Consider this: Until about 12 years ago, cryptocurrencies did not exist. Today, they are worth more than US$1 trillion. The rapid rise of this new form of digital money has been truly unprecedented, surpassing that of any other new asset class in history.

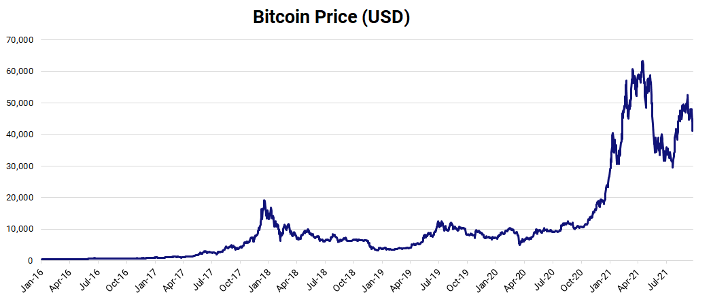

As the likes of Bitcoin entered the vocabulary of much of the world’s population over the past year, the cryptocurrency, despite recent price adjustments, has come a long way from its 2016 price of US$418 to US$44,458 by mid-September 2021. At the time of writing, the total market cap of cryptocurrencies stands at US$1.9 trillion, with Bitcoin and Ethereum – the two largest cryptocurrencies – worth US$837 billion and US$365 billion, respectively.

In the aftermath of the Global Financial Crisis of 2008 that exposed the vulnerabilities of commercial banks and governments, this ecosystem of digital money was invented in January 2009 as a rival to the traditional model of fiat money. Cryptocurrencies were born out of the belief that power should be returned to the people, a goal that its creator Satoshi Nakamoto thought could be achieved by an encrypted, decentralised, immutable, and more trustworthy way of transacting money online.

It is safe to say the idea has not failed. Today, over 12,000 different cryptocurrencies are in existence as more and more investors begin to see these digital currencies as an asset class that cannot be ignored. Furthermore, individuals aren’t the only ones taking part. Traditional financial institutions are entering the crypto market, despite many of them initially speaking out against it.

Traditional finance gets a slice of crypto

Banks have begun offering products with an exposure to cryptocurrencies like Bitcoin – the clearest sign yet that crypto is slowly but surely becoming mainstream.

In March, Morgan Stanley became the first major U.S. bank to offer its wealth management clients access to Bitcoin funds, in response to clients demanding exposure to the cryptocurrency notwithstanding its volatility. JPMorgan Chase in the following month also announced it was preparing to offer an actively managed Bitcoin fund to certain clients despite its CEO’s well-documented prior apprehensions towards Bitcoin. The fund will only cater to private wealth clients, said Coindesk. Goldman Sachs then followed suit in May, offering Wall Street investors a way to take positions through non-deliverable forwards, a derivative tied to Bitcoin’s price that pays out in cash.

Moving beyond the ultra rich, Crypto custody firm NYDIG announced in May that they will soon enable the average banking customer in the United States to buy, hold, and sell crypto through their existing bank accounts, with hundreds of banks reportedly eager to participate in the program.

Crypto’s use cases are growing – and banks see it

While this shift may seem sudden, traditional financial institutions such as banks have looked at the data and can see their customers transferring money out to buy cryptocurrencies, according to NYDIG president Yan Zhao. As the use cases of cryptocurrencies grow beyond trading and speculation, banks are increasingly making the calculation that it is wiser to get on the train rather than miss it.

A new medium of payment

As the popularity and market cap of cryptocurrencies grew over the years, more businesses have begun to accept them as a medium of payment. For Bitcoin alone, at least 15,000 businesses across the globe accept it for a host of investment, operational, and transactional purposes as of late 2020, according to Fundera. Major companies such as Microsoft, PayPal, Starbucks, and Home Depot are accepting them as a payment option, underscoring how the once-negligible cryptocurrency space now has a steadily growing influence in the payment system.

Governments may soon join the crypto bandwagon, with El Salvador becoming the first country to accept Bitcoin as legal tender, in addition to the U.S. dollar. This means that prices can now be displayed in Bitcoin and all entities in the Latin American country must accept the digital money as a payment method for goods and services. Additionally, El Salvadorians will be able to use the cryptocurrency to pay taxes.

A new source of investment income

While cryptocurrency for payments is still in an “early adoption” phase globally, cryptocurrency as a source of investment income is much more established. It is in fact the primary use case for most people who have exposure to Bitcoin or Ethereum today. According to a 2020 global survey by Crypto.com, the share of respondents who saw cryptocurrencies as an investment (54%) was more than twice of those who saw it as a currency (21%).

How does crypto investing work? Many investors earn a return by trading cryptocurrencies directly or by buying cryptocurrencies and depositing them with companies that pay a return on those deposits, sometimes referred to as ‘yield farming’. Some investors also buy into cryptocurrencies indirectly – for example, by investing through a crypto fund or a product that is linked to crypto, such as a derivative. The price of cryptocurrencies tends to be much more volatile than that of other asset classes, such as company stocks or gold, and investors therefore do face some risk of losses if prices drop suddenly and precipitously. Regulators in many countries have also repeated warnings that cryptocurrencies are not backed by “real assets”. Nonetheless, an investor who took a buy-and-deposit strategy on Bitcoin a year ago would have seen the value of his principal sum rise by more than 350% - before taking into account the interest paid on his deposit.

