In today's ever-changing financial landscape, traditional players in the industry, including securities firms and online brokers, are undergoing a remarkable transformation. They are expanding their focus to include comprehensive wealth management divisions, offering end-to-end solutions to their clients.

While venturing into wealth management, these institutions face a critical challenge: providing clients with the ability to build resilient portfolios. One major obstacle they encounter is limited access to alternative investments, which often come with high barriers to entry. This is where partnering with a platform that offers seamless access and reduced barriers to private markets becomes vital.

Advantages of platform partnerships

Diverse supply of investment options across asset classes

Teaming up with a platform to offer clients access to private markets ensures a continuous supply of fresh investment opportunities. These platforms have dedicated teams of experts who curate a diverse range of investment options across sectors and asset classes, such as commercial paper, private equities, and hedge funds. Wealth managers can provide their clients with a wide selection of potential investments that align with their objectives and risk profiles, conveniently available on the platform.

Streamlined user experience with minimal disruptions

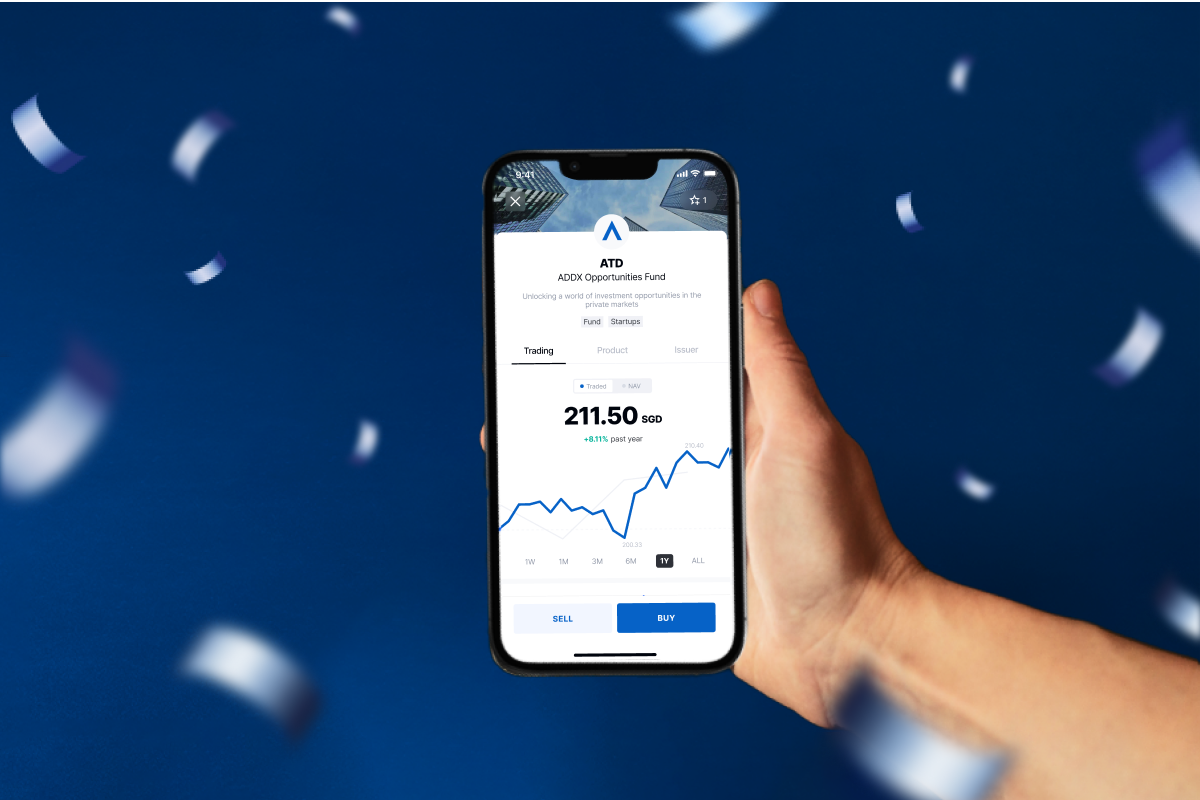

In the digital era, a seamless user experience is crucial. Partnering with a platform that offers a plug-and-play solution allows wealth managers to integrate offerings seamlessly into their existing systems. By leveraging well-harnessed technology, wealth managers can provide their clients with a highly impactful overall experience through a user-friendly interface that simplifies the investment process on a digital platform.

Elimination of resource-intensive manual processes

Accessing private markets often requires significant resources, which can be a challenge for small to mid-size wealth managers. Building specialized capabilities to originate investment opportunities may not be economically feasible for them. Partnering with a platform that provides access to private markets addresses this challenge by eliminating time-consuming manual processes.

These platforms act as gateways, streamlining the investment lifecycle from deal sourcing to execution. Wealth managers can rely on the platform's expertise, tapping into a curated selection of investment opportunities without the need for extensive in-house capabilities. This saves valuable time and resources, enabling wealth managers to focus on delivering exceptional service to their clients.

Unlocking secondary trading through technology

Traditionally, private market investments lacked liquidity and flexibility. However, some platforms leverage technologies like blockchain to enable secondary trading. This breakthrough feature enhances liquidity within private markets, offering investors greater flexibility in managing their portfolios. Partnering with such platforms allows wealth managers to provide their clients with added convenience and liquidity that was previously unavailable in private markets.

Flexible account management options

Wealth managers operate with diverse business models, licenses, and regulatory requirements. The right platform understands these unique needs and offers flexible account management options. Wealth managers can choose to allow end-investors to manage their own holdings on the platform, giving them direct control over their investments. Alternatively, relationship managers can create and manage sub-accounts on behalf of their clients, executing trades and performing fund transfers. This flexibility ensures a more seamless and customized experience for investors while meeting the specific requirements of wealth managers.

In the realm of wealth management, accessing alternative investments can be complex. However, by partnering with platforms that offer access to private markets, wealth managers can overcome these barriers and provide their clients with unparalleled investment opportunities. These partnerships help wealth managers unlock new business potential, improve operational efficiencies, open doors to additional revenue streams, increase client engagement, and ultimately differentiate themselves in the competitive wealth management landscape.

By embracing these partnerships, wealth managers can elevate their services and empower their clients to navigate the dynamic landscape of private markets more effectively.

ADDX is proud to have forged strong partnerships with renowned wealth management institutions such as KGI Securities (Singapore) and CGS-CIMB Securities. These industry-leading wealth managers have recognized the value and potential of platform partnerships in transforming the way wealth management services are delivered. Together, we are breaking down the barriers to accessing private markets and unlocking new business potential.

To explore the possibilities and discover the power of private markets, reach out to us at team@addx.co or visit ADDX Advantage for more information.

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX have any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.