In the face of unprecedented monetary tightening and banking system disruption, many investors are wondering if the case for private equity still stands amid this uncertain environment.

The short answer? Yes. According to Hamilton Lane, a leading private markets investment manager – private equity funds have outperformed public equities over most of the past 20 years – even during the recent bull market for public stocks, and even after fees.

Learn more about why private equity outperforms even in down markets, and why it still plays an important role in diversifying and enhancing your long-term returns.

We highlight the key takeaways from Hamilton Lane’s 2023 Market Overview Report.

Investors await every move by the Fed as if it were the Great Wizard of Oz. We expect the Fed to see the future, ward off inflationary dragons, and save the economy.

The truth is probably further away from that.

While inflation is trending down and some argue that central banks may stop raising rates soon, the reality is that the Fed is no wizard. Some say they may have been too slow to hike rates in 2021 to tame inflation, and some say they may have now hiked too fast.

It’s tough to be the Fed. But as investors, if we can’t rely with predictability where inflation or rates might land, let’s focus on the facts.

Risk of recession may matter more than inflation and rates as key investment considerations for 2023

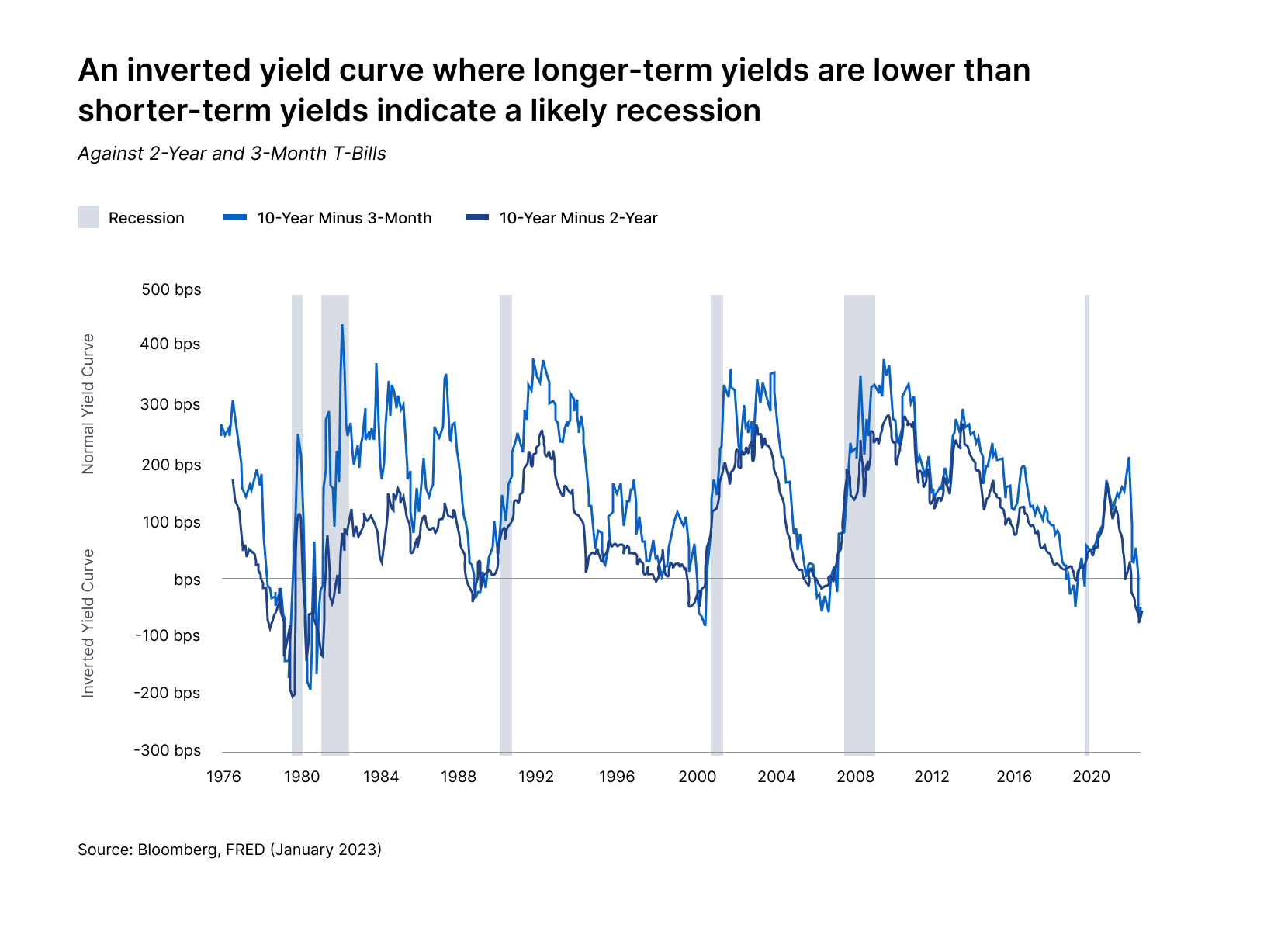

One of the most infallible economic indicators – the yield curve – is now signalling a potential recession. What is the yield curve and what do we mean?

