Private markets are evolving rapidly in 2025. After years of cautious investing due to economic uncertainty, many investors are now turning their attention to growth. Global private market assets are projected to grow from $13 trillion today to over $20 trillion by 2030, supported by easing monetary conditions and resurgence in deal flow.1 Yet, trade tensions and policy shifts remain challenges, making a thoughtful strategy essential. How can investors position themselves to capture opportunities in this dynamic landscape?

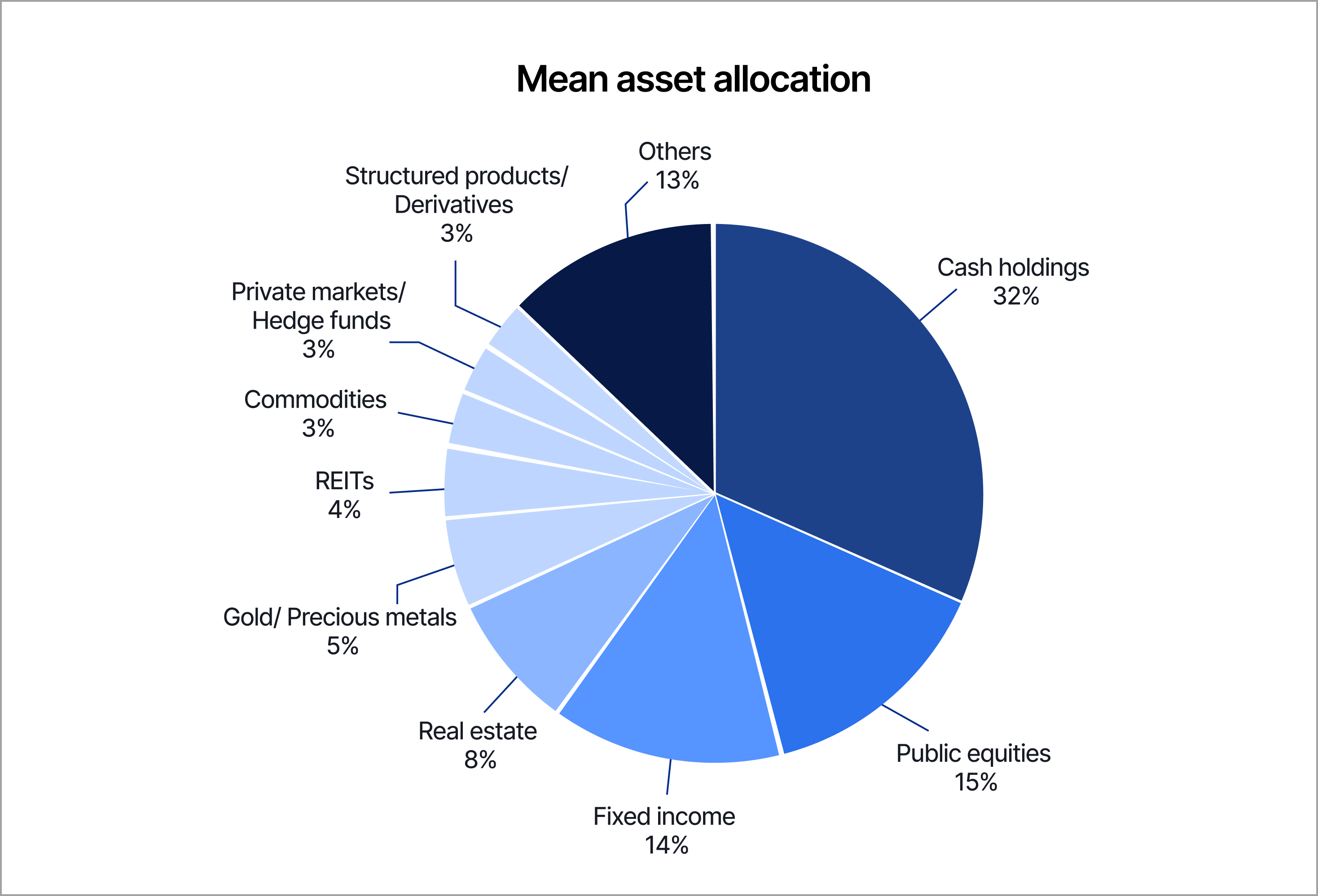

In recent years, due to high market volatility, geopolitical tensions, and persistent inflation pressures, investors have become more cautious in their asset allocation. In such an uncertain economic environment, cash has been seen as a low-return but high-security asset for investors, and many investors have chosen to increase their cash holdings or spread risks to avoid potential losses. From HSBC’s survey in March 2024 across 11 markets, 32% of individual investors’ portfolios are allocated to cash (Figure 1), although those planning to rebalance portfolios within the next year say they will invest 54% of this cash, on average.2

