This ADDX Insights Report is part of an ongoing series exploring opportunities in private markets and alternative investments. This report was produced by Yellowstone Research and was commissioned by ADDX.

Introduction

Private Credit Opportunities in Emerging Markets

Private credit is booming across emerging markets (EM), after rising as a formidable asset class in developed markets (DM) post Global Financial Crisis (GFC). Global private credit AUM has grown to $666bn in 2017 from $248bn in 2008, growing at 12% annually, and is expected to grow at an increased pace of 15%+ annually. As per Preqin, private credit AUM reached $812mm as of June 2019 and is now the third-largest asset class in private capital, ahead of infrastructure and natural resources.

The key driving forces behind the emergence of private credit as an asset class globally has been:

- Global search for yield in the face of low interest rate environment

- Demand/Supply mismatch in under-served niches such as middle-market corporate/SME lending and long-tenured real asset projects that have been under-served by traditional lenders

- Lack of attractive alternate investment opportunities

- Increased regulations for traditional lenders (banks)

EM focused private credit demand has seen rapid growth since the GFC. Capital raised for EM focused private credit strategies, post GFC, has grown to $9.4bn in 2018 (highest level recorded since 2006 when EMPEA started tracking such data through its data program) from $1.4bn in 2008, an annual growth of 21% vs 12% for overall global markets. Despite the rapid growth, EM private credit represents a small segment of the overall global private credit market with just 1.2% share. However, this is poised to change meaningfully with increasing interest for EM focused private credit from global institutional investors. As per a survey by EMPEA, the share of global institutional investors (as per the sample surveyed by EMPEA) who plan to begin investing or increase their allocation to private credit opportunities in EM has almost doubled to 47% in 2018 from 24% in 2014.

What is Private Credit?

Private credit, in simple terms, is lending by private investment funds (funded by institutional investors such as sovereign wealth funds, family offices, pension funds, foundations, insurers, banks, etc.), business development companies or development finance institutions. As the name suggests, private credit is not issued or traded on the public markets. Private credit assets span across tenor, capital structure, and risk/reward profile.

Benefits of Private Credit

Private credit provides strong win-win value proposition for both borrowers and lenders. For lenders, it helps in mitigating risks by enabling them to enter into customised covenants and contractual terms which can add significant value relative to developed world which is moving more and more towards covenant-lite structures. It also enables investors to generate excess returns through custom structuring including hybrid equity payout structures. For borrowers, it helps in accessing non-dilutive financing solution with flexible structuring allowing repayments to be tied to the actual cash flows of the business.

This is particularly important for South-east Asia region where a large number of companies are owned by families who tend to avoid dilution of their equity ownership. These family-owned promoters like to partner with long-term capital providers, preferably sole lender, with whom they can establish close-knit relationship. These capital providers being institutional in nature also bring sophistication to the table and are well versed with the real challenges of the business. They can help structure the financing dynamically with the evolution of the business. These investors are also less prone to be perturbed by economic cycles or temporary headwinds and can add value to the business through their network and professional industry expertise. They are also more open and flexible to accepting non-traditional collateral (e.g. intangible assets such as royalties, patents, etc.) and thus are better equipped to serve new-age service-oriented and technology-driven firms.

Risk/Reward is more attractive in EM Private Credit vs DM

EM Private credit offers more attractive risk/reward profile than DM opportunities led by the below factors.

Stronger Covenants:

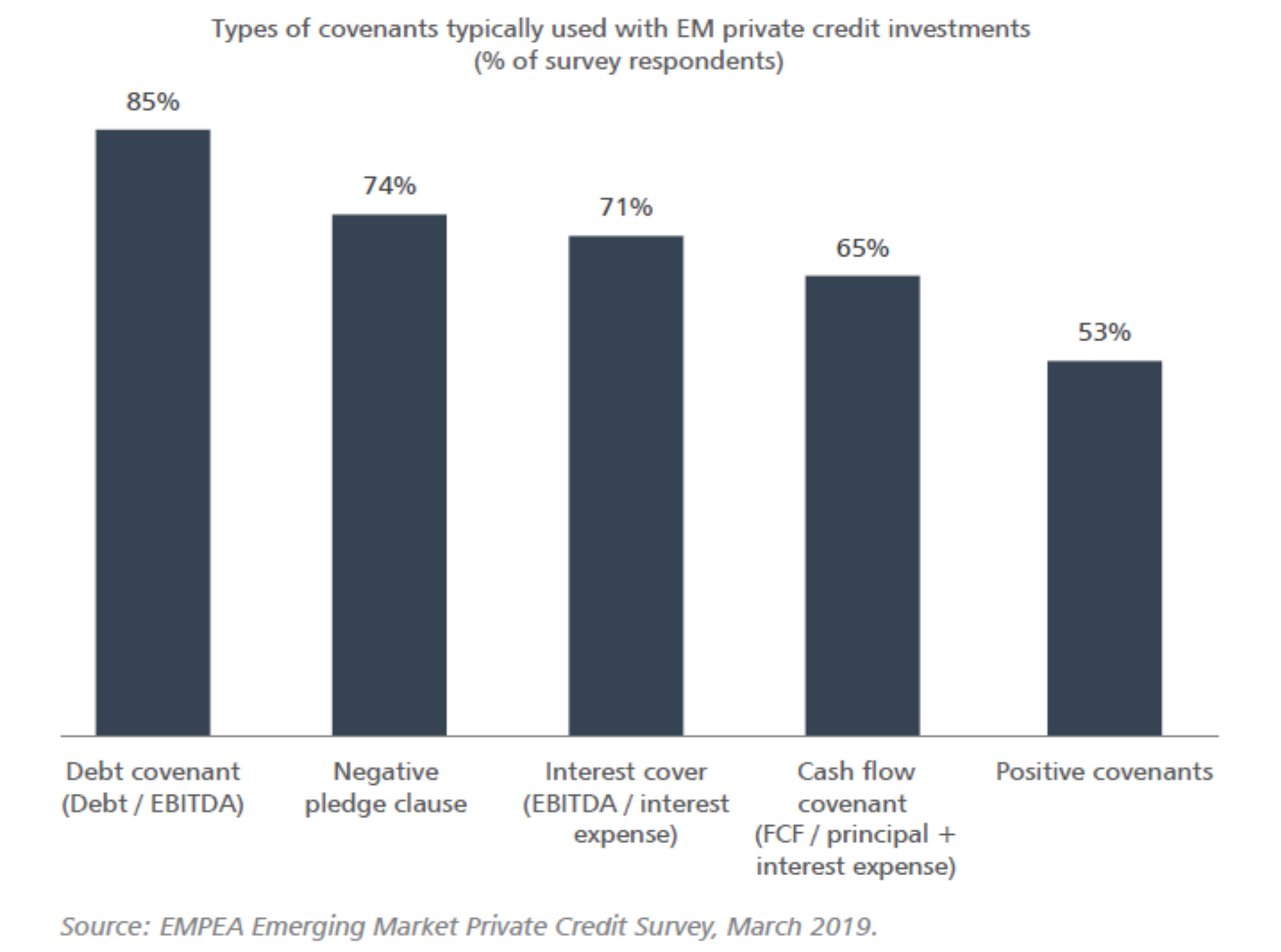

In DM, intense competition has led to significant deterioration in covenants. US and Western Europe have seen significant rise of covenant-lite loans. In 2018, covenant-lite loans comprised 88% of total transactions in Western Europe vs zero seven years ago. 80% of new-issue first- lien loans in US were rated as covenant-lite vs 5% in 2010. In contrast, EM has been completely unscathed from the concept of ‘covenant-lite’ loans. An EMPEA survey revealed a wide variety of covenants are employed in EM, resulting in lower risk. Approximately 85% of them structure a debt covenant pledge, while negative pledge clauses, interest covers, and cash flow covenants, were also frequently utilised by 74%, 71%, and 65% of the survey respondents, respectively.

