This ADDX Insights Report was produced by Zero One Research and commissioned by ADDX.

What You Need to Know:

- Corporate debt plays a key role in capital markets. In general, corporate debt ‒ as compared to other asset classes ‒ generates more consistent returns, represents lower investment risk, and provides reliable cash payouts in set intervals. Instruments such as corporate bonds, notes, and commercial papers make corporate debt a preferred option for more risk-averse investors while acting as a unique tool in diversifying one’s portfolio in the event of economic fluctuations.

- The corporate debt market remains inaccessible for many investors and companies. Despite its key role in capital markets, the corporate debt market prices out many investors, start-ups, and small-to-medium enterprises (SMEs) due to its over-the-counter nature, high minimum investment sizes, and hefty issuance & transaction costs.

- Distributed Ledger Technology (DLT) can drastically lower debt investment sizes, providing more investors with access. For example, by leveraging smart contracts, corporate bonds at S$200,000 tranches could potentially be broken down and traded in smaller slices of S$10,000. This allows more people, including lower-end accredited investors (AIs), greater access to corporate bonds while potentially paving the way for higher interest debt issued by start-up and SMEs who are now able to issue debt at lower sizes.

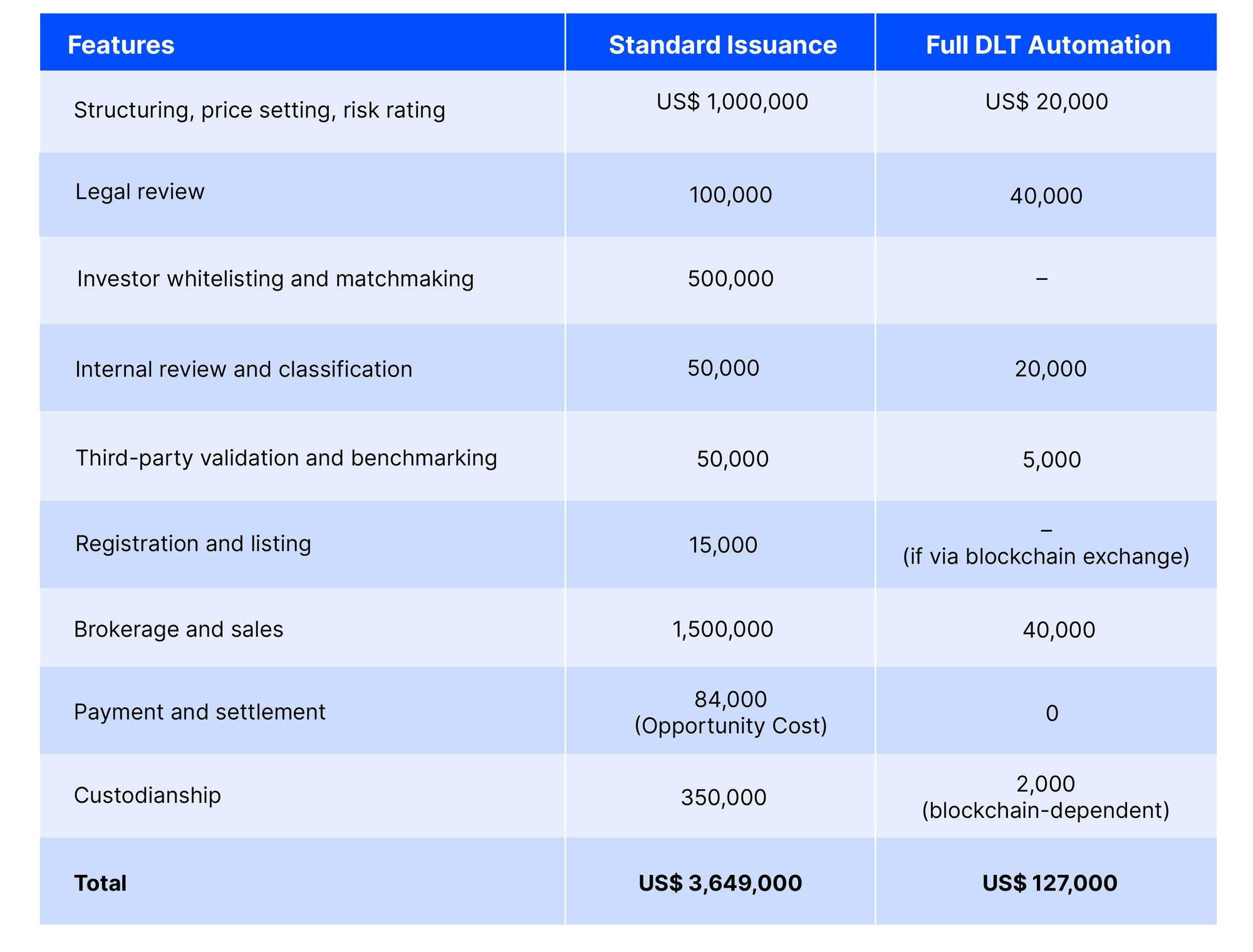

- DLT can dramatically reduce debt issuance costs by up to 97% and allows more companies to access debt financing. According to a 2019 Blockchain Report by HSBC and the Sustainable Digital Finance Alliance, full DLT automation could reduce the total issuance cost of a US$100million bond from US$3.6 million to US$127,000 ‒ effectively a 97% cost reduction. This enables more companies ‒particularly start-ups and SMEs ‒ to tap debt capital markets for financing.

