Navigating the new cycle

Uncertainty has become the defining feature of global capital markets in 2025, as investors adapt to changing economic signals. Inflation has moderated over the past year, and major global central banks have entered a rate-cutting cycle, with many accelerating their pace of reductions. The Federal Reserve cut rates by 25 basis points in September 2025, and subsequent employment data showing deterioration has reinforced expectations of further easing ahead.1 In this macro environment, public markets, due to their more immediate trading and frequent information disclosures, have already reflected policy expectations and corporate earnings pressures. In contrast, private markets, due to lagged valuation updates, typically experience delayed adjustments. This suggests that the coming quarters will be a critical repricing phase for private markets. McKinsey’s 2025 Global Private Markets Report notes that while fundraising in 2024 fell to its lowest level since 2016, actual capital deployment by private funds still saw double-digit growth.2 This indicates that long-term capital remains confident in private markets, seeking new entry windows amid volatility.

Institutional capital, which comprises sovereign wealth funds, pension funds, and top-tier family offices with a long-term investment perspective, often captures these new cycle opportunities first due to their foresight and resource advantages. Their capital flows not only reveal cutting-edge market trends but also provide valuable signals for other investors. So, what are their latest moves, and which assets are they targeting?

Institutional capital’s playbook: Investment trends

In the new private market cycle, the investment logic of institutional capital is manifesting through three key dimensions. These trends offer unique references for individual investors seeking to understand the market and evaluate allocations.

1. Record-breaking private secondaries transactions: A key channel for improved transparency and potentially shorter liquidity horizons

Secondaries allow investors to purchase existing stakes in private equity funds or direct company investments. From LP-led transactions that provide discounted entry into existing funds to GP-led deals that deliver exposure to high-quality assets, secondaries create distinct opportunities to engage with mature investments and attractive return profiles.

In the first half of 2025, global private secondary market transaction volume reached $103 billion, a 51% year-on-year increase, setting a record for the period.3 Jefferies notes that this figure not only reflects institutions’ accelerated entry but also indicates market acceptance of private secondary stake pricing. Meanwhile, GP-led transactions reached approximately $47 billion in the first half, up 68% year-on-year,3 further highlighting the trend of managers extending investment periods for high-quality assets through continuation funds. According to William Blair’s 2025 Secondary Market Report survey, global private secondary market transaction volume in 2024 was approximately $156 billion, with market participants expecting it to rise to about $175 billion in 2025, a roughly 13% increase.4

Private equity secondaries are emerging as a segment to watch, as growing institutional capital flows signal the market’s expanding importance. At the same time, investment platforms like ADDX are beginning to open secondary opportunities to individual investors.

