The Future of All Securities is Digital

Digital financial securities are essentially traditional securities that exist as a digital token on a distributed ledger of an exchange or issuance platform. What this means is that they don’t require many of the manual offline backroom operations of traditional securities and offer the potential for more transparent, more efficient versions of traditional securities.

In the future one can imagine that most securities will in fact become digital securities, much the same way that we today don’t expect physical share certificates to be delivered to our door every time we buy some shares of Apple or Microsoft online.

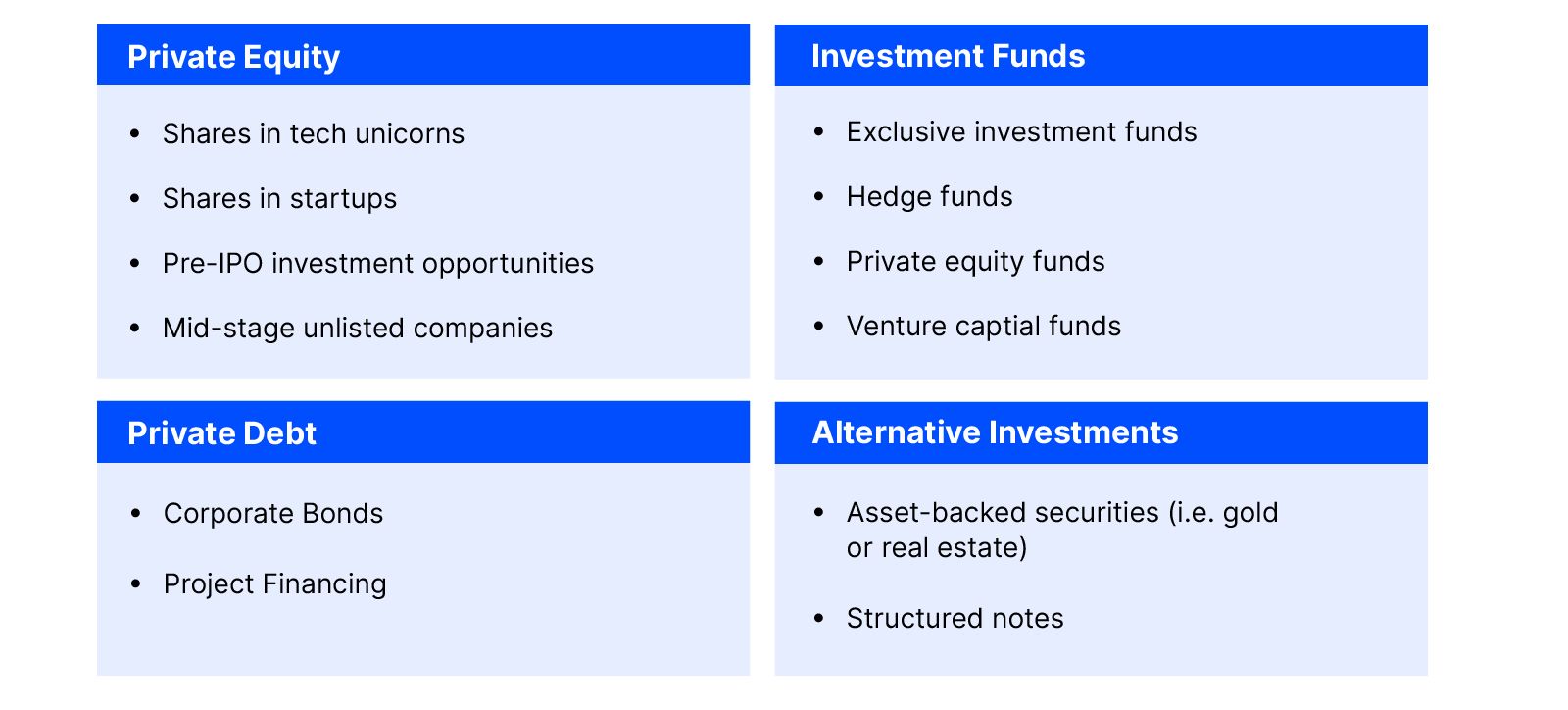

Traditional securities such as equity, debt, funds, and asset-backed securities can all be digitised into security tokens that can then be issued and traded on exchanges. This process is enabled by smart contracts that allow for more transparent and cost-effective transactions, while also allowing new securities to be created and issued at a lower cost in comparison to their traditional counterparts.

