations and structural changes.

Learn from history: Resilience and long-term returns of private markets

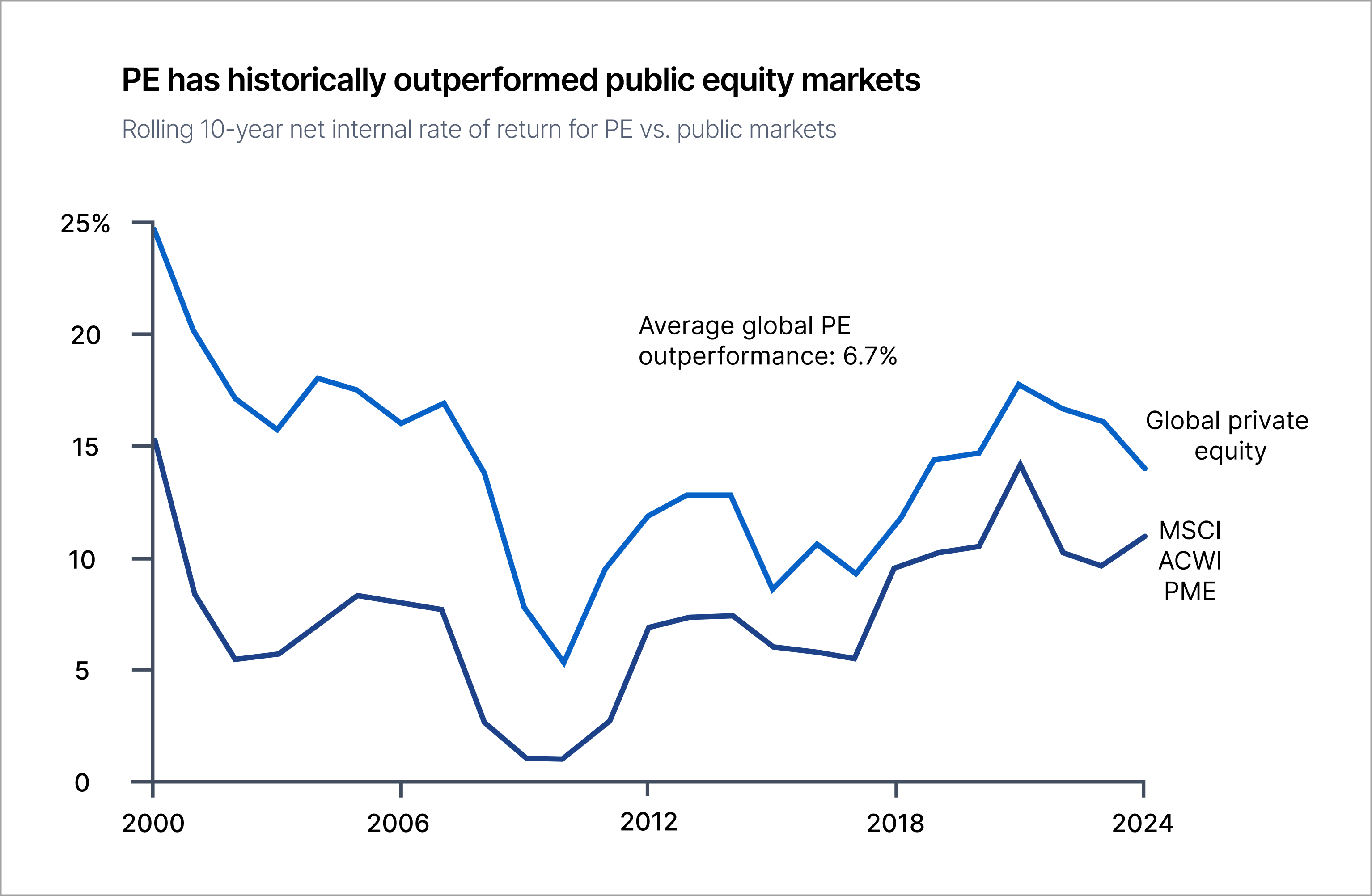

Looking at historical data, private markets have often demonstrated relative resilience during periods of economic crisis or high volatility. According to Vanguard, the 10-year rolling net internal rate of return (IRR) of global private equity funds exceeded that of public equities by approximately 6.7% (Figure 1).1 This period encompassed several episodes of market stress, including the European sovereign debt crisis, the Chinese stock market turbulence, and the market volatility triggered by the COVID-19 pandemic. During these high-volatility years, private equity funds performed relatively steadily, with long lock-up periods and structured arrangements helping investors withstand short-term market panic.

Vanguard’s report also shows that, despite short-term market turbulence, private equity exit activity rebounded significantly in 2024. In the U.S., total exit value reached approximately $413 billion, up nearly 49% from the previous year, with 1,501 exits completed.1 This indicates that even during periods of market stress or uncertainty, funds were able to execute capital distributions and reinvestment, realizing value for investors. Furthermore, activity in the secondary market during periods of high volatility provides additional insight. In the first half of 2024, secondary market transaction volume reached $68 billion, a 58% year-over-year increase,1 demonstrating that investors were still able to acquire mature assets at a discount during periods of market stress or liquidity constraints.

Vanguard’s capital market model further projects that over the next ten years, the median annual return of global private equity will be approximately 8.9%, higher than the 5.4% expected for global public equities.1 This suggests that, even in high-uncertainty environments, private market products have the potential to deliver relatively stable excess returns through long-term investment and structured strategies. Overall, these historical data indicate that during crises or periods of market volatility, private markets not only demonstrate resilience but also provide opportunities for investors with a long-term perspective. Long-term lock-ups and systematic investment approaches allow capital to navigate short-term fluctuations and accumulate value over time.