2. Private credit with floating rate structures remains attractive

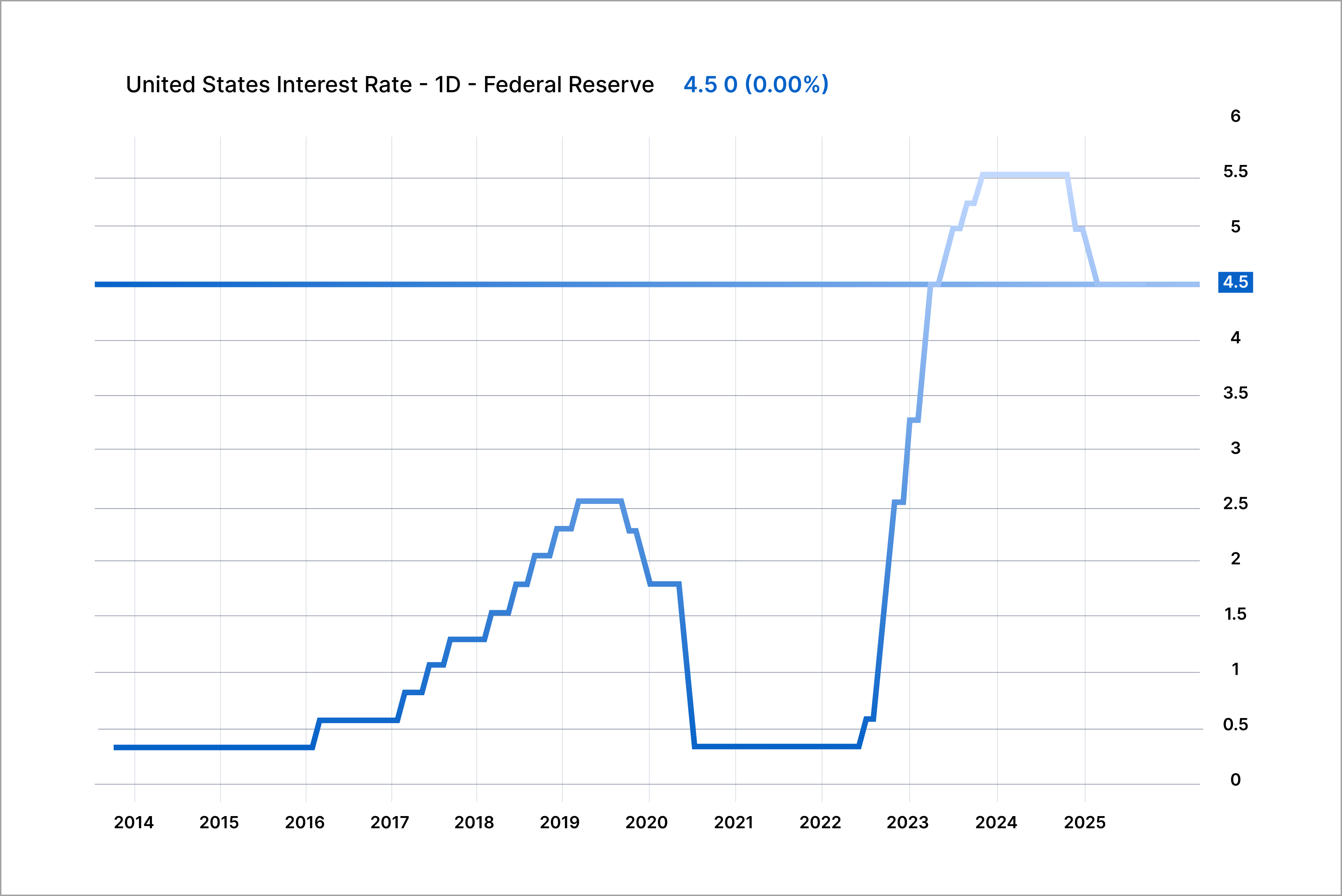

Although major central banks have entered a rate-cutting cycle, current interest rates remain relatively high. For instance, the Federal Reserve’s latest benchmark rate is around 4.5%, and even with gradual cuts, it remains significantly higher than the sub-2% levels seen for much of 2010–2021.5 Similarly, policy rates from the European Central Bank and the Bank of England are in the early stages of decline from their highest levels in a decade.6,7 This means newly issued private credit assets can still lock in coupon returns notably above historical averages.

Institutional capital’s investment trends confirm this. According to Private Debt Investor’s H1 2025 report, institutional allocations to private credit rose from 5.1% in H1 2024 to 5.7%, with sovereign wealth funds showing particularly strong growth, increasing from 4.2% to 6.9%.8 Major alternative asset managers like Blackstone have also increased their credit strategy allocations, with approximately half of their Q1 2025 capital inflows directed to credit and insurance segments.9

These signals indicate that institutional capital is actively increasing its allocation to private credit, viewing it as a key asset class that combines stable cash flows with strategic flexibility in the new cycle, marked by rate cuts and evolving credit dynamics.

3. Thematic investing takes off

Beyond secondary markets and credit assets, institutional capital is increasingly focusing on long-term, structural thematic opportunities, such as energy transition, sustainable infrastructure, and artificial intelligence. Preqin’s Asset Allocation Outlook 2025 report emphasizes that institutional investors’ preference for infrastructure, sustainable infrastructure, and energy transition themes continues to rise, making them critical components of future allocations.10 Approximately 75% of surveyed institutional investors have made sustainability a core consideration in their private market investment decisions, with energy transition and green infrastructure among the most prioritized areas.12

In the AI sector, PitchBook data shows that venture capital (VC) investments in AI/ML startups accounted for 35.7% of global VC deals in 2024, indicating that creative technology themes remain highly valued by smart capital in growth-stage investments.11 Meanwhile, S&P Global Market Intelligence data indicates that private equity investors are prioritizing investments in the infrastructure supporting AI's expansion, particularly data centers, with private equity-backed global data center M&A transaction volumes reaching $18.15 billion in 2024, the highest total in at least five years.13

These trends suggest that individual investors considering private market allocations should not only focus on asset classes (e.g., credit vs. equity) but also evaluate the long-term certainty of thematic opportunities (driven by policy and technological innovation), as these areas often provide strong moats and compounding growth potential across cycles.

Lessons from institutional capital

The private markets in 2025 are entering a new cycle. Institutional investors have already demonstrated their allocation preferences: seeking seasoned investments and attractive return profiles in secondary markets, pursuing stable cash flows in private credit, and increasing exposure to long-term themes like energy transition, sustainable infrastructure, and artificial intelligence. While not exhaustive, these trends outline several representative paths for institutional investors today.

For individual investors, understanding the logic behind institutional capital and gradually allocating through compliant, transparent investment platforms is the true path to navigating cycles and capturing long-term returns.

References:

1https://www.reuters.com/world/china/dollar-edges-up-with-us-inflation-report-tap -2025-08-11/

2https://www.mckinsey.com/industries/private-capital/our-insights/global-private-markets-report

3https://www.jefferies.com/wp-content/uploads/sites/4/2025/08/Jefferies-Global-Secondary-Market-Review-July-2025.pdf

4https://www.williamblair.com/-/media/downloads/ib/2025/williamblair-pca-secondary-market-report-survey-march-2025.pdf

5https://www.tradingview.com/chart/?symbol=ECONOMICS%3AUSINTR

6https://commonslibrary.parliament.uk/research-briefings/sn02802/

7https://www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html

8https://media.privatedebtinvestor.com/uploads/2025/07/h1-2025-investor-report-pdi.pdf

9https://www.blackstone.com/wp-content/uploads/sites/2/2025/04/Blackstone1Q25EarningsPressRelease.pdf

10https://www.preqin.com/insights/research/reports/asset-allocation-outlook-2025

11https://pitchbook.com/news/articles/ai-startups-grabbed-a-third-of-global-vc-dollars-in-2024

12https://www.avivainvestors.com/en-gb/capabilities/private-markets/private-markets-study-2025/

13https://www.spglobal.com/market-intelligence/en/news-insights/articles/2025/6/venture-capital-seeks-ai-winners-as-private-equity-makes-infrastructure-play-89907740

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX bear any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.