When yields of longer-term interest rates, like 10-year US Treasury yields, are lower than shorter-term interest rates, like 2-year US Treasury yields, we say that the yield curve is inverted.

Why does this matter? It matters because over the course of history, almost every time the yield curve inverts – like in the case of today – a recession arrives.

So, does this mean we should put aside interest rates and inflation as key considerations for how to invest this year? One of the largest global private markets investment managers, Hamilton Lane, thinks these factors are likely to take a back seat.

They argue that how you invest and where you invest this year is likely be a function of whether we have a recession, and how deep it would be. They believe a recession is very likely; mild in the US and more severe in Europe, while China will likely escape one.

This means that investors need to be focusing on investing in companies or strategies in economies where their revenues and earnings are less impacted by recession.

Sounds straightforward, but it can be difficult to do.

Regardless of which macroeconomic scenario you subscribe to, let’s turn to some of Hamilton Lane's Market Overview data to review the historic performance of private and public markets across different scenarios to help you make a more informed decision.

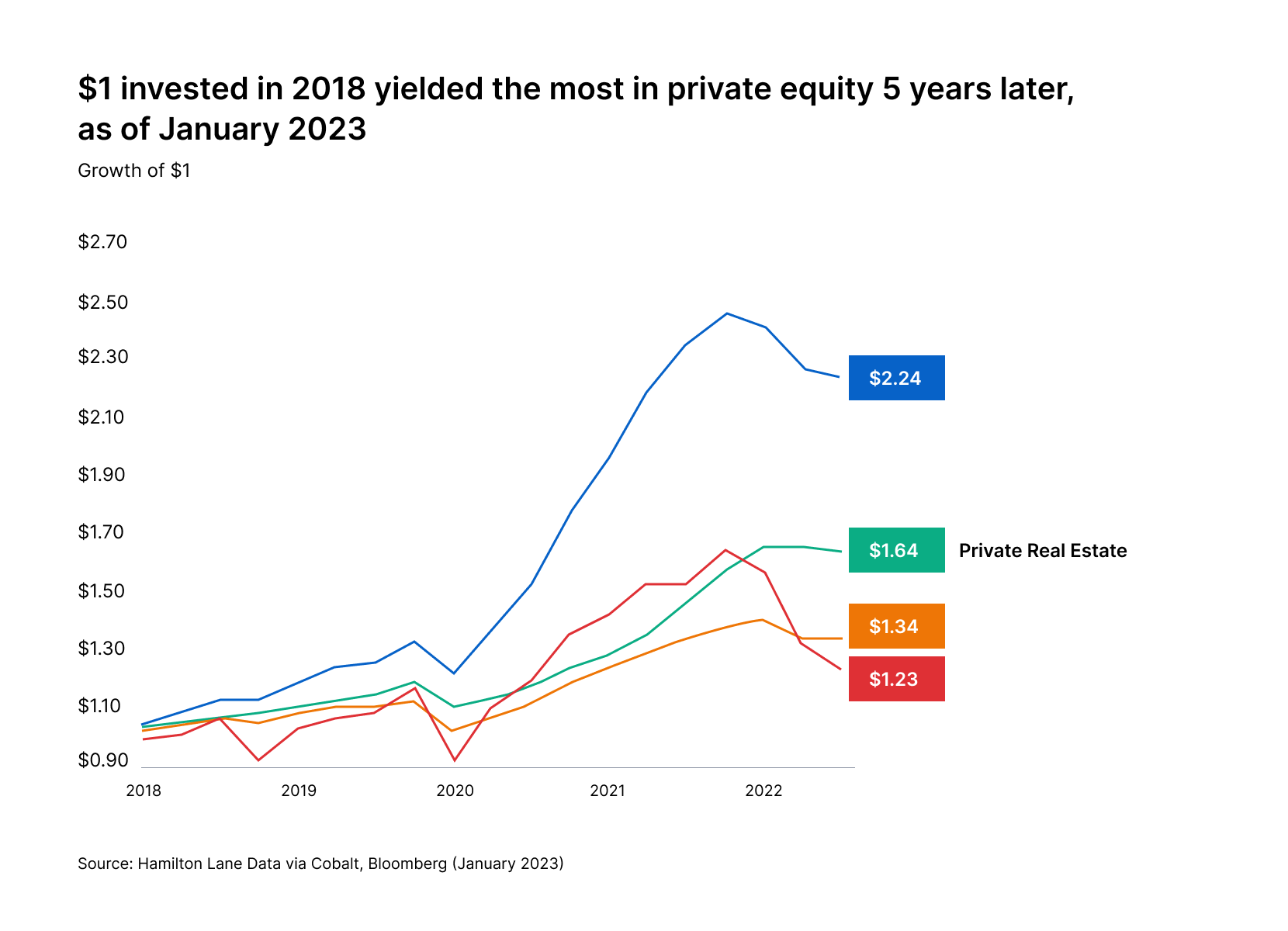

How $1 in 2018 returned more in private strategies vs public

First of all, no market – private or public – was immune to the impact of higher inflation and higher rates in 2022. But if we zoom out, the bigger picture looks more positive.

According to the data, $1 invested 5 years ago in 2018 yielded the most in private equity (PE) and the least in public equity, as of the start of 2023. Private equity returned $2.24, followed by private real estate at $1.64, private credit at $1.34, and public equities at $1.23.

