Structured products are investment solutions that typically combine a bond and a derivative where the return is linked to the performance of one or more underlying assets. Structured products give accredited investors access to non-traditional return profiles, exposure to a wide range of underlying asset classes and ability to act on market views.

Introduction to structured products

Structured products are hybrid investments that typically comprise of two components: (1) a bond/note and (2) a derivative.

The derivative component is most commonly an option. Options are based on the value of an underlying asset, such as stocks, bonds, commodities, currencies, interest rates, and market indices. You do not invest directly in the underlying asset(s) when purchasing structured products.

The two components combined create a unique return on investment that is linked to the performance of the underlying asset(s).

Structured products allow accredited investors to express a market view (bullish, bearish or neutral) and gain exposure to a variety of underlying asset classes.

Illustrative example of a structured product

Why consider investing in structured products?

Here are several reasons to consider structured products, keeping in mind that each structured product is unique and the risk-return is dependent based on the type.

1. Diversify your portfolio through a wide range of underlying securities

Structured products act as a portfolio diversifier by providing exposure and access to derivatives and underlying asset classes that may otherwise not be readily accessible. Structured products can help to broaden your sources of returns without actually owning the underlying asset.

2. Preserve your investment value with built-in downside protection with certain types of structured products

Some types of structured products, like 100% minimum redemption notes, offer the investors a minimum redemption level equal to their nominal amount invested at maturity. This format provides a safety net for invested nominal amount regardless how the underlying asset performs.

3. Potentially enhance your returns by taking on market views

Payoffs are dependent on specific scenarios and you can potentially enhance overall returns if the underlying asset(s) performs in line with your market views.

What are some types of structured products?

Structured products generally fall into four categories, minimum redemption at maturity, yield enhancement, participation or leverage. Two popular categories are:

Minimum Redemption Notes (MRNs)

What are Minimum Redemption Notes?

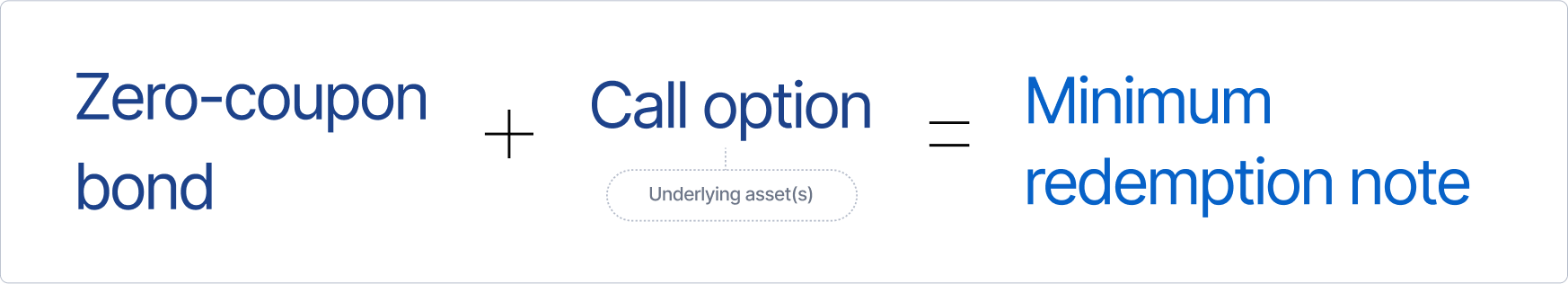

They are typically structured as a zero-coupon bond (a bond that pays no interest until it matures) plus an option. Subject to the creditworthiness of the issuer, the zero-coupon bond provides the minimum redemption at maturity while the option provides the opportunity to participate in the movement of the underlying asset(s)’s value.

Who are MRNs suitable for?

MRNs are potentially appealing for more conservative investors who have a lower risk tolerance but still want the potential to benefit from the performance of markets outside of fixed income (i.e. stock market). MRNs allow investors to, subject to the creditworthiness of the issuer, preserve their initial investment value while offering participation on the performance of the underlying asset.

Illustrative example of a MRN

What is an example of a MRN?

You invest $10,000 in a one-year 100% MRN that offers a zero-coupon bond plus a call option linked to the S&P 500 index, on the basis that you believe the index will rise in value. This means for your initial investment of $10,000 on day one and, subject to the creditworthiness of the issuer, you receive $10,000, regardless how the S&P 500 performs. Your payoff depends on the scenario at maturity.

