Cryptocurrencies have typically been seen as damaging to the environment. This should not drive us to conclude that there is limited use to blockchain, the technology behind cryptocurrencies. In fact, blockchain can be helpful in driving the development of environmental, social and governance (ESG) goals.

Bitcoin and cryptocurrencies are often associated with a negative environmental impact due to the significant energy they consume. According to the Cambridge Centre for Alternative Finance (CCAF), Bitcoin currently consumes about 126.50 Terawatt Hours of electricity per year, representing 0.57% of global electricity consumption. This is also roughly similar to the electricity consumption of countries such as Norway and Ukraine.

However, does this mean that blockchain, the technology behind cryptocurrencies, has a similarly poor ESG track record? For those unfamiliar with blockchain technology, it is a distributed ledger of transactions across a peer-to-peer network. Through blockchain, participants can confirm transactions without the need for a central authority.

Beyond driving the cryptocurrency boom, it is worthwhile taking a closer look at the numerous uses of blockchain technology. Blockchain can support a wider range of digital assets and can also help to facilitate fund transfer. In addition, it is also playing a major role in shaping developments in the ESG space. The list of applications of blockchain in promoting ESG outcomes has grown to include providing transparent ESG reporting and widening financial access.

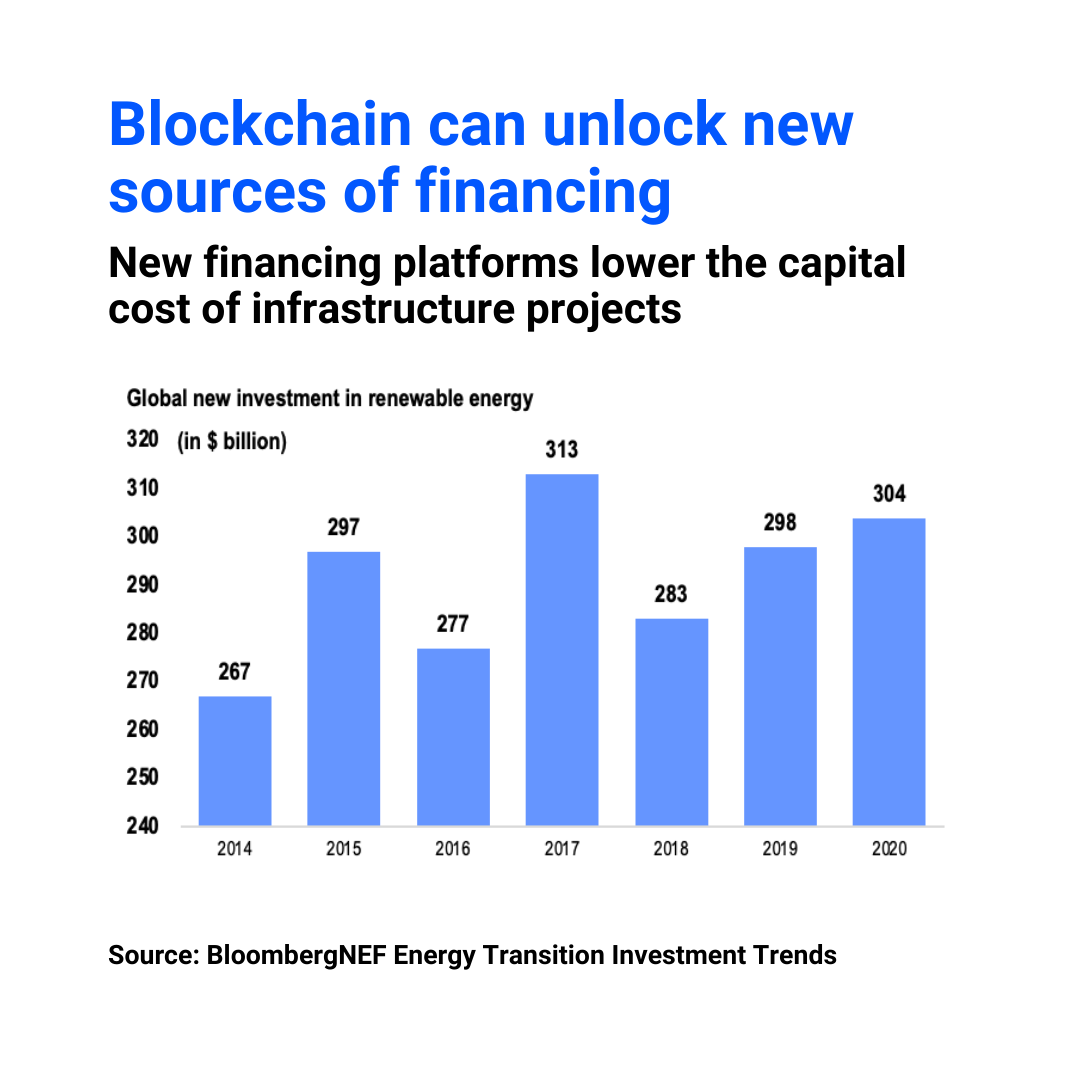

1. Blockchain can unlock new sources of financing

According to the Organisation of Economic Co-operation and Development (OECD), blockchain technology can unlock new sources of financing and lower the cost of capital for infrastructure projects. Through establishing new financing platforms, the technology can bring improved liquidity, transparency and expanded access to finance. This could help to drive continued investment in renewable energy projects which have averaged about US$300 billion per annum in the past five years.

A blockchain-based financing infrastructure could enable investors from various backgrounds to invest directly in sustainable infrastructure. This will help to transform illiquid assets into tradeable digital assets, leading to an increase in funding available for sustainable development projects. Tokenisation of infrastructure also reduces dependence on intermediaries, thus bringing about lower costs.

For example, ADDX has tokenised the Hanwha Global ESG Innovators Fund, an actively managed, long-only fund investing in equity securities of public companies with ESG-centric business models. The fund seeks out companies with transformative business models, innovative products, and sustainable supply chains through its proprietary ESG evaluation process.