According to research by PWC, the average CFO can expect to spend over US$1 million on one-off preparation expenses to IPO their company, even before paying hefty underwriting fees to investment banks. By bringing down the cost of issuing new securities through removal of many physical back-office processes, digital securities offer to open up many new companies and assets to securities issuance. This will greatly increase the range of choice for investors.

Digital securities also offer issuers and investors other benefits as well; for example, they may be fractionalized (e.g. allowing investors to purchase $100 fractions of Amazon instead of $2000 for a single share) and are capable of providing immediate settlement as well.

Expanding Access to More Investors

Financial institutions are already preparing for the expansion of digital securities to replace traditional securities. For example, JP Morgan has been developing a distributed ledger system to facilitate more efficient money transfers while Citi and Goldman Sachs in January 2020 reportedly executed their first equity swap transaction using distributed ledger technology (“DLT”), the backbone of digital securities, which enables transparent transactions, faster settlements, and lower costs for both investors and issuers.

However, one of the most compelling near-term opportunities for investors is that digital securities enable investors to invest in and trade securities that have traditionally been difficult to access and illiquid. Digital securities allow for easier trading and lower transaction costs for investments such as:

Digital Securities and Their Advantages

DLT is a decentralised database of shared and synchronised data that removes the need for an intermediary to settle and authenticate transactions. In a distributed ledger, each node verifies each item thereby creating a record and consensus of said item’s authenticity. In contrast, traditional databases rely on a centralised data store and administrator functionality.

Blockchain is one form of DLT. Blockchain bundles transactions into time-stamped “blocks” that are chained together, and then distribute them into the nodes of the network. Each new entry has a logical relationship to all its predecessors and secured with cryptographic signatures called “hashes”. Records can be added but cannot be changed, making them truly immutable.

Public vs. Private Ledgers

Broadly speaking, there are two types of blockchain solutions: public ledgers and private ledgers. Each have their own use cases depending on the objective, but the main difference between the two is the level of access the participants are granted.

Public ledgers are completely open to the public — allowing anyone to participate by adding or verifying data. One of the biggest features of a public ledger is that it is built to be trustworthy by design in that everything is recorded, public, and cannot be changed. The most common examples of public distributed ledgers are Bitcoin and Ethereum.

Private ledgers, such as the ADDX platform, only allow certain entities or users to participate in a closed network. Each participant on a private distributed ledger is granted specific rights and restrictions on the network, allowing for more granular controls while facilitating secure transactions between parties without the need for a trusted intermediary. This structure gives private distributed ledgers three main advantages: speed, scalability, and privacy.

Private ledgers can process transactions much faster than public ledgers as there are far fewer participants authorised to make decisions. They are also more scalable as decision making is centralised to fewer authorised participants — unlike public distributed ledgers that require majority consensus across all participants. Lastly, private ledgers can protect private information better as everyone has well-defined rights and permissions on the network.

These attributes make private ledgers more suitable for B2B purposes that require relatively more centralised authority, more timely transactions, and confidentiality.

Because of the technological benefits involved, digitising securities on private ledgers can unlock value in capital markets for investors and issues in the following ways:

Benefit for Investors

Access to a Wider Range of Securities

Digital securities allows issuers to digitise illiquid assets and offers fractional ownership of illiquid assets like private securities and real estate. This unlocks access to a variety of private assets typically only available to larger financial institutions and ultra-high net worth investors while lowering the minimum investment size for a wider base of accredited investors.

Transparency & Trust

Data stored via digital securities is immutable and traceable, reducing the risk of potential fraud, double-spending, or hacks. Investors on a distributed ledger are assigned unique digital signatures for authentication, ensuring trustless digital transactions when investing in digital securities.

As most digital securities platforms operate on a private distributed ledger, tokens and transactions can be cancelled and re-issued to the rightful owners in the unlikely case of a hack.

Disintermediation of Third Parties to Lower Transaction Costs

As the distributed ledger they are based on allows all parties to keep an unalterable copy of the data, digital securities allow investors and issuers to buy and sell directly with each other without the need for clearinghouses or third-party intermediaries. This reduces costs while not compromising trust and reliability.

Instant Settlement of Trades

Settlements can be completed almost immediately through digital securities, reducing transaction time and settlement risk for investors in a transaction. This is in contrast with traditional centralised clearinghouses that take longer and bear expensive fees to rectify errors.