Corporate Debt: A Key Role in Capital Markets

Corporate Debt ‒ whether in the form of bonds, notes, or commercial papers ‒ has always had a significant role in the capital markets. For investors, debt securities provide consistent and stable payouts through recurring interest payments and the return of the notional value at the end of a fixed period. For companies, issuing debt to investors provide flexibility in financing and operations, as opposed to banks that tend to offer more restrictive and expensive financing.

Some of the advantages of investing in typical corporate debt instruments include:

1. Return of the full principal at the end of the period.

Debt securities are structured in a way that investors can expect the return of the principal amount at the end of a fixed period. The same can’t be said for equity investments since stock prices can fluctuate and could potentially be higher or lower than the original purchase price.

2. For interest-bearing debt, cash payouts are consistent and stable.

Interest-bearing debt such as corporate bonds require issuers to pay fixed recurring interest payments ‒ the amount and schedule of which are predetermined in contract. Stocks don’t provide that assurance as dividend amounts per period can vary depending on board declaration, and in some cases can even be cut or withheld entirely.

3. Investors in corporate debt are priority payees in case of bankruptcy.

In the event that a company defaults and begins the process of liquidation, investors in debt instruments ‒ as creditors of the company ‒ have higher repayment priority. On the other hand, shareholders are lower in priority in asset distribution and could potentially receive nothing in the event of corporate liquidation.

All of the above make corporate debt a preferred option for more risk-averse investors, while acting as a useful tool in diversifying one’s portfolio in the event of economic fluctuations.

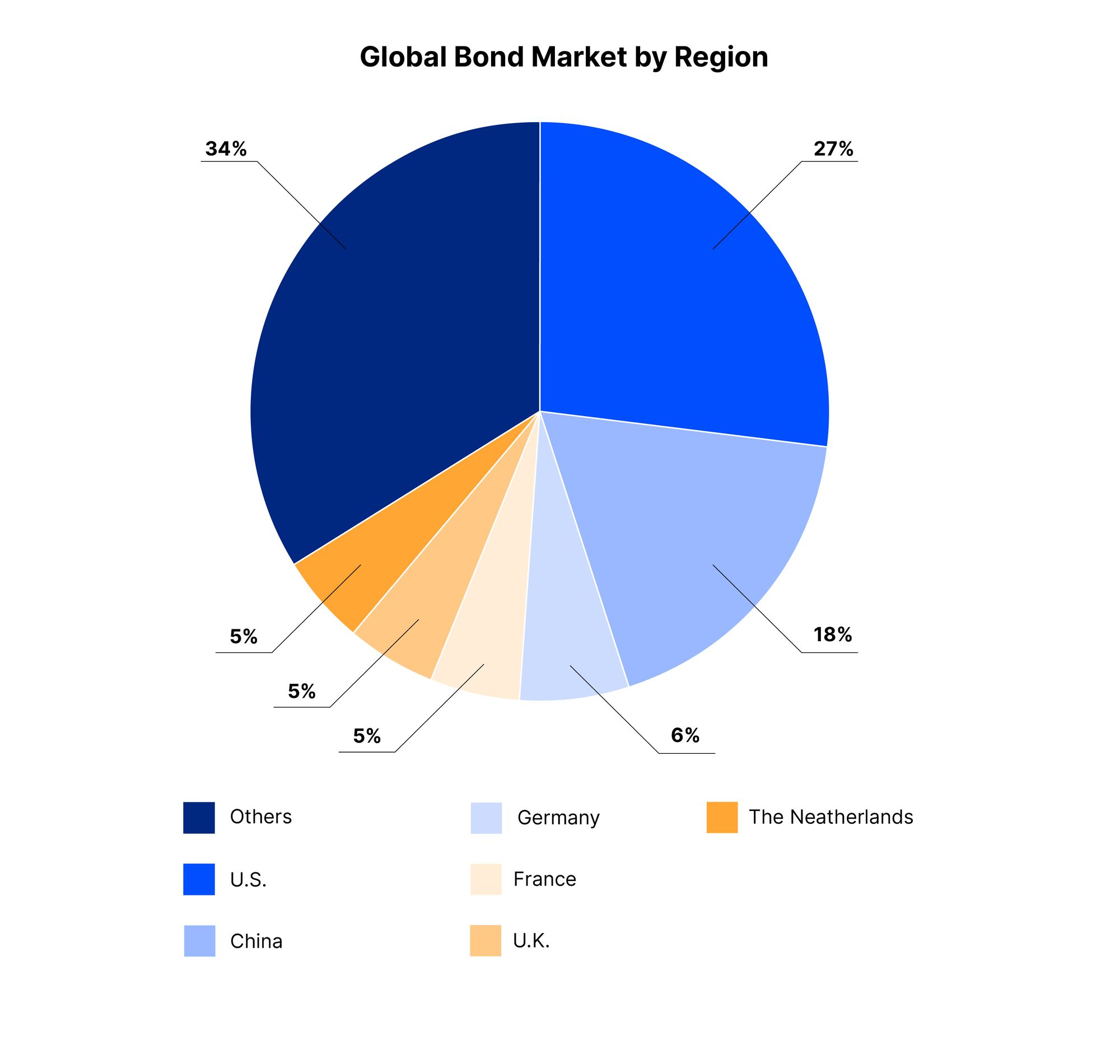

Source: International Capital Market Association (August 2020), Zero One

The Pitfalls of the Current Corporate Debt Market

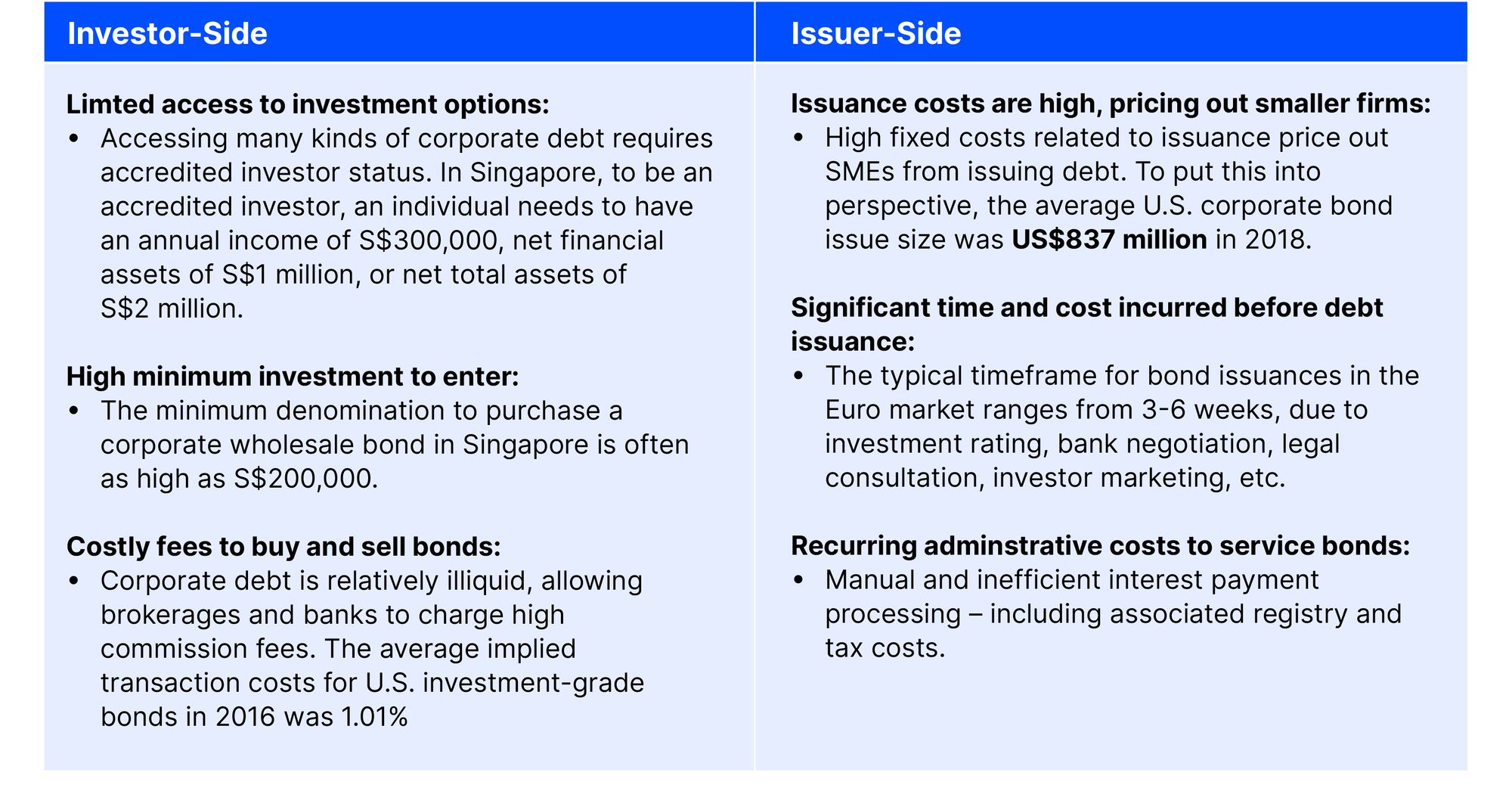

Unlike shares that are publicly traded on stock exchanges, most corporate debt instruments are traded over-the-counter (OTC), relying on brokerages and banking institutions to facilitate transactions. Additionally, the debt issuance process itself is mostly manual and time-consuming, with the typical fund-raising timeframe for a stand-alone bond in the Euro market ranging from three to six weeks. These factors combined create a market biased towards wholesale debt trading, where only well-established corporations issue debt to institutional and accredited investors.

As discussed in the table below, investors usually need significant capital just to purchase fixed asset investments. For example, in Singapore, to be an accredited investor, an individual needs to have an annual income of S$300,000, net financial assets of S$1 million, or net total assets of S$2 million to invest in a wholesale bond market with minimum investment sizes of S$200,000 tranches. For lower-end accredited investors that just meet the annual income requirements, investing two-thirds of that into corporate bonds is prohibitively expensive and makes it difficult to diversify their portfolio.

On the issuer side, average debt issuance sizes are often large due to hefty fixed costs in issuance and servicing. To put this into perspective, the average issue size in the U.S. was at US$837 million in 2018. Therefore, a majority of investors and companies ‒ particularly start-ups and small-to-medium enterprises (SMEs) ‒ are priced out from the corporate debt market.

Overall, despite its key role in capital markets, corporate debt remain inaccessible and impractical for many smaller investors, start-ups, and SMEs.

Source: Zero One

Distributed Ledger Technology Could Unlock the Corporate Debt Market

Distributed Ledger Technology (DLT) offers the ability to democratize the entire debt issuance and trading process for a significant number of investors and issuers. For example, by leveraging digital cryptography and smart contracts, traditionally high denomination corporate bonds at S$200,000 tranches could potentially be broken down and traded in smaller denominations or “tokens” of S$10,000.

DLT also reduces manual verification and simplifies reconciliation for issuing companies ‒ significantly bringing down costs by an estimated 97% according to a September 2019 Blockchain Report by HSBC and the Sustainable Digital Finance Alliance. See the table below for the comparison of price estimates for standard issuance versus a full blockchain automated issuance for a typical bond with a notional amount of US$100 million and 20-year maturity.

Source: HSBC & Sustainable Digital Finance Alliance (September 2019), Zero One

With significantly reduced expenses associated with issuing and trading corporate debt, DLT can open up the market to a wider investor and issuer base and overall creates a more efficient and liquid corporate debt market.

DLT for Investors: More Investors Can Now Participate in the Corporate Debt Market

Benefit 1: Asset Tokenization Can Lower Bond Denominations from S$200,000 tranches to S$10,000 or less

In most countries, the majority of corporate debt markets are wholesale, where only institutional or accredited investors can purchase fixed income assets in large denominations. In Singapore, the minimum amount to invest in wholesale corporate bonds is at S$200,000 – pricing out a significant number of investors. Even for accredited investors who meet the required annual income of S$300,000, investing two-thirds of that into corporate bonds is prohibitively expensive and makes it difficult to diversify their portfolio.

DLT and Asset Tokenization allows high denomination debt to be broken down or “tokenized” into smaller sizes of S$10,000 or less. This provides major benefits for investors of all sizes. Previously priced out investors are now granted access to debt investing with smaller tranches, while more affluent investors have greater flexibility in diversifying their portfolios due to smaller investment sizes.

Benefit 2: More Fixed Income Investment Options in Start-ups or SMEs

Given that start-ups and SMEs are often less stable or don’t have as much collateral as larger companies, the debt they issue often provides higher interest rates to compensate for the increased risk. For example, Southeast Asia’s Funding Societies is a P2P lending platform for SMEs that reported an 8-18% annual return for its SME loans in 2019. Compare that to the 10-year average return of 4.15% for fixed income securities according to the Bloomberg Barclays Capital Government/Credit Bond Index.

DLT – by dramatically reducing the cost of debt issuance and servicing – further enables more start-ups and SMEs to issue debt, as opposed to relying on P2P platforms or bank financing. This paves the way for the potential entry of new higher risk – higher yield fixed income instruments issued by start-ups or SMEs, catering to investors with larger risk appetites who need the diversification and consistent cash payouts fixed income instruments bring.

Benefit 3: Automated KYC Allows Intermediaries to Instantly Pre-Approve Investors

Based on surveys conducted by the Frankfurt School Blockchain Center, a major cause for inefficiency is the manual-intensive work behind due diligence, Anti-Money laundering (AML), and Know-Your-Customer (KYC) procedures. Investors have to repeatedly fill up forms and go through manual identity verification per investment. The study also showed that at least in the European bond market, 70% of the investor bases among all banks are the same, further highlighting the inefficiency of the current system.

Storing investor information via DLT eliminates KYC redundancies across different financial institutions, reduces risks of fraud, and enables real-time authentication. Instead of repeatedly conducting KYC, issuers and intermediaries could access KYC data of investors via an independent third party that provides official and consolidated investor information on a single distributed ledger. This way, barriers to entry for investors to start trading debt securities are reduced and overall enhancing debt market liquidity.

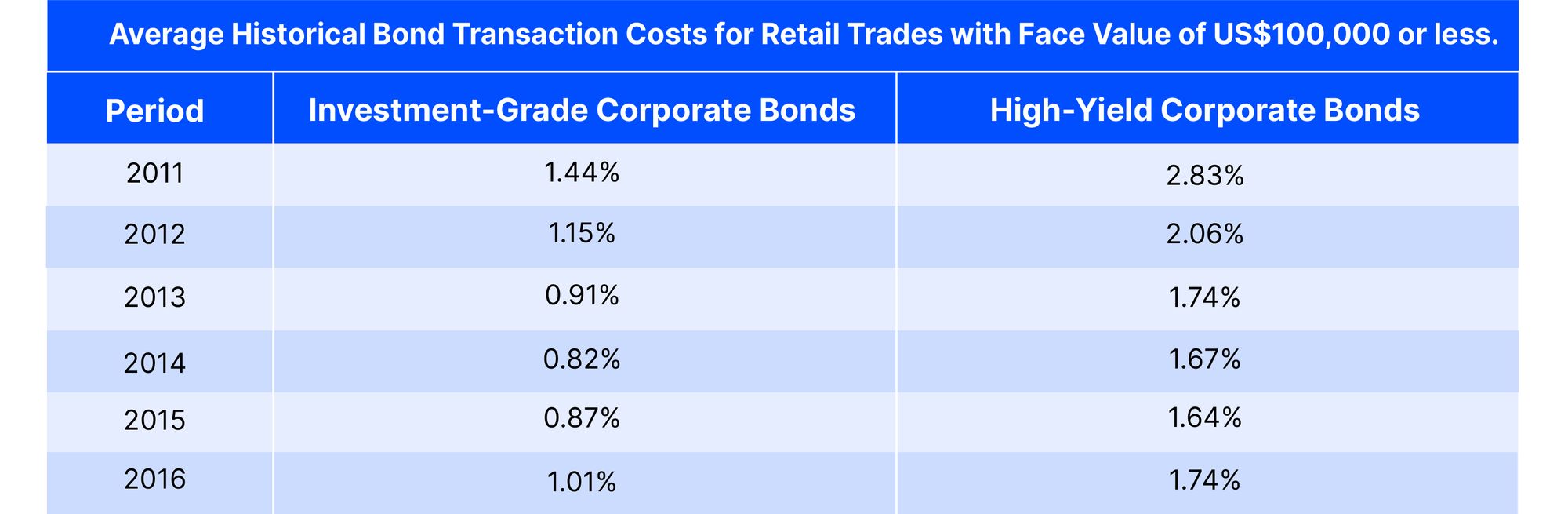

Benefit 4: Lower Transaction Costs

As a consequence of its over-the-counter (OTC) nature, there’s often a lack of clarity and transparency in pricing data and transaction fees for corporate debt. Rather than explicit commission fees, transaction costs are often imputed through a markup on the price of the debt security. In a report by S&P Dow Jones Indices in June 2016, the average implied transaction costs for investment-grade corporate bonds are at 1.01%, while high-yield corporate bonds had an implied transaction cost of 1.74% (for retail trades with a face value of US$100,000 or less).

