This ADDX Insights Report is the second of a two-part series on China's enterprise and productivity tech startup scene. In this report we explore China's burgeoning Software as a Service (SaaS) sector. This report was produced by Douglas Kim and was commissioned by ADDX.

Executive Summary

Driven by world-changing modern technologies such as artificial intelligence (AI), big data, cloud services, and smartphones, one of the most interesting industry sectors globally is China’s enterprise SaaS sector. China accounts for less than 5% of the global SaaS sector but is enjoying nearly double the global growth rate in this sector of nearly 30-35% per year. This pace is expected to continue over the next couple of years.

There are some major barriers that have prevented SaaS from enjoying even higher growth rates in the past decade, including low labour costs, concerns about storing business information on the cloud, concerns about the lack of adequate protection of intellectual property/software, and requirement of highly rigorous customisation for vertically integrated SaaS products. Nonetheless, it is becoming increasingly clear that the benefits are outweighing the negatives of adopting SaaS in China, especially among the millions of small and medium-sized enterprises (SMEs) in China that have greater cash constraints and who are more willing to adopt SaaS systems. Furthermore, the COVID-19 pandemic has accelerated the growth of the SaaS sector in China.

Strong Market Growth of SaaS in China

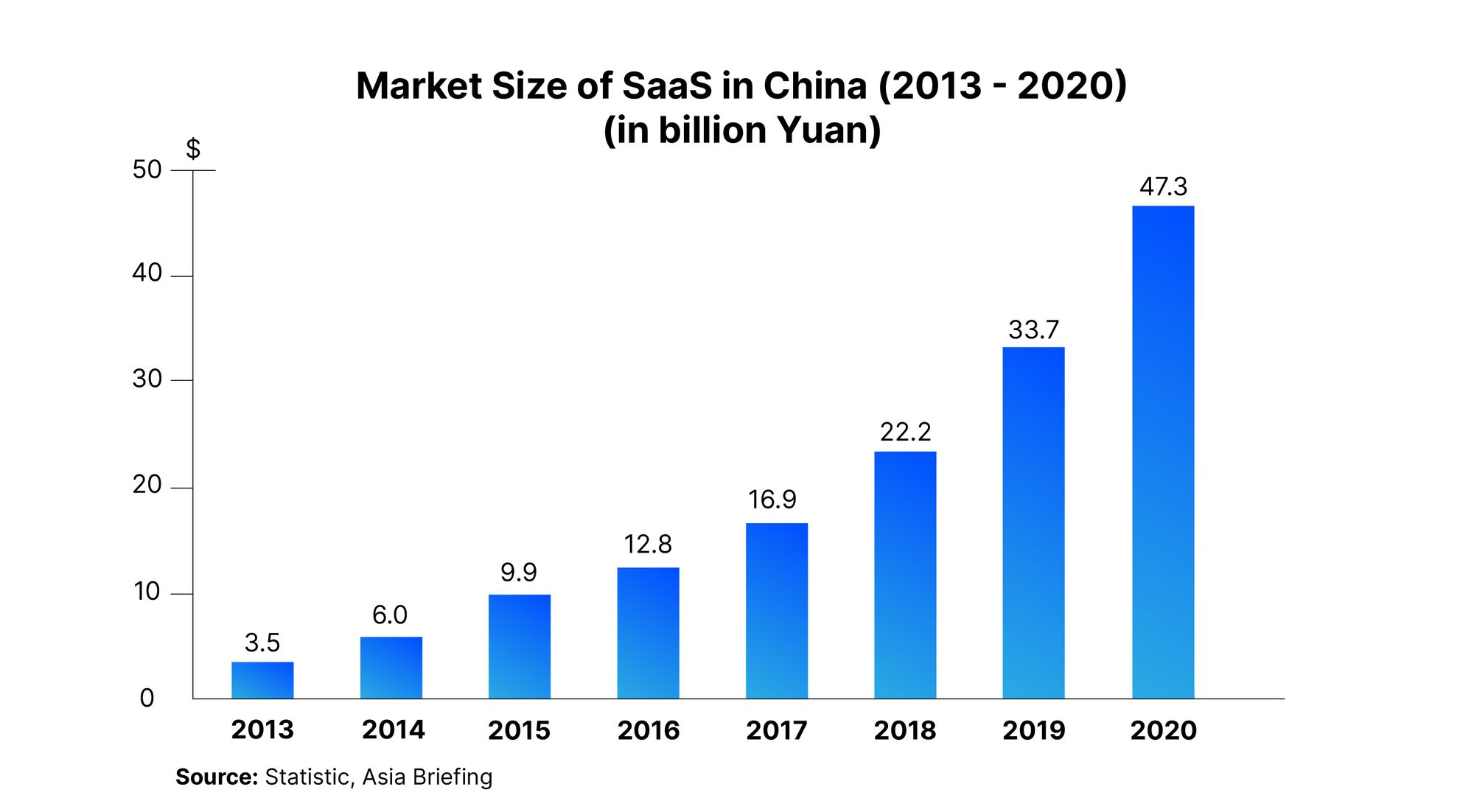

One of the most intriguing sectors globally with excellent potential for long-term, high growth is the Enterprise SaaS sector in China. The Chinese enterprise Software-as-a-Service (SaaS) sector trails the more developed U.S. SaaS sector by nearly 5 to 10 years. Despite this lag, the SaaS market in China has grown rapidly over the past five years. In 2015, the SaaS market in China was about 9.9 billion yuan and this market is expected to reach nearly 47.3 billion yuan in 2020 (US$7.2 billion), representing nearly 36.7% compounded annual growth rate (CAGR) growth rate from 2015 to 2020.