Benefits for Issuers

Cheaper and Faster Channel for Raising Funds Outside of Public Markets

For issuers, the process for a traditional IPO can take up to two to three years to complete and is a very costly process. In a survey conducted by PwC, 83% of CFOs surveyed estimated spending more than US$1 million on one-time costs associated with an IPO, and this excludes underwriting fees.

The prohibitively high cost of IPOs and debt issuances prices out many companies seeking to access the public markets for funding. However, by digitising securities with DLT, companies are now able to list online on a digital exchange and issue equity-backed or debt-backed security tokens at a fraction of the cost of a traditional IPO or issuance of debt in debt capital markets.

Due to the lower cost of listing digitally, companies can now also seek IPOs or debt issuances in digital exchanges to reach a wider network of investors to raise funds faster and more efficiently.

Unlocking Liquidity for Traditionally Illiquid Assets

Digital securities also enable issuers to digitise and offer fractional ownership in previously illiquid assets such as private equity, private debt, and real estate. In doing so, issuers can attract a wider base of investors that can now more easily and cost-effectively access traditionally illiquid and difficult-to-access securities. To give an illustration, not everyone can afford $10,000 per share of a private company, but they can afford smaller $100 of the same share. This opens access to a much larger pool of investors.

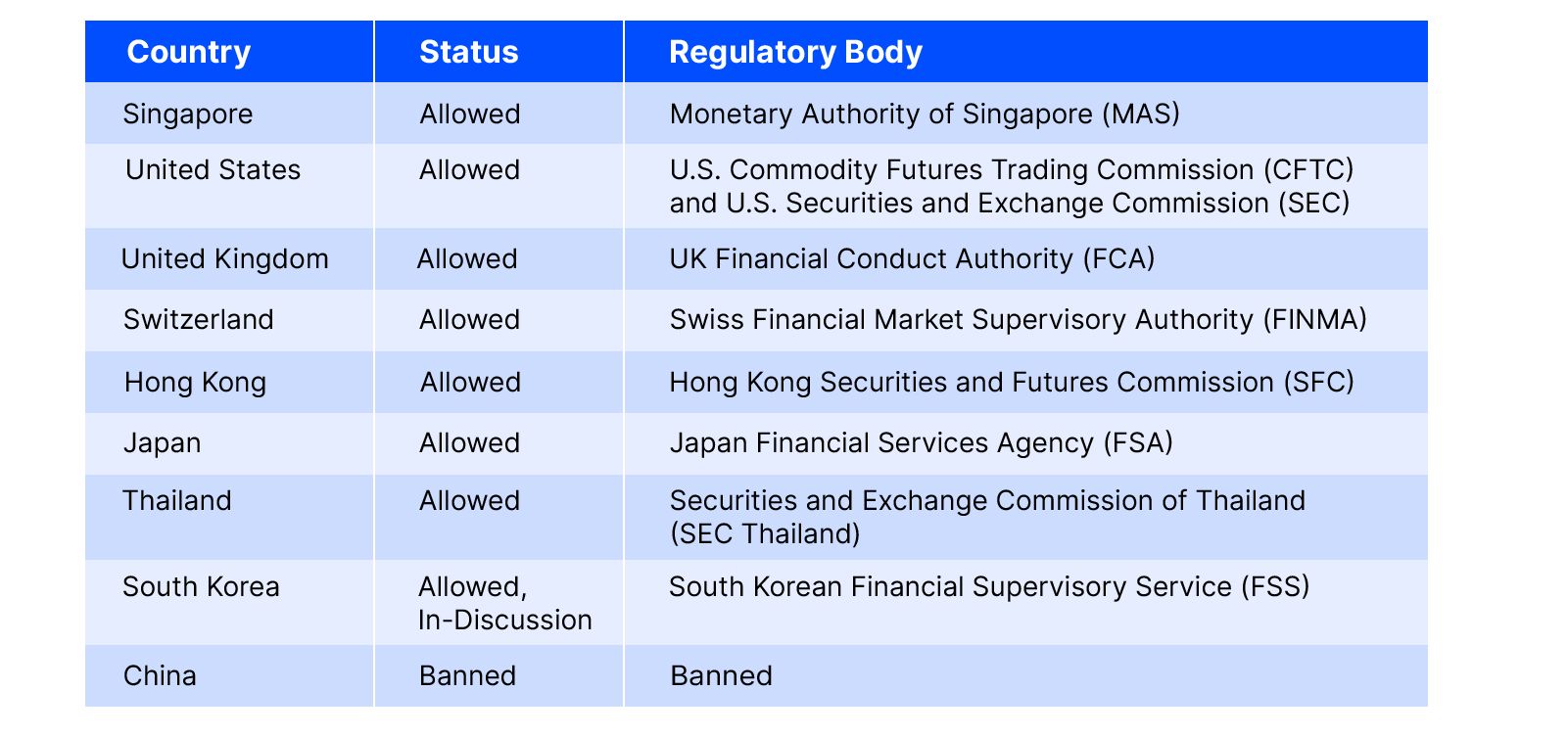

Key Regulated Digital Securities Markets

Given that the digital securities market is still in its infancy, many regulators around the world are still deliberating how best to treat or classify digital assets with varying levels of stringency. Singapore was one of the first countries in the world to formally recognise digital securities and provide a legal framework on how to regulate them. Thus far, it is one of the most accommodative regulatory jurisdictions for digital securities and has provided a great deal of clarity around how they should be treated from a regulatory and tax perspective. This includes a tax guide and guidance on what should be treated as a security and what should not.

According to the Monetary Authority of Singapore (“MAS”), offers or issues of digital tokens in Singapore may be regulated by the MAS if the digital tokens are capital markets products under the Securities and Futures Act (“SFA”). However, this is subject to approval and examination of the structure, characteristics, and rights attached to the digital token before qualification as a capital markets product. If approved, digital tokens that have securities as their underlying assets (e.g. shares, debentures, business trusts, etc.) would be regulated by the MAS and subject to the relevant securities laws.

Likewise, in terms of tax implications, liabilities will be dependent on the investor’s tax jurisdiction, any relevant cross-border tax treaties, and the underlying asset of the said digital security in a similar fashion to traditional securities. Legal recourse related to digital securities largely follow the same framework as for traditional securities.

As seen in the table below, most of the world’s financial hubs allow for digital securities and, for the most part, regulate them based on their respective existing laws for traditional securities. Regulatory oversight over digital asset exchanges that issue and trade digital securities will boost investor confidence and engender wider acceptance.

Conclusion: The 2020’s Will Be the Decade of Digital Securities

