This research is commissioned by ADDX in collaboration with Zero One, an insight provider on SmartKarma.

Executive Summary:

Private markets represent under-tapped opportunities.

Today, many of the most attractive investment opportunities lie in the private markets. Despite that, most individual investors have little to no exposure to private asset classes, choosing instead to focus on the public markets.

Private markets generate higher returns than public markets.

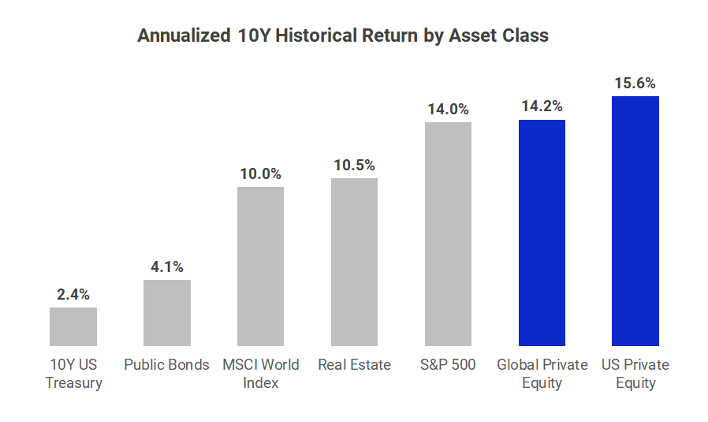

Over the last 10 years, global private equity has yielded an average annual return of 14.2% versus global public equities at 10.0%. Early-stage venture capital has generated higher returns of 16.3% versus the S&P 500 at 14.0%. Private debt markets also yield higher returns (10.6% from 2014-19) compared to public debt markets (10-year historical return of 4.1%).

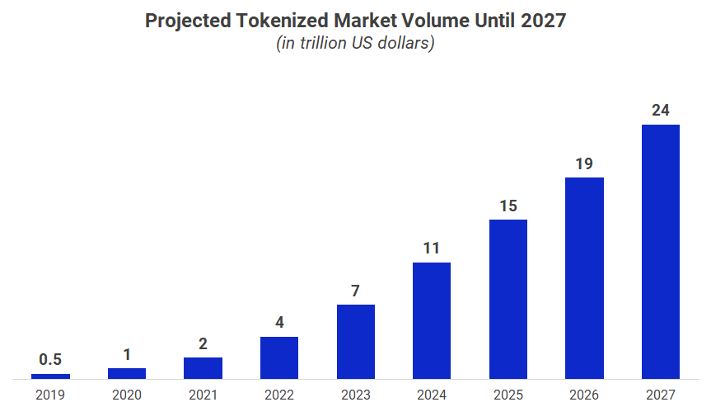

Blockchain is democratising access to private investment opportunities.

Through a process called tokenisation, previously illiquid assets across equities, debt, and real estate can now be broken down into smaller pieces and traded far more efficiently. This is dramatically lowering the cost and diversification barriers to allocating more capital towards private investment opportunities.

Digital exchanges offer private investors multiple advantages.

Digital exchanges such as ADDX can offer investors the ability to access multiple asset classes in a single portal, direct market access to private investment opportunities that help cut fees, faster settlement times, and a more convenient KYC/ AML process.

Private Markets: Offering Higher Returns and Differentiated Investment Opportunities

Managing investments is one of the most critical aspects of building, maintaining, and growing wealth. Thus, depending on the investor’s risk profile and target returns, it is important to design an investment strategy that appropriately allocates and diversifies across multiple asset classes.

Despite this well-understood adage, most individual investors remain heavily focused on the public equity and public debt markets with often little to no exposure to the private markets. This is due to a variety of factors including lack of access to private opportunities, high minimum investment sizes, regulatory accreditation requirements, and a lack of understanding.

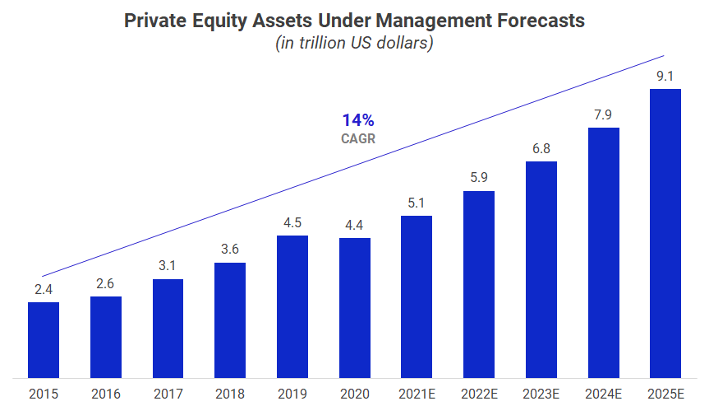

This is a shame, given that many of the most attractive opportunities today lie in the private markets. As seen in the chart below, over the last 10 years, private equities provided higher returns both globally (14.2%) and in the USA (15.6%) than global public equity (10.0%) and US public equity (14.2%). This is according to benchmark data compiled by Cambridge Associates.