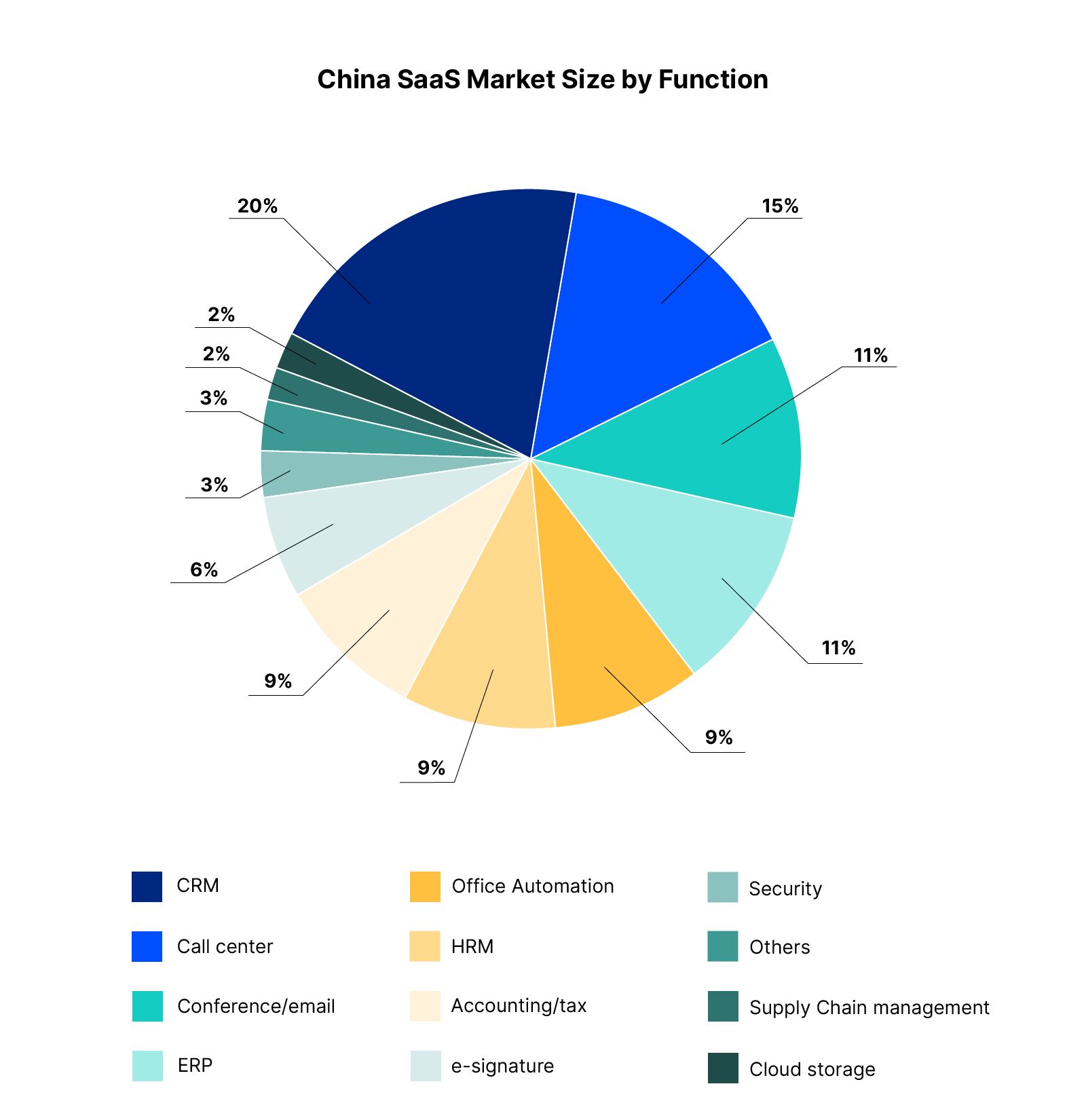

The global market size of the SaaS is estimated to be about $157 billion in 2020. China is estimated to account for about 4.6% of the global SaaS market in 2020. In our view, the global SaaS market is expected to grow at about 15-17% per year over the next two years whereas China’s SaaS market is likely to grow at nearly double the global average of about 30-35% per year in the same period, taking into account their recent market growth rates. In terms of the specific SaaS sectors, customer relationship management software (CRM), office automation software (OA), intelligent manufacturing software (IM), and office collaboration software have the highest potential for growth in China over the next several years, especially among the millions of SMEs in China.

Major Positive Forces Driving Higher Adoption of SaaS in China

In this whitepaper, we define SaaS to be software that is licensed on a subscription basis so the incoming revenues are more recurring and it is mostly run on a cloud-based system. The Chinese SaaS sector is highly fragmented with numerous innovative companies. SaaS is becoming more important among companies due to the accelerating evolution of technology in terms of greater adoption of cloud-based services, smartphones, artificial intelligence (AI), big data, internet of things (IoT), and increasing programming sophistication that reduces the need for human manual labour.