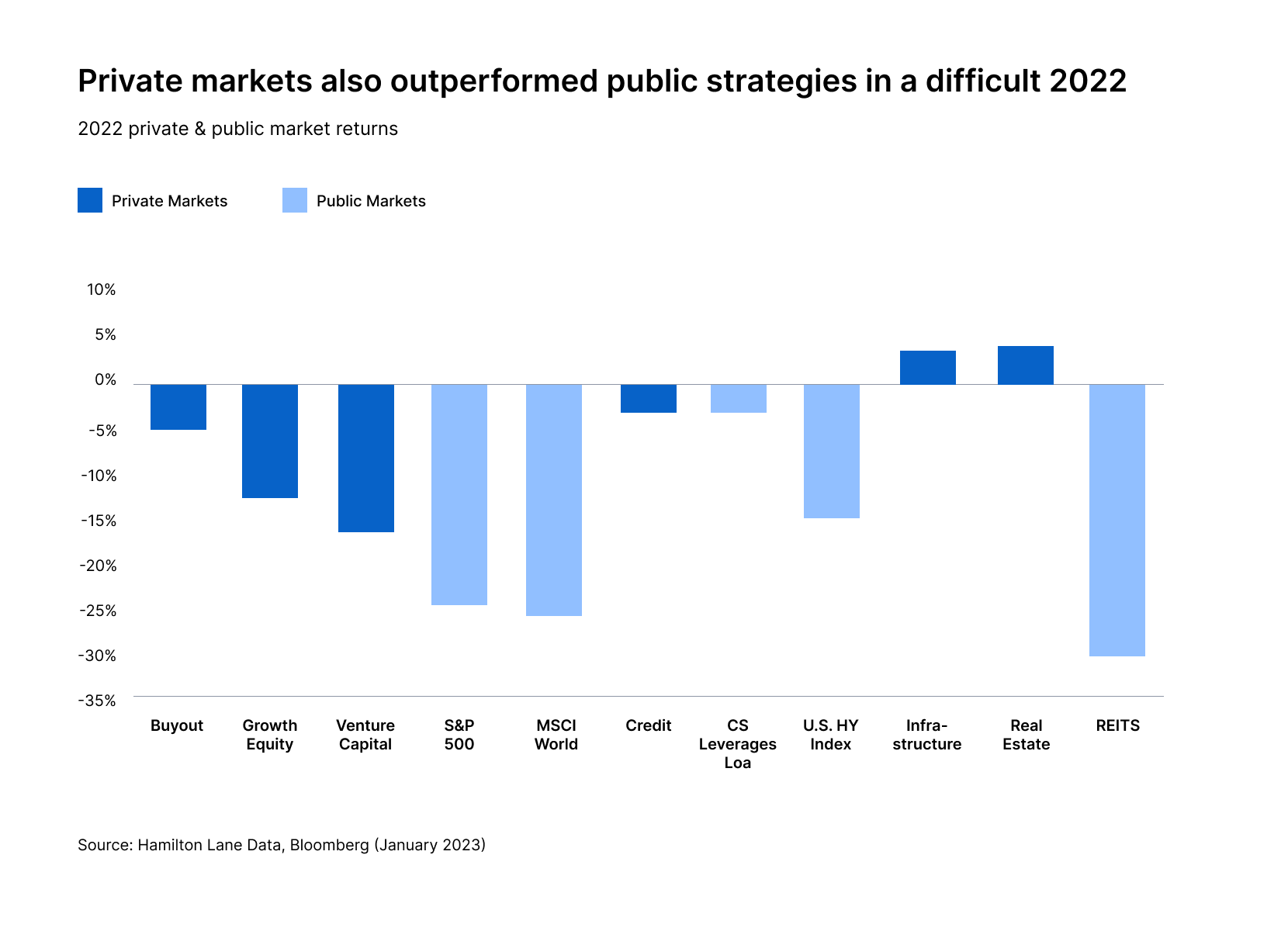

Even in a challenging 2022, most private markets strategies outperformed public strategies across the board through the end of Q3. And in some cases, by well over 1,000bps!

Historically, private equity outperforms public in down markets and across market environments

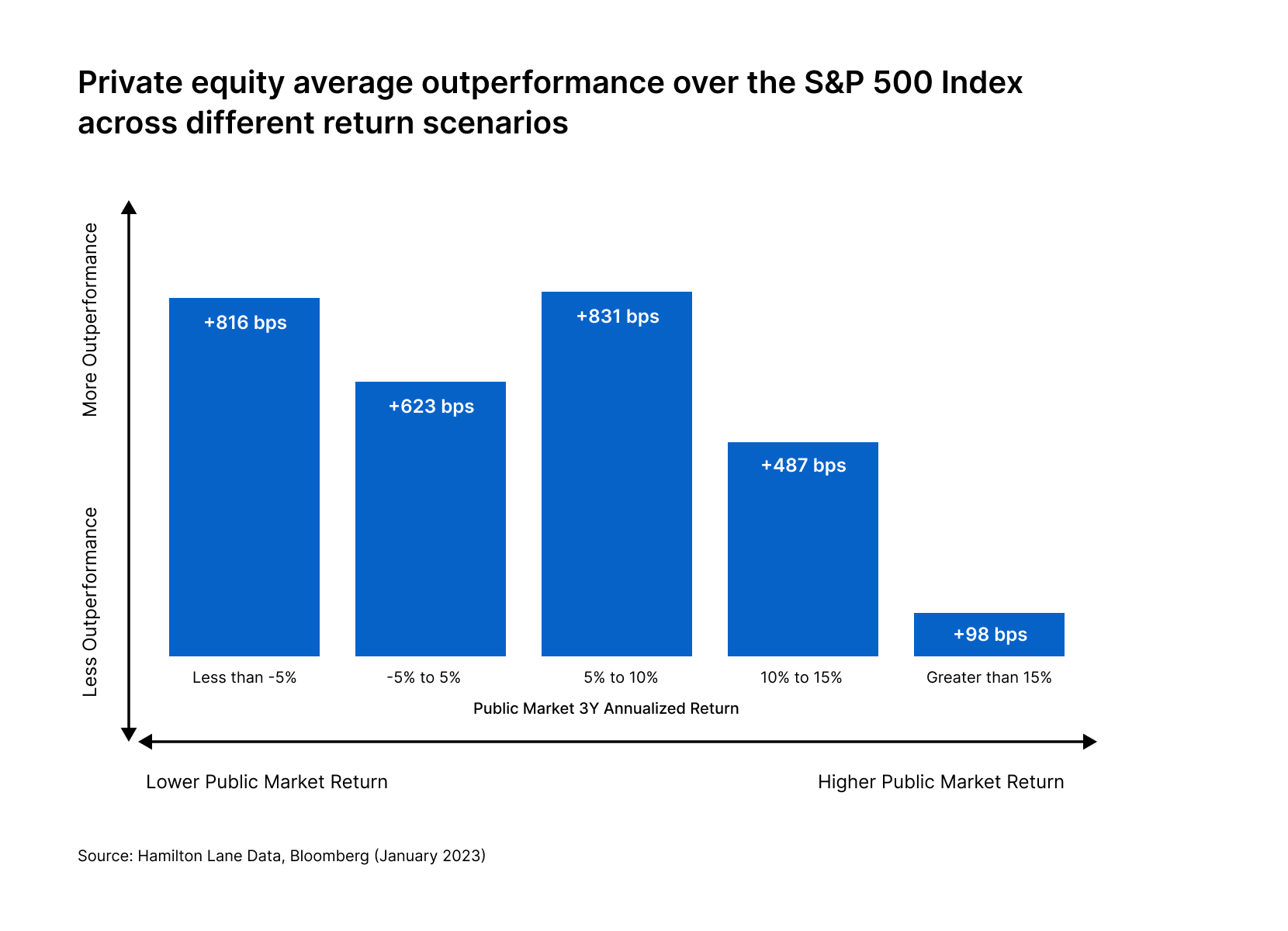

Looking at previous cycles, simply put, private equity outperforms in nearly any market environment. This Hamilton Lane chart here calls it a day. Sure, PE, on average, outperforms less when public markets are roaring, but it has historically outperformed. And contrary to popular belief, it can outperform even when public markets are down.