Improving Creditor Protection:

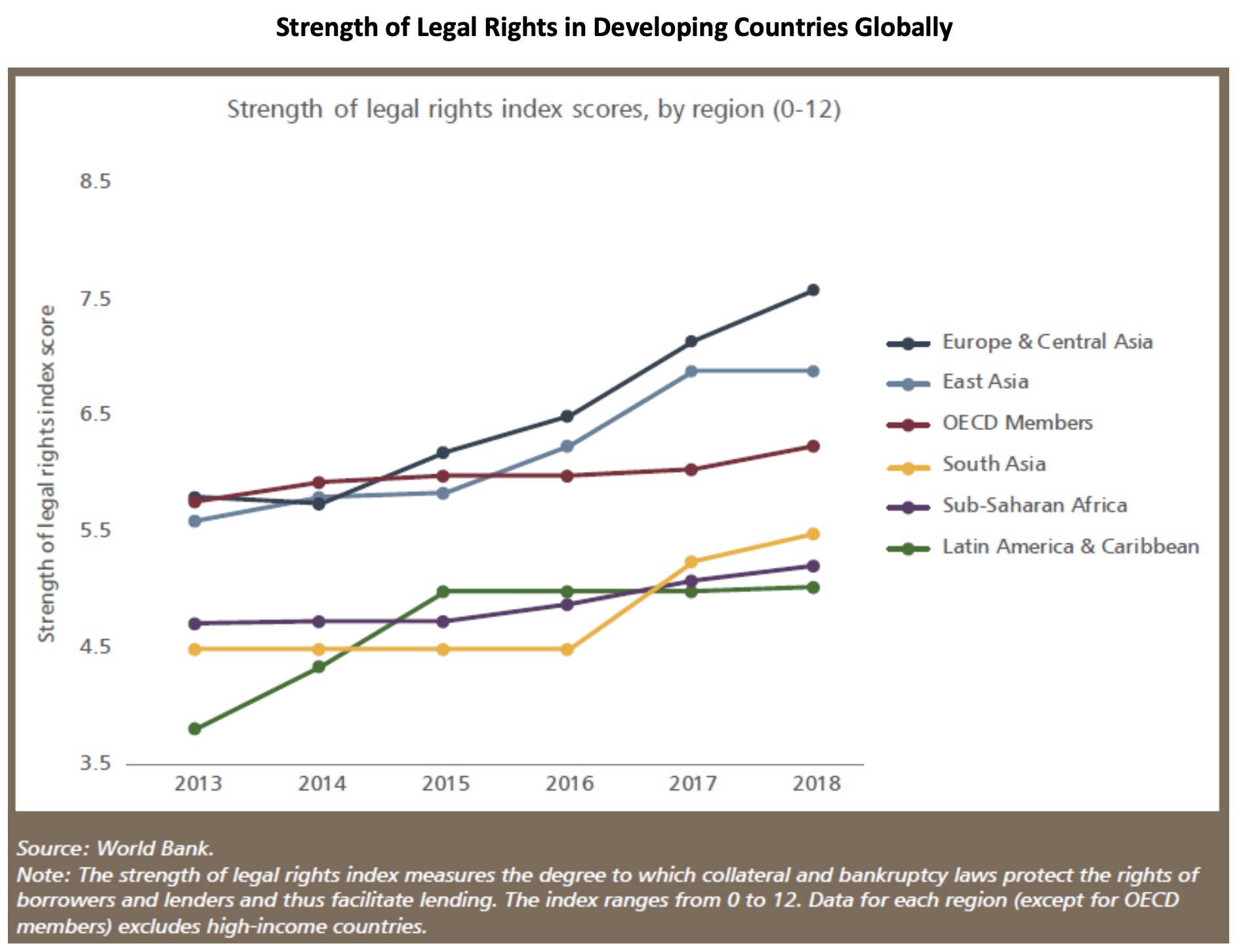

Risks in EM are declining due to improving protections led by strong improvements in regulatory, legal, and political framework. As measured by World Bank’s legal rights index, a measure evaluating the degree of protection offered by a country’s collateral and bankruptcy laws to the borrowers and lenders, developing countries in East Asia, Europe, and Central Asia, are already well placed relative to more developed OECD member countries, as measured by a composite score. Meanwhile, other emerging regions have been on an uptrend and are closing in on OECD member countries. Borrower standards are also improving in EM as these firms are realising the importance of good governance and institutional approach in attracting foreign capital.