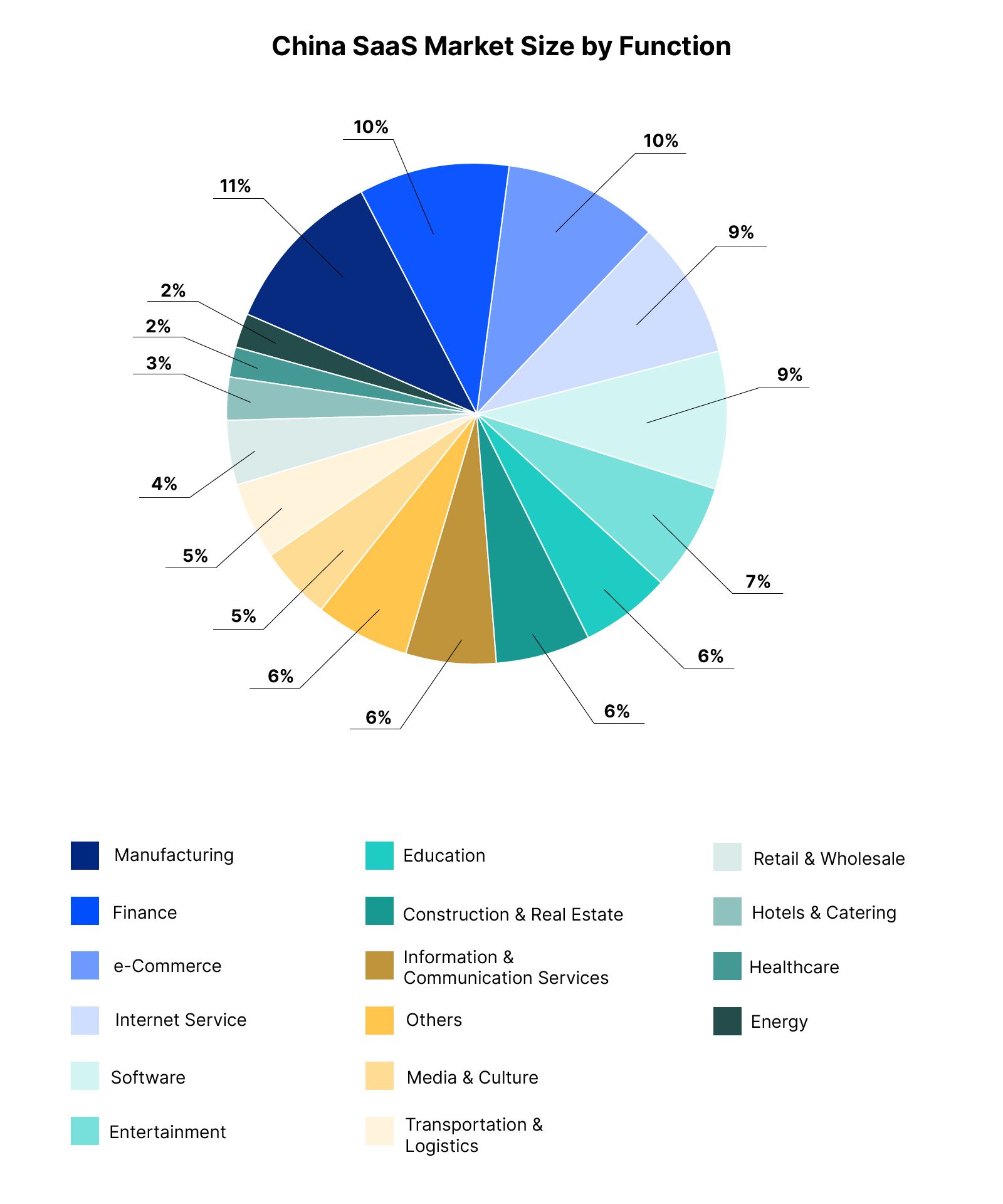

The new SaaS systems that are currently provided by the SaaS companies in China are often easier to use, more convenient and versatile, involve much lower initial capital than the traditional enterprise software systems, and provide real improvements in business performance. For example, a typical business cycle for sales normally encompasses numerous steps, including quotation, order, goods picking and shipping, and invoicing. By using SaaS (such as from a vendor called Stoqo), the business cycle steps including order, inventory, and invoice are simplified, and tightly linked and managed together. One of the unique aspects of the SaaS sector is that it touches upon so many other industries and sectors. Whether it be financials, energy, utilities, consumer B2C e-commerce, telecom, and government, there are so many existing and new types of software that try to improve the current workflow or business processes.

Major Barriers to SaaS Adoption in China

Despite these positive factors driving the greater adoption of SaaS globally as well as in China, some of the key reasons that have prevented SaaS from exploding even higher in China are as follows:

Lower labour costs

China's labour costs are lower in general as compared to the United States and there are lower incentives to use software to reduce labour costs. SMEs account for over 60% of China's total GDP and SMEs represent nearly 99% of the total number of all companies in China. Many of these SMEs still rely heavily on manual labour. However, the labour costs are increasing at worrisome rates in major cities in China, which is likely to force thousands of companies in China to increasingly consider the adoption of SaaS systems in the coming decade.

Overall, the SMEs have been more receptive to adopting SaaS in China as compared to the larger companies and state-owned enterprises (SOEs). This has partly been due to the SOEs existing investments in legacy enterprise software systems and also due to cash constraints at many SMEs which favour the SaaS subscription model since it requires lower initial capital investment.

Concerns about outsourcing business information on the cloud

One of the persistent concerns about the adoption of the SaaS systems in China is the fact that many Chinese CEOs are often very protective and secretive about their entire business operations, especially in terms of data management. As a result, instead of relying on cloud-based computing and data management systems, many companies in China still operate their businesses the old fashion way, including having their own servers and storing all their essential business information database on them, instead of relying on outsourced, external cloud-based systems. Nonetheless, due to the tremendous amount of improvement in SaaS in terms of the cost-benefit criteria in recent years, there are great incentives to adopt SaaS system in China and the adoption curve of SaaS is likely to enjoy strong growth in the years ahead.