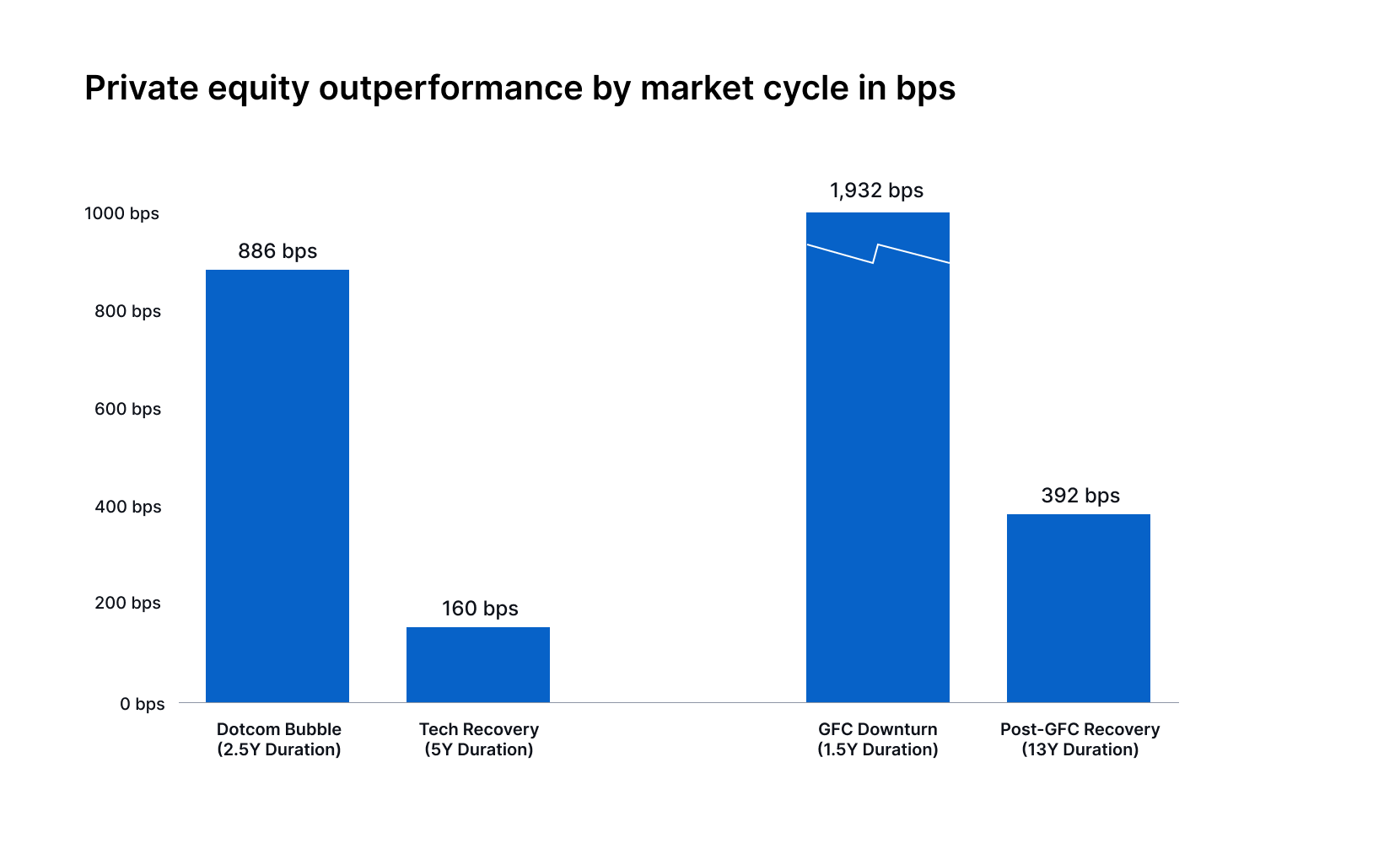

Even during both the dot-com bubble and Global Financial Crisis, private equity outperformed during both the downturn and recovery periods.

What about private market valuations – bogus or real?

Let’s start with the punch line. According to HL’s data, valuations are pretty fair across most private market sectors.