Lower Leverage:

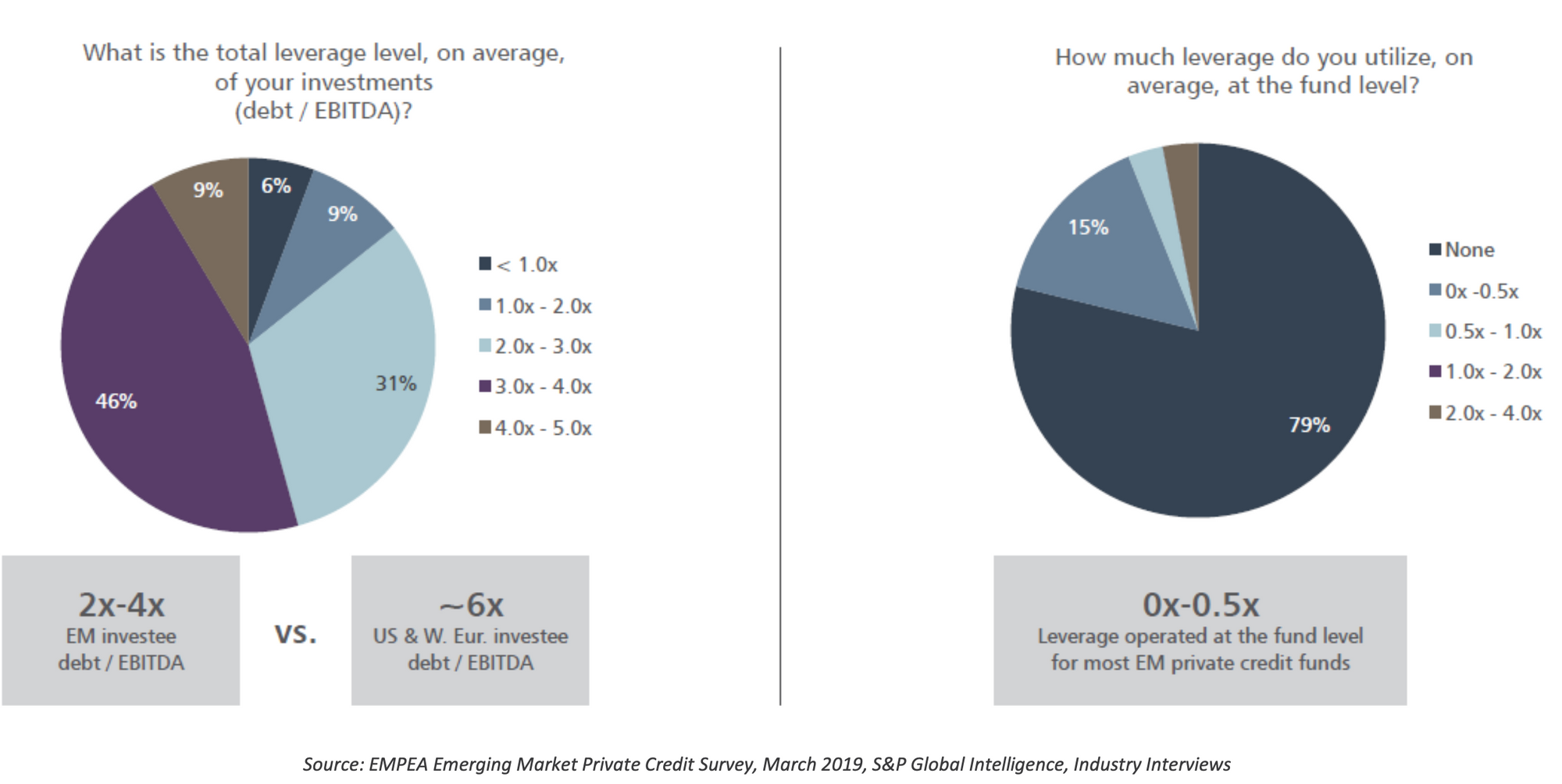

EM private credit focused opportunities involve less leverage than DM at both the fund level and at the borrower level. As per an EMPEA survey, about 46% respondents revealed that on average, leverage at the borrower level is <3x Debt/EBITDA. An additional 46% disclosed it to be between 3x and 4x. This compares with 6.1x in US and 5.9x in Europe. Further, majority (79%) of the private credit funds surveyed said that they do not utilise leverage while another 15% apply up to 0.5x turns of leverage.