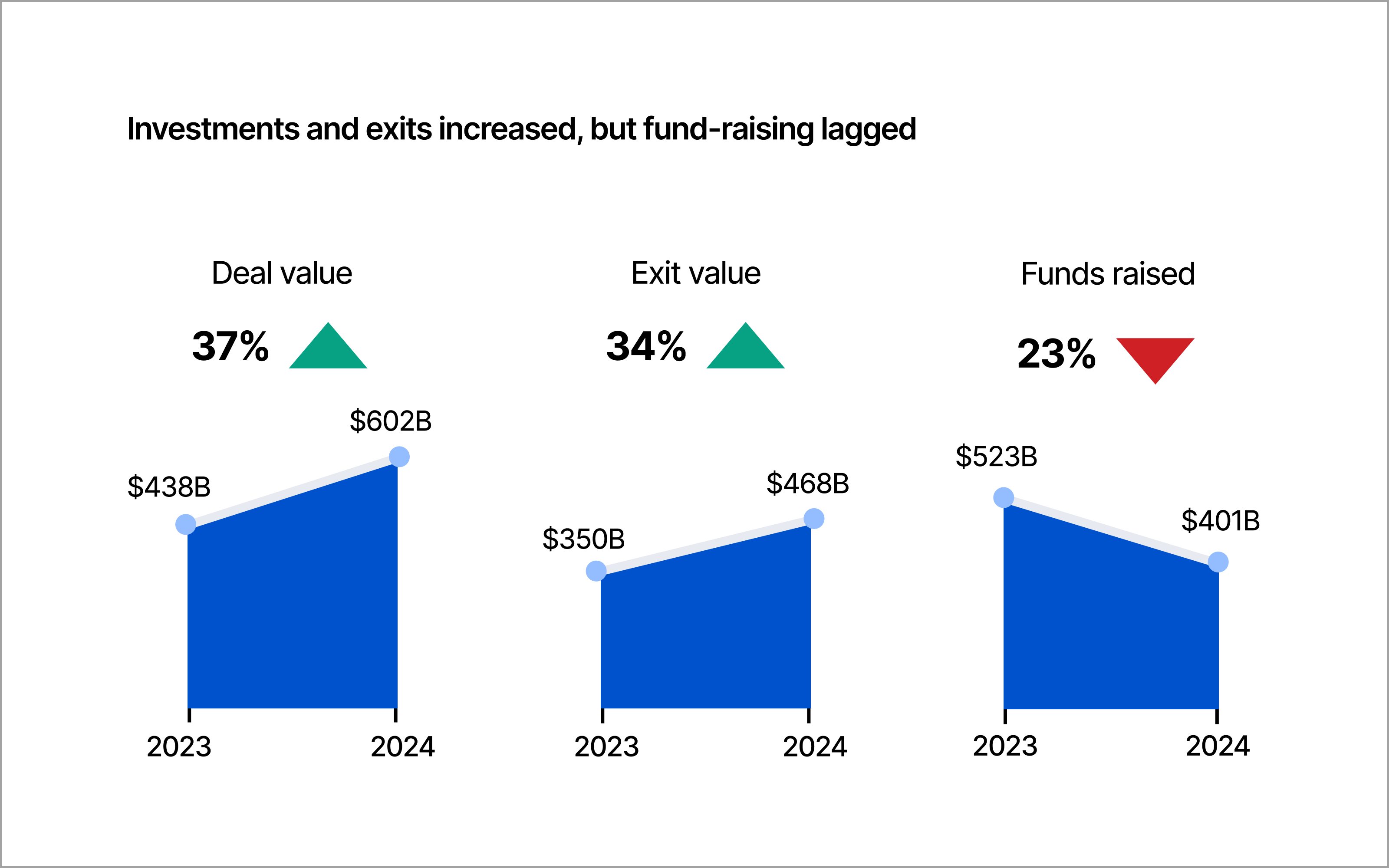

This cautious approach worked during tough times but limited asset growth. Despite a 24 percent drop in private market fundraising in 2024,3 reflecting investor caution, this decline is a lagging indicator, often tied to slower cash flows from exits. Meanwhile, private equity gained momentum, with deal values rising 37% and exits increasing 34% to 468 billion dollars in 2024 (Figure 2), reversing two years of declines.4 This rebound in part fueled by lower interest rates after Federal Reserve cuts, signals a shift toward growth-focused strategies. Additionally, according to the American Investment Council, over the 10 years ending in 2023, private equity delivered 15.2% annual returns, real estate 9.6%, far outpacing cash yields of 1 to 3% in 2024.5 Thus, investors holding cash may miss these opportunities as fund managers deploy record levels of unused capital into dynamic markets.

Private equity and venture capital: Positioning for growth

While venture capital continues to fuel innovation through investments in startups. Over the past few years, both PE and VC have faced significant challenges but have shown signs of recovery. Global private equity fundraising fell for the third consecutive year in 2024, while deal activity, after two years of sharp declines, showed signs of recovery.6 Venture capital faced similar headwinds, with both deal count and the growth in deal value experiencing a larger decline than other private equity sub-asset classes globally.3 Exits were limited, with private equity distributions to limited partners falling short of capital calls for eight years straight until 2024.1

Looking ahead, analysts forecast continued recovery, with private equity benefiting from a supportive rate environment and the restart of mergers, acquisitions, and initial public offerings.1 Deal activity is expected to accelerate, as lower borrowing costs (following Federal Reserve rate cuts) tend to encourage more