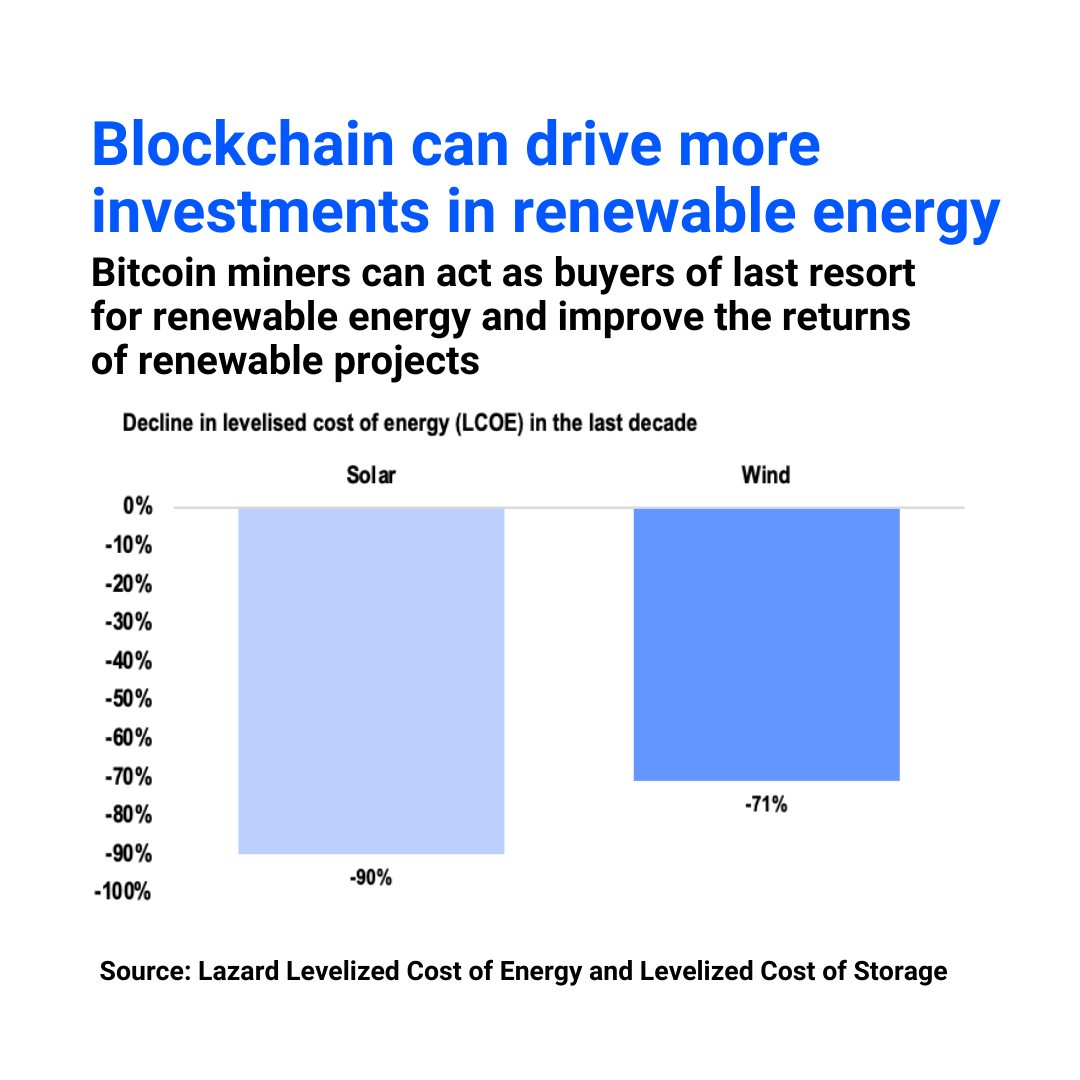

2. Blockchain can drive more investments in renewable energy

The Bitcoin Clean Energy Initiative has shared its vision of how the Bitcoin network could function as a unique energy buyer enabling more solar and wind generation capacity to be deployed. In a research report published by American fintech company Square and Cathie Wood’s ARK Invest, it was suggested that solar and wind are now the least expensive energy sources in the world as the lifetime cost of building and operating these renewable plants, adjusted for energy produced, has declined by more than 70 percent in the past decade. However, they are approaching deployment bottlenecks as a result of intermittent power supply and congestion on the grid.

Bitcoin miners could serve as a flexible load option by becoming an energy buyer of last resort, purchasing electricity when there is low demand from other sources. This will create a positive feedback loop by further bringing down the cost of these renewable technologies as their scale increases. By combining with storage projects, such a solution could improve the returns for renewable project investors and developers, driving more investments in the space.

3. Blockchain can lead to greater transparency

Blockchain can provide a trusted and traceable record of transactions, thus leading to more transparency. In particular, its key feature of being resistant to tampering can be useful in areas with weak institutions or that lack transparent reporting. This is evident in the development of sustainable supply chains, where blockchain technology can provide transparency on the environmental or social impact.

For example, initiatives are being developed to test the technology’s ability to perform carbon tracing. IBM is partnering with Walmart to introduce traceability mechanisms into the company’s food supply chain. In the pilot programme by Walmart, the use of blockchain technology led to a decline in the time to trace a package of mangoes from the farm to the store from days or weeks to just two seconds.