Sovereign Risk ≠ Credit Risk:

EM focused investors often have a notion that EM-based borrowers have higher counter-party risk. While EM countries do exhibit higher geopolitical and macroeconomic risks than DM countries, stretching it to individual companies is a bit excessive, especially in situations where these counter-parties are handpicked through robust due diligence on governance, management quality, industry fundamentals and company’s financial strength. This is attested well by industry experts who even mention that many private funded EM businesses are in fact superior to an average DM based business, due to use of less leverage and potential for higher growth. As such, when investing in private credit opportunities, it is important to dis-aggregate the sovereign risk premium from the company risk premium.

Favourable Return Proposition relative to DM Private Credit:

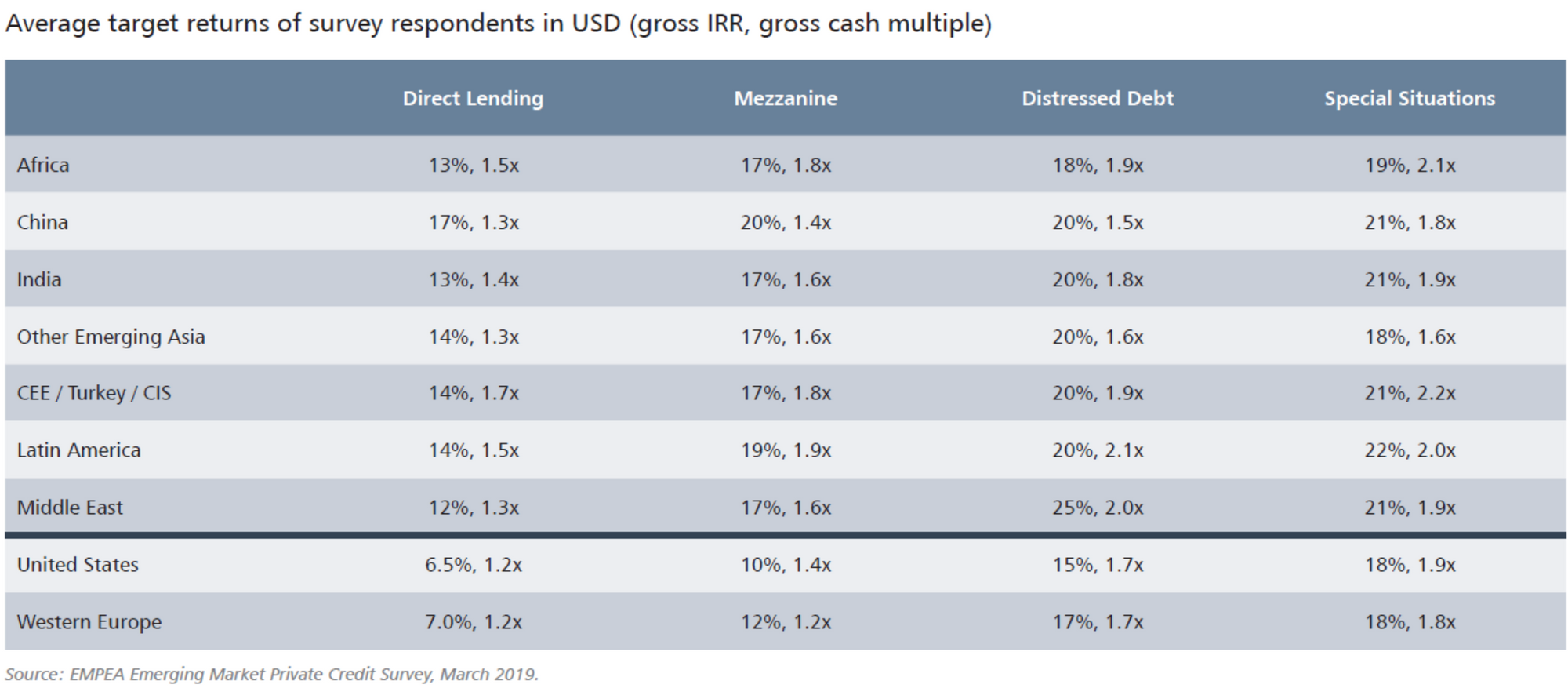

EM private credit offers more attractive return proposition vs DM private credit opportunities. EM vs DM out-performance across most sub- segments of private credit range from 5-10% points in USD terms, as per an EMPEA survey.

Large Headroom for Growth:

Despite the rapid growth in EM private credit, it represents a small segment of the overall global private credit market with just 1.2% share.

While the number of players and the amount of capital chasing private credit opportunities in EM has grown, there is still a high level of demand/supply mismatch in various pockets:

- Mid-market and SME businesses in EM face significant financing gaps: As per an IFC study, there are 30 million SMEs that face a formal financing gap of over $4 trillion. In comparison, the total capital raised for EM focused private credit strategies pales with just $57bn capital raised since 2006.

- Distressed investing is in high demand with NPLs of $1 trillion on bank’s balance sheet across EM, as per IFC.