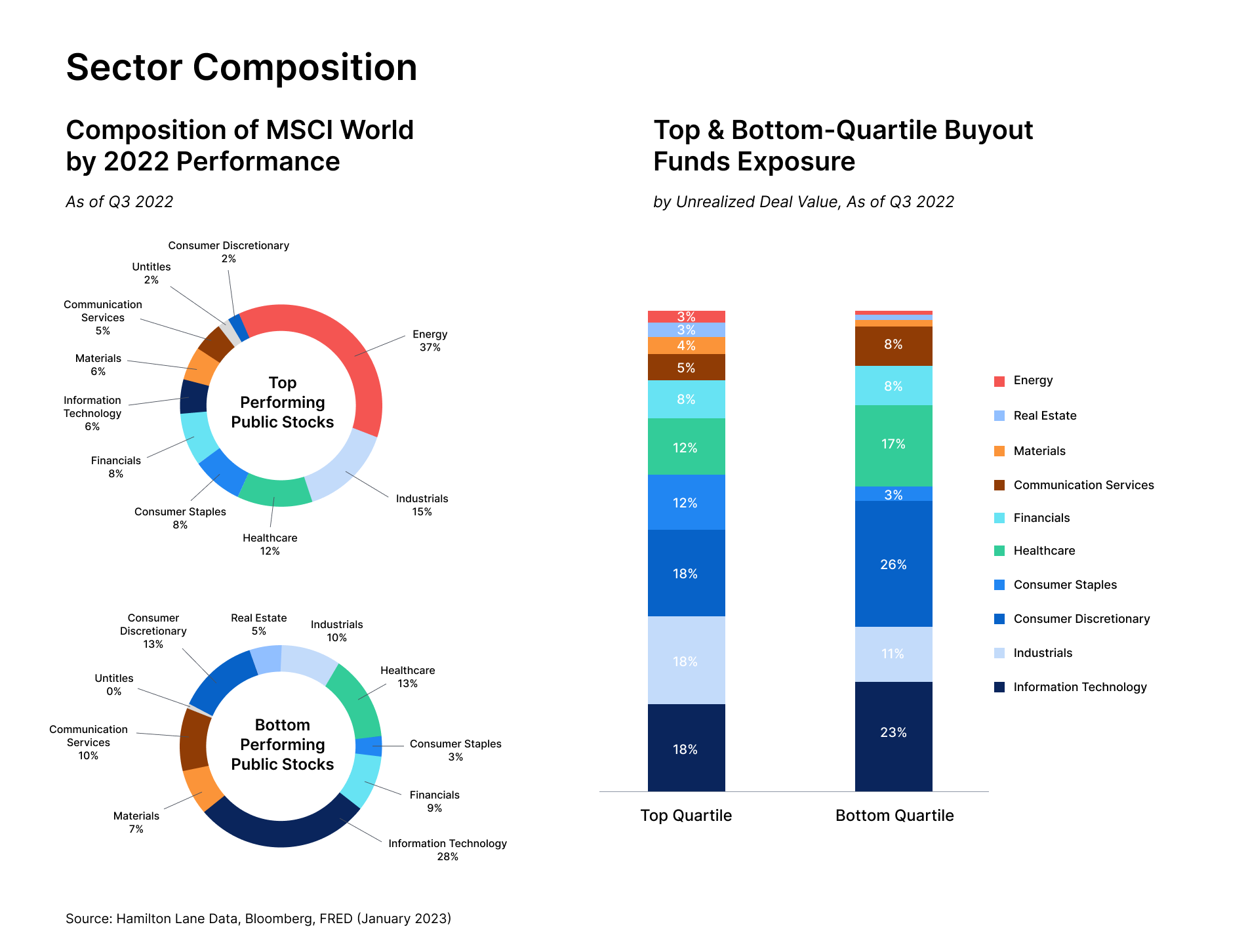

In short, sector selection matters a great deal. The top quartile private equity managers saw less allocation to information technology (one of the poorer-performing sectors in 2022) compared to bottom quartile managers and public indexes, and more allocation to industrials and consumer staples (better-performing sectors in 2022).

Believe it or not, even from a revenue and earnings perspective, private companies actually performed better than their public counterparts. Only 8% of private companies had negative EBITDA through Q3 2022 compared with 40% of Russell 2000 index companies.