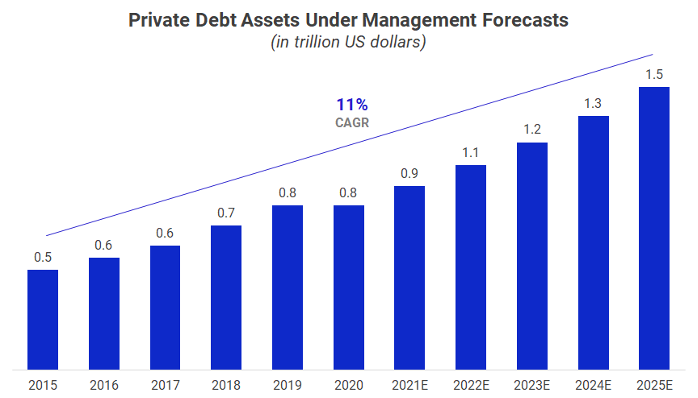

This trend extends beyond equities too. Private debt, for example, yielded an average annual return of 10.6% from 2014 to 2019 versus the 10-year average historical return of public bonds at 4.1%.

One of the reasons for the higher returns of the private market can potentially be attributed to its relatively untapped nature. Compared to the public markets that are already extremely efficient due to their many mechanisms and participants in place, the private markets remain relatively under-tapped by investors which means less competition for attractive investment opportunities.

For example, in venture capital (where many of the most innovative and disruptive businesses are), most of the startups remain cash-strapped and starved for capital. This provides venture capital investors, especially in earlier stages, more negotiating power to invest at significantly lower valuations. For reference, early-stage VCs in the United States have generated an average annual return of 16.3% over the last 10 years – higher than both the S&P 500 index at 14% and the Russell 2000 index at 10.5%.

A similar story can be found in the private debt markets where SMEs with strong business models are often denied term loans or working capital financing simply because they do not meet the rigid collateral or financial history requirements of banks. Investors are thus able to charge much higher interest rates in the private market that would not have been possible in the public debt market due to the ease of funding there. For example, between 2014 to 2019, non-bank private lenders generated an average annual return of 10.6% versus the 10-year annualized return of 4.1% for public bonds.

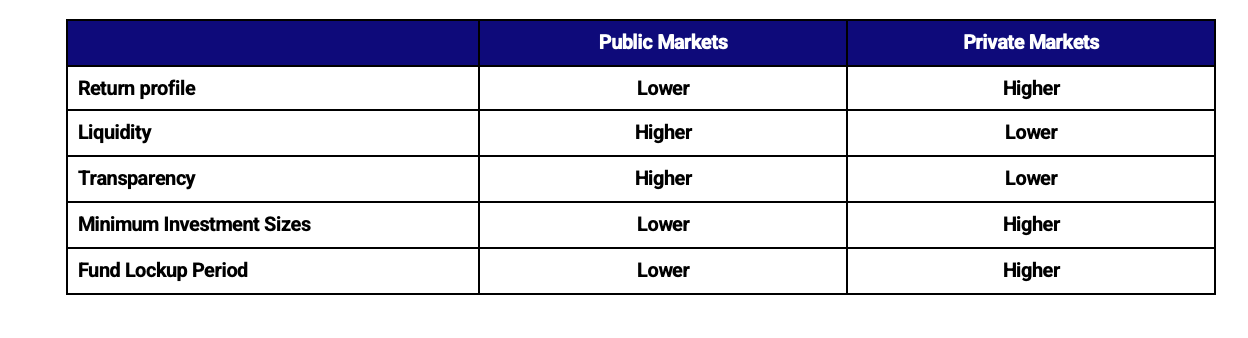

We highlight some key differences between public and private markets in the table below:

Types of Private Market Opportunities: Equity, Debt, and Real Estate

Blockchain is Rapidly Democratizing Access to Private Investments. Access to private market opportunities is rapidly being democratized today with the rapid adoption of blockchain technology. Through the process of tokenization (the act of issuing a digital token that represents and has a claim to the underlying asset), previously large or illiquid assets can be broken up into smaller pieces and transacted upon on the blockchain.