Despite digital securities being in a nascent phase of development, an increasing number of countries are progressively formalising regulatory frameworks to allow for more financial institutions and exchanges to begin offering digital securities. Meanwhile, the world’s largest financial companies are developing digital solutions for their traditional securities processes using DLT. In the coming years, digital securities are likely to become a significant channel for smaller companies and issuers to gain access to capital markets globally at a lower cost. For investors, digital securities will democratise access to previously exclusive investments, reduce costs, increase liquidity and improve market transparency. Increasingly, forward-looking issuers will choose digital securities over traditional securities because of the clear benefits offered. This means that 2020 is likely just the beginning of what will be the decade of the digital securities.

To download report, click here.

ADDX is your entry to private market investing. It is a proprietary platform that lets you invest from USD 10,000 in unicorns, pre-IPO companies, hedge funds, and other opportunities that traditionally require millions or more to enter. ADDX is regulated by the Monetary Authority of Singapore (MAS) and is open to all non-US accredited and institutional investors.

Zero One Research Team:

Vincent Fernando, CFA

Eric Sy

Simeon Spencer

Disclaimer — User Agreement Terms & Conditions

If you do not agree to these terms, please do not use this document. Clearsight Systems Pte. Ltd. (“Zero One”) provides this document to you subject to compliance with the terms and conditions set forth herein. By using this document, you hereby accept and agree to comply with the terms and conditions set forth in this User Agreement. This User Agreement is a binding agreement between you and Zero One, and governs your access and use of this document.

Disclaimer, Exclusions, and Limitations of Liability

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information. Zero One is not a broker/dealer, investment/financial adviser under Singapore law or securities laws of other jurisdictions and does not advise individuals or entities as to the advisability of investing in, purchasing, or selling securities or other financial products or services.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information does not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Zero One is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Zero One shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance. You understand that employees, shareholders, or associates of Zero One may have positions in one or more securities mentioned in this document. This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Zero One considers reliable and endeavours to keep current, Zero One does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. To the fullest extent permissible pursuant to applicable law, Zero One disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Zero One does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Zero One nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Zero One’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Zero One to any registration requirement within such jurisdiction or country. Zero One is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

Indemnification

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Zero One and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Zero One shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Zero One expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

Severability

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

Governing Law

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Zero One and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.