Concerns about the lack of adequate protection of intellectual property/software

Another major reason why SaaS market has not really taken off as it has in the U.S. is due to the complicated issues related to the lack of adequate protection of intellectual property/software in China. This is not likely to be corrected quickly and is likely to remain a key stumbling block that could continue to act as a key deterrent in the adoption of SaaS systems in China.

Difficulties of highly rigorous customisation

Vertically integrated SaaS products require high levels of customisation. However, many Chinese companies face difficulties in providing these rigorous levels of customisation of SaaS products. Many of these Chinese companies tend to have centralised decision-making processes and the main people in charge of the companies' IT systems tend to rely on legacy systems rather than try new SaaS products.

Impact of COVID-19 on the Chinese SaaS sector

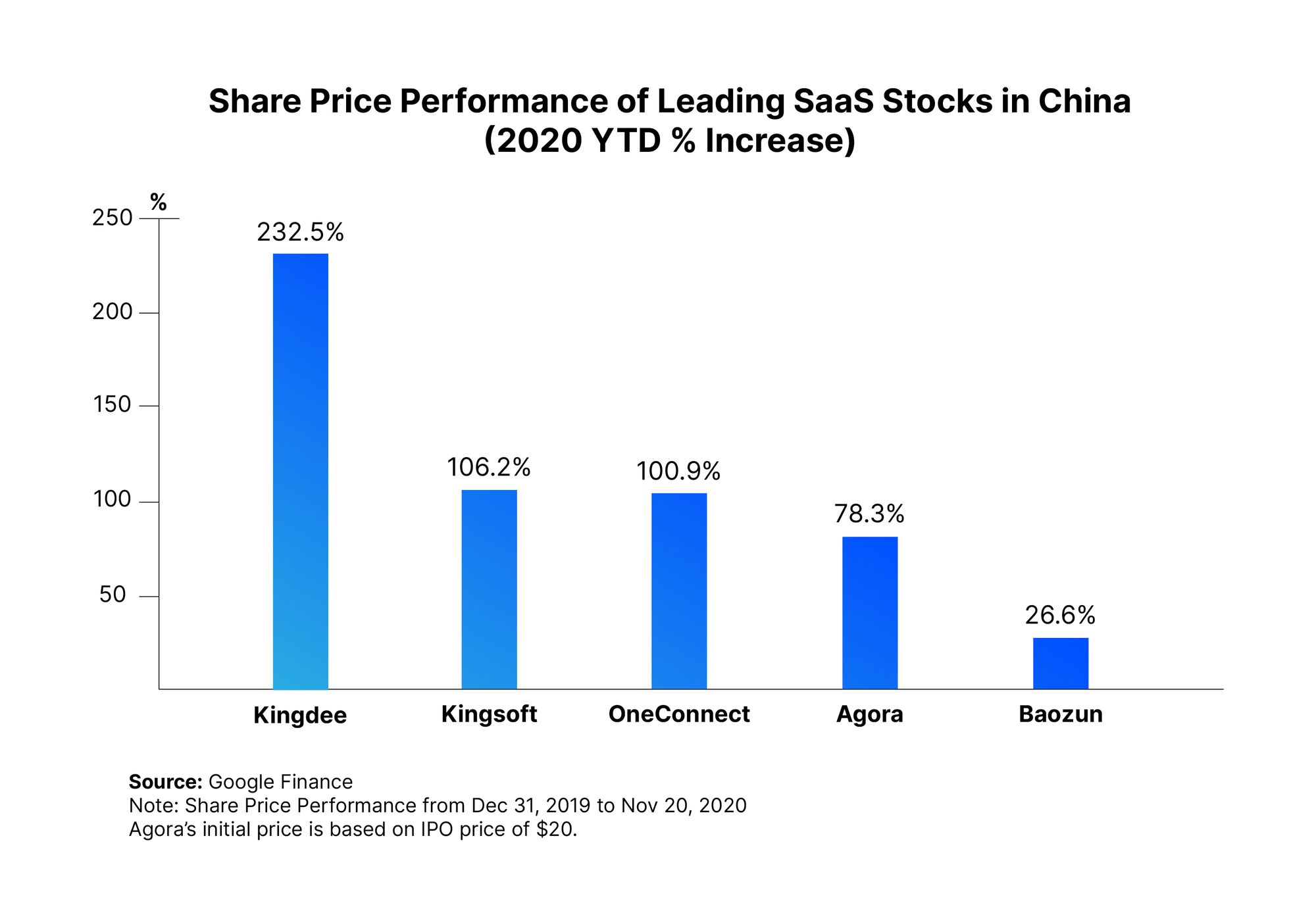

Although the COVID-19 pandemic has had a negative impact on reducing the overall GDP growth globally as well as in China, it has actually had a positive impact on accelerating the growth of the SaaS sector in China. This is mainly due to increasing telecommuting, social distancing, greater use of e-commerce, smartphone apps, and accelerated efforts to reduce human labour and improve productivity in remote non-office environments. According to a recent survey (of over 4,200 IT leaders, including over 100 leaders from mainland China and Hong Kong) by Harvey Nash/KPMG COVID-19 forced one of the biggest surges in technology investment in history. Companies spent about $15 billion extra a week on technology to enable safe and secure home working during COVID-19. The majority of CIOs in mainland China and Hong Kong have prioritised analytics and systems of insight, new technology development, IT management and operations, and cloud/SaaS as key areas for investment. This is one of the reasons why the SaaS related stocks in China have performed so well this year, far outperforming the general market overall.

33 Major Enterprise SaaS Companies in China

In the table below, we highlighted 30 of the major SaaS related companies in China. We have included 15 public companies and 18 private companies in China. The top three SaaS related stocks in China include OneConnect Financial Technology, Kingdee International Software, and Kingsoft Corp. Other major private SaaS related companies include Datacanvas, Forcelclouds, PingCAP, and Beisen. Currently, the Chinese SaaS systems consist largely of CRM, office automation, intelligent manufacturing software, and office collabouration software.

