Executive Summary:

Millennials and Gen-X are Quickly Growing into Their Role as Investors of the Future.

Over the next decade, more than US$15 trillion of wealth is expected to be passed down from Baby Boomers to younger generations such as Millennials and Gen-X. This transfer is set to change the dynamics of the current investment landscape, as younger investors have vastly different expectations on pricing, speed, and access to opportunities.

Millennials and Gen-X: More Beliefs-Driven, Collaborative, and Demanding.

Young investors differ from the current generation in three key ways: they are more focused on values & trends they believe in, they collaborate and crowdsource ideas with peers, and they often expect on-demand and fully digital experiences. We see these characteristics exhibit themselves in the bullish 2020 growth of ARK Invest’s ETFs, the rise of Reddit’s Wall Street Bets, and the greater demand for a convenient and digital investment experience, according to Accenture data.

Traditional Financial Institutions Need to Adapt to Win Over Investors of the Future.

To remain at the forefront of servicing investors, traditional financial institutions will need to adapt to the expectations and demands of future investors. There are three key areas for improvement: offering more diverse investment opportunities (private equity, ESG funds, etc.), offering services at more flexible and accessible price points, and offering more personalized and convenient processing.

Millennials and Gen-X are Quickly Growing into Their Roles as Investors of the Future

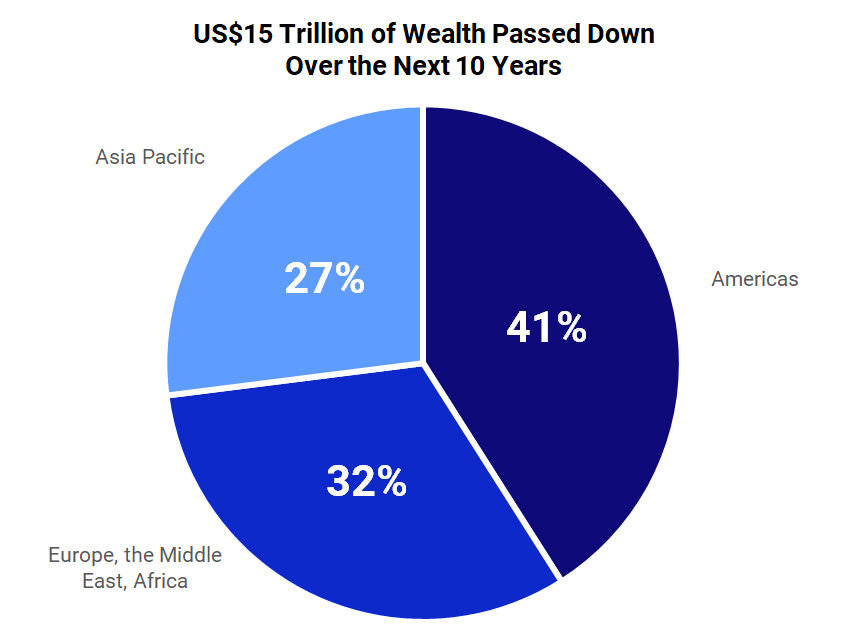

Over the next 10 years, more than US$15 trillion of wealth is expected to be passed down from Baby Boomers to younger generations such as Millennials and Gen-X. This is according to a study commissioned by IQ-EQ that expects 41% of this wealth transfer to come from the Americas, 32% from Europe, the Middle East, and Africa (EMEA), and 27% from the Asia Pacific.

This great transfer of wealth is remarkable given that it is set to change the dynamics of the current investment landscape, as younger investors have vastly different expectations on pricing, speed, and access to opportunities from prior generations.

As younger investors take the driver’s seat on where and how investment dollars are allocated, traditional financial institutions will need to adapt to the times and ensure that they remain at the forefront of servicing the investment clients of the future

Source: IQ-EQ, Barton Consulting, Wealth-X, Zero One

Millennials and Gen-X: More Beliefs-Driven, Collaborative, and Demanding

Younger investors differ from the current generation in three key ways: they are more focused on values & trends they believe in, they collaborate and crowdsource ideas with peers, and they often expect on-demand and fully digital experiences. We elaborate more on each of these below.

More Beliefs-Driven and Tolerant of Volatility

According to a study by Public.com and Finimize, millennials are far more likely to invest in trends they believe in. 53% of those aged 18 to 29 say that they would put money behind trends they believed in, versus only 39% for those aged 66 and above. These “beliefs-driven” investments range from disruptive companies that are changing their respective industries (e.g. stocks like Tesla in automotive or Square in payments) to companies that meet environmental, social, and governance (ESG) transparency requirements and have made commitments to improve social and environmental impact. In a July 2020 UBS Investor Watch, 69% of millennials said they were highly interested in sustainable investing, as opposed to 44% of baby boomers.

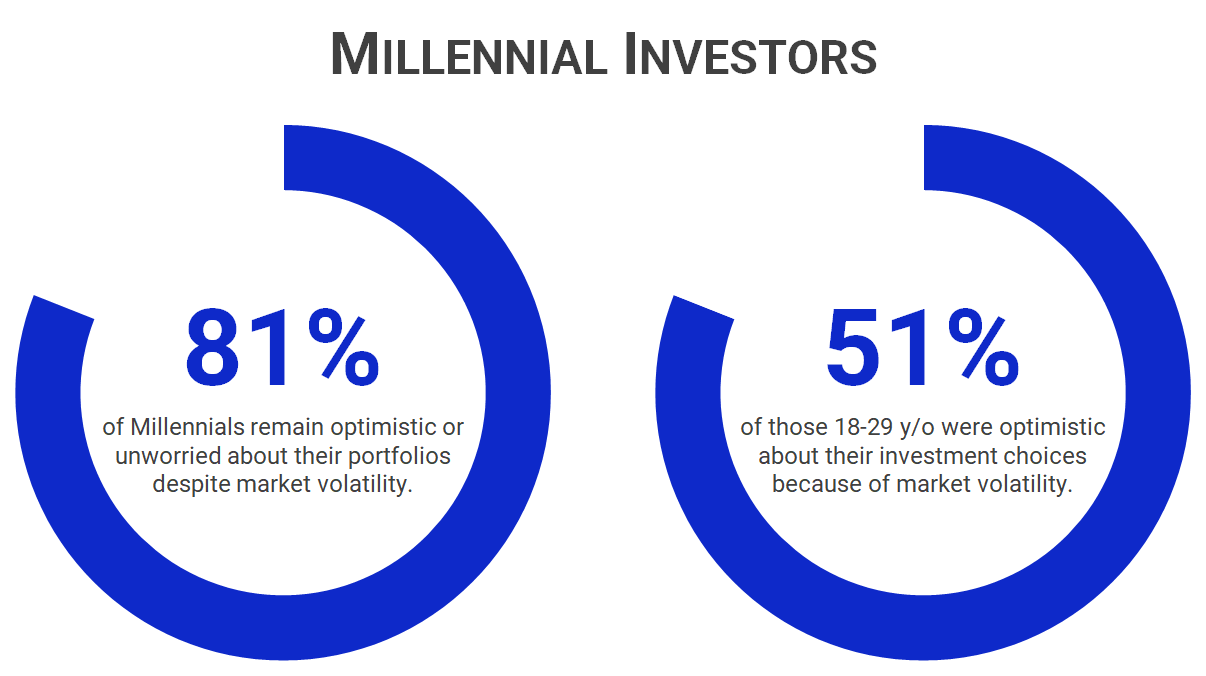

With strong convictions for values and beliefs championed by companies they’ve invested in, young investors – in general – hold more bullish views on their investments and are unfazed by market volatility. The same study mentioned that nearly 81% of millennials remain optimistic or unworried about portfolios despite market volatility and that 51% of millennials surveyed were optimistic about their investments precisely because of market volatility.

Source: Public and Finimize, Zero One

Case Study of ARK Invest and ARKK ETF

One example that highlights this well is the rise of ARK Invest, known for its themed exchange-traded funds (ETFs) with holdings in disruptive technologies such as Tesla (TSLA), Spotify (SPOT), Teladoc (TDOC), Roku (ROKU), and Square (SQ).

During 2020, the stock price of its flagship ETF ARK Innovation (ARKK) shot up nearly 150%, experiencing assets under management (AUM) growth of 882% from US$1.8 billion to US$17.7 billion and garnering a devoted young investor following of “ARK believers.”

Even with the ARKK stock price falling as much as 20% in 12 trading days from its peak on Feb 12 – ARKK investors (many of whom are younger) have remained staunch in their holdings, with the ETF’s AUM overall increasing 36% from US$17.7 to US$24 billion from January to April 2021. This highlights the confidence and bullish outlook of young investors for investments they strongly believe in, regardless of market fluctuations or volatility.

More Collaborative - Knowledge Sharing and Crowdsourcing Investments

Because of new tools and the internet at their disposal, younger investors are a lot more collaborative and resourceful than previous generations of investors were. MagnifyMoney found that nearly 6 out of 10 investors aged 40 and younger are members of investment communities or forums such as Reddit.

While the rise of the forums like Reddit’s “Wall Street Bets” has certainly been contentious and subject to criticism by many parties, the fact remains that the willingness of younger investors to share information and collaborate on investment strategies has led to more knowledge sharing and ultimately brought increased awareness to the role of managing investments collaboratively.

Source: Reddit r/wallstreetbets

More Demanding - Expectations of an On-Demand, Personalized, and Fully Digital Experience

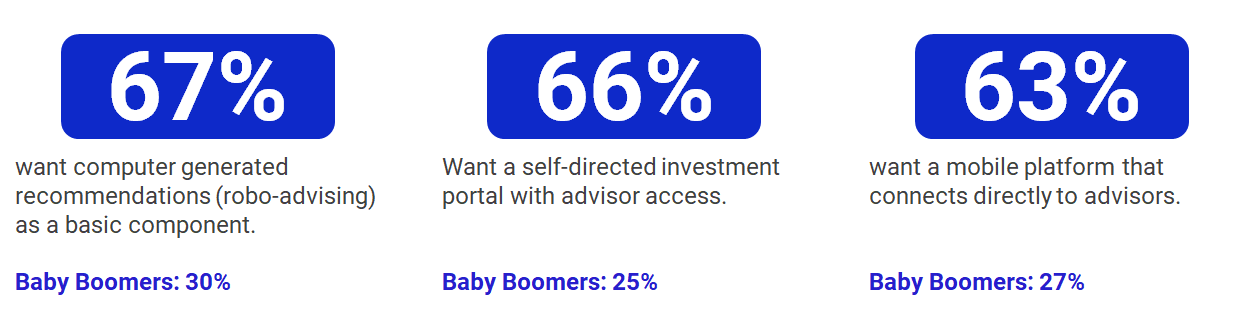

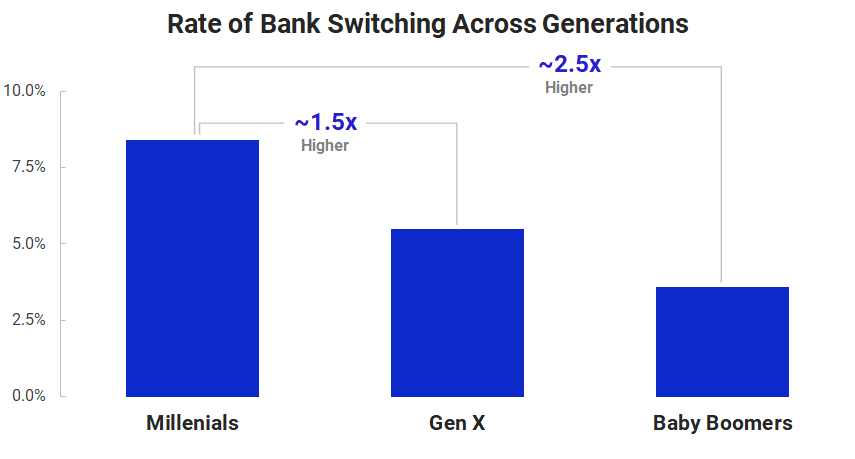

Because of this vast amount of information sharing and collaboration, younger investors are also more financially knowledgeable and technologically savvy. Accenture research has shown that 67% of millennials want computer-generated recommendations (robo-advising) as a basic component in investing, as compared to 30% for Baby Boomers. 66% would rather a self-directed investment portal where they can manage investments themselves, against 25% of Baby Boomers.

These emphasize the high expectations young investors have in their investing experience: that it should be as convenient as e-Commerce: 100% digital, on-demand, quick to execute, personalized, and cheap.

Source: Accenture, Zero One

Traditional Financial Institutions Need to Adapt to Win Over Investors of the Future

To remain at the forefront of servicing investors, traditional financial institutions will need to adapt to the expectations and demands of future investors. In our view, this means future-proofing by doing three things:

- Offering Investors More Investment Opportunities

- Offering Investors More Access to Services and Advisory / Research Resources

- Offering Investors More Personalization & Convenience

We elaborate more on each below.

1: Offering Investors More Investment Opportunities

As discussed in the section above, the new generation of younger investors wants to back companies whose values and beliefs, potential for disruption and exponential growth, and long-term goals resonate with them. This can range from ESG-oriented companies to disruptive technology types of businesses. However, not all of these investment opportunities are easy to access and many – such as cutting-edge startups – exist outside the traditional public securities markets.

Currently, it can be difficult for investors to access these types of asset classes given varying regulatory requirements and minimum investment sizes. Private bonds, for example, sometimes require minimum investment sizes of at least $200,000 – barring out most investors from tapping those opportunities. Venture capital and private equity opportunities often cost even more to buy into and are also often restricted to investors with very high net worth.

One way of providing investors with more opportunities is therefore offering them the ability to easily invest across multiple different asset classes from both the public and alternative investment worlds. This can range from traditional public equities, fixed income instruments, earlier stage venture capital, later-stage private equity, real estate, and even cryptocurrencies. Through the use of blockchain technology, underlying assets can be tokenized into smaller denominations which makes it easier for investors to diversify and trade across multiple opportunities.

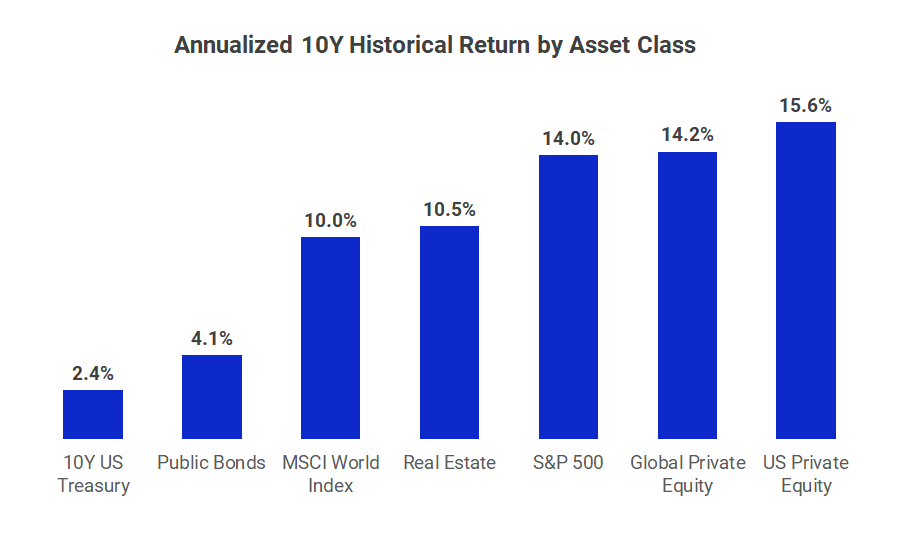

As seen in the chart below, different asset classes provide different return profiles based on the level of risk investors are comfortable with. Making it easy for investors of the future to choose and diversify across these should therefore be a key capability that institutions should work on.

Source: Cambridge Associates Index and Selected Benchmark Statistics (June 2020), Bloomberg, Zero One

2: Offering Investors More Access to Services and Advisory / Research Resources

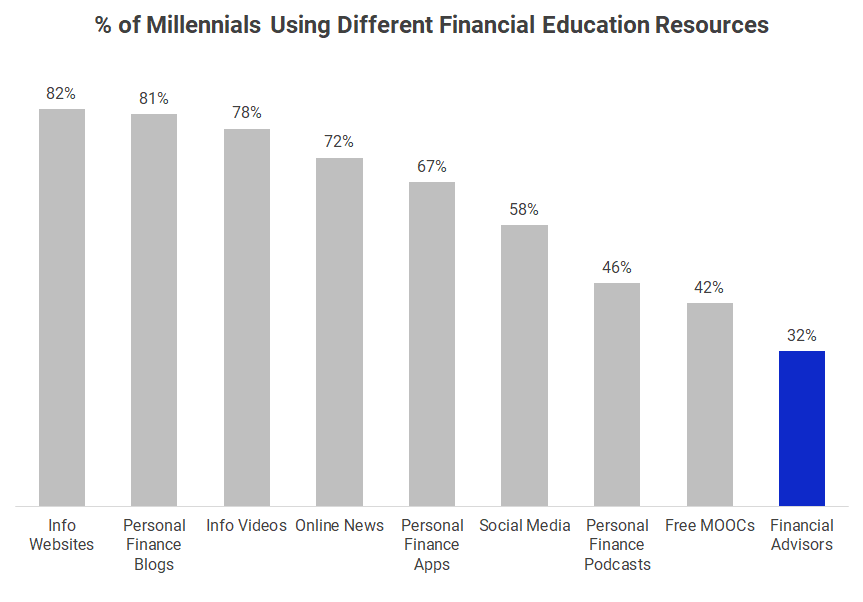

Beyond making it easier for investors of the future to tap different asset classes, institutions should also focus on providing investors more accessibility in the form of robust 24/7 mobile app services with intuitive UX and UI, along with more affordable access to quality financial advisors and investment research resources.

In today’s environment, financial and wealth advising remains a high-touch and very manual service, causing it to be quite expensive and prohibitive for most investors. Whereas older investors may have been more willing to pay a two and twenty fee structure due to lack of awareness or understanding, Millennials have been found to be far more price conscious, according to Accenture, with 41% of millennials discussing fees quarterly, versus just 14% of Baby Boomers. In fact, MagnifyMoney has found that 46% of young investors have turned to social media instead for investment research and advice, with Youtube (41%), Tiktok (24%), and Instagram (21%) being the most common platforms used.

Financial institutions should find ways to deliver investment services in a more accessible manner and price point – especially to younger investors. In the same way that technology has revolutionized the trading industry to now offer zero-commission trades, technology also has the ability to drastically reduce fixed costs for advisory and research resources.

Today, there are already robo-advisors such as Wealthfront and Stashaway that have managed to drive more efficiencies through digitization and automation thereby allowing more investors to access these resources. As millennials and generation X take the center stage, we expect this to only become more ubiquitous.

Source: Global Finance Literacy Excellence Center (May 2019), Bloomberg, Zero One

3: Offering Investors More Personalization & Convenience

Institutions of tomorrow will have access to more technologies and data sets on their investors than ever before. This opens up unique opportunities to offer investors more personalized and curated products & services.

For example, instead of manually collecting KYC and customer due diligence the old-fashioned way, companies could simply store this information and regularly update it on the blockchain. That way, any firm could simply request access to the customer’s data to automatically approve account openings within minutes instead of days.

Armed with the customer’s investment preferences and risk tolerance levels, algorithms could then intelligently suggest which investment opportunities might be the most relevant or attractive at any point in time. Features such as goal-based investing and rule-based investing could also be implemented to provide investors of the future with personalized investment services in a cost-efficient and scalable manner.

Source: Gallup (2018), Bloomberg, Zero One

Conclusion

In conclusion, the investment and wealth management landscape will shift dramatically as young Millennial and Gen-X investors take the reins and decide how and to whom their investment dollars will be allocated. As Millennials and Gen-X’ers are more beliefs-driven, collaborative, and demanding, outdated investment offerings and services will no longer suffice for the next generation of investors. Traditional financial institutions will need to quickly adapt to the times to ensure that they remain at the forefront of servicing the investment clients of the future.

ADDX is your entry to private market investing. It is a proprietary platform that lets you invest from USD 10,000 in unicorns, pre-IPO companies, hedge funds, and other opportunities that traditionally require millions or more to enter. ADDX is regulated by the Monetary Authority of Singapore (MAS) and is open to all non-US accredited and institutional investors.

Copyright 2021, Clearsight Systems Pte. Ltd. This research is commissioned by ADDX in collaboration with Zero One. Please read our full disclaimer and

important terms & conditions at the back of this report. You acknowledge that this document is provided for general information purposes only. Nothing in

this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or

strategy.

Disclaimer – User Agreement Terms & Conditions

If you do not agree to these terms, please do not use this document. Clearsight Systems Pte. Ltd. (“Zero One”) provides this document to you subject to compliance with the terms and conditions set forth herein. By using this document, you hereby accept and agree to comply with the terms and conditions set forth in this User Agreement. This User Agreement is a binding agreement between you and Zero One, and governs your access and use of this document.

Disclaimer, Exclusions, and Limitations of Liability

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information. Zero One is not a broker/dealer, investment/financial adviser under Singapore law or securities laws of other jurisdictions and does not advise individuals or entities as to the advisability of investing in, purchasing, or selling securities or other financial products or services.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Zero One is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Zero One shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance. You understand that employees, shareholders, or associates of Zero One may have positions in one or more securities mentioned in this document. This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Zero One considers reliable and endeavours to keep current, Zero One does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. To the fullest extent permissible pursuant to applicable law, Zero One disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Zero One does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Zero One nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Zero One’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Zero One to any registration requirement within such jurisdiction or country. Zero One is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

Indemnification

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Zero One and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Zero One shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Zero One expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

Severability

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

Governing Law

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Zero One and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

![[Report] What Will Investors Of The Future Want?](/insights/content/images/2021/05/ADDX_BrandRefreshPosts_Batch2_1200X800-01.jpg)

![[Report] Private Markets: A Primer into the Under-Tapped Asset Class](/insights/content/images/2021/05/ADDX_BrandRefreshPosts_Batch2-03.jpg)