entries and exits, potentially pushing global private markets assets under management from $13 trillion today to over $20 trillion by 2030.1 Venture capital is poised for a return to dealmaking and exits, with tech IPO momentum and M&A in AI-driven sectors leading the way.7 Generative AI funding has already surpassed 2024 totals in the first half of 2025, accounting for 45% of VC investments alongside software and development tools,8 as corporates and venture firms target capital-intensive plays in applied AI and hard tech.

Overall, the sector's long-term appeal lies in diversification and performance, with 30% of limited partners planning to increase allocations in the next year amid evolving fund structures like continuation vehicles and AI-enabled value creation.3

Private credit: From downside protection to high returns

Private credit is increasingly viewed as a core allocation and an important source of high yields, helping to meet financing needs not fully served by traditional banks.

From 2020 to 2024, its global market grew from $1 trillion to approximately $1.6 trillion, driven by demand for direct lending and asset-backed loans as banks tightened lending amid high interest rates.1,9 Private credit delivered 8 to 10% yields in 2024, far exceeding fixed income’s 2.1% annualized returns over the decade ending 2023.10,11

Despite tighter margins in buyout financing, deal volume rose in 2024, particularly for mid-sized company acquisitions, reflecting strong investor appetite. In 2025, stable interest rates following Federal Reserve cuts are expected to sustain this growth, with private credit projected to reach $2.3 trillion by 2028.12 Opportunities in small and mid-sized businesses, real estate, and infrastructure loans are expanding, offering diversified returns through funds and structured products. Thus, if investors prioritize cash over private credit, they tend to risk missing these high-yield opportunities in a dynamic lending landscape.