Some of the biggest tech giants in China such as Alibaba, Tencent, and JD provide SaaS products and services but these tech giants cannot be classified as pure-SaaS companies since they provide numerous, diversified tech products and services. Other major global SaaS/software giants including Microsoft, Oracle, SAP, Salesforce, and ServiceNow have also been very aggressive in their efforts to expand their market share in the Chinese SaaS market in the past several years.

Major Domestic Leaders of the Enterprise SaaS Market in China (Publicly Listed)

The following are brief summaries of the some of the top publicly listed “mostly pure play” SaaS players in China including Kingdee, Kingsoft, and OneConnect. These five stocks below are up on average 109% YTD, far outperforming the overall market.

Kingdee - Founded in 1993, Kingdee is a provider of enterprise application software and it provides its products and services to more than 6.8 mn enterprises, government agencies, and other organizations globally. The company’s customers include companies such as Huawei, Haier, and China Eastern. Kingdee broadly serves the manufacturing, services, retail and, construction, and real estate industries.

Kingsoft - The company provides internet and software services and is listed on the Hong Kong Stock Exchange. At present, the company’s service offering is based on interactive entertainment, internet security, and office software with cloud computing being an integral part of the service offering.

OneConnect - Founded in 2105, OneConnect is a leading SaaS provider for financial institutions. The company's customers include nearly 99% of China's city commercial banks and more than half of China's insurance companies. The company utilizes AI, big data, and blockchain to deliver its SaaS services. One of the company's great strengths is its dominance in providing SaaS solutions the major banks and financial institutions in China.

Agora - The company was founded in 2013 and was listed on NASDAQ in June 2020. Agora offers a cloud platform as a service that incorporates video, audio, real-time messaging, and real-time recording. Agora serves numerous sectors including gaming, social, retail, and education. Major clients include Xiaomi, Sound Cloud, Vain Glory, Hike, Momo, Talk Space, and Meet Me.

Baozun - Baozun was founded in 2006 and is involved in providing e-commerce solutions. Baozun covers all parts of the e-commerce value chain from IT solutions, store operations, digital marketing, customer services, warehousing, and fulfillment. Baozun helps companies accomplish their e-commerce strategies by providing a technology platform that integrates big data, AI, and cloud computing.