Investing with patience and staying rational through volatility

Periods of uncertainty often test investors’ discipline more than their analytical skills. After major market shocks, it is common to see capital retreat from risk assets, driven by fear rather than fundamentals. Yet, history repeatedly shows that those who stay invested and avoid emotional decisions, tend to achieve stronger long-term outcomes. Morningstar’s annual Mind the Gap study finds that over the 10-year period ended December 31, 2024, the average investor typically earned 1.2% less per year than the funds they own, largely because of poorly timed purchases and sales.2 This illustrates how short-term reactionary behavior can erode returns.

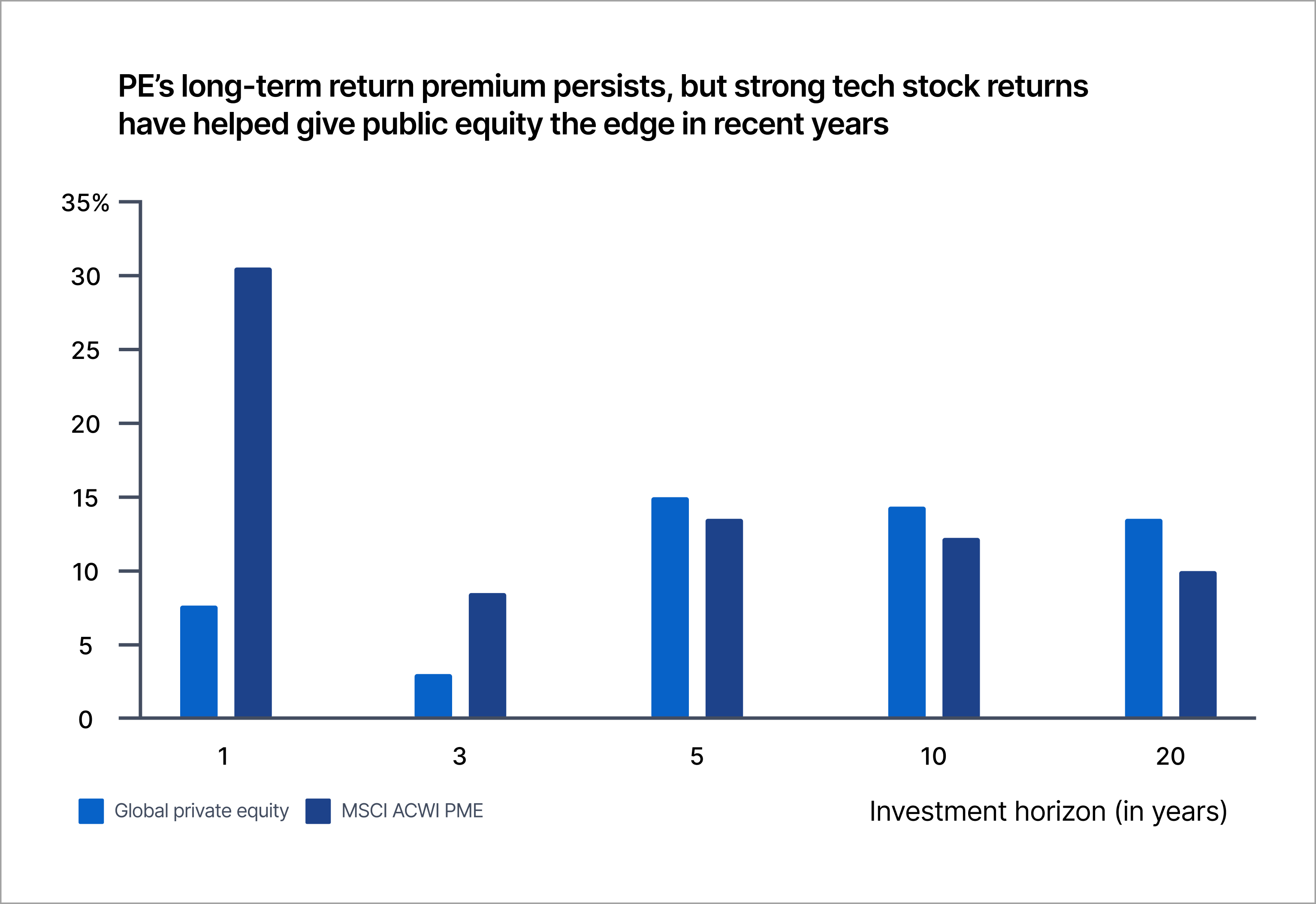

Vanguard’s 2025 Private Equity Market Outlook further illustrates this point. As shown in Figure 2, the longer the investment horizon, the greater the performance advantage of private equity over public markets. While short-term results may vary due to market conditions, private equity has delivered consistently higher returns over ten- and twenty-year periods.1 This pattern demonstrates the strength of patient, long-term investing and the value of staying committed during periods of uncertainty.

For individual investors, the message is clear: volatility is temporary, but compounding is lasting. Maintaining a long-term perspective and avoiding impulsive decisions are essential to realizing the full potential of private market investments.

If you would like to understand how private market strategies can fit into a long-term portfolio, explore our latest insights and educational resources on private investing.

References:

1Vanguard 2025 private equity market outlook

2File Download

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX bear any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.