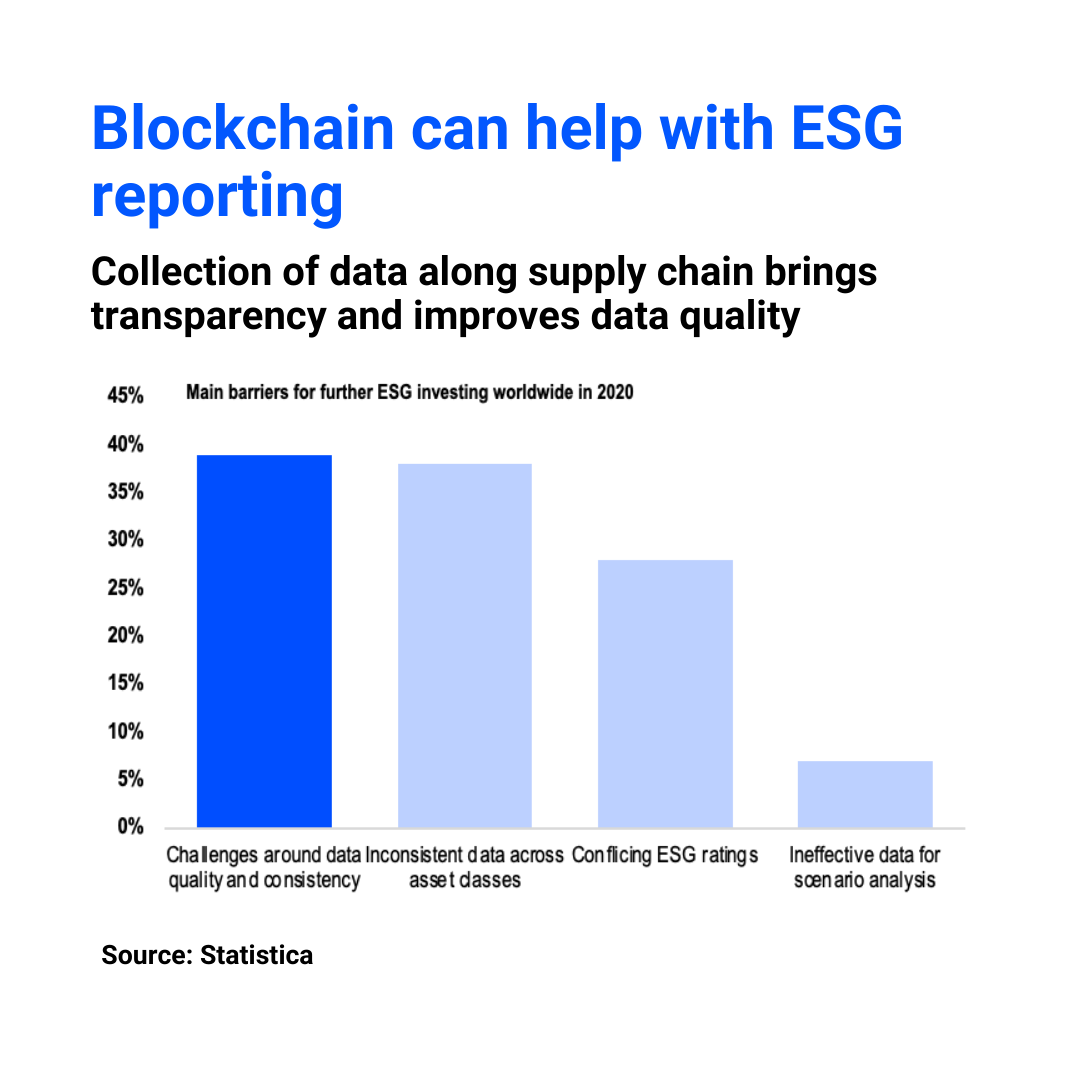

4. Blockchain can help with ESG reporting

One of the key barriers to wider ESG adoption is the lack of verified and standardised ESG data. In a survey conducted by Statistica, close to 40 percent of respondents claim that the main barrier for further ESG investing lies in challenges around data quality and consistency. With the greater transparency that comes with blockchain technology, sustainability metrics can become more measurable and easily verified.

The World Economic Forum has documented numerous use cases of how blockchain technology can be used in supporting the collection of ESG data. In particular, the technology can automate data collection across various points of a company’s supply chain. As a result, these companies can have greater visibility on their environmental impact rather than relying on data provided by their vendors.

When combined with the Internet of Things (IoT), the use of blockchain in collecting ESG data shows even more promise. For example, the Seneca Park Zoo in New York has used a system of wireless sensors and satellite imagery and a blockchain-based platform to monitor its progress in tree-planting in Madagascar. This allows donors to receive real-time updates about its conservation projects in a transparent manner.

