In the world of investing, it's often assumed that wealthy individuals succeed because they have more capital to invest in. However, the truth is more nuanced. The wealthy do not just invest more; instead, they invest differently. Their approach to asset allocation, risk, time horizon, and access is distinct from that of everyday investors.

This article explores what the wealthy are investing in, why they do it, and how ordinary investors can invest like them.

What are the wealthy investing in?

Many individual investors tend to build their portfolios around publicly traded assets, and a typical portfolio often includes a mix of stocks, bonds, and cash. This structure reflects priorities such as liquidity for short-term needs, growth potential through stocks, and stability or income through bonds and cash.

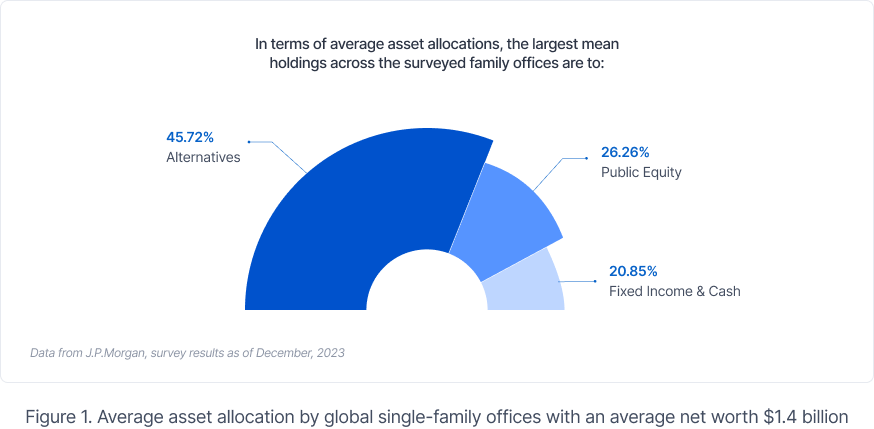

Wealthy investors, however, take a different approach. According to the 2024 Family Office Report published by J.P. Morgan Private Bank 1, which surveyed 190 global single-family offices with an average net worth of 1.4 billion dollars, ultra-high-net-worth families are moving away from traditional portfolio models. Figure 1 shows that 45.72% of their assets are allocated to alternatives on average. Public equities account for 26.26%, while fixed income and cash make up 20.85%.

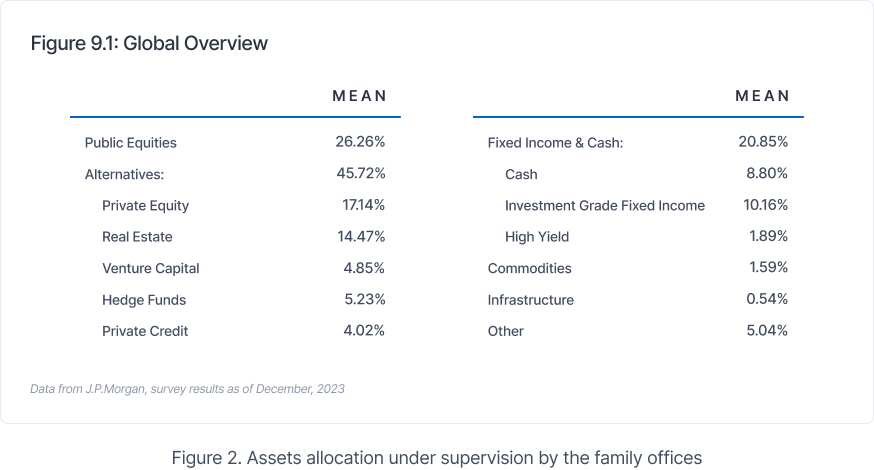

Breaking down the alternatives, wealthy portfolios allocate an average of 17.14% to private equity, 14.47% to real estate, 5.23% to hedge funds, 4.85% to venture capital, and 4.02% to private credit. 1 (Figure 2)

This comparison reveals more than just a difference in asset types. It shows a divergence in philosophy. While most investors follow a model shaped by liquidity and accessibility, wealthy families are constructing portfolios around long-term positioning, diversification beyond public benchmarks, and participation in the private economy that drives much of global growth.

Why do wealthy investors prefer these assets?

From Figure 1, it is obvious that alternative investments make up the largest share of wealthy portfolios, surpassing both public equities and traditional fixed income holdings. For wealthy families, alternative investments are not just a portfolio add-on. They are a core pillar of a long-term wealth strategy. Among them, private equity, real estate, and venture capital stand out as dominant choices. These asset classes offer more than just potential returns. They reflect how affluent investors think about risk, control, and time.

Private equity is the largest allocation within alternative holdings, and for good reason. It provides exposure to private companies that are not subject to daily market pricing. Many wealthy investors come from entrepreneurial backgrounds, so they understand business building and prefer investments where they can take an active role or partner with experienced operators. Private equity allows them to do just that. It offers a chance to participate in the value creation over several years, often with the potential for higher returns than public equity.2 In addition, the lack of daily price fluctuations helps investors stay focused on fundamentals rather than short-term sentiment.

Real estate, a close second in portfolio weight, brings a mix of income generation, inflation protection, and long-term capital stability. Unlike stocks or bonds, real estate offers tangible, productive assets. These properties can be leased, improved, and strategically held across generations. Wealthy people tend to use real estate to diversify geographically, protect against inflation, and sometimes even to align with social or philanthropic goals. Commercial buildings, logistics hubs, and purpose-driven developments like healthcare or education infrastructure are common holdings. 3

Venture capital (VC), while smaller in percentage terms, plays a distinct role. It gives wealthy families access to innovation at its earliest stages. Whether in technology, climate solutions, or medical science, venture investment allows families to participate in industries that shape the future. Many are drawn to this asset class not only for its return potential but also because it aligns with their personal experiences or values. It is common for families with entrepreneurial roots to invest in startups that reflect the sectors they know well.1

How can one invest like the wealthy?

For decades, the core assets favored by the wealthy, including private equity, venture capital, and real estate, were largely out of reach for most investors. High minimum investments, long lock-up periods, and limited access to top-tier fund managers made these opportunities available only to large family offices and institutions. But that is beginning to change as regulatory frameworks and fund structures are evolving to support broader participation in private markets.

For example, in the real estate area, investors no longer need to directly acquire and manage physical properties. Professionally managed real estate funds now provide access to diversified portfolios across commercial, industrial, and purpose-built sectors. These vehicles are often designed with income generation, capital preservation, and long-term growth in mind, and this way is like how family offices approach real assets.

Exposure to VC is also becoming more feasible. Investors today can participate through professionally managed VC funds that invest in a broad range of early-stage companies. Some of these funds focus on specific industries, such as healthcare, technology, or clean energy, which allows investors to target areas they believe in or are familiar with. Others are designed to spread risk by including many startups in one portfolio, helping investors avoid the need to select individual companies on their own. These strategies maintain the high-risk, high-reward nature of venture capital, while offering greater diversification and professional oversight.

Today, it is increasingly possible for individual investors to build exposure to the same private market strategies long favored by the wealthy. While these assets still require thoughtful planning and a long-term view, the gap between institutional and individual access is narrowing. Investing like the wealthy is no longer a theoretical goal - it is becoming a practical path.

Ready to build a portfolio like the wealthy? Begin your journey with ADDX.

Sources

1 2024-global-family-office-report.pdf

2 articles_publictoprivateequityintheusalongtermlook_us.pdf

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX bear any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.