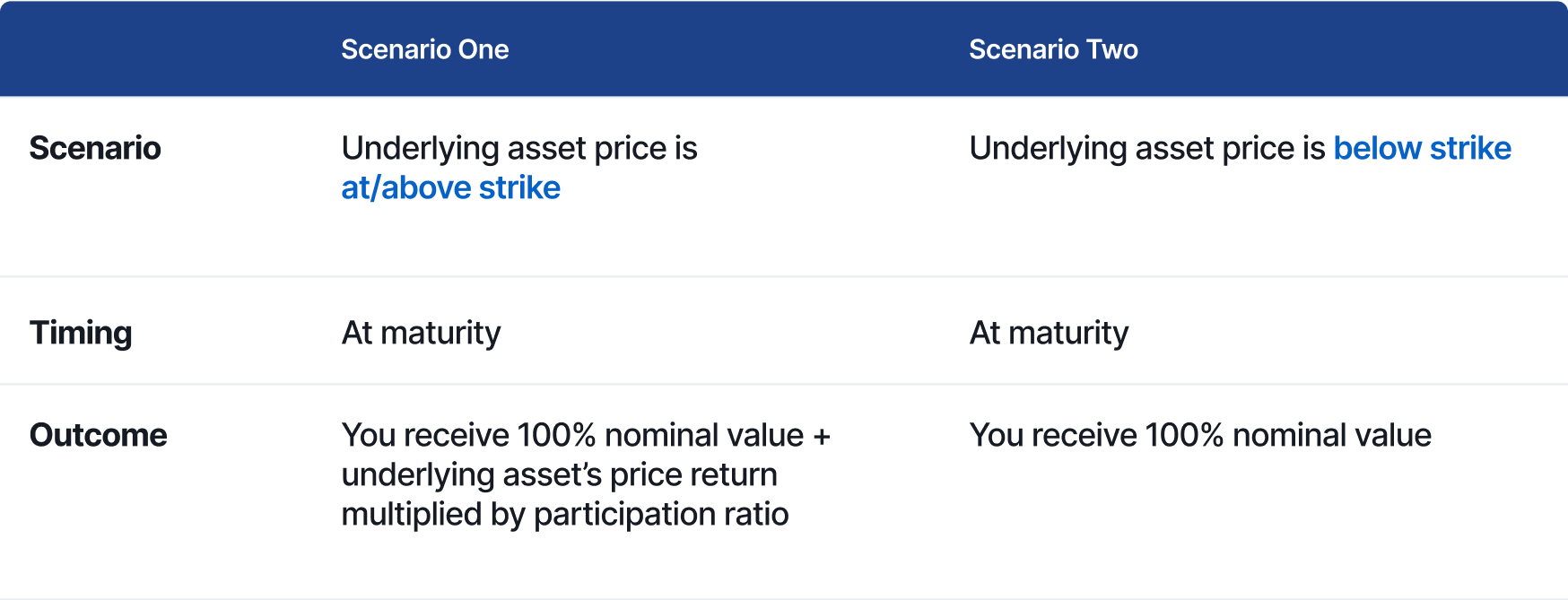

What are the different scenarios?

- If the index rises in value at/above the strike price at maturity:

- You receive a return in addition to the 100% nominal repayment. The return on the index is (i.e. 15%) is multiplied by a participation rate (i.e. 120%) to determine part of the payoff

- If the index decreases in value at maturity:

- Subject to the creditworthiness of the issuer, you still receive your $10,000 nominal investment in full.

Yield Enhancement Notes

What are Yield Enhancement Notes?

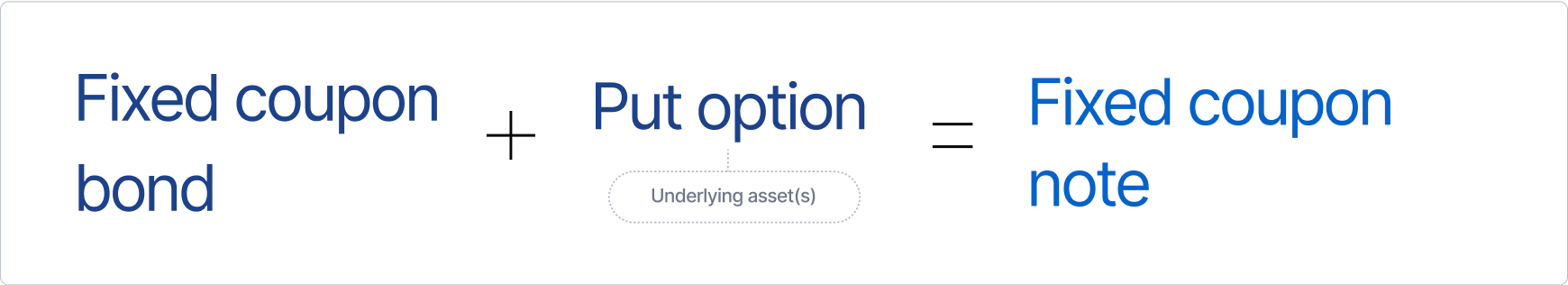

Yield Enhancement Notes are structured products that aim to provide enhanced returns linked to the performance of an underlying asset(s). Fixed Coupon Notes (FCNs) are examples of yield enhancement notes and unlike MRNs, the invested nominal value is at risk in exchange for enhanced yield. The underlying asset(s) for FCNs is typically a stock or basket of stocks.