Rising Stars in the Enterprise SaaS Market in China (Private)

There are numerous rising stars in the Enterprise SaaS market in China including the following companies:

PingCAP – Established in 2015, PingCap is an enterprise SaaS provider of open-source, distributed SQL database for real-time analytics. The company has received $342 million in funding since its establishment. On 18 November 2020, PingCAP closed a $270 million Series D funding, which was jointly led by GGV Capital, Access Technology Ventures, Anatole Investment, Jeneration Capital, and 5Y Capital. Coatue, Bertelsmann Asia Investment Fund (BAI), FutureX Capital, Kunlun Capital, Trustbridge Partners, and existing investors Matrix Partners China and Yunqi Partners also participated in this round. PingCAP surpassed MongoDB to be the world’s leading open source database company in 2018.

PingCAP’s TiDB is an open-source hybrid transactional and analytical (HTAP) database targeted at companies that need to handle large volumes of data and scale quickly. TiDB combines both online transactional processing (OLTP) and online analytical processing (OLAP) workloads in the same database. It has been adopted by more than 1,500 companies globally across multiple industries, including finance, e-commerce, payment, online video, gaming, logistics, media, manufacturing, and travel. Customers include Square (US), PayPay (Japan), Shopee (Southeast Asia), Dailymotion (France), and BookMyShow (India).

Kujiale –Kujiale provides cloud based SaaS products for home decoration and design services. Kujiale has received $235 million in private funding since its establishment. The company is headquartered in Hangzhou, China. Kujiale reached a unicorn valuation of more than $1 billion after the completion of a Series D+ round in October 2019. Kuijiale is trying to disrupt the home design and decoration industry with its SaaS based intelligent solutions, which include numerous value-added solutions including 3D product configuration, automated imagery, floor planning tools, and mixed reality experiences powered by augmented reality (AR) and virtual reality (VR).

Worldwide Logistics – Established in 2001, Worldwide Logistics Group (WWG) has an annual turnover of RMB 2.7 billion and it has been included as one of the top 50 global freight forwarders. WWG has heavily emphasized the use of digital and SaaS platforms to improve its business operations. WWG’s digital platform links the upstream and downstream resources and networks of the shipping industry through SaaS applications to provide users with internet services of freight rates. Users can fully dock with ship owners, airlines, and overseas agency platforms to obtain the best freight rate in real-time, as well as comprehensive supporting services (customs declaration, trailers, warehousing, overseas networks and finance, etc).

Finally, you can see the breakdown of China's SaaS market size by function and industry in the charts below. The CRM, call center, ERP, conference/email, and office automation currently comprise the biggest components of China's SaaS market by function. Going forward, key SaaS sectors including office automation, supply chain management, accounting/tax, ERP, and HRM could experience some of the fastest growth rates in China's SaaS market, especially driven among the millions of SMEs in China, in our view.

ADDX is your entry to private market investing. It is a proprietary platform that lets you invest from USD 10,000 in unicorns, pre-IPO companies, hedge funds, and other opportunities that traditionally require millions or more to enter. ADDX is regulated by the Monetary Authority of Singapore (MAS) and is open to all non-US accredited and institutional investors.

Sources:

(1) https://www.statista.com/statistics/1029285/china-software-as-a-service-market-size/, https://99firms.com/blog/saas-statistics/#gref, Asia Briefing

(2) https://99firms.com/blog/saas-statistics/#gref

(3) https://www.statista.com/statistics/1029285/china-software-as-a-service-market-size/, https://99firms.com/blog/saas-statistics/#gref, Asia Briefing, https://melchers-china.com/the-rapid-growth-of-chinas-software-industry/

(4) https://www.eastwestbank.com/ReachFurther/News/Article/Chinas-SaaS-Market-has-a-Silver-Lining, https://www.ngpcap.com/news/the-rise-of-the-enterprise-software-economy-in-china

(5) https://www.megichina.com/blog/2018/07/13/inventory-management-systems-in-china/

(6) https://www.chinabankingnews.com/2018/06/22/smes-account-60-chinas-gdp-beijing-mulls-inclusion-loans-mlf-collateral/

(7) https://home.kpmg/cn/en/home/news-media/press-releases/2020/09/covid-19-forces-one-of-the-biggest-surges-in-technology-investment-in-history.html

(8) https://www.ngpcap.com/news/the-rise-of-the-enterprise-software-economy-in-china

![[Report] Emerging Enterprise SaaS Startups In China](/insights/content/images/2021/05/Emerging-enterprise.jpeg)

![[Report] Private Credit Opportunities In Emerging Markets](/insights/content/images/2021/05/Private-credit.jpeg)