A new way to access financial services

Cryptocurrencies have also given rise to Decentralised Finance (DeFi), which are peer-to-peer (P2P) financial services that do not rely on intermediaries or central authorities such as banks to transact. Using public blockchains such as Ethereum as a foundation and cryptocurrencies as a medium, the DeFi world builds applications that can offer services such as lending, insurance, and investments. One could potentially take out loans in Ether, receive insurance payouts in Bitcoin, or invest in cryptocurrency futures.

As of August 2021, the total market cap of DeFi has exceeded US$100 billion, while total value locked (TVL) or capital deposited by users is at around US$85 billion, according to data from CoinGecko and DeFi Pulse. All these factors have driven more investors into cryptocurrencies, and possibly away from the old-school world of finance. Traditional financial institutions are now taking notice, and that has driven some to offer their own crypto products to compete.

How to get started with cryptocurrency investing

Having understood what cryptocurrencies are and their key use cases, investors then have to decide how they would like to go about investing in cryptocurrencies. Broadly speaking, there are two categories of companies investors can turn to. On the one hand, there are crypto exchanges and services providers, that have typically emerged from the realm of non-traditional finance. On the other hand, there are regulated entities. These are more likely to be traditional finance players that have ventured into the crypto space.

Investing Via Crypto Exchanges and Service Providers

Led by the likes of Kraken, Coinbase and Binance, cryptocurrency exchanges are the most common marketplaces used by investors to buy and trade crypto. The space remains largely unregulated, and this means investors bear greater risk, because unlike traditional institutions, these crypto exchanges have not undergone the rigorous scrutiny of regulators, who are tasked with protecting individual investors as well as maintaining the health and stability of the overall financial system.

Sometimes things can go spectacularly wrong. For example, in April, the founder of Turkish cryptocurrency exchange Thodex reportedly froze trading and fled the country with an estimated US$2 billion (S$2.7 billion) in investors' assets. At the time of writing, Thodex’s founder is still at large.

Of course, not all crypto exchanges are unsafe. Some have grown to a very large scale in part because they have succeeded in building a measure of trust within the global crypto investing community. Nonetheless, the recent spate of regulatory actions against Binance, one of the world’s biggest crypto exchanges, demonstrates that the industry still has significant room for improvement.

The lack of regulations can sometimes pose problems in situations that demand accountability. For example, the Wall Street Journal reported that Binance froze trading for an hour on 11 July 2021, as the price of Bitcoin and other cryptocurrencies fell steeply. The stoppage prompted lawsuits from some 700 traders. Binance’s unregulated status, and the fact that it has no headquarters, represents a significant roadblock for aggrieved parties who want to recoup their losses.

Investing via Regulated Entities

Another viable path into the crypto world is to invest through a regulated entity instead. The number of regulated financial institutions that now offer cryptocurrency products has increased significantly in the past year. PayPal is among the latest to make an announcement on this front, announcing in August 2021 that its UK customers can buy and hold Bitcoin through PayPal. Other financial institutions are also responding to the rising demand among their customers by launching direct or indirect crypto products – including funds and cryptocurrency price trackers.

The main advantage of investing through a regulated entity is the added layer of investor protection. Because regulated entities come under annual and ongoing scrutiny from regulators, their products and operational processes are more likely to be designed responsibly and in accordance with the best practices of the investment industry. The partners that they work with will also have to pass stricter due diligence processes, because these partnerships would fall under the ambit of regulatory scrutiny. This is important for crypto investors, because it gives them greater assurance that the digital assets they have bought do belong to them and have been custodised securely, for example. For individual investors, adding Bitcoin to their portfolios via a regulated financial institution can be a safe transition into crypto investing.

Cryptocurrencies are the next emerging asset class

In an annual company meeting in 2021, Larry Fink, CEO of the world’s largest asset manager Blackrock, was asked by a shareholder whether the company would invest in Bitcoin. While urging caution, Fink said cryptocurrencies could someday play a role in long-term investing as an asset class similar to gold.

With the wave of demand in crypto investments staying strong, many big financial institutions are now starting to seriously consider playing a role in the crypto ecosystem. Sooner or later, this will push cryptocurrencies further into the mainstream – from a speculative gamble into an established asset class that is worthy of an allocation in any investor’s portfolio.

Note:

This research is commissioned by ADDX in collaboration with Zero One, an insight provider on Smart Karma.

ADDX is your entry to private market investing. It is a proprietary platform that lets you invest from USD 10,000 in unicorns, pre-IPO companies, hedge funds, and other opportunities that traditionally require millions or more to enter. ADDX is regulated by the Monetary Authority of Singapore (MAS) and is open to all non-US accredited and institutional investors.