- There is also strong unmet demand for project financing where traditional lenders shy away from, due to lumpiness in cash flows and long gestation period. As per an ADB (Asian Development Bank) study, private sector funding gap in the infrastructure sector is as high as $187bn.

With many economies within South-east Asia poised to clock high (>5%) real GDP growth for many years to come, the demand for credit in these economies is likely to remain strong. Significant under- penetration of credit as % of GDP suggests that the credit growth is likely to exceed GDP growth in these economies. The growing theme of trade diversification away from China should also benefit SE Asia and further provide impetus to the region’s growth prospects.

Private Credit Opportunities In Asia

Private credit opportunities in Asia span across corporate lending, real asset lending and impact financing.

Distressed Credit and Special Situations

Within EM, Asia has been the key hub for distressed credit and special situations. Distressed debt has flourished well in Asia due to high availability of NPLs, particularly in large economies like India and China. Ticket sizes per deal have been >$100mm over the past 3 years. 82% of capital raised for EM distressed debt, over the last 3 years, has gone into Emerging Asia. Recent years in particular saw the largest volume of capital raised for the strategy, in part, driven by success of Edelweiss’ India Stressed Assets Fund II, a $1.3bn vehicle representing the largest India-focused private credit fund as per EMPEA records. Asia has also been the predominant location for special situations activity. Recent notable fund raises include SSG Capital Partners’ fifth vehicle ($1.2bn), Bain Capital Special Situations Asia ($1bn) and PAG China Special Situations Fund III ($1bn).