Real estate and infrastructure: Building for the future

Real estate and infrastructure have shifted from safe, steady investments to engines of growth. From 2022 to 2024, global real estate transactions increased 11% to $707 billion in 2024, driven by demand for logistics and data centers.3 Infrastructure deal values rose 18% in 2024, with renewable energy projects like solar and wind leading the surge.3 Over the decade ending 2023, real estate delivered 9.6% annual returns,11 far outpacing cash yields and fixed income’s returns.

In 2025, the green data center market reached $85.68 billion, and is on track to reach $279.88 billion by 2030, reflecting a 15.99% CAGR due to AI and cloud computing needs.13 Looking ahead, data centers tends to be set for steady expansion, supported by government incentives for accelerating the development of data center infrastructure.14 These assets provide strong returns and stability, appealing to investors seeking growth amid uncertainty.

Hedge funds and alternatives: Finding new wins

Hedge funds and alternative investments, such as commodities and digital assets, have shifted from shielding against risk to driving strong returns. Hedge funds delivered an average return of 10.7% in 2024 through November, compared to 5.7% in the same period of 2023.15

Looking ahead, hedge funds are expected to play a critical role in investor portfolios, capitalizing on policy-driven opportunities and deregulation, while benefiting from sustained artificial intelligence fervor.

Commodities tied to energy transition, like copper, are also set to expand. These assets offer investors a way to capture growth and protect against inflation in uncertain times.1

Conclusion

Private markets in 2025 are entering a new phase. After a period of caution marked by elevated cash holdings and weak fundraising, lower interest rates and improving exit activity have reopened paths to growth. Private equity and venture capital are showing signs of renewed momentum, private credit is gaining traction as investors seek higher yields, and real estate and infrastructure are supported by trends in digitalization and the energy transition. Hedge funds and alternatives are also adapting with technology-driven strategies. For investors, the opportunity lies in shifting from defense to offense through selective deployment, diversification and disciplined risk management.

References:

[1] https://www.blackrock.com/ca/institutional/en/literature/whitepaper/2025-private-markets-outlook-stamped.pdf

[2] https://www.wealthbriefing.com/html/article.php/cash-dominates-affluent-investors'-portfolios

[3] https://www.mckinsey.com/industries/private-capital/our-insights/global-private-markets-report

[4] https://www.bain.com/insights/topics/global-private-equity-report/

[5] https://www.ai-cio.com/news/private-equity-continues-as-top-performer-for-pension-plans-study-says/

[6] https://www.bain.com/insights/outlook-is-a-recovery-starting-to-take-shape-global-private-equity-report-2025/

[7]https://www.jpmorgan.com/content/dam/jpmorgan/documents/cb/insights/banking/commercial-banking/jpm-cb-docs-q2-2025-venture-capital-update-monitor-ada.pdf

[8] https://www.ey.com/en_ie/newsroom/2025/06/generative-ai-vc-funding-49-2b-h1-2025-ey-report

[9] https://www.morganstanley.com/im/en-us/individual-investor/insights/articles/private-credit-outlook-2025-opportunity-growth.html

[10] https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/why-private-credit-remains-a-strong-opportunity

[11] https://www.investmentcouncil.org/icymi-media-outlets-highlight-aic-study-on-private-equitys-superior-returns-for-public-pensions/

[12]https://www.morganstanley.com/im/publication/insights/articles/article_evolutionofdirectlending.pdf

[13] https://www.mordorintelligence.com/industry-reports/global-green-datacenter-market-industry

[14] https://www.jpmorgan.com/insights/real-estate/commercial-real-estate/commercial-real-estate-trends

[15] https://www.reuters.com/markets/hedge-funds-deliver-double-digit-returns-2024-2025-01-02/

[16] https://www.reuters.com/markets/commodities/critical-minerals-are-stuck-between-demand-hopes-oversupply-reality-2025-09-29/

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX bear any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.