This is not dissimilar to how shares of public companies currently trade on exchanges. The difference however lies in the flexibility on what assets can be tokenized, the degree to which they can be fractionalized into smaller pieces, and how fast or efficiently they can be processed and transferred.

By leveraging tokenization, previously illiquid assets such as real estate can be denominated into far smaller increments of $10,000 per token, for example. The same can be said for private startups, mid-market bond issuances, public equities (e.g. $100 tokens of AMZN instead of $3000 per share), and even claims to certain cashflows or revenue share agreements.

We elaborate more on the different types of private market opportunities available to investors below.

Venture Capital & Private Equity: More Access and Faster Exits for Investors

Venture capital (“VC”) and private equity (“PE”) investing refer to the act of taking positions or allocating funds to companies that are not listed on any public stock exchange. The difference is that venture capital tends to start at the earlier stages (raising capital for new disruptive businesses across seed-stage and Series A to E) whereas private equity tends to focus more on larger more established companies.

As discussed in the previous section, both VC and PE industries have historically generated higher returns than their public equity counterparts. Over the last 10 years, global private equity has returned 14.2% versus global public equities at 10.0%. Earlier stage investments in US venture capital have also outperformed at 16.3% versus S&P 500 at 14.0%.

Historically, investing in VC and PE was a difficult process as one needed to be a very high net worth individual or an institutional investor (such as family offices). This barred out the majority of investors from accessing these private market opportunities. Even for some lower-level accredited investors (with liquid assets of ~$2-3 million), many would not be able to access these opportunities given the large minimum commitments.

On the other hand, for investors that would rather opt to invest in private companies directly, it was often a challenging process given that there are lower disclosure, reporting, and auditing requirements for private companies. Exiting or liquidating the investment was also a major challenge given that one needed a liquidity event such as an acquisition or an IPO to get back their investment.

This is all changing with the application of blockchain technology to the VC and PE sectors. By tokenizing shares in private companies, even smaller accredited investors will be able to access these opportunities. For existing investors in private companies, the tokenization of private companies also offers them the opportunity to easily and cheaply liquidate and exit their investments even without an IPO or acquisition.

Private Debt: More Transparency and Lower Investment Sizes

In contrast to public companies that can easily raise debt financing by issuing bonds that are rated by credit agencies and then subsequently distributed by banks, private debt refers to debt issued by SMEs or midmarket companies that typically struggle to raise financing from traditional bank sources. This can be due to a lack of financial history or the unavailability of collateral. This stringent process of banks cuts off many promising companies – especially software companies that naturally do not hold significant amounts of tangible or fixed assets.

Due to the difficulty of accessing financing for these private companies, they are often more willing to pay higher interest rates. For reference, Funding Society (a Southeast Asian P2P platform) cites on their website that private debt can yield interest rates of up to 18% per annum. Non-bank lenders managing their own loan books to private companies have also historically generated higher returns at 10.6% per annum – higher than the 10-year historical return of public bonds at 4.1%.

Blockchain can take an active and impactful role in this space as well. Beyond tokenizing private bonds into smaller increments, blockchain can also increase transparency, ensure compliance with covenants, and enforce proper and timely disbursement of interest payments. This is through the use of smart contracts that can be programmed to automatically take certain actions assuming certain conditions have been met.

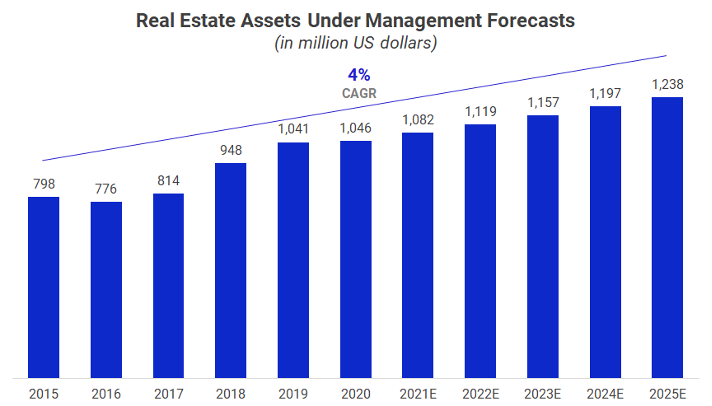

Real Estate: More Diversification and Bypassing Intermediaries

To get exposure to the real estate market, most investors currently do it in three ways:

Get a mortgage

The most traditional way to get exposure to the real estate market is simply by purchasing the property outright. This can be tricky to manage however given that many properties can be north of $1,000,000 making diversification difficult and requiring the usage of loans to finance the purchase.