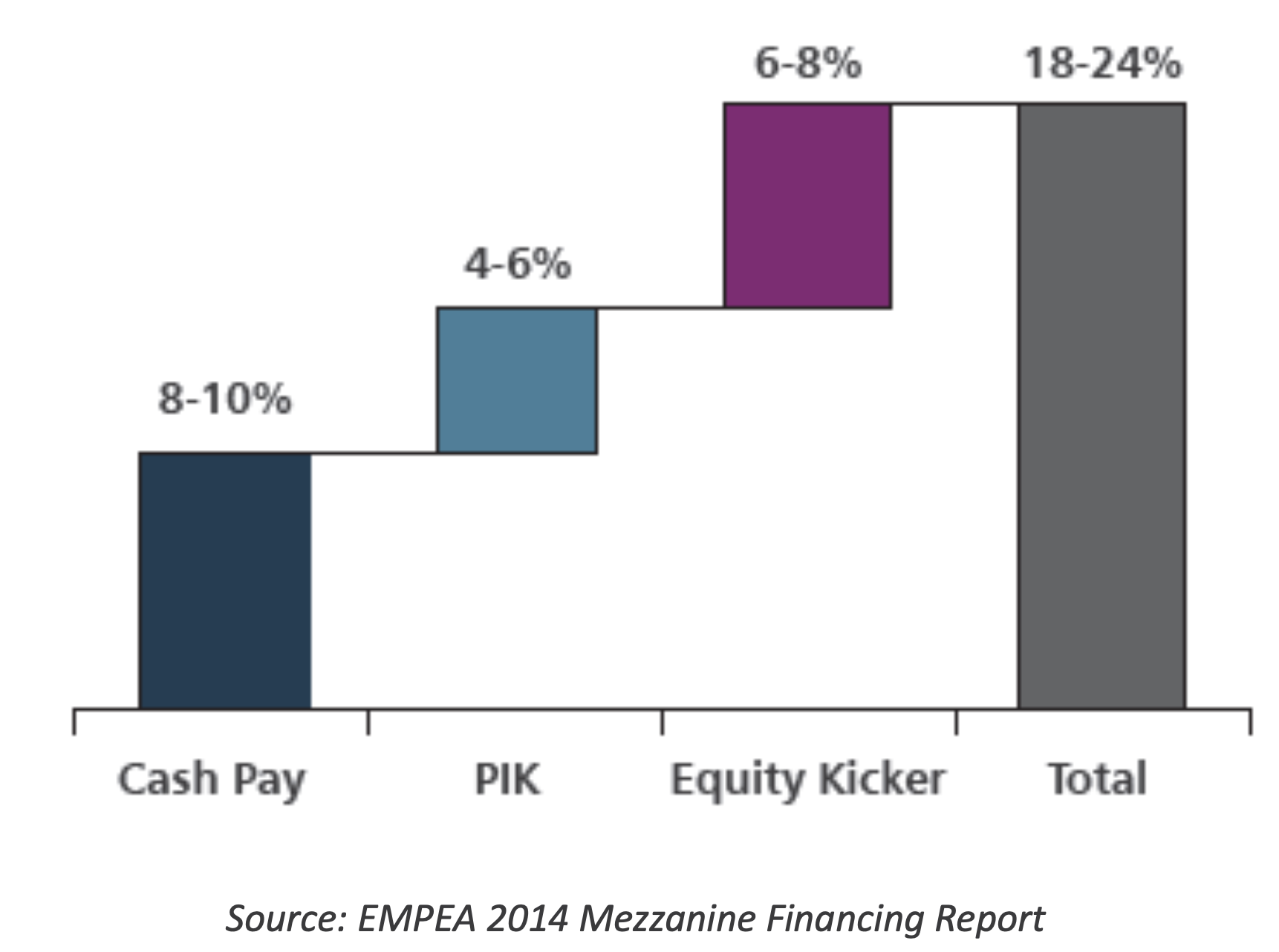

Growth focused Mezzanine Financing

It has been quite active with interest from alternative asset managers including private equity players, especially in growth countries like India, China, Vietnam, Indonesia, Philippines and Malaysia. Compared to the developed markets, leveraged buyout financing has been somewhat limited in Asia and EM. However, mezzanine investors over time have innovated to venture into growth focused mezzanine financing. With lack of alternate sources of funding for growth-hungry mid-market corporates and SMEs, especially in high-growth countries, there is a significant credit supply gap. A number of the mezzanine lenders have found success in funding these growth led companies via mezzanine debt structures, without the participation of any private equity sponsor. These lenders also work closely with company management and owners to add value and earn equity kicker.

Venture Debt

With the advent of the start-up culture and technology led disruption in Asia, venture debt is rapidly emerging as a formidable niche private credit segment.

Dave Richards at Capria Ventures, an institutional asset manager with active investments in venture debt segment, mentions:

“If you have working capital needs, it’s way too expensive to use venture capital for that. Companies like Gojek and Grab have a lot of working capital needs, since they pay their drivers weekly, thus they have to collect money for that and other operational costs. When you have to finance between different accounts, you have to see which accounts are payable. None of the banks will fund this, because they don’t want to provide risk capital—they are not set up to do that. So you have to bring along someone who provides a solid financial product and understands the risk and opportunities of investing alongside venture investors, but with a debt-oriented product.”