Who are FCNs suitable for?

FCNs can be designed for investors with moderate to high-risk appetites and with a neutral to slightly positive outlook of the underlying asset(s). There is also the possibility of receiving physical delivery of the underlying asset if the underlying asset performs poorly, i.e. below the strike price on the final fixing date, so investors of FCNs need to be comfortable taking on that risk. In the case where the settlement type is cash redemption, the investor will receive a final redemption amount in proportion to the performance of the underlying asset below the strike price, which may be less the investor’s principal amount invested.

Illustrative example of a FCN

What is an example of a FCN?

You invest in a $10,000 one-year FCN with a monthly 1.2% coupon and put options linked to a basket of stocks, on the basis that you believe the performance of the underlying stocks will remain the same or rise slightly in value. You receive monthly fixed coupons and the performance of each underlying stock is evaluated on an “observation date.” This observation date is at regular intervals and is a period where the underlying stock prices are measured relative to the knock-out/autocall levels. Your payoff depends on the scenario at any given observation date and/or at maturity

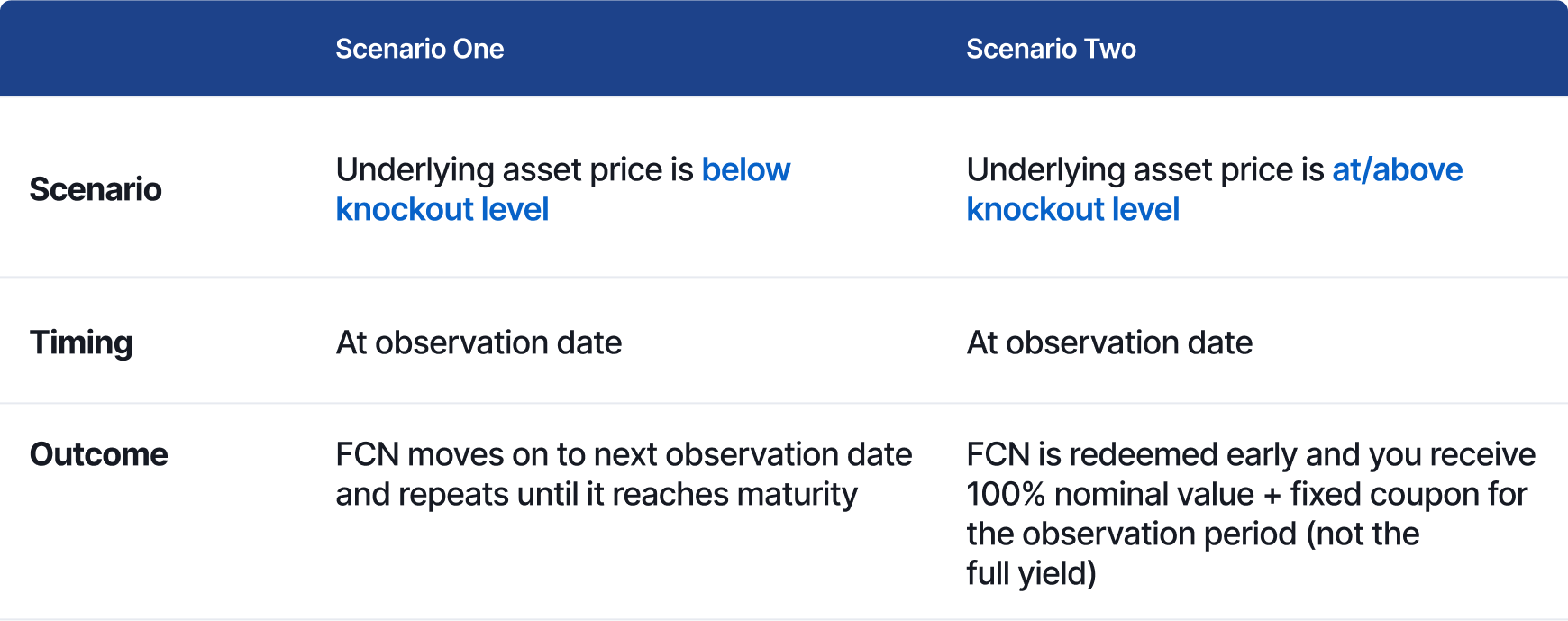

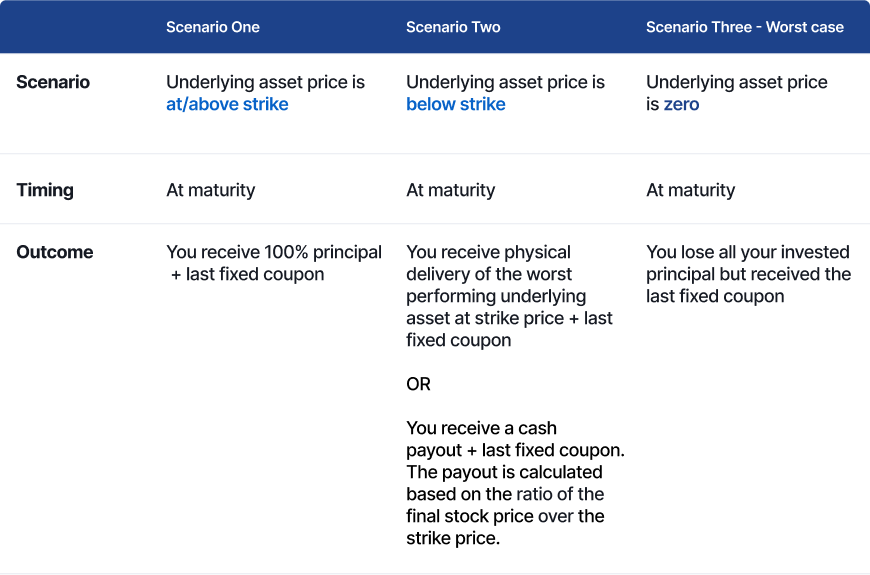

What are the different scenarios?

- At each observation date:

- If an underlying asset closes at/above the knock-out level, the FCN will be redeemed early and you receive 100% nominal value plus any fixed coupon. If this happens, you will not be able to collect the full yield given the early redemption.

- If all underlying assets close below the knock-out level at an observation date, then the FCN simply continues to the next observation date and repeats until it reaches maturity.

- At maturity:

- If all the underlying assets are valued at/above their respective strike levels, you receive 100% of nominal value in addition to the last periodic fixed coupon. This means you received your nominal repayment in full in addition to gaining the full yield.

- If any of the underlying assets fall below strike level, you are obliged to receive physical delivery of the worst performing underlying asset in the basket at the strike price but also receive the last periodic fixed coupon. This is a scenario where you will end up owning the actual underlying asset(s). Alternatively, if cash settlement method is applicable, you would receive a monetary payout instead of stock at maturity. This cash payout is calculated based on the ratio of the final underlying stock price over its strike price for each denomination held.