Stocks of property developers

Alternatively investors could also gain exposure by purchasing the shares of property developers. This is a far more cost-effective way of gaining exposure, however, it is also relatively indirect as it is dependent on the skill of the real estate developers to consistently build and sell attractive properties.

REITs

REITs or real estate investment trusts are another popular way to get access to the property market. REITs allow investors to get the rental cashflows associated with certain properties. These can be residential, office, commercial, or even focused on certain types of assets (e.g. data-center focused REITs). However, just as with property developers, investors are still dependent on the skill of the REIT managers to properly choose and manage the said properties.

With blockchain, investors will be able to bypass intermediaries like property developers and REIT managers and gain direct access and exposure to real estate assets. This is akin to owning the property yourself. The difference is that by purchasing tokens of properties, investors can better diversify across multiple types of properties given that investment sizes can be as low as $10,000 per property token.

Liquidity is also significantly easier to manage given that investors no longer need to pay expensive fees to property agents to market and sell their properties. Investors will have the option to simply sell tokens of their properties on digital asset exchanges.

Digital Exchanges: The Smarter Way to Access Private Market Opportunities

Given the numerous opportunities in the private market that are being democratized by blockchain technology, digital asset exchanges represent a smart way to access them. Compared to traditional exchanges that remain reliant on legacy technology infrastructure and manual & paper-based processes, digital exchanges can automate many key processes which enable faster, cheaper, and more efficient services overall. We highlight four key advantages of using digital exchanges below:

Multi-Asset Class

Investors can invest and trade across multiple different asset classes via tokens that represent the underlying asset. By conducting all transactions in a single place, investors can have a more holistic view of all their allocations and positions across different asset classes. This is significantly better than the current environment of managing different types of investments across multiple different platforms which can make it difficult to have a full top-down picture.

Faster Trade Settlement

Real-time ownership and trade data on who owns what via a blockchain-powered share registry can also help speed up several key processes given that timely and accurate information can be accessed at any time. For example, trade settlements can theoretically become near-instantaneous in a decentralized finance setting vs. the 2-5 days it currently takes in some markets.

Direct Market Access

By leveraging blockchain technology, investors no longer need to go via intermediaries such as banks or brokers. This can help reduce trading fees, which all else equal, can boost liquidity on platforms. Moreover, with smart contracts and programmed automation in place, it paves the way to the potential for 24/7 access and trading.

Automated KYC/ AML

Another key advantage of using digital asset exchanges which have their technology infrastructure built on the blockchain is that KYC and AML can be significantly faster and streamlined. By storing investor information on the blockchain, it can be accessed at any time instead of having to request investors to fill up forms every time they wish to access a new type of product. Using this customer information on target returns and risk profiles, digital exchanges can then set algorithms to intelligently recommend relevant investments and other products.

To learn more about private investment opportunities, visit ADDX, one of the world’s first fully regulated digital exchanges.

ADDX is your entry to private market investing. It is a proprietary platform that lets you invest from USD 10,000 in unicorns, pre-IPO companies, hedge funds, and other opportunities that traditionally require millions or more to enter. ADDX is regulated by the Monetary Authority of Singapore (MAS) and is open to all non-US accredited and institutional investors.

Disclaimer – User Agreement Terms & Conditions

If you do not agree to these terms, please do not use this document. Clearsight Systems Pte. Ltd. (“Zero One”) provides this document to you subject to compliance with the terms and conditions set forth herein. By using this document, you hereby accept and agree to comply with the terms and conditions set forth in this User Agreement. This User Agreement is a binding agreement between you and Zero One, and governs your access and use of this document.

Disclaimer, Exclusions, and Limitations of Liability

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information. Zero One is not a broker/dealer, investment/financial adviser under Singapore law or securities laws of other jurisdictions and does not advise individuals or entities as to the advisability of investing in, purchasing, or selling securities or other financial products or services.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Zero One is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Zero One shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance. You understand that employees, shareholders, or associates of Zero One may have positions in one or more securities mentioned in this document. This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Zero One considers reliable and endeavours to keep current, Zero One does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. To the fullest extent permissible pursuant to applicable law, Zero One disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Zero One does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Zero One nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Zero One’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Zero One to any registration requirement within such jurisdiction or country. Zero One is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

Indemnification

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Zero One and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Zero One shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Zero One expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

Severability

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

Governing Law

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Zero One and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

![[Report] Private Markets: A Primer into the Under-Tapped Asset Class](/insights/content/images/2021/05/ADDX_BrandRefreshPosts_Batch2-03.jpg)