5. Blockchain can widen access to financial services

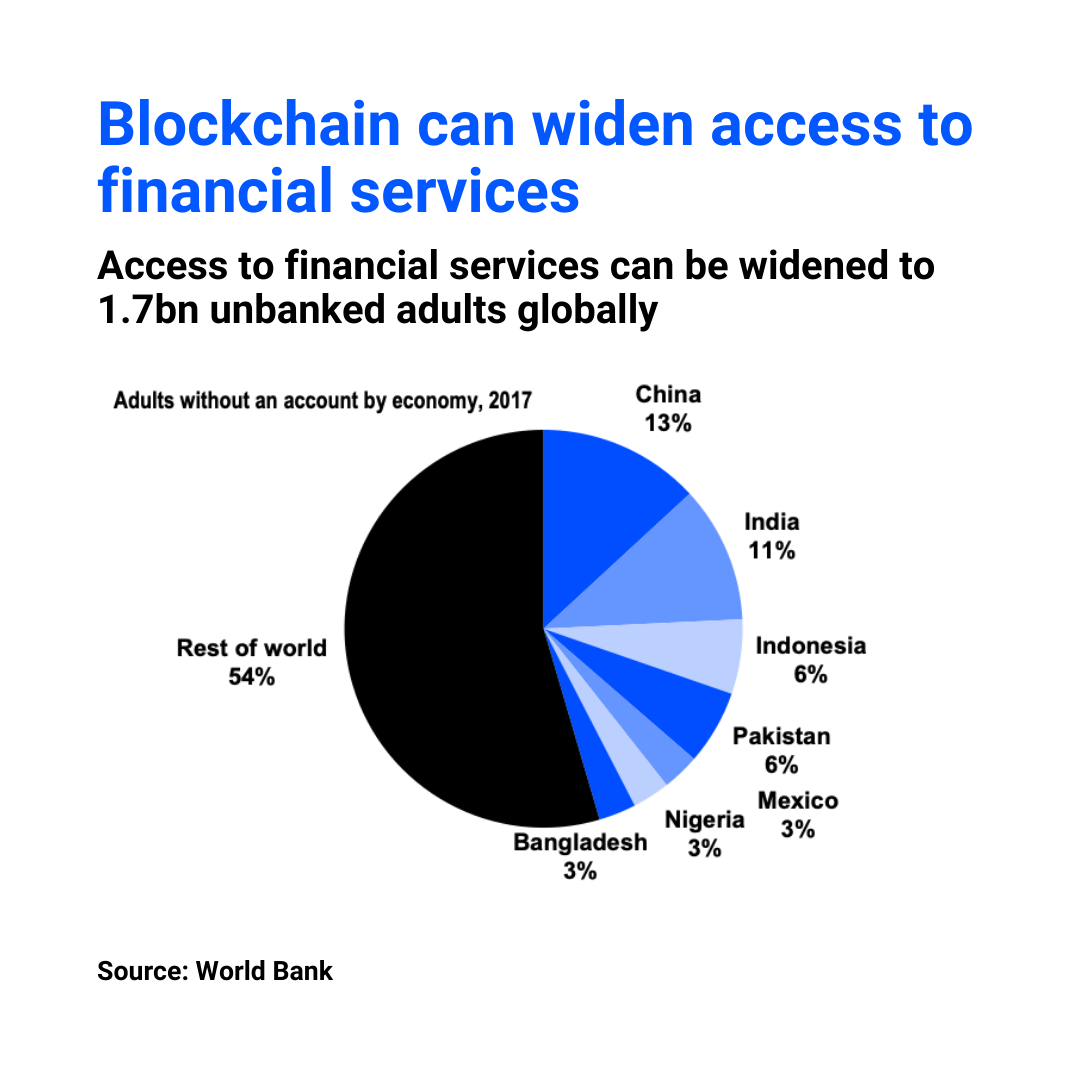

Blockchain can drive greater financial inclusion, which is incorporated into many of the UN’s sustainable development goals. According to the World Bank, blockchain can democratise access to financial services to the 1.7 billion adults globally who are currently unbanked. Many of these individuals residing in emerging economies rely on a shadow finance system with limited access to formal credit, and blockchain can help to reduce the barriers for them to access financial services.

In some parts of the world, transaction fees for blockchain transactions could be lower than the cost of intermediary-coordinated money transfers. Users can also conduct these transactions with enhanced security using their mobile devices rather than requiring a physical banking location.

For example, El Salvador approved a proposal to make Bitcoin legal tender in June 2021, with the objective of bringing financial inclusion to the country. In particular, it was noted that making Bitcoin legal tender could help 70 percent of the country’s population that is unbanked access financial services.

This research is commissioned by ADDX in collaboration with Canopy Research, a bespoke insights provider by Beansprout dedicated to guiding investors along their financial journey. Beansprout is a next-generation investment advisory platform licensed by the MAS.

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX have any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.