Real Asset Financing

The need for robust infrastructure and real asset development is increasing to support the fast growing economies in Asia. Real asset development typically involves long- tenured projects and is most suitable for investors with patient capital like pension funds and insurers. Opportunities in this space include:

Sustainable Energy and Power Investment Opportunities

Increased focus on green energy has led to attractive opportunities in this space.

Real Estate

With increasing digitization, that has been further accelerated by COVID, various real estate segments like data centers and logistics centers are witnessing strong growth and have attracted significant attention from private credit investors.

Diversification away from China as a financier

With growing anti-sentiment against China, there is an impetus across the globe to reduce financing and trade dependence on China. SE Asia historically has relied significantly on China led financing. However, with the changing tides, the need for diversification away from China as a financier should further boost demand for private credit, particularly in the SE Asia region.

Within Asia, Pierfront Capital backed by Temasek has a notable presence in this segment. Some of Pierfront’s featured EM investments include debt exposure to an India-based renewable energy developer, Greenko, and an Indonesia mine, Merdeka.

Impact Financing (financial inclusion, education, healthcare, etc.)

With growing demand for ESG focused investments among institutional investors, supply for impact financing is gaining traction. Over $900mm have been deployed in SE Asia during 2007-17 by private impact investors. Development Finance Institutions who have been the major investors so far have deployed $11.2bn during this period. Private microfinance has been the biggest receiver of impact funding, so far, especially in countries like India, Cambodia and Myanmar. Going forward, the impact financing space is likely to grow manifold.

Our Top Pick within the Private Credit Opportunity Set

Our top pick within the private credit opportunity set is growth focused mezzanine financing to EM based mid-market corporates and SMEs. To us, this segment offers the most attractive risk/reward proposition in the EM Private Credit space.

While traditional mezzanine finance involves subordinate debt funding in conjunction with a PE sponsor to enable a leveraged buyout, mezzanine finance in EM are often standalone deals, also referred to as sponsor-less deals. Many of these deals involve active engagement with the company and the management to support growth and drive additional value through functional expertise and network synergies brought by the lender. These benefits are often compensated by equity kicker mechanisms, contingent on realization of specific performance targets.

This kind of uniqueness in EM is largely due to the ownership structure of companies in EM. Most mid- market companies, who are the key contenders for growth/mezzanine financing, are family-owned and the promoters are less willing to give up their ownership/equity. They prefer non-dilutive debt funding to fund their growth needs. Lack of financing through traditional lenders and lack of developed debt capital markets also contribute to the strong demand for private credit.

With SE Asia comprising of high-growth economies such as Indonesia, Vietnam, Philippines, growth focused mezzanine financing presents a large opportunity set for prospective investors looking to make EM focused private credit investments. Ranging from early-stage venture debt financing to funding growth for relatively mature mid-market corporates and SMEs, the space is ripe with diverse opportunities. However, local deal flow and thorough on-ground due diligence are essential to succeed in the space. Having on-ground presence is quintessential. Some of the established global alternative asset managers players like Oaktree, KKR, Blackstone, have developed strong local presence over time. Alternative asset managers based out of Asia such as Baring, Kendall Court, PAG, also have strong established presence to source private credit deals. Raj Makam, a managing director with US-based Oaktree Capital, highlights the importance of having a strong local presence - “Despite the healthy deal flow, successful participants in the space remain limited, which observers attribute to the necessity of extensive on-the-ground networks for finding attractive proprietary deals and the risks inherent to some Asian markets. Unless they are willing to make the required investments in time and resources to overcome these challenges, new growth mezzanine players will struggle to enter the market.”

ADDX is your entry to private market investing. It is a proprietary platform that lets you invest from USD 10,000 in unicorns, pre-IPO companies, hedge funds, and other opportunities that traditionally require millions or more to enter. ADDX is regulated by the Monetary Authority of Singapore (MAS) and is open to all non-US accredited and institutional investors.

![[Report] Private Credit Opportunities In Emerging Markets](/insights/content/images/2021/05/Private-credit.jpeg)

![[Report] The Alternative Lending Opportunity in South East Asia](/insights/content/images/2021/05/underbanked.jpeg)