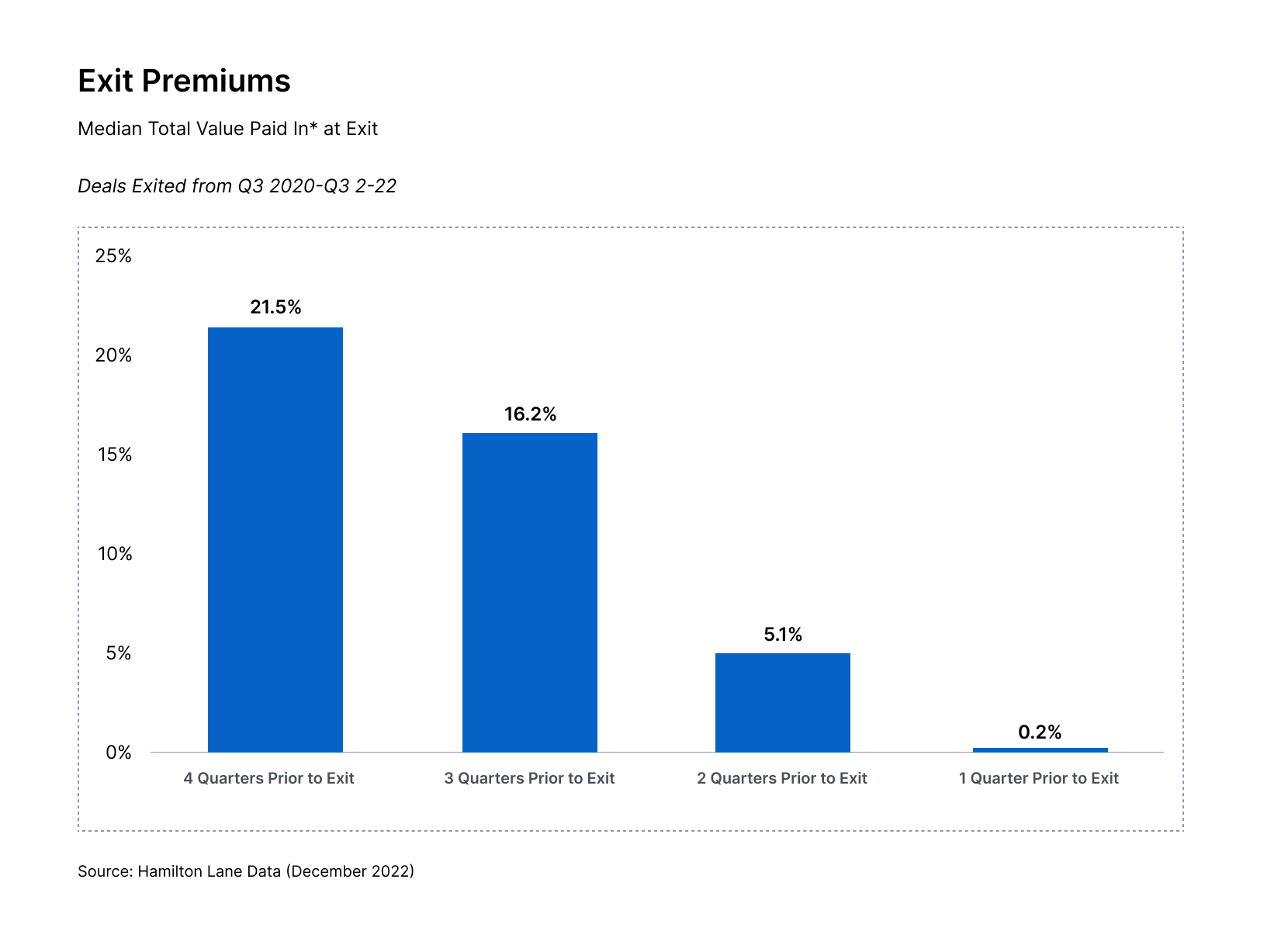

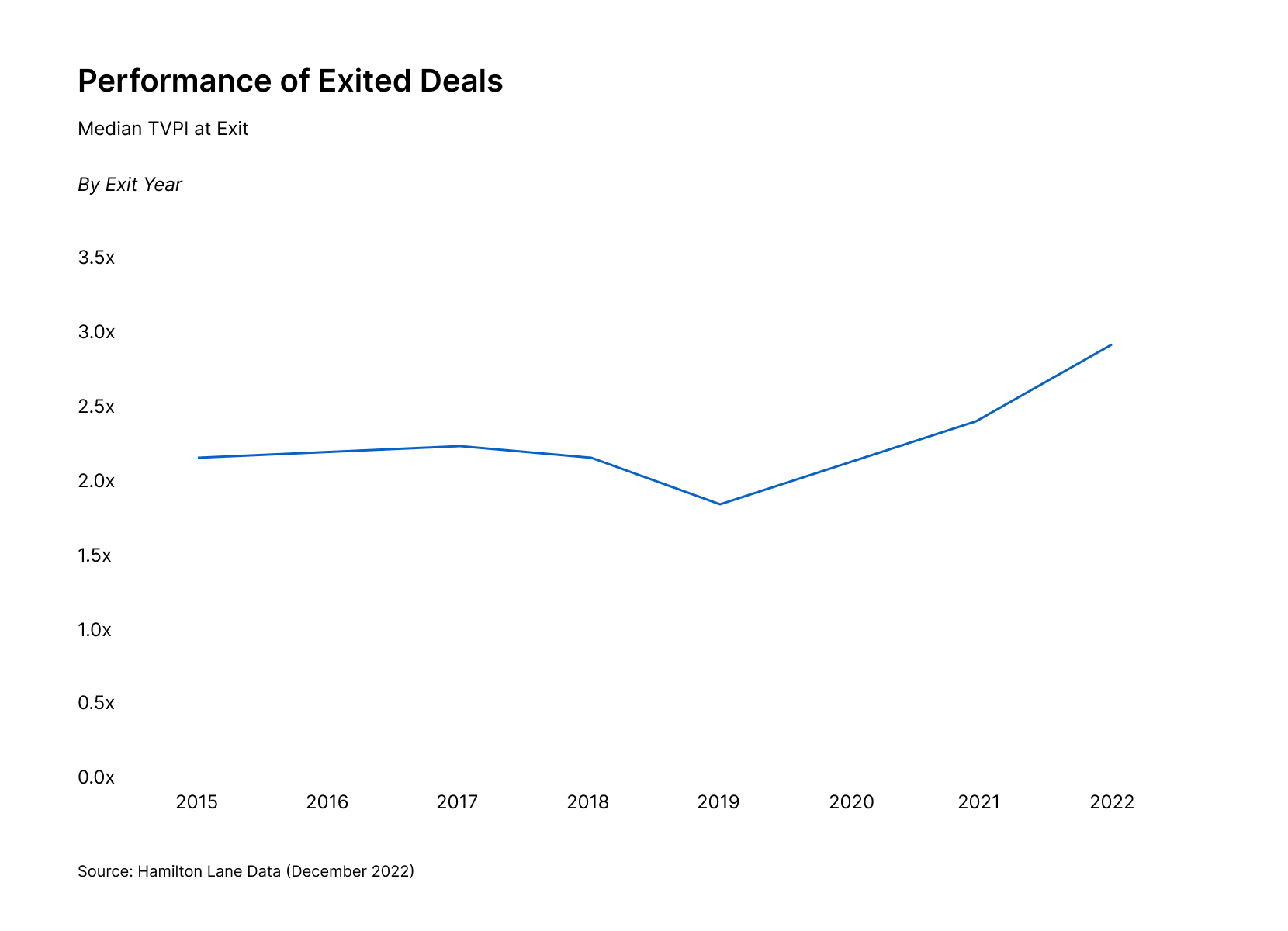

Of course, the real proof of whether valuations are accurate is whether you exit a portfolio company at the value you show for it.

Median exit data from Hamilton Lane shows that they tend to occur at prices higher than valuations, including in 2022, and in a period where public markets are declining 20%.

Total value paid in refers to the ratio of current value of remaining investments plus the total value of all distributions to date, relative to the total amount of capital paid to date

While the likelihood for such exits are happening for better-performing companies, the point isn’t that every company is precisely valued in every private market portfolio but that in aggregate, with the exception of the venture/growth space, valuations accurately reflect what’s happening in portfolios at this time.

Start your private markets investment journey at ADDX

At ADDX, we believe that having a diversified private markets and alternatives portfolio is key to broadening and increasing your sources of return in this environment.

Accredited investors globally, excluding the US, can gain access to private equity, credit, real estate and hedge funds at investment sizes as low as USD5,000.

See our full list of opportunities on the ADDX app or visit addx.co.

This article is for general informational purposes only and has not been independently verified to ensure its accuracy and fairness. This article does not constitute any advice or recommendation from ADDX or ICHX Tech Pte. Ltd. (“ICHX”) or any of its affiliates. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs. No representation, warranty or other assurances of any kind, expressed or implied, is made with respect to the accuracy, completeness, adequacy, reliability validity or availability of any information in this article. Under no circumstance shall ADDX or ICHX have any liability to the reader for any loss or damage of any kind incurred as a result of the use or reliance on any information provided in this article. This article may not be modified, reproduced, copied, distributed, in whole or in part and no commercial use or benefit may be derived from this article without the prior written permission of ADDX and ICHX. ADDX and ICHX reserve all rights to this article.