Source: S&P Dow Jones Indices (June 2016), Zero One

With the application of DLT to the corporate debt market, the transaction costs involved with trading can be driven down due to a reduction of intermediaries in tandem with more transparent pricing data for investors. This will eventually bring the corporate debt market closer to the equities market online, with zero-dollar trading championed by brokerages such as Robinhood and Charles Schwab.

DLT for Issuers: More Companies Such as Startups & SMEs Can Now Issue Debt

Benefit 1: Significantly Reduce Debt Issuance and Servicing Costs by Up to 97%

HSBC and the Sustainable Digital Finance Alliance estimate the cost of a standard bond issuance with a value of US$100 million and 20-year maturity at US$3.6 million. As most bond transactions are facilitated over-the-counter (OTC), a large portion of the total costs consequently comes from intermediaries such as rating agencies, law firms, brokerages, and custodian/trustee banks.

With the application of DLT to the debt issuance and servicing, the required intermediaries involved are significantly reduced. Instead of relying on brokers to matchmake companies to investors, DLT could transform the traditionally OTC corporate debt market into a digital exchange similar to how stocks are traded. This significantly reduces the cost of issuing and servicing debt, with the same HSBC report estimating the cost of a full DLT-automated issuance to be US$127,000 for a bond of the same notional amount and maturity ‒ effectively a 97% cost reduction.

Benefit 2: Broaden Sources of Funding for Start-ups and SMEs

Given the high costs associated with issuing and servicing debt, most start-ups and SMEs are traditionally priced out of the corporate debt market. To put this into perspective, the average U.S. corporate bond issue size in 2018 was US$837 million ‒ an amount usually beyond the required capital raising a start-up or SME needs. This leaves them the option of taking an often more restrictive loan from a bank or diluting ownership through issuing shares to investors ‒ both of which aren’t always ideal for a small company.

A DLT-powered corporate debt market can allow companies better access to the lending pool and reduce barriers to entry. SMEs and startups could issue debt at lower sizes without hefty fees for issuance and servicing. This can be in the form of longer-term bonds, shorter-term notes, or commercial papers. Through DLT, issuers could also enjoy better access to a broader range of target investors and face reducing obstacles for cross-border transactions.

Conclusion: A Glimpse into the Digitized Future

Despite the nascent development phase of DLT and its application to corporate debt, DLT is likely to play a key role in upheaving the status quo of the market in the next decade.

For investors, DLT can pave the way for the establishment of digital debt exchanges that carry a wider variety of debt instruments across different risk profiles in smaller token denominations. These corporate debt securities could be issued by either multinational companies or even bootstrapping start-ups. In addition, investors of any level can invest any amount in corporate debt and encounter minimal downtime as a DLT-powered exchange allows instant KYC verification and real-time settlement of trades.

For issuers, DLT allows both multinational companies and budding startups to raise any amount of money from anyone in the world. Instead of going through the tedious and expensive alternatives of bank financing, equity raises, or OTC bond issuances, companies ‒ especially start-ups and SMEs ‒ can simply use DLT to issue debt online and tap into a wider range of investors, even from different geographies. And with smart contract automation handling administrative work, companies can instead focus their efforts and newfound funding on further developing their core businesses.

Investors and issuers alike would be well-advised to keep tabs on distributed ledger technology development and its potential to reshape the corporate debt market as we know it.

ADDX is your entry to private market investing. It is a proprietary platform that lets you invest from USD 10,000 in unicorns, pre-IPO companies, hedge funds, and other opportunities that traditionally require millions or more to enter. ADDX is regulated by the Monetary Authority of Singapore (MAS) and is open to all non-US accredited and institutional investors.

![[Report] Unlocking the Potential of Digitised Debt](/insights/content/images/2021/05/digitised-debt.jpeg)

![[Report] Emerging Enterprise SaaS Startups In China](/insights/content/images/2021/05/Emerging-enterprise.jpeg)