- If any of the underlying asset prices close at zero, you lose all your invested nominal but still receive the last periodic fixed coupon.

Structured products provide a wide range of investment solutions across the risk/return spectrum, from minimum redemption structures like MRNs to higher risk structures like FCNs. As a hybrid investment, structured products offer you access and ability to capture enhanced returns. You can take advantage of short-term market opportunities with structured products, acting on your market views and accessing non-traditional sources of returns that can complement your investment portfolio.

Key risks:

Capital risk: As return of a structured product depends on the performance of the underlying assets, adverse price movements may cause a loss of capital.

Credit risk of the issuer: The issuer might fail to fulfill its obligations in the event it becomes insolvent. There is a possibility of losing the entire invested capital.

Liquidity risk: Structured product investments may have no or limited liquidity before maturity. The issuer is not obligated to provide a liquid secondary market, and investors may not be able to sell your investment.

The risks mentioned above are only a part of the broader risk considerations that any potential investor should evaluate before making an investment decision. Investors should carefully review the full risk disclosures provided in the relevant product documentation, including the Termsheet and Information Memorandum, before making any investment decisions.

This is not an advertisement making an offer or calling attention to an offer or intended offer. The information contained herein are for informational purpose only and has not been independently verified to ensure its accuracy and fairness. Nothing in this article should be relied upon as a representation or warranty as to the future. Neither ADDX Pte. Ltd. (the “Company”) nor its affiliates accept any direct or indirect responsibility or liability for the information and contents supplied in this article or all losses, damages, costs and expenses incurred by the recipient or any party as a result of this article. In considering any investment or other performance contained herein, investors should bear in mind that past performance is no guarantee of future results.

Neither this article nor anything contained herein shall form the basis of any contract or commitment whatsoever and should not form the basis of any investment decision and should not be considered as advice or recommendation by the Company, its affiliates, representatives, directors, managers officers, employees, agents, to acquire any capital markets products.

This article is confidential and may not be copied, distributed or reproduced in any form for any purposes.

Full disclaimers here.